How Uber's tech stack, datasets drive AI, experience, growth

Uber has leveraged its technology stack and data architecture to create a flywheel that can expand into multiple new markets. Uber is data incorporated and likely a glimpse into future business models.

At Uber's Investor Day, CEO Dara Khosrowshahi and the company's executive team outlined the company's growth plans, a $7 billion buyback and its data flywheel.

- Meet Data Inc. and what a post AI company looks like

- Uber Q4 strong, eyes platform expansion

- Uber aims to press its 'data advantage' for AI, model training

Here are some key takeaways from Uber's 90-minute session with analysts.

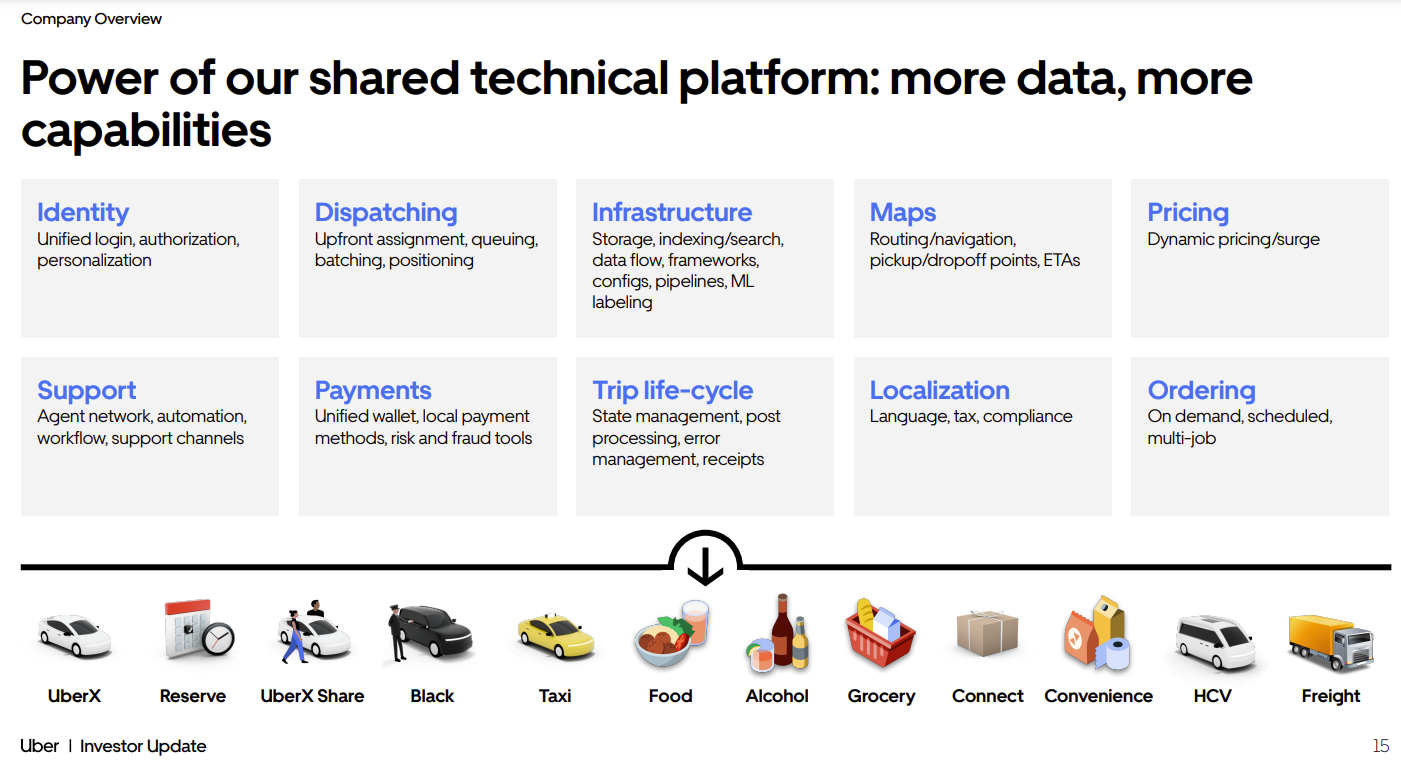

Uber's technology stack is its secret sauce. Khosrowshahi said the technology stack is the company's biggest advantage.

