PC industry's big dream: AI enabled PCs spur upgrade cycle

PC giants are all betting that AI-enabled PCs will get sales growing again and create new use cases, but it's unclear whether technology buyers will play along.

Apple's launch of the new 13- and 15-inch MacBook Air with the M3 processor dedicated a good bit of space to AI applications. Apple noted:

"Combined with the unified memory architecture of Apple silicon, MacBook Air can also run optimized AI models, including large language models (LLMs) and diffusion models for image generation locally with great performance. In addition to on-device performance, MacBook Air supports cloud-based solutions, enabling users to run powerful productivity and creative apps that tap into the power of AI, such as Microsoft Copilot for Microsoft 365, Canva, and Adobe Firefly."

Get used to similar statements from other PC vendors. In fact, the AI PC talk is already starting as companies hope for a second half sales rebound. Here's a sampling of recent comments from earnings calls from PC giants HP, Lenovo and Dell.

HP CEO Enrique Lores:

"We remain extremely excited about the opportunity that AI PCs will bring in terms of both the customer value that they will deliver in terms of security, in terms of latency, in terms of cost and also the impact it will have over time in the company."

Lenovo CEO Yuanqing Yang:

"AI PC could represent an inflection point for the PC industry. It could drive a new product cycle with premium pricing, which is key to delivering premium to market growth, strong ASP and sustainable profitability."

Dell Technologies Chief Operating Officer Jeff Clarke:

"We have hardware enabled AI PCs with an application base coming that should make it an exciting opportunity to own an AI PC."

All of these executives said their take on an improving second half 2024 for PC sales was based on third party validation, notably an IDC report. IDC expects AI PCs will represent 60% of all PC shipments worldwide and grow from 50 million units in 2024 to 167 million in 2027.

The argument for the ramp of AI PC shipments is that the installed base is already long in the tooth and AI can change the future of work. These AI PCs will be able to improve productivity, offer faster performance and lower inferencing costs as they leverage compressed language models.

All that's missing is the killer application, which Microsoft is working to provide in the latest versions of Windows. Lenovo said it is starting to ship AI PCs and the portfolio will expand through 2025. Yang said AI PCs will be a win for users as well as their employers due to hybrid AI that will leverage local compute.

"AI PC comes with a personal intelligent agent using natural language user interface, a compressed local large language model, heterogeneous computing with CPU, GPU, NPU, privacy and security protection and our AI application ecosystem. We believe this trend will stimulate another industry refresh cycle, as the users require devices designed for more creativity and productivity."

Lores said HP is working with partners to make sure applications can leverage the new PC capabilities. Lores noted that HP has seen more stability in small business sales and education and AI PCs will drive gradual sales improvements over the next two years.

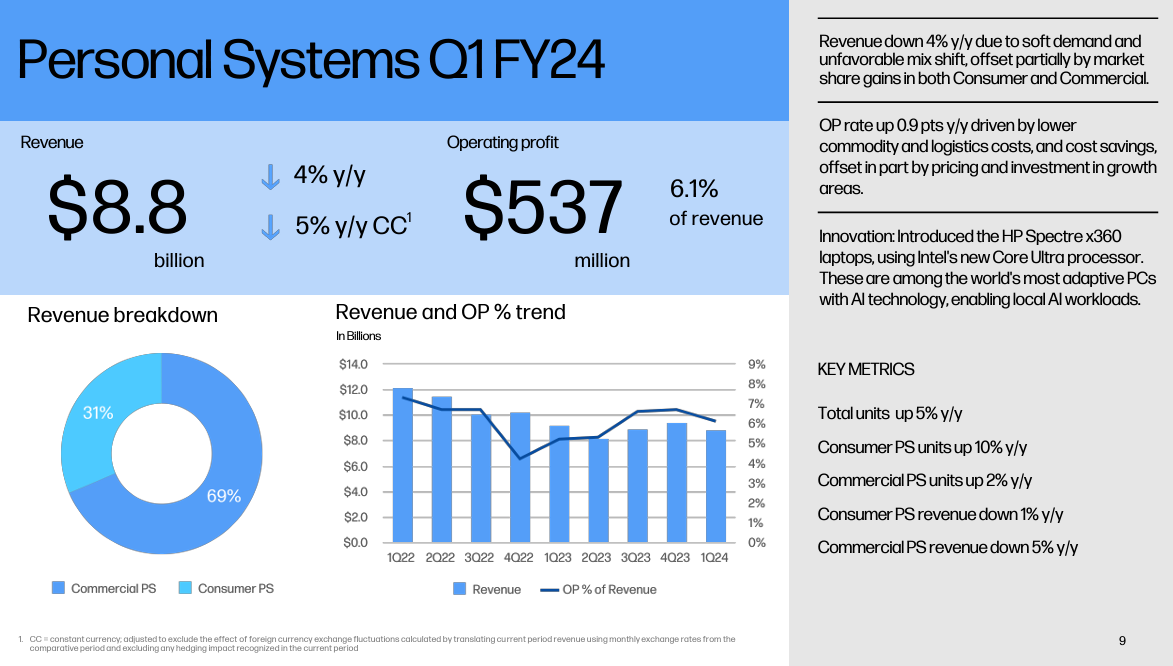

For HP and Lenovo, AI PCs will have to appeal to consumers and enterprises to move the needle. HP's PC sales in the first quarter skewed commercial.

