Nvidia has pricing power: Q2 results surge, projects Q3 revenue of $16 billion

There's generative AI money to be made--at least if you're selling the GPUs that power the compute. Nvidia posted another ridiculous quarter and delivered an outlook that looks like a misprint.

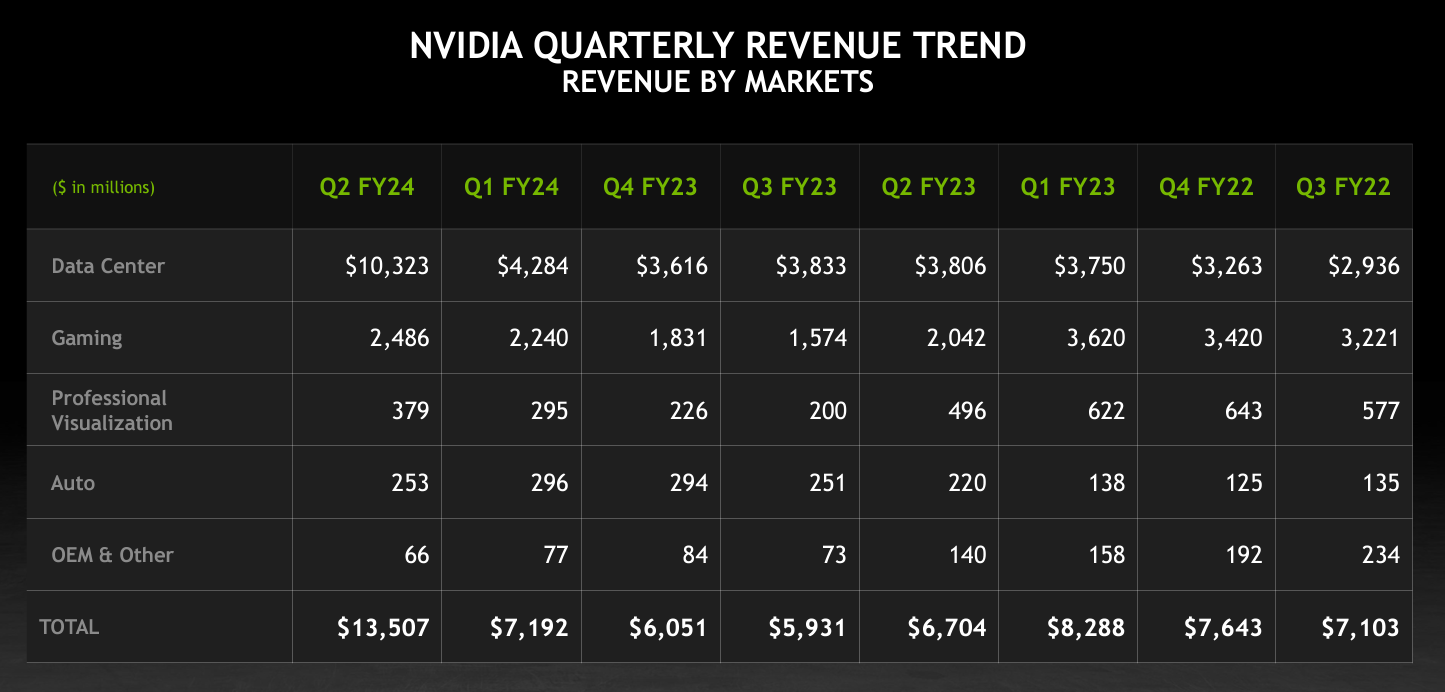

Nvidia established itself as an AI growth darling last quarter. The second quarter will only bolster that position. The company reported second quarter revenue of $13.51 billion, up 101% from a year ago. Earnings were $2.48 a share and non-GAAP second quarter earnings were $2.70 a share.

Wall Street was expecting Nvidia to report second quarter earnings of $2.09 a share on revenue of $11.22 billion.

CEO Jensen Huang said Nvidia is benefiting from its GPUs as well as its Mellanox networking and switch gear. Infrastructure sales are booming as cloud providers and enterprises ramp up for generative AI workloads. Nvidia is seeing gains from its H100 AI infrastructure.

- Nvidia fleshes out generative AI vision from PC, workstation to cloud

- Nvidia data center revenue, outlook strong due to AI infrastructure boom

- Snowflake, Nvidia team up to enable custom enterprise generative AI apps

- AMD makes its case for generative AI workloads vs. Nvidia

- Snowflake launches Snowpark Container Services, linchpin to generative AI strategy

Indeed, data center revenue was $10.32 billion, up 141% from a year ago. Nvidia outlined a series of partnerships in the quarter with the likes of Accenture, ServiceNow, VMware and Snowflake. How AI workloads will reshape data center demand

Nvidia is also enjoying pricing power since rivals such as AMD are just ramping up AI efforts. For instance, Nvidia's second quarter gross margin was 70.1%, up 43.5% from a year ago.

The outlook for Nvidia also blew away estimates. Nvidia said third quarter revenue will be about $16 billion. Gross margins are expected to improve to 71.5% to 72.5% in the third quarter.

In prepared remarks, CFO Colette Kress said:

"Data Center revenue was a record, up 171% from a year ago and up 141% sequentially, led by cloud service providers and large consumer internet companies. Strong demand for the NVIDIA HGX platform based on our Hopper and Ampere GPU architectures was primarily driven by the development of large language models and generative AI. Data Center Compute grew 195% from a year ago and 157% sequentially, largely reflecting the strong ramp of our Hopper-based HGX platform. Networking was up 94% from a year ago and up 85% sequentially, primarily on strong growth in InfiniBand infrastructure to support our HGX platform."

On a conference call, Kress said Nvidia's supply chain and manufacturing relationships have been built up over the last decade and those partnerships are paying off now. She said:

"There is tremendous demand. Our supply chain partners have been phenomenal in supporting our needs. We have lined up additional capacity and components. We expect supplies to increase each quarter through next year."

Kress noted that demand was strong among cloud providers, consumer Internet companies and enterprises, who are looking at on-premises generative AI workloads. "Virtually any industry can benefit from generative AI," she said.

By the numbers:

- Nvidia said it has authorized an additional $25 billion in stock repurchases.

- Gaming revenue was $2.49 billion, up 22% from a year ago.

- Automotive revenue was $253 million, up 15% from a year ago.

- Pro visualization revenue $379 million, down 24% from a year ago.