Micron Technology: More AI, more memory, more demand ahead

Micron Technology CEO Sanjay Mehrotra said artificial intelligence workloads are boosting demand for memory chips as AI-optimized systems with GPUs and upcoming AI PCs are faring well.

In prepared remarks with Micron Technology's second quarter results, Mehrotra said AI server demand for high-bandwidth memory, data center solid-state drives and DDR5 are boosting prices. he said:

"We expect DRAM and NAND pricing levels to increase further throughout calendar year 2024 and expect record revenue and much improved profitability now in fiscal year 2025."

Mehrotra's argument is that Micron is well positioned for edge and data center inference workloads.

We are in the very early innings of a multiyear growth phase driven by AI as this disruptive technology will transform every aspect of business and society. The race is on to create artificial general intelligence, or AGI, which will require ever-increasing model sizes with trillions of parameters. On the other end of the spectrum, there is considerable progress being made on improving AI models so that they can run on edge devices, like PCs and smartphones, and create new and compelling capabilities. As AI training workloads remain a driver of technology and innovation, inference growth is also rapidly accelerating. Memory and storage technologies are key enablers of AI in both training and inference workloads."

Micron said it is seeing the following tailwinds:

- Its high-memory offerings with better bandwidth are seeing demand due to better power consumption.

- Micron is making progress qualifying its memory products with multiple customers. The company recognized its first revenue from HBM3E, which will be part of Nvidia's H200 Tensor Core GPUs, in the fiscal second quarter.

- Data center SSD revenue hit a record for Micron in calendar 2023.

- The PC market is expected to grow modestly and accelerate due to AI PC demand, which uses more memory.

- AI will also drive smartphone memory specs over time.

Also see:

- Nvidia Huang lays out big picture: Blackwell GPU platform, NVLink Switch Chip, software, genAI, simulation, ecosystem

- AI is Changing Cloud Workloads, Here's How CIOs Can Prepare

- GenAI trickledown economics: Where the enterprise stands today

- Will generative AI make enterprise data centers cool again?

- PC industry's big dream: AI enabled PCs spur upgrade cycle

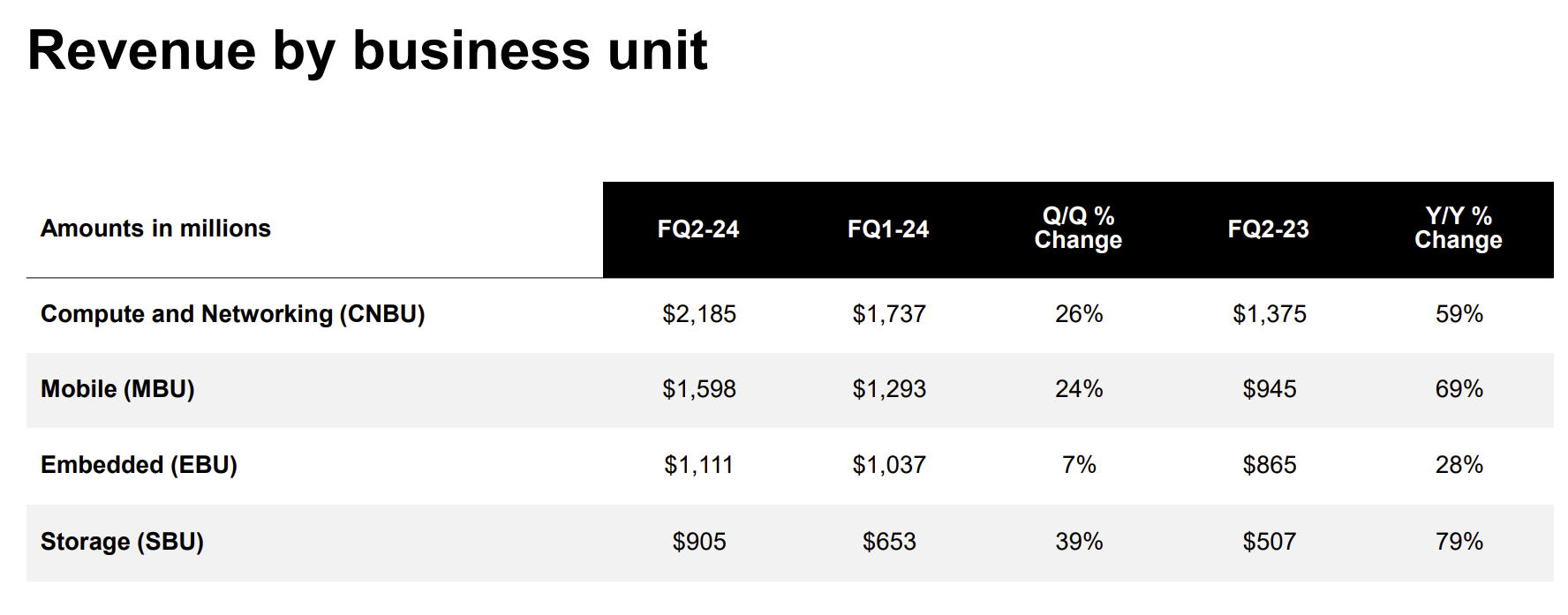

For its second quarter, Micron reported net income of $793 million, or 71 cents a share, on revenue of $5.82 billion, up 58% from a year ago. Non-GAAP earnings were 42 cents a share.

Wall Street was expecting a non-GAAP second quarter loss of 24 cents a share on revenue of $5.35 billion.

As for the outlook, Micron said third quarter revenue will be $6.6 billion give or take $200 million with non-GAAP earnings of about 45 cents a share, give or take 7 cents. Wall Street was expecting third quarter non-GAAP earnings of 9 cents a share on $6 billion in sales.