HPE to acquire Juniper Networks for $14B: What it means

Hewlett Packard Enterprise said it will acquire Juniper Networks in a deal valued at $14 billion, or $40 per Juniper share. HPE said the purchase will strengthen its networking business and complement its edge-to-cloud strategy.

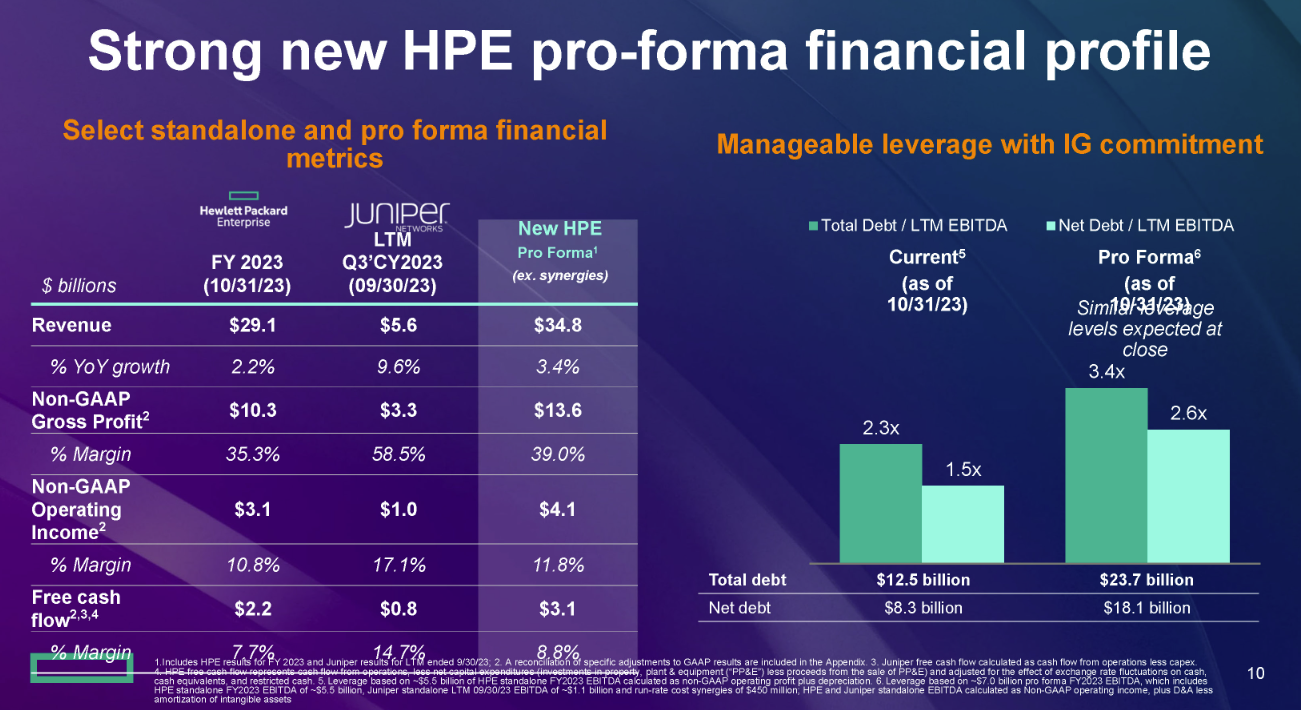

According to HPE, Juniper will give the company a higher growth business with more free cash flow and margins. HPE will also continue to invest in AI and cloud. With Juniper in the fold, HPE said networking will represent 31% of pro forma annual revenue and more than 56% of operating income.

For HPE, Juniper also enables it to build out AI-focused networking gear. Networking will be included in HPE's hybrid cloud and AI tools delivered through HPE Greenlake. Juniper can also be leveraged in HPE's high-performance computing efforts.