"While it may not always be visible to the casual user or investor, this really is our secret sauce. Whether you're ordering a ride or delivering much of the underlying tech and tech enabled operations, identity maps payments, fraud detection, ordering, dispatching, pricing and more. They're all shared across Uber," he said. "In fact, around 75% of our engineering resources are focused on these shared elements. This advantage is also self-reinforcing as the lessons we learn in one business can be applied elsewhere and technical investments we make in one area accrue to the whole platform."

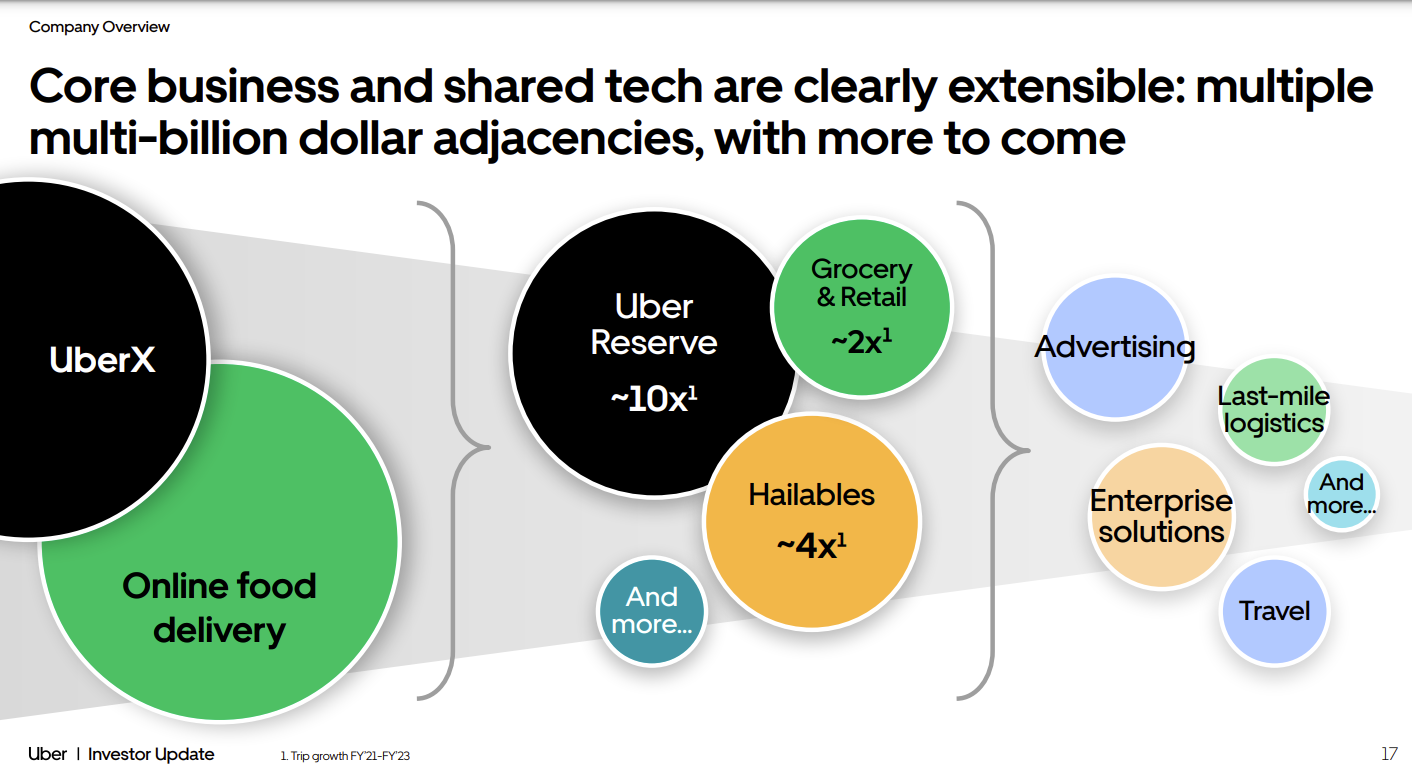

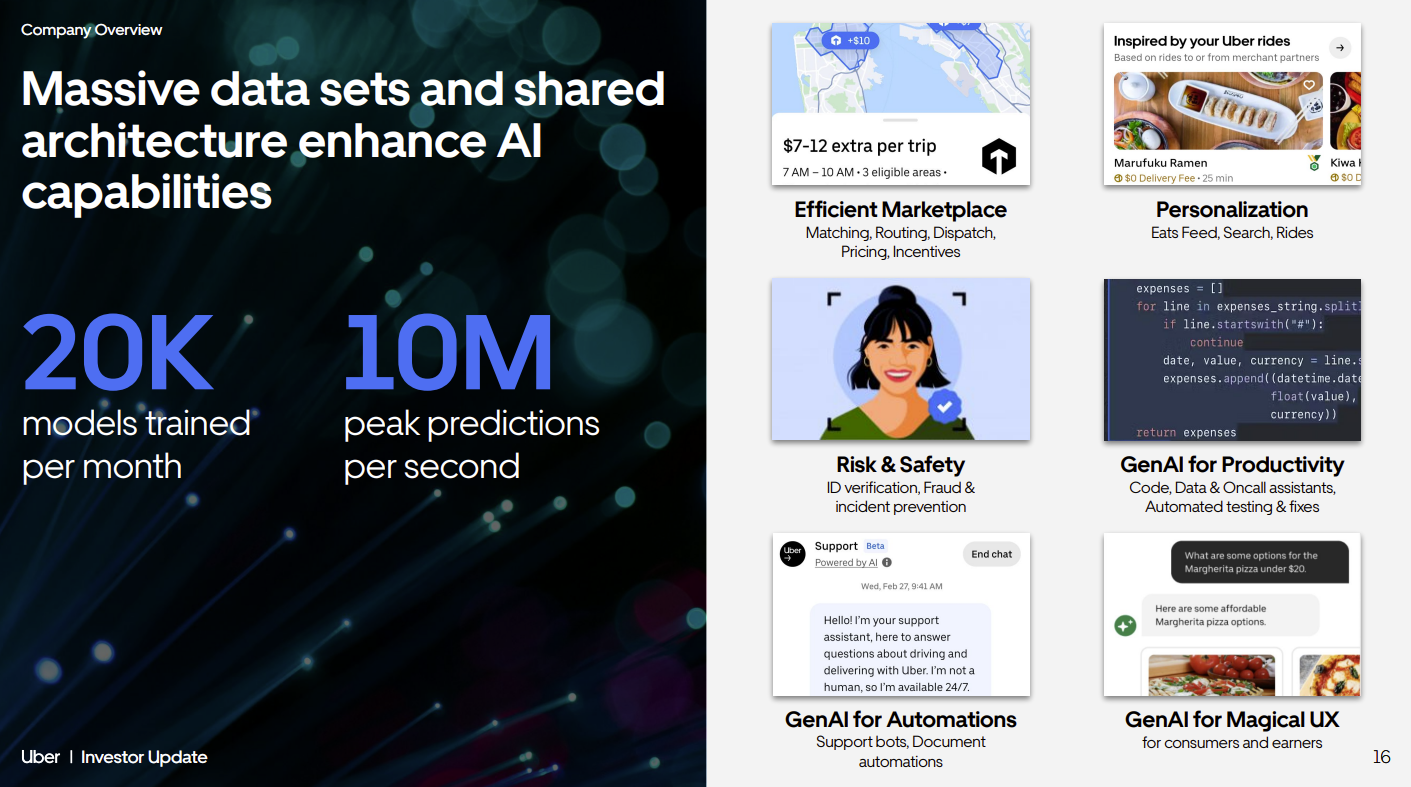

The tech stack and platform drive the datasets that drive AI. Khosrowshahi said Uber's shared architecture and platform drives the data loop that enables it to build predictive models, personalized offers, generative AI assistants and tools that can be used in new markets including advertising, travel, last mile delivery and enterprise.

Disruptive technologies are nice but keep the business goals in front. Khosrowshahi said the company's strategy is simple: "To build best in class products and then amplify them with the power of the platform."

