CVS Health’s transformation rides on data, AI and customer experiences

CVS Health has big plans to deliver health care to consumers across multiple touch points, but its success will depend on how it leverages data across its multiple touch points to deliver good customer experiences.

What CVS Health is aiming to do is improve customer experiences (and patient outcomes) across its pharmacy infrastructure, benefit plans, retail stores and health care delivery services via clinics. CVS Health is also an omnichannel juggernaut with digital and physical touch points. The CVS Health transformation effort is worth watching ahead of Constellation Research’s Healthcare Transformation Summit December 14-15, 2023.

To understand the scale of what CVS Health hopes is a flywheel of customer engagement it helps to know a few key facts.

- CVS Health is expected to have $355 billion in revenue for 2023.

- The company serves more than 120 million consumers, processes more than 2.3 billion pharmacy claims and handles more than 10 million annual health services visits.

- 85% of the US population lives within 10 miles of a CVS location.

- CVS Health is comprised of Aetna, which has $104 billion in annual revenue and more than 35 million unique members, CVS Healthspire, which has $182.7 billion in revenue, and CVS Pharmacy with $115.9 billion in revenue.

- The company has more than 55 million digital customers who will have a more personalized experience via a new CVS Health App.

- CVS Health's Signify unit has 11,000 clinicians that will do nearly 3 million home visits in 2023.

According to CVS Health CEO Karen Lynch, the company is "dedicated to unlocking the value in health care by delivering superior experiences, improving health and lowering the total cost of care."

Speaking at CVS Health's Investor Day, Lynch said: "We have powerful assets that work together to integrate all the moments of care that matter. We're able to provide panoramic care for all of our 100 million members."

8 takeaways from Constellation Research's Healthcare Transformation Summit | AI Meets Mental Health Assessments: How Futures Recovery Healthcare, Aiberry Co-innovated

Now all CVS Health has to do is connect the dots between its businesses and channels. "We're creating value by bringing all together these powerful assets to engage consumers and health across multiple channels," said Lynch. "The value generation that we will create is for all of our stakeholders, our clients, our customers, our providers, and our shareholders. Our segments individually each are profitable. However, when combined, they mutually reinforce growth and are more successful together than they are alone."

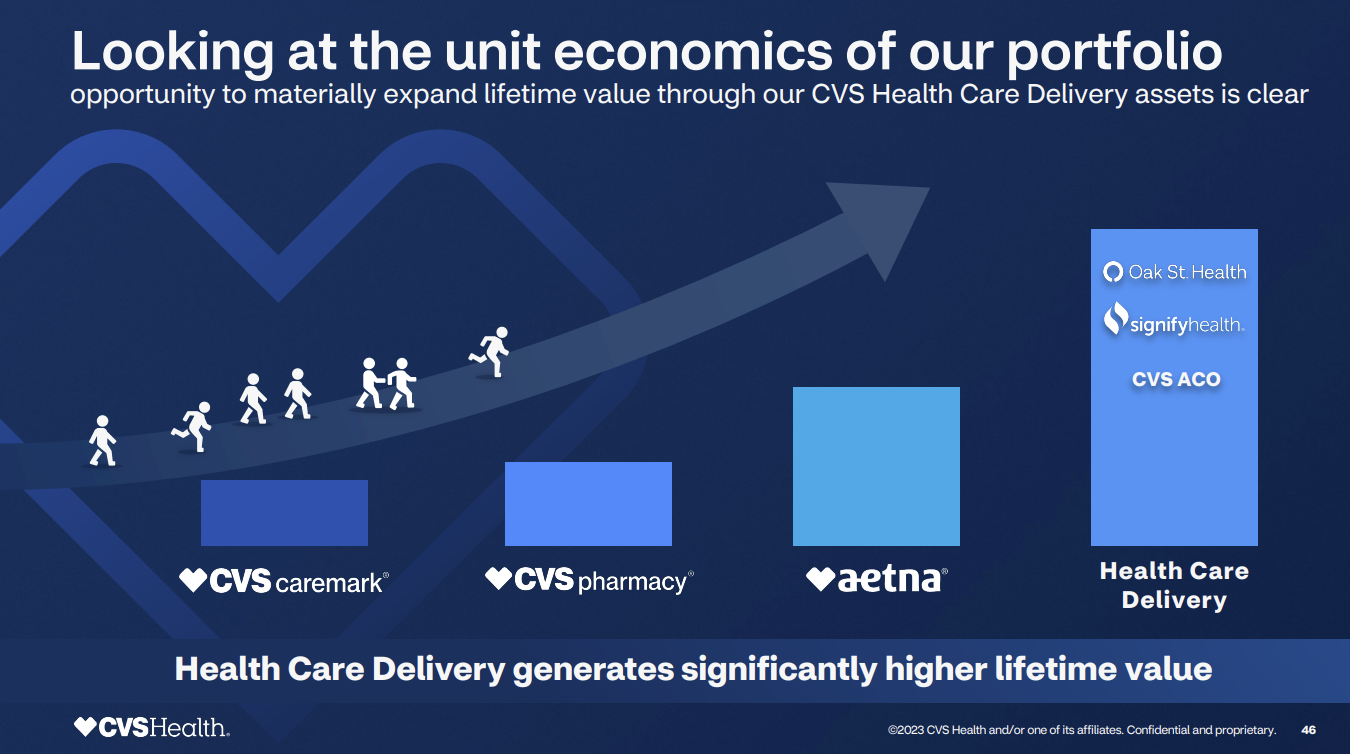

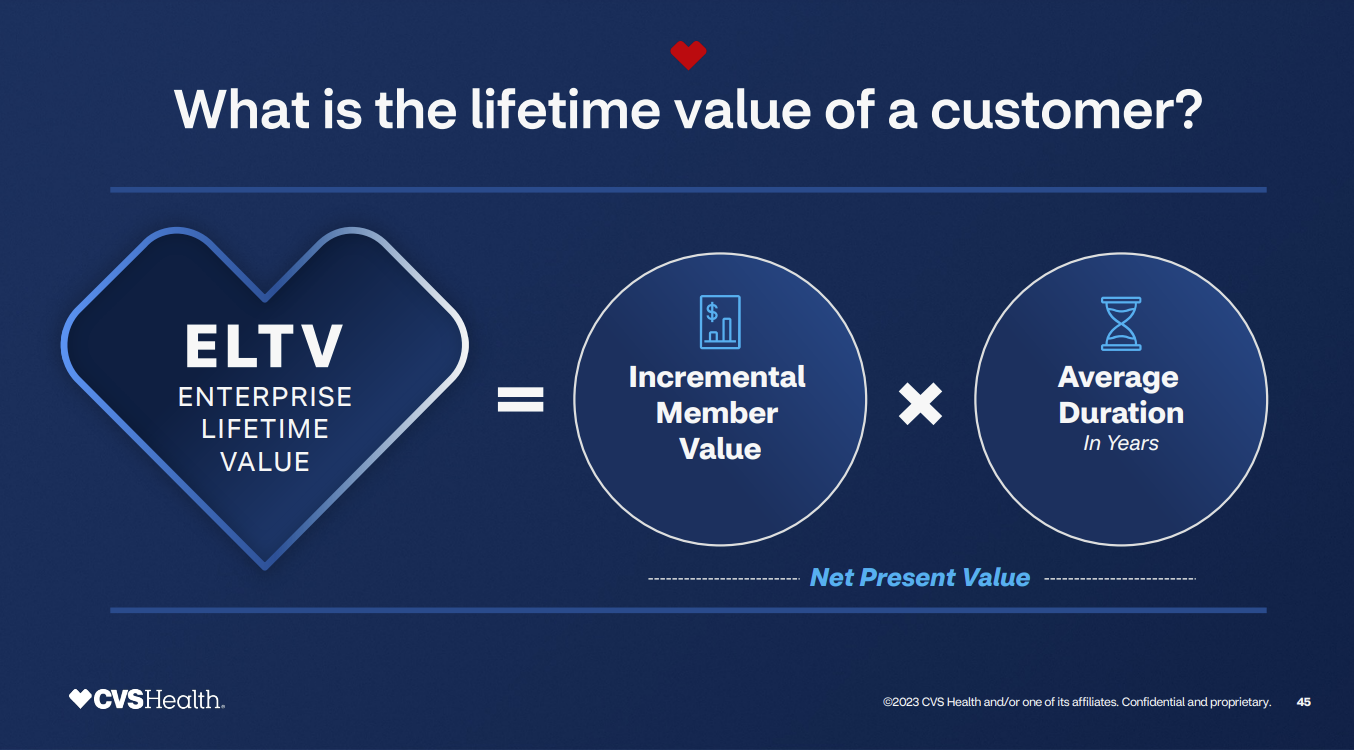