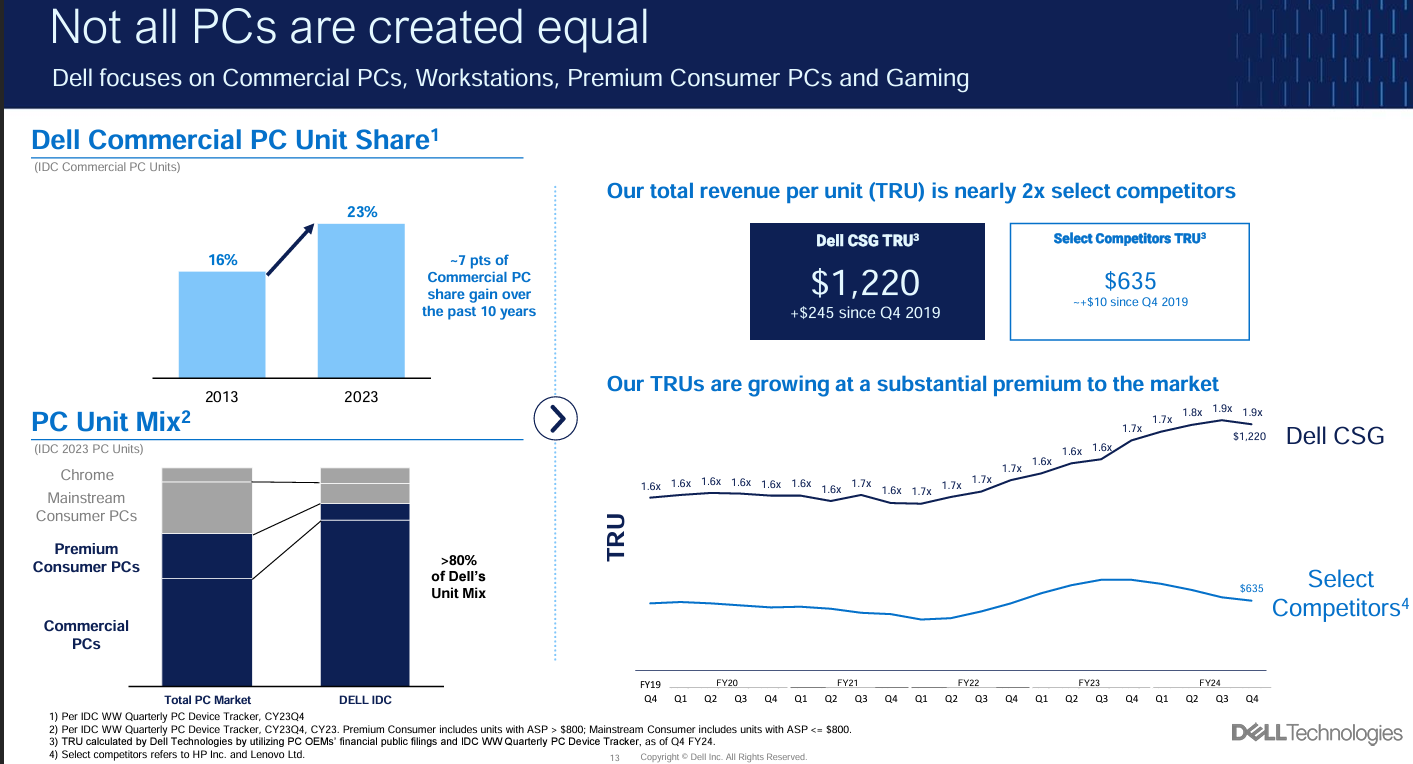

Dell is mostly focused on sales to corporate customers. The bulk of Dell's PC sales go to enterprises and the focus pays off as total revenue per unit is nearly twice as large as the competition.

Clarke said AI PCs will drive sales, but Dell's guidance doesn’t include them. Simply put, Dell isn't seeing the upside yet. Clarke's bet is that the Windows upgrade cycle is likely to drive corporate sales.

"Do I expect the PC market to be bigger in calendar 24 than 23? Yes. Do I think the PC market is likely bigger in the second half of 24 than it is in the first half? Absolutely. We believe the opportunity in PCs is second half driven. That is primarily a result of an aging install base. It has never been bigger or older than it is today. We have a version of Windows that is retiring.â€

What can derail the AI PC dream? Inflation and constrained budgets for both consumers and enterprises. Consumers are stretching out used cars well beyond historical life spans and PCs aren't going to be much different. Enterprises have steadier refresh cycles, but will want to see productivity gains from AI PCs, which will cost more than regular PCs. Enterprises will also be looking to leverage those pandemic-era PCs as long as possible because IT budget priorities rest elsewhere.

Bottom line: There's hope that PC sales will improve in the second half of 2024, but it's telling that major players aren't including any uplift in their financial guidance. In the end, that approach makes sense. Hope isn't strategy.