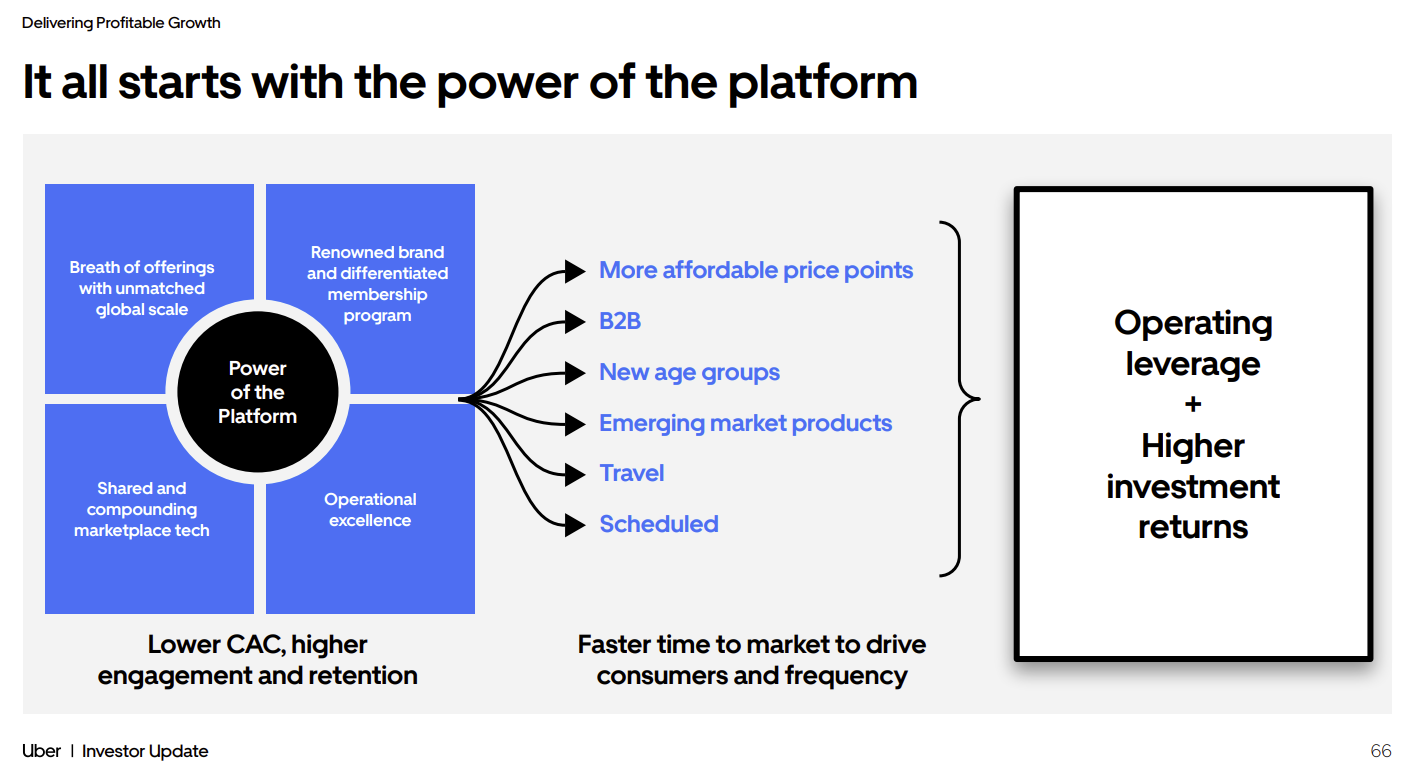

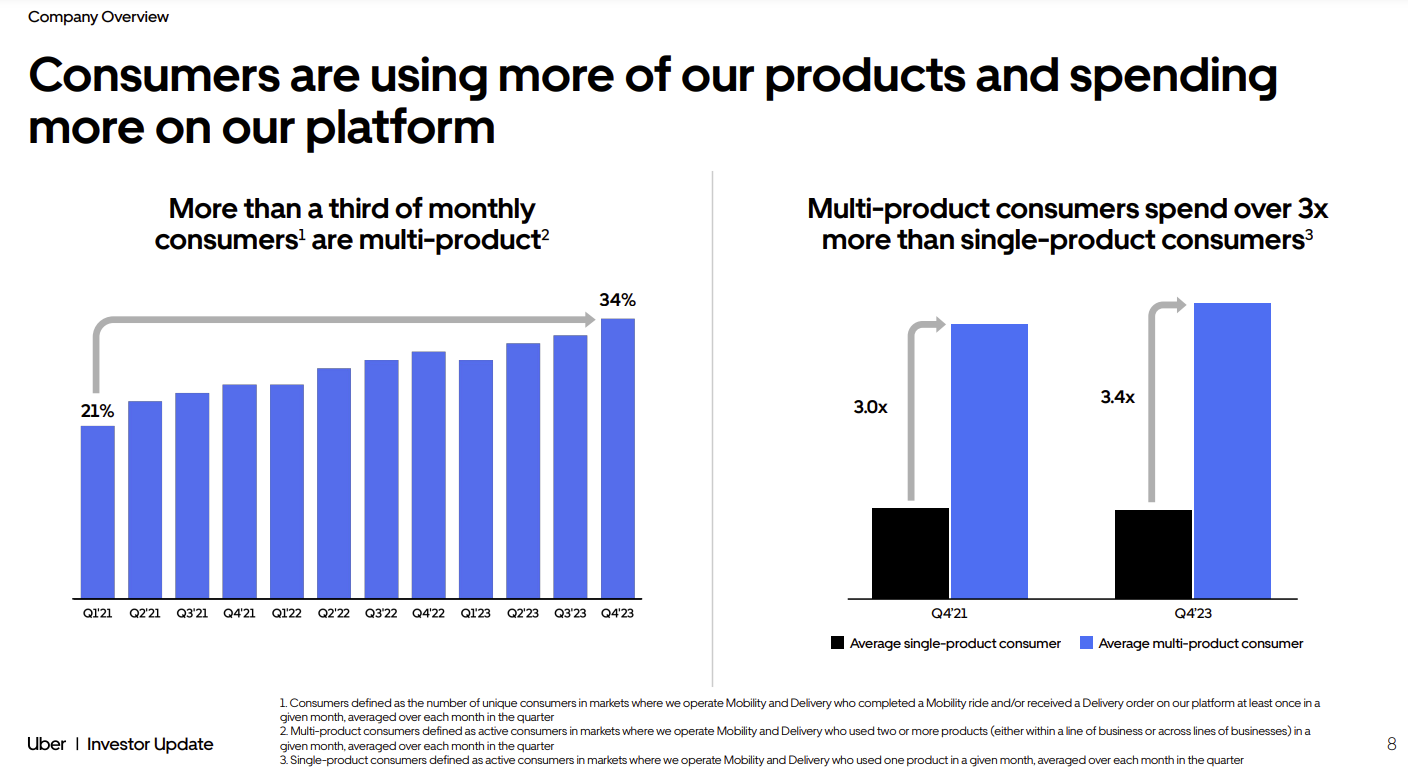

He added that Uber can acquire customers at a lower cost and generate higher customer lifetime values. "We want to bring in new consumers through our mobility and delivery apps and then convert them into Multi Product consumers both within and across segments," said Khosrowshahi.

Data and customer experience drives multi-product usage. Khosrowshahi said that more than a third of Uber users now use multiple products. "The mathematical advantage for Uber lies in the fact that consumers who use multiple products on average spend 3.4 times more than those who don't," he said. The simple truth is that in the end, math wins, and compounding only amplifies the win."

Khosrowshahi said:

"The more products and services we add to the platform, the more data we have and the more opportunities we have to make that particular pitch really compelling for the consumers at the right time. With the right incentives. And with shared identity and payments across all of our apps we can make it super simple, super easy to move from one app to the other, or one service to the other."

Loyalty programs also play into multi-product usage. Uber One now has 19 million members. Those members not only drive the data flywheel, but also spend more--3x more.

Simply put, frequency matters and Uber's growth depends on using multiple products and membership.

Khosrowshahi said:

"We have a product team that is focused on driving essentially AI driven offers to put in front of consumers. In the morning it might be coffee. In the evening, it might be dinner. If we see you reserve an on-demand trip to an airport we may say you can reserve next time. All of this is going to be driven by AI so we just have more shots on goal than anyone else."

