For Informatica, 'Switzerland of data' approach paying off

Informatica is planning on riding digital transformation, which is still a work in progress for enterprises, a need to integrate data across vendors, clouds and on-premises and generative AI in 2024.

The data management and governance company hit its stride in the fourth quarter with strong results. Informatica CEO Amit Walia said the company is benefiting from customers that are getting their data houses in order as well as a vendor agnostic approach. Walia said:

"Customer spending more than $1 million in subscription ARR increased 17% year-over-year to 240 customers. We had a record number of customers spending more than $5 million in subscription ARR, which grew 57% year-over-year. We pride ourselves on being the Switzerland of data and have accelerated ecosystem co-selling with Microsoft Azure, AWS, Google Cloud, Snowflake and Databricks and announced a new strategic partnership with MongoDB."

As enterprises focus more on data platforms to fuel digital transformation, automation and generative AI plans, Informatica stands to gain. Informatica does appear to be at an inflection point and topped the high-end of its guidance for the fourth quarter and year.

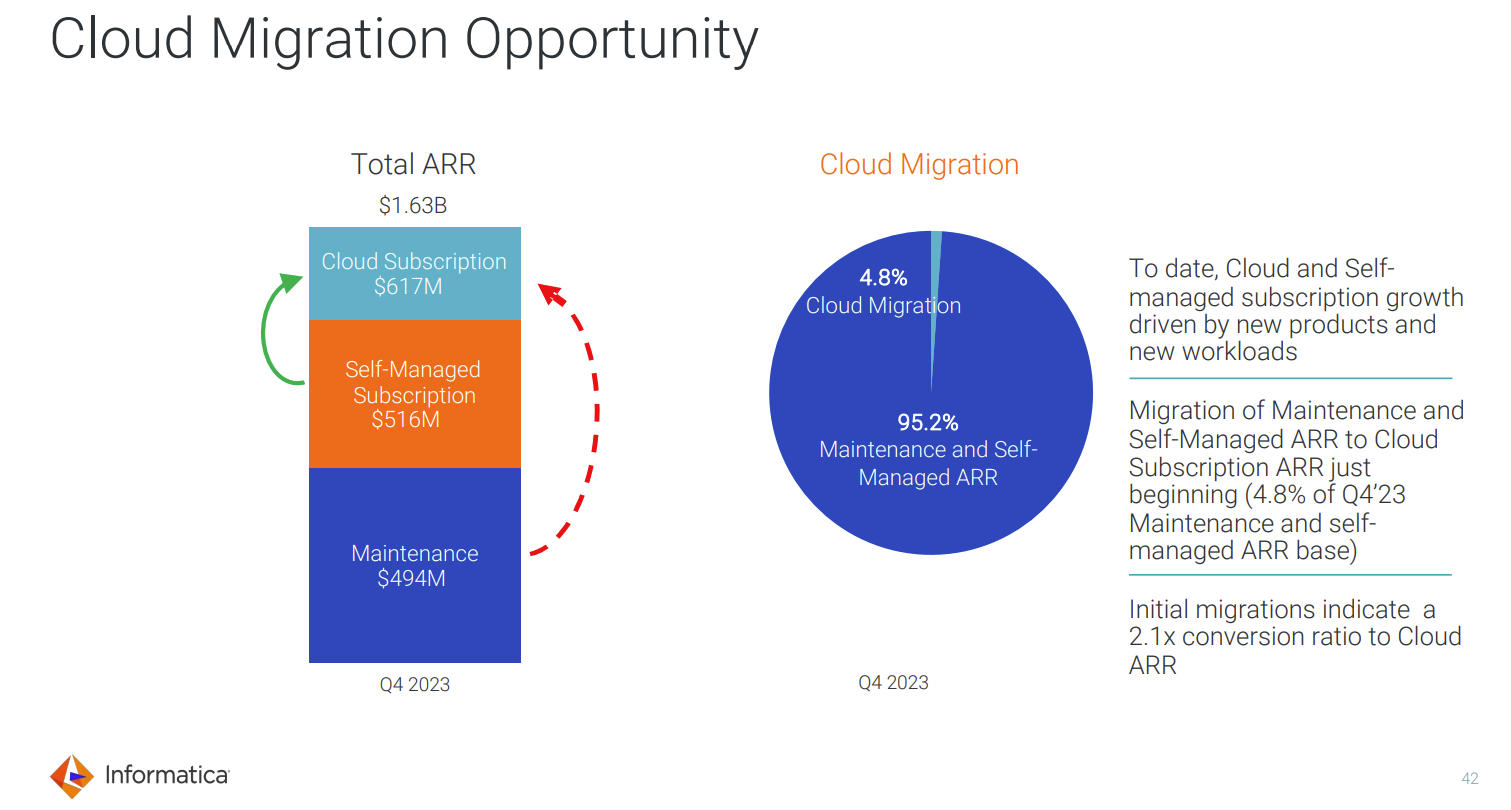

In the fourth quarter, Informatica reported net income of $64.26 million, or 21 cents a share, on revenue of $445.18 million. The company has been migrating customers from licensing to a cloud subscription model, but still has a sizable on-premises installed base.

- Constellation ShortListâ„¢ Master Data Management

- Data leaders bullish on generative AI, but multiple challenges remain, says Informatica

- Informatica adds generative AI, ESG tools to its Intelligent Data Management Cloud

For 2023, Informatica reported a net loss of $125.3 million on revenue of $1.59 billion. Informatica has also been able to pay down its debt ahead of schedule and is now under a 2x leverage ratio.

Informatica also passed the $1 billion mark in subscription annual recurring revenue for the fourth quarter and year. Cloud subscription ARR in the fourth quarter was up 37% from a year ago to $617 million. Informatica also said it processed 86 trillion cloud transactions per month in the fourth quarter.

Walia said 75% of new cloud bookings came from new workloads and expansion by customers. Informatica's updates to its platforms, led by its CLAIRE AI, have been coming at a steady cadence. In addition, the company is on track to integrate the data access management tools acquired in the Privatar acquisition.

Informatica, which cited Royal Caribbean, Pella and enGEN as key customer wins in the quarter, said first quarter revenue will be between $375 million to $395 million, up 5.4% from a year ago. Cloud subscription ARR, which is what Wall Street is watching closely, will be up 34.5% in the first quarter. For 2024, Informatica is projecting $1.68 billion to $1.7 billion.

Holger Mueller, Constellation Research analyst, said that Informatica's ability to move to double-digit growth rates for cloud and subscriptions is notable. The company still has to pay down debt and build on its product roadmap. Mueller said:

"Informatica for the first time broke the $1 billion in revenue milestone with software revenue now running at double the size of maintenance and professional service revenue, an improvement over the past. Informatica is more valuable. What is weighing hard on Informatica is interest expense, roughly at 10% of revenue, dragging the vendor into the red, more than doubling losses per share. It will be key for Amit Wallia and team to address this in the coming fiscal year. Informatica needs to keep product innovation and strategic partnerships (a 2023 highlight) going."

Constellation Research analyst Doug Henschen added:

"Informatica hit an important milestone in reaching $500 million in cloud subscription revenue in 2023, representing 50 percent of total subscription revenues. That percentage will only increase as cloud subscriptions continue to drive the company's growth."

Walia said future growth will come from the following key trends:

- Enterprises need a neutral platform that can handle multiple vendors and clouds.

- Digital transformation efforts require modern data stores and integration tools. "Enterprises need to move away from bespoke tactical tools and adapted end-to-end data management platform that treats data strategically to drive digital transformation," said Walia.

- Informatica customers are migrating to the cloud and there are plenty of migrations coming. The company still has $1 billion in on-prem maintenance and self-managed revenue.

- Generative AI is landing Informatica new customers. "There is no Gen AI without data. And for data to have value, it needs core data management such as holistic data, clean data, govern data, accessible data," said Walia.