Inforum 2016 Day One: Key Takeaways

Infor offered up plenty of news, updates and future directions during day one of its Inforum conference in New York this week. While not unexpected, the flow of information nonethless underscores the aggressive growth plans and efforts at internal change Infor has undertaken under the leadership of former Oracle president Charles Phillips, who became CEO in 2010. Here's a look at the key highlights of the day:

Scaling the Business: Infor now has 90,000 customers, adding 20,000 in the past several years, Phillips said during an opening keynote. Two ways it is helping itself achieve growth are a continued focus on retail and other industries, and a reliance on Amazon Web Services. "We want to change industries, not infrastructure," Phillips said.

Cloud Conversions: More than 40 percent of Infor's license revenue for its fiscal 2016 came from SaaS, compared to 10 percent three years ago, the company announced in June. During Monday's talk, Phillips cited a figure of 50 percent, but it wasn't immediately clear whether that was a projection for the current fiscal year. In either case, the growth seems dramatic, unless it's a case where Infor's many legacy on-premises customers simply aren't adding many licenses, or Infor is focusing its salesforce investments in cloud versus on-premises.

Marquee Customers: I've been to some keynotes by software vendors multiple times the size of Infor, where no customers took the stage to offer an endorsement. That wasn't the case with Inforum's opener, which saw representatives from the likes of large U.K. building materials supplier Travis Perkins, Triumph Motorcycles and Whole Foods make appearances. Importantly, each was able to speak to Infor's strengths in meeting their specific vertical's needs, rather than simply provide general praise. In the case of Whole Foods, the grocer is actually co-developing a new retail suite with Infor, which will be taken to the broader market later.

Ramping Up R&D: Infor has spent $800 million on research and development since September 2014, when it held Inforum in New Orleans, Phillips said. Privately held Infor doesn't reveal deep details of its financials, but a corporate document from May listed annual revenue of $2.8 billion. Using some rough, back-of-the-napkin math, that works out to about 14 percent of revenue devoted to R&D, putting Infor on par with Oracle and SAP. The question for Infor customers is how much of that R&D was devoted to next-generation technologies versus updates to older software they may still use extensively.

Cloud Migration Help: Of course, Infor wants those legacy customers to move their systems to the latest and greatest, particularly on the cloud. To that end, Infor has formed a partnership with Backoffice Associates on a set of data migration accelerators for products such as M3, LN and S3.

Hook & Loop Goes External: Infor often refers to its newer applications as having "beautiful" user interfaces, a look it has acheived with the help of an in-house design firm called Hook & Loop. The group is apparently now mature and robust enough to offer Infor customers external services. Dubbed H&L Digital, the division will use interactive workshops to help a customer build a digital strategy for their brand; develop user experiences for both internal and customer-facing purposes; tie together product components for a digital strategy; and provide ongoing managed SaaS services. This will be an interesting area to watch given what a differentiator Hook & Loop has been for Infor in its original form.

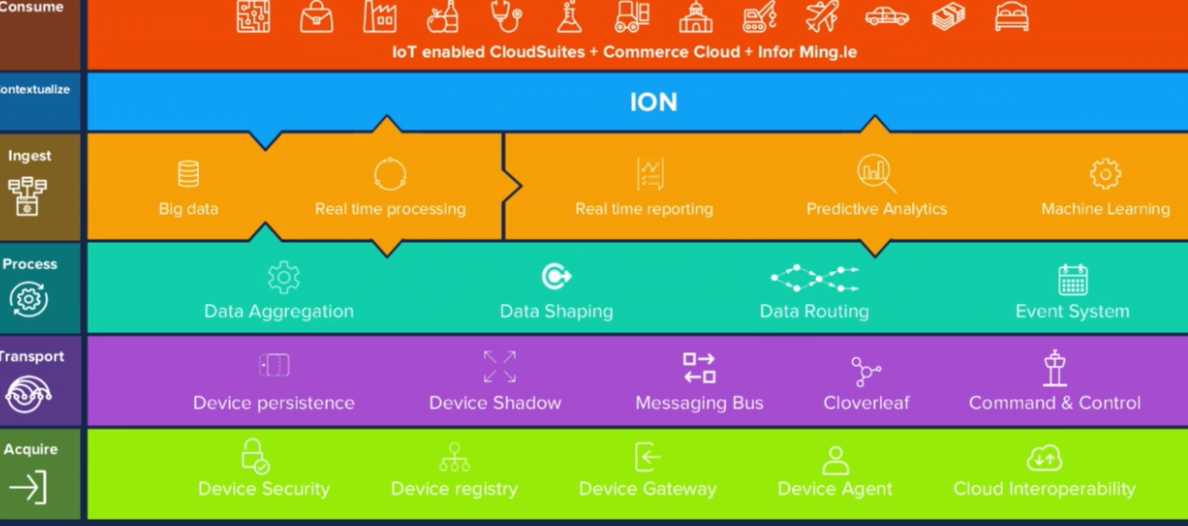

Infor's IoT Play Unveiled: Infor took the occasion of Inforum to lay out its IoT (Internet of Things) platform strategy. From an architectural perspective, Infor is biting off a fairly large spectrum of the IoT stack, as this slide featured Monday shows:

Infor described work with early customers on the IoT platform, featuring familiar use cases such as predictive maintenance and asset tracking. The platform is in preview now with a general announcement scheduled for later this year, according to a spokesman.

Infor Buys Starmount for 'Converged Commerce' Play: Infor has purchased store systems vendor Starmount and plans to align its products with the GT Nexus supply chain management platform and demand management software from Predictix, both of which are also the result of acquisitions. The end result will be "converged commerce," which evolves beyond omnichannel commerce in that it involves a "single selling system for all consumer interactions." The benefits include better information and reduced expenses around integrations, Infor says. The question now is how quickly Infor can pull together this package and show customers having success with it.

The Bottom Line

When Phillips came on board at Infor, he faced an uphill battle reversing the image of the vendor as largely a holding company for aging, neglected ERP software assets. Today, through a combination of fairly aggressive M&A activity, a focus on modern UI design and an updated architecture, Infor's strategic product set is in pace with its peers and in some ways has outpaced it. The challenge remains for Infor to sell its substantial legacy installed base on the benefits of those new products. There is plenty of runway to go.

24/7 Access to Constellation Insights

If you’d like unrestricted access to Constellation Insights, consider joining the Constellation Executive Network for analyst advice and analyses that you can use.