- HPE bets AI, edge, supercomputing workloads will drive growth

- HPE sees Q4 strength in AI, edge, high performance computing

- How AI workloads will reshape data center demand

- HPE launches GreenLake for LLMs, aims to democratize Cray supercomputing for AI training

-

HPE expands GreenLake services amid private cloud renaissance

Juniper was projecting revenue growth of 5% to 6% for fiscal year 2023, which was scheduled to be reported Jan. 30, with earnings per share growing at a double-digit clip. Exiting the third quarter, Juniper had an annual revenue run rate of $5.6 billion.

The deal is expected to close in late 2024 or early 2025. If the deal is terminated, HPE will pay Juniper a $815 million fee.

Key items to note:

- HPE plans to combine Juniper Networks with its HPE Aruba Networking and design an HPE AI interconnect fabric.

- The company said it will create better user and operator experiences with AI.

- HPE said the combination will be accretive to non-GAAP EPS in the first-year post-closing.

- The combination of the two companies is expected to create run-rate annual cost synergies of $450 million within 36 months post-closing.

- Juniper CEO Rami Rahim will lead the HPE networking business and report to HPE CEO Antonio Neri.

Constellation Research analyst Holger Mueller said:

"HPE did not have the critical mass with Aruba for SD-WAN and now it has it. And HPE lacked cloud revenue with the 'AI' and SD-WAN business from Aruba so the deal makes sense. Antonio is a smart guy and plays with the hand he has.

Basically, HPE has to outexecute Dell in the shrinking on-premises market. HPE is finding more future revenue beyond on-premises than Dell is ... for now."

In a statement, Neri said:

"This transaction will strengthen HPE’s position at the nexus of accelerating macro-AI trends, expand our total addressable market, and drive further innovation for customers as we help bridge the AI-native and cloud-native worlds, while also generating significant value for shareholders."

