Dell Q2 strong as AI-optimized servers, workstations see demand surge

Dell Technologies reported better-than-expected second quarter results and said it saw strength in AI optimized servers, storage and workstations that can run AI workloads locally.

The company reported second-quarter earnings of 63 cents a share on revenue of $22.9 billion, down 13% from a year ago, but 10% higher than the first quarter. Non-GAAP earnings for the quarter were $1.74 a share.

Wall Street was expecting Dell Technologies to report earnings of $1.14 a share on revenue of $20.85 billion.

Dell Technologies, like HPE, said it was seeing strength as cloud providers and enterprise build infrastructure for AI workloads. Dell has a partnership with Nvidia for AI-optimized infrastructure. How AI workloads will reshape data center demand

Jeff Clarke, Dell's chief operating officer, said the company saw "a better demand environment" and AI "is already showing it's a long-term tailwind, with continued demand growth across our portfolio."

In prepared remarks, Clarke said Dell was cautious about the quarter, but demand "improved at a faster rate than we anticipated, particularly as we moved into June and July."

Clarke added that Dell executed well and was more selective on deals and pricing.

Dell has built out its lineup for generative AI gear and has validated designs with Nvidia. Other generative AI optimized products include Dell PowerEdge XE9680 servers and Dell Precision workstations with up to four Nvidia RTX 6000 Ada generation GPUs.

Research:

Clarke said:

"From a solutions perspective, we saw significant strength in AI enabled servers. PowerFlex and PowerStore demand grew within our storage portfolio. PowerFlex, our proprietary software defined storage solution, has now grown for eight consecutive quarters, with demand in Q2 more than doubling year-over-year. Workstation demand grew and was another bright spot that will continue to benefit from the rise of AI. Developers and data scientists can now fine-tune Gen AI models locally before deploying them at scale."

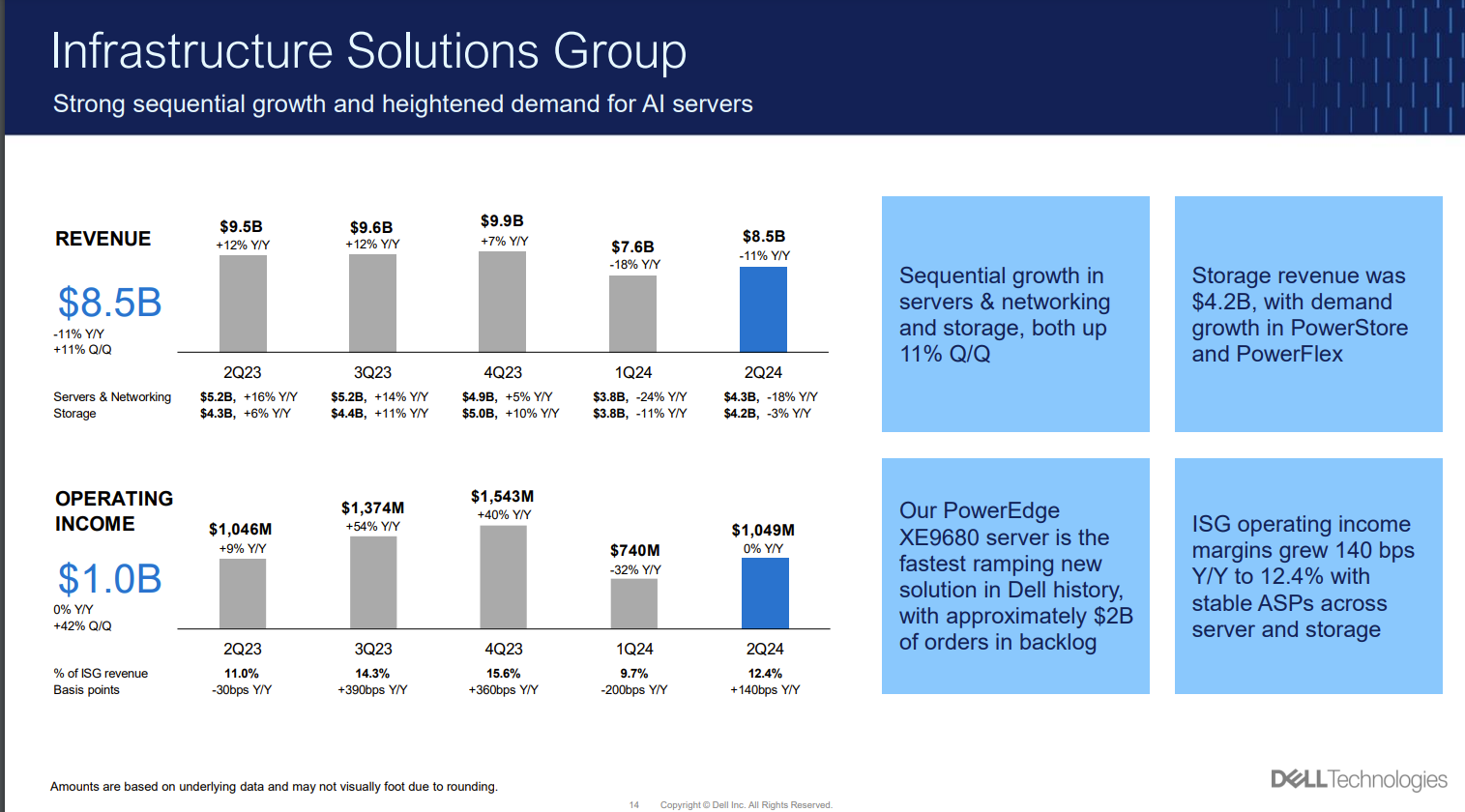

The company's Infrastructure Solutions Group had second quarter revenue of $8.5 billion, down 11% from a year ago. Storage revenue was $4.2 billion with servers and networking revenue of $4.3 billion. Operating income was $1 billion.

"In Q2 alone, we saw unprecedented strength from our PowerEdge XE9680. It's the fastest ramping new solution in Dell history and builds on the success of other GPU enabled servers we have been selling for years," said Clarke.

Although Dell didn't provide an outlook, the demand surge for AI-optimized servers appears to be ongoing. AI servers were 20% of server order revenue in the first half of the year and Dell has $2 billion of XE9680 orders in backlog with a strong sales pipeline.

Dell's Client Solutions Group had second quarter revenue of $12.9 billion, down 16% from a year ago. Commercial client revenue was $10.6 billion and consumer revenue were $2.4 billion. Operating income was $969 million.

Clarke added that many AI workloads will be on-premises or at the edge due to latency, data security and costs. Customers are focused on using generative AI for customer operations, content creation, software development and sales.