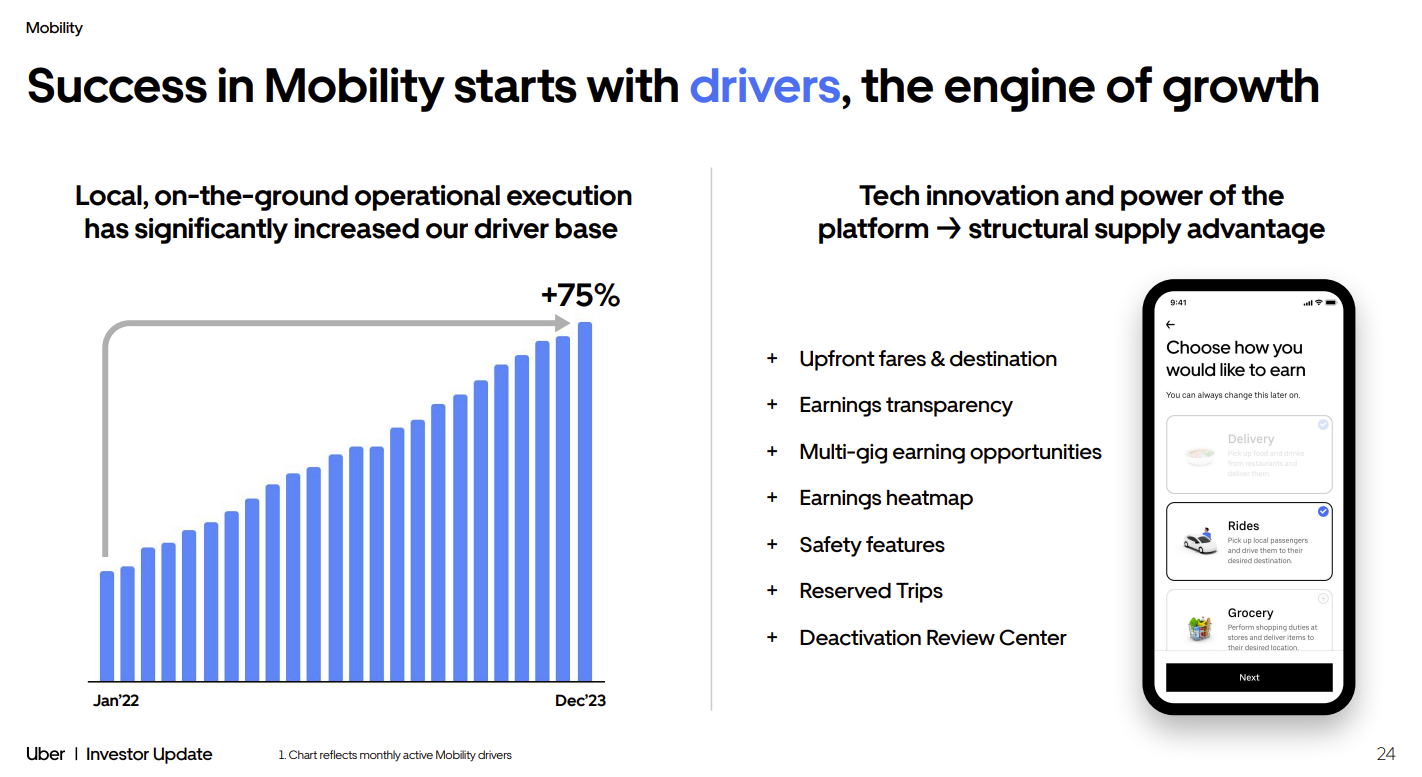

The platform and data strategy also drives the supply side of the equation. The running theme throughout Uber's Investor Day is that it needs to continue to recruit drivers organically on its own platform on multiple services. "The platform gives us a much more cost-efficient way of finding drivers than through external channels," said Khosrowshahi. "So, for example in the US, converting an existing courier into a driver is about half the cost of finding a new driver through third parties. This is a huge opportunity. In fact today 20% of first time drivers in the US have come from a courier pool."

This organic recruitment across multiple services is critical since Uber is expanding into healthcare transportation as well as a bunch of other areas.

Andrew MacDonald, Senior Vice President of Uber's Mobility and Business Operations, said the driver experience on the platform is critical. "Our tech teams have shipped hundreds of improvements to improve the driver experience," said MacDonald.

Uber's expansion into advertising is just starting. "The power of our advertising platform stems from what Uber users tell us every time they use our apps where they want to go and what they want to get. And as a result, we've got the unique ability to bring together both location based and shopping data with closed loop attribution across our mobility and delivery channels for both performance and brand campaigns," said Khosrowshahi.

In fact, Uber is combining consumer signals with its AI to automate offers on the fly.

Khosrowshahi said Uber will follow the data to balance advertising load and customer experience. "We run a certain percentage of our audience with no ads on a long-term cohort basis. And then we compare that audience behavior to audiences who are receiving ads and we make sure that the experience there isn't significantly different," he said. "You don't want to build an ad business that penalizes the customer experience."

Continuous improvement on costs is the mantra. Uber CFO Prashanth Mahendra-Rajah said data, technology and the platform can be leveraged to drive costs out of the business. He said:

"There's a term in the Uber lexicon called operating cost structure or OCS. OCS is a collection of capturing all costs between revenue and EBITDA. There is a team within Uber to grind out incremental cost efficiencies out of that OCS. When you think of what's in that cost bucket it breaks down into variable and fixed."

Examples of how the OCS team expands margins include implementing technology to optimize routing, incentivizing customers to use different payment options, reducing fraud costs with data and AI.