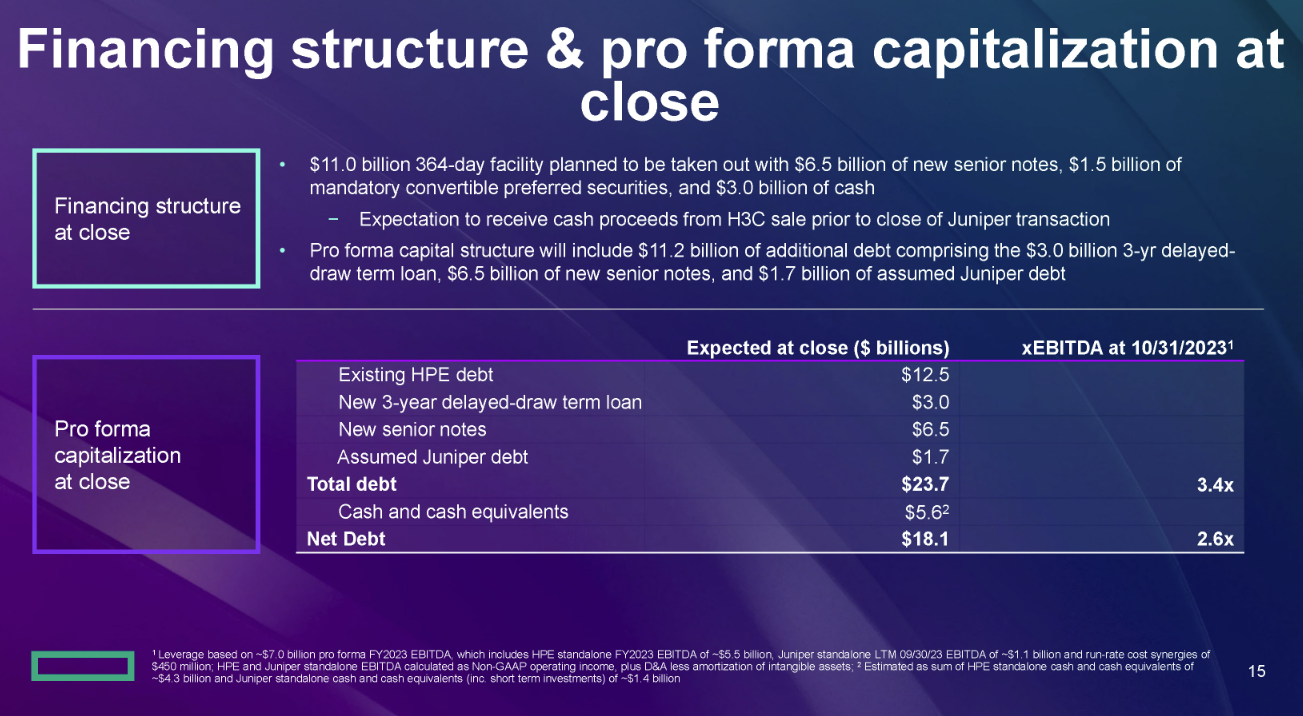

HPE said it will fund the purchase with $14 billion in term loans that will be replaced by a combination of new debt, convertible preferred securities and cash. HPE said it plans to reduce leverage 2x in two years post close.

On a webcast, Neri said:

"HP will be a new company where networking will be the core foundation of everything we do. We're going to accelerate what we call an AI driven agenda. And that will allow us to capture this massive inflection point.

Rahim said:

"We were born in the era of the internet, and we built the products to help the internet scale for what it is today. Fast forward to today. The biggest inflection since the dawn of the internet itself is artificial intelligence. That's AI and the thing that I am most excited about with this combination is that we will be able to bring the depth and the breadth of the portfolio is necessary. To capture the full market opportunity that AI presents in front of us."

Other items from the conference call:

- Neri was asked whether HPE and Juniper could collaborate ahead of closing. Neri said: "we have to collaborate with the regulators to make sure we do the utmost to accelerate the closing a transaction. That's a very standard process. And, you know, our goal is to get this transaction close as quickly as possible. Both companies have to stay focused on the respective customers and plans."

- Rahim said he was bullish on the combination of Juniper and Ariba. He also said there's a big data center play. "I'm equally excited about the AI data center opportunity where today you can complement the Juniper networking high performance silicon capabilities with compute, storage, networking, Slingshot and the automation capabilities in a way that I think it will be completely unparalleled," he said.

- The security lineup. Rahim and Neri said there is an opportunity to combine security portfolios on-premises, data center, edge and cloud. "Security is a very big part of the competitive thesis here," said Rahim.

- Neri said HPE with Juniper can offer a full lineup of gear and silicon for cloud and AI workloads with edge and supercomputing.

-

Rahim said that Juniper's Junos OS would garner more investment and is the company's "crown jewel.

-

The companies were asked about customer service organizations and combining teams. Neri said HPE has kept Aruba's industry focused services team and said the goal is to maintain Juniper's customer services teams.

