HPE bets AI, edge, supercomputing workloads will drive growth

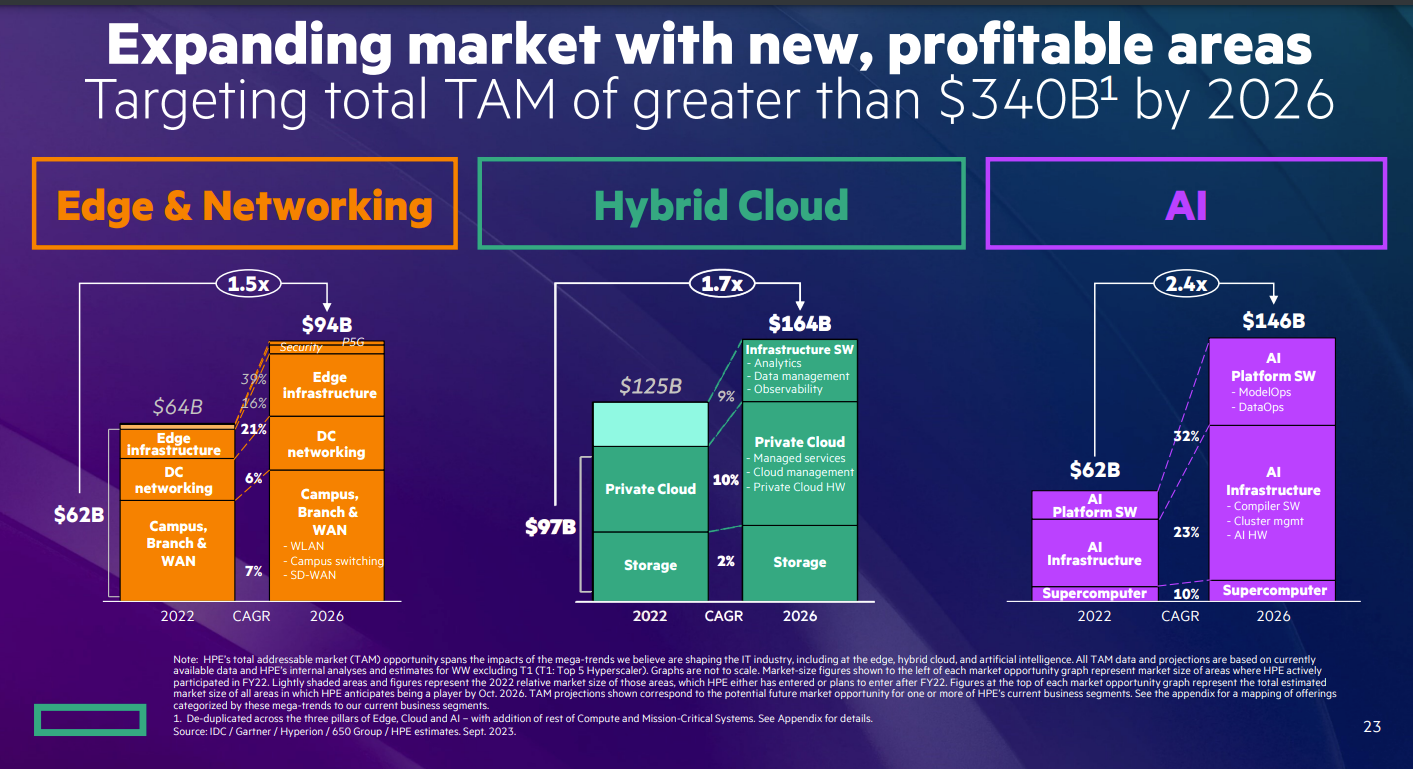

HPE outlined a three-year strategy that has its three fastest growing businesses--edge computing, high performance computing and artificial intelligence—representing more than 50% of the company's revenue by fiscal year 2026.

The strategy and outlook were outlined at HPE's Securities Analyst Meeting in New York. CEO Antonio Neri and interim CFO Jeremy Cox provided noted that the HPE can expand its total addressable market by almost $100 billion over the next four years due to AI use cases.

"HPE’s strategy is aligned to significant market trends around edge, hybrid cloud and AI – all of which create profitable market expansion opportunities," said Neri. "Customers continue to validate our strategy turning to us to power critical business transformations. And even in this micro economic environment, we continue to see them prioritize in data first digital transformation initiatives. And those initiatives increasingly include AI which is invigorating today's IT spending."

HPE's other big bet is hybrid cloud and HPC that can be delivered as a service. HPE is projecting revenue growth of 2% to 4% for fiscal year 2024 through fiscal 2026. However, it's big bets--AI, HPC and hybrid cloud--will grow faster over that time frame. HPE also said that it will return 65% to 75% of free cash flow to shareholders over the next three years, up from the 50% to 60% range today.

For fiscal 2024, HPE is expecting revenue growth to be 2% to 4% with non-GAAP operating profit growth of 3% to 5%. Fiscal 2024 non-GAAP earnings will be between $1.82 a share and $2.02 a share. Fiscal 2023 revenue growth will be 4% to 6% with non-GAAP earnings of $2.11 to $2.15 a share.

- HPE sees Greenlake, edge strength in Q3

- HPE Enters the Next-Generation Computing Market

- Interview with Vishal Lall, SVP & GM, HPE GreenLake Cloud Services Solutions

Not surprisingly, HPE's strategy has a heavy dose of Greenlake with a mix of subscription and consumption revenue streams, Aruba (Intelligent Edge) and supercomputing and AI infrastructure delivered as a service. HPE is betting it can take share as well as grow the total market.

Here's a look at the components of HPE's growth plans.

Intelligent Edge and Networking

HPE's Intelligent Edge unit is on track to deliver $5 billion in fiscal 2023 revenue and drive the highest profitability.

According to the company, it will expand its market by gaining share in campus and branch networking, expanding in the data center and entering new security and 5G markets.

HPE also said that it will bet on network-as-a-service, which will leverage AI-driven analytics as well as automation for large enterprises and mid-market companies.

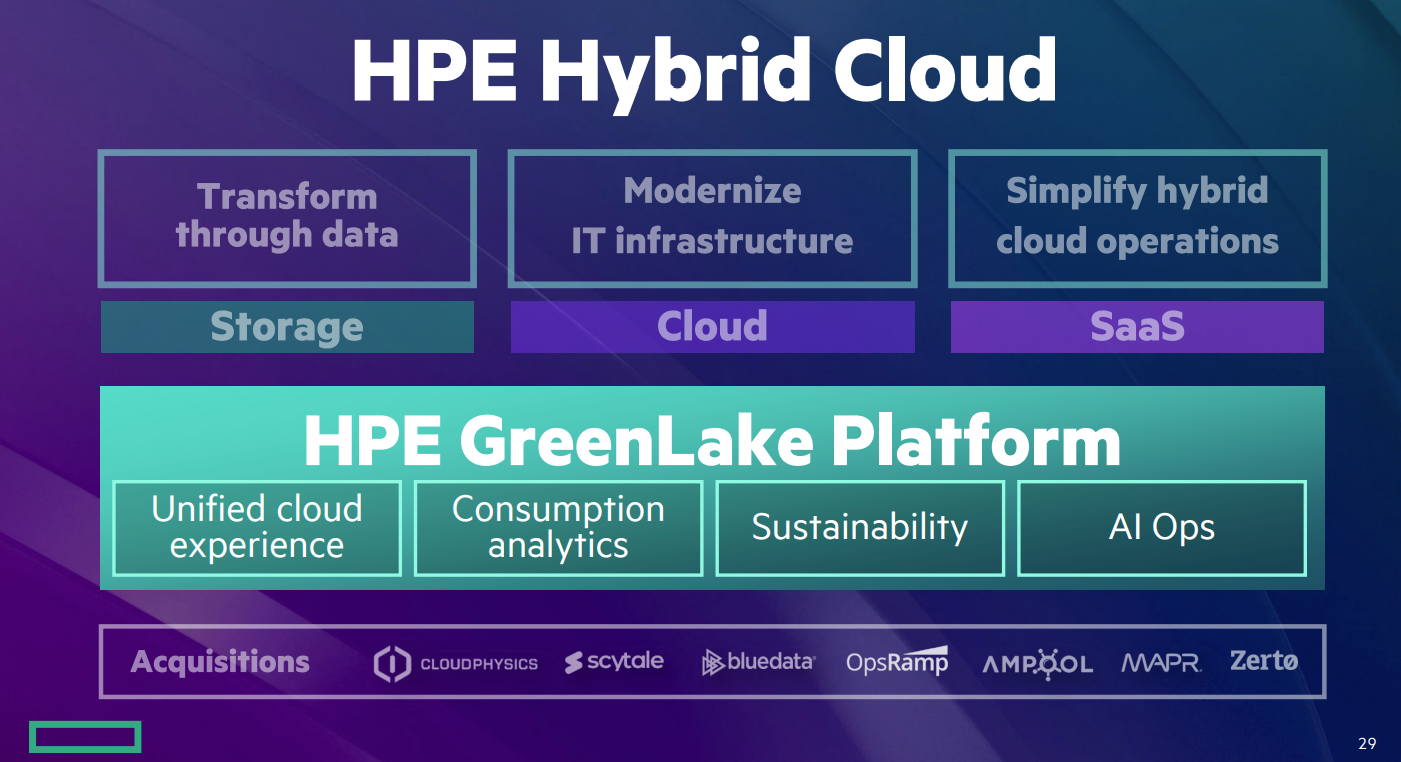

Hybrid Cloud

HPE's Hybrid Cloud unit combines storage and compute as-a-service offerings including HPE Greenlake Private Cloud and software. HPE Greenlake is going to carry the unit and already accounts for 70% of the annual recurring revenue for the company.

Constellation Research analyst Dion Hinchcliffe recently published a report outlining how CXOs are moving to private cloud models for cost savings. In a nutshell, public cloud providers haven't been passing on savings and encouraging enterprises to move workloads such as AI on premises.

According to the company HPE Greenlake has 27,000 unique customers and ARR growth of 35% to 45%.

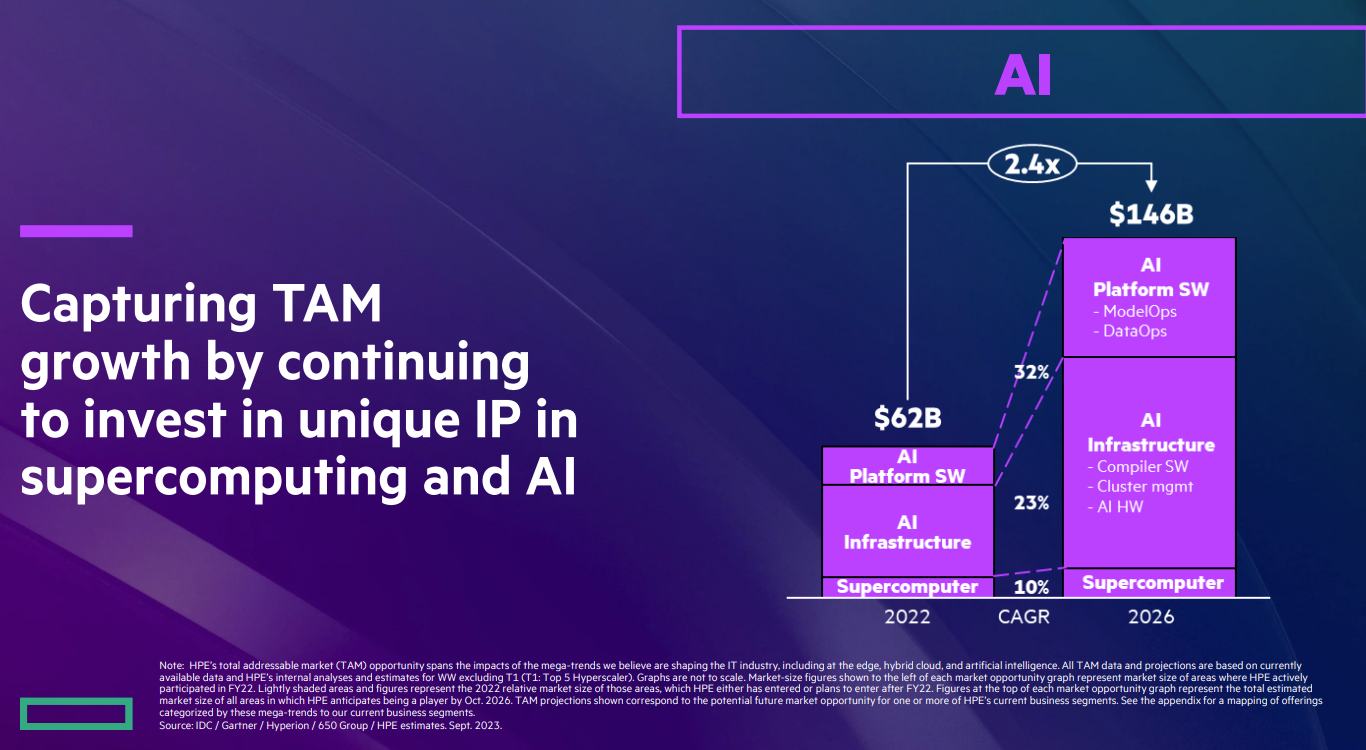

AI

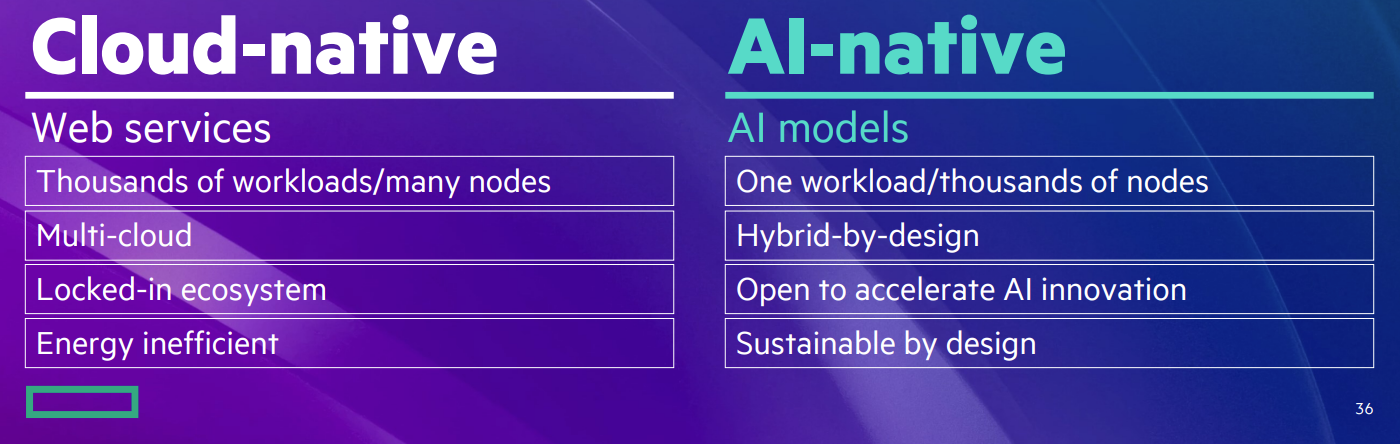

Supercomputing and AI is HPE's best shot for expanding its market. HPE is betting that its AI platform software, infrastructure and supercomputing powered by Cray will turbo charge the business.

As HPC scales, HPE will get more leverage and be able to shift more toward IP rich offerings and software.

HPE plans to expand into ModelOps as well as DataOps and manage clusters.

According to Justin Hotard, Executive Vice President and General Manager of High Performance Computing, AI and Labs at HPE, it's very early in generative AI use cases in the enterprise.

"Customers are investing in LLMs for broad commercial applications, but they're not deployed yet in the enterprise," said Hotard. "The enterprise buildout will be massive, but it's just beginning. There will be technical use cases, scientific models, financial and trading and those use cases will go on and on."

Neri added that most enterprises are looking to leverage LLMs for productivity and then focus on tuning. From there, they will look for generative AI to drive revenue.

AI is also expected to drive demand for HPE's compute due to tuning and inference workloads.

Constellation Research analyst Holger Mueller said:

"It is good to see HPE getting more revenue drivers, it previously shrank its offerings down to too much Greenlake. Its HPC portfolio has been strong all the time, so it is good to see it becoming its rightful visibility - the question now is - can they get the traction beyond the HPE/Cray installed base and take market share. The AI offering is equally interesting, more importantly viable - so it really comes to Antonio Neri & team to execute and go to market."