Salesforce Q1 strong, outlook raised for Q2

Salesforce delivered better than expected first quarter results and upped its outlook for the second quarter. The company said it saw strength in Data Cloud and AI annual recurring revenue.

Salesforce reported first quarter net income of $1.54 billion, or $1.59 a share, on revenue of $9.3 billion. Non-GAAP earnings were $2.58 a share. Wall Street was expecting Salesforce to report first quarter earnings of $2.55 a share on revenue of $9.75 billion.

The company’s first quarter results land a day after the company announced its $8 billion acquisition of Informatica for its data integration and management platform.

- Salesforce acquires Informatica for $8 billion to bolster Agentforce

- Salesforce revamps Agentforce pricing with Flex Credits: What you need to know

- Salesforce expands ecosystem, courts developers and partners to Agentforce

CEO Marc Benioff said the company is seeing traction due to its “deeply unified enterprise AI platform.†Robin Washington, President, Chief Operating and Financial Officer, said the company delivered “solid execution†in the first quarter.

By the numbers for the first quarter:

- Salesforce has closed more than 8,000 Agentforce deals. Half are paid.

- Nearly 60% of Salesforce’s top 100 deals in the first quarter included Data Cloud and AI.

- More than half of Salesforce’s top 100 deals in the quarter included more than six clouds.

- Data Cloud ingested 22 trillion records in the first quarter.

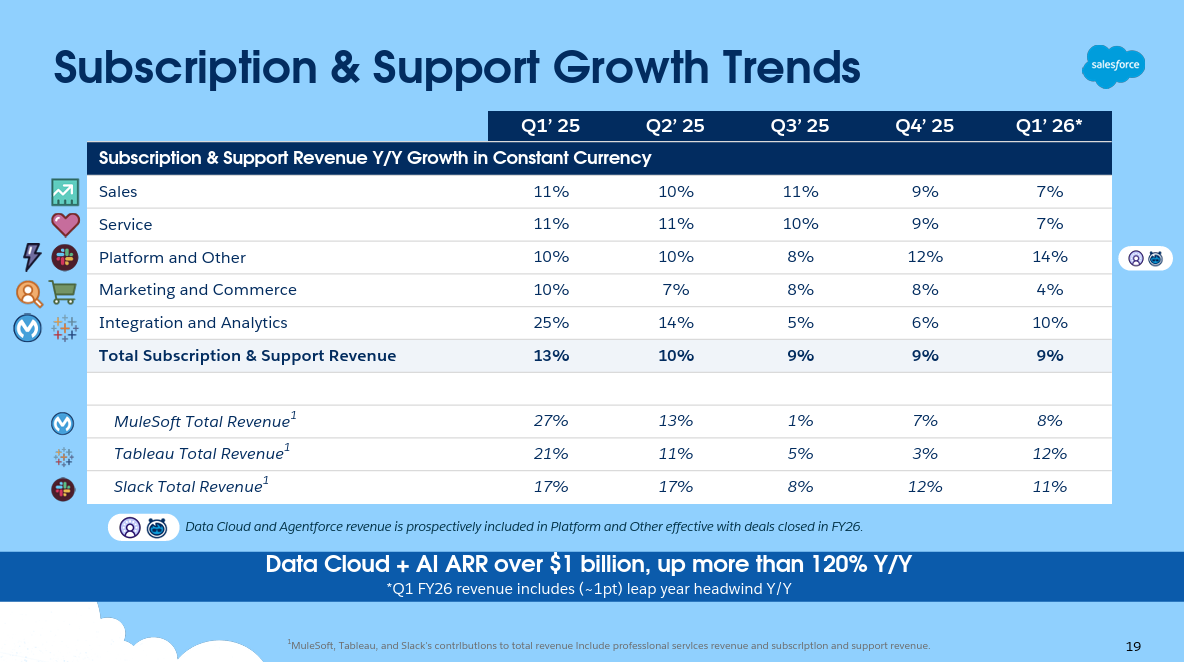

- Sales cloud revenue in constant currency was up 7% from a year ago as was service.

- Platform and other revenue in constant currency was up 14% from a year ago.

- Marketing and commerce revenue in constant currency was up 4% from a year ago.

- Integration and analytics in constant currency was up 10%.

As for the outlook, Salesforce said it would see a currency tailwind due to a weaker US dollar. The company projected second quarter revenue of $10.11 billion to $10.16 billion, up 8% to 9%. Non-GAAP earnings in the second quarter will be between $2.76 a share to $2.78 a share. In constant currency, growth would be 7% to 8%. Salesforce projected fiscal 2026 revenue of $41 billion to $41.3 billion, up 8% to 9%. Non-GAAP earnings for fiscal 2026 are projected to be $11.27 a share to $11.33 a share.

Here are the takeaways from the Salesforce earnings call:

- Informatica. Benioff said Salesforce sees Informatica as a transformational deal at a good price. "Every AI transformation is a data transformation," said Benioff. "You have to have your enterprise data together to get the results that you want. Informatica combined with Salesforce Data Cloud and Tableau will create this incredible data business."

- Slack as UI. Benioff said that Slack is where you'll go to begin and end every Agentforce conversation. "You will really like AI taking place on Slack and agents just coming right into your channels to talk to you in real time," Benioff.

- AI agent washing. Benioff said that "every company does say they have agents, but with out the agents, the data, the apps and metadata framework you're not able to deliver this complete experience for the enterprise including delivering digital labor."

- Finding growth. Benioff said that Salesforce is finding growth pockets inside the company, notably in small and medium sized businesses. Miquel Milano, chief revenue officer, said the company is known for structuring large deals, but Salesforce is also making it easier for companies to buy. The company booked $2 billion in business through AWS Marketplace.

- Consumption models. Milano said the company is focused on its consumption motion and selling the overall platform. Thirty percent of Agentforce bookings in the first quarter were due to customers increasing consumption.