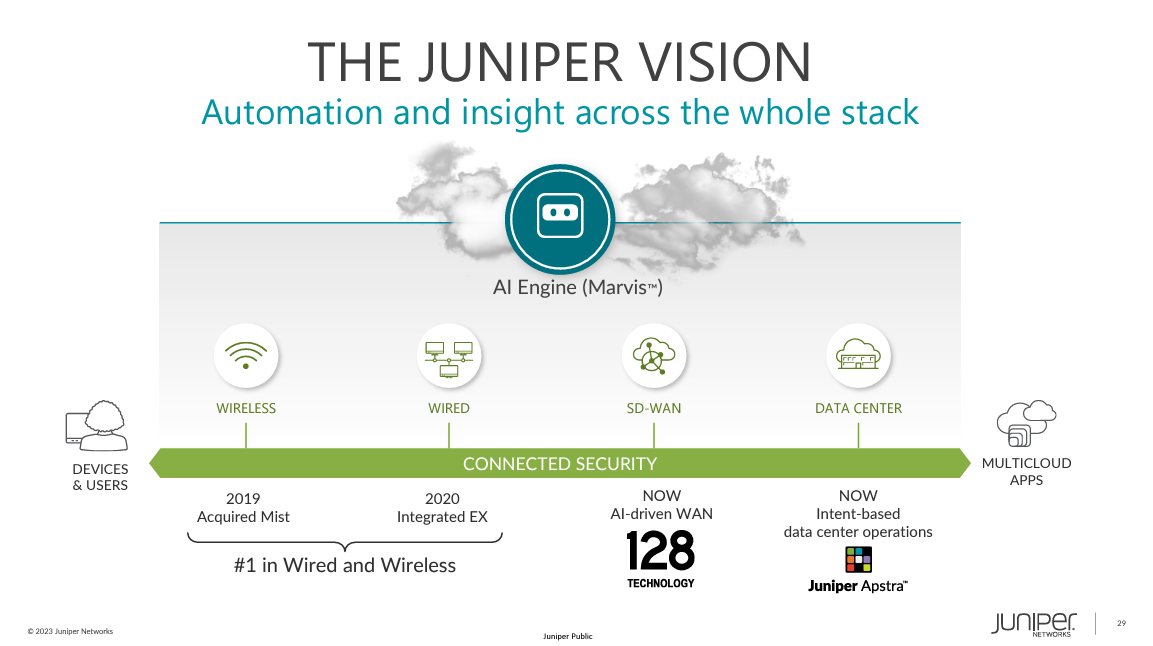

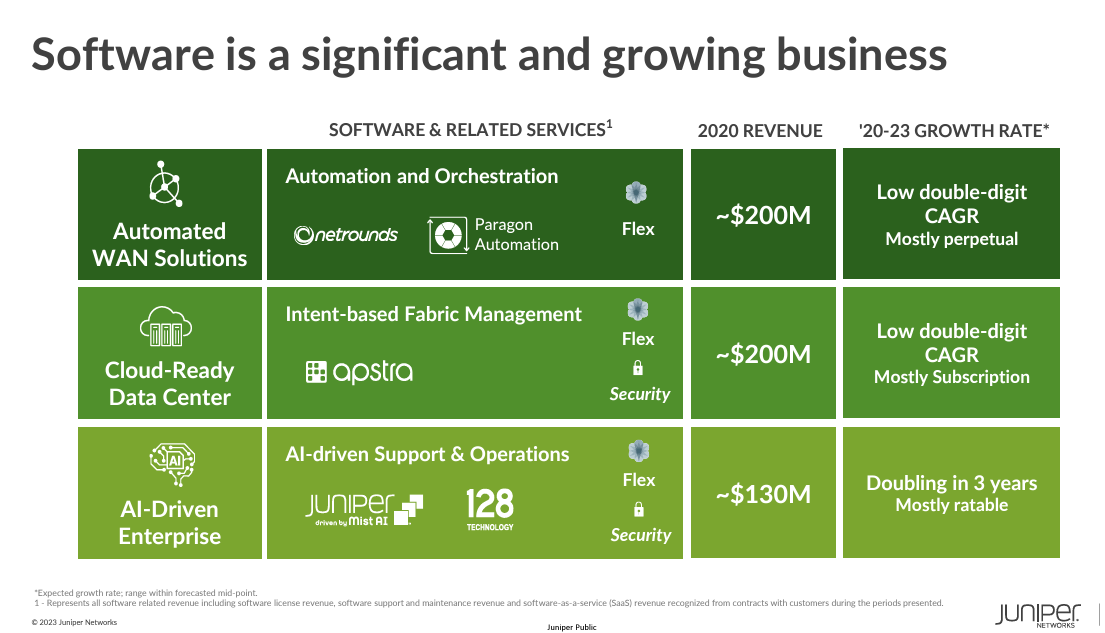

Juniper had aligned its business around three primary use cases including automated wide area networking, cloud-ready data center and AI-driven enterprise. The company had also been targeting routing in edge, core and 5G networks.

In addition, Juniper also launched Mist AI, a cloud-first AIOps platform that included end-to-end security. Juniper also has recently outlined its software business as it aimed to move beyond networking gear.

Here's a look at Juniper's vision that will now be incorporated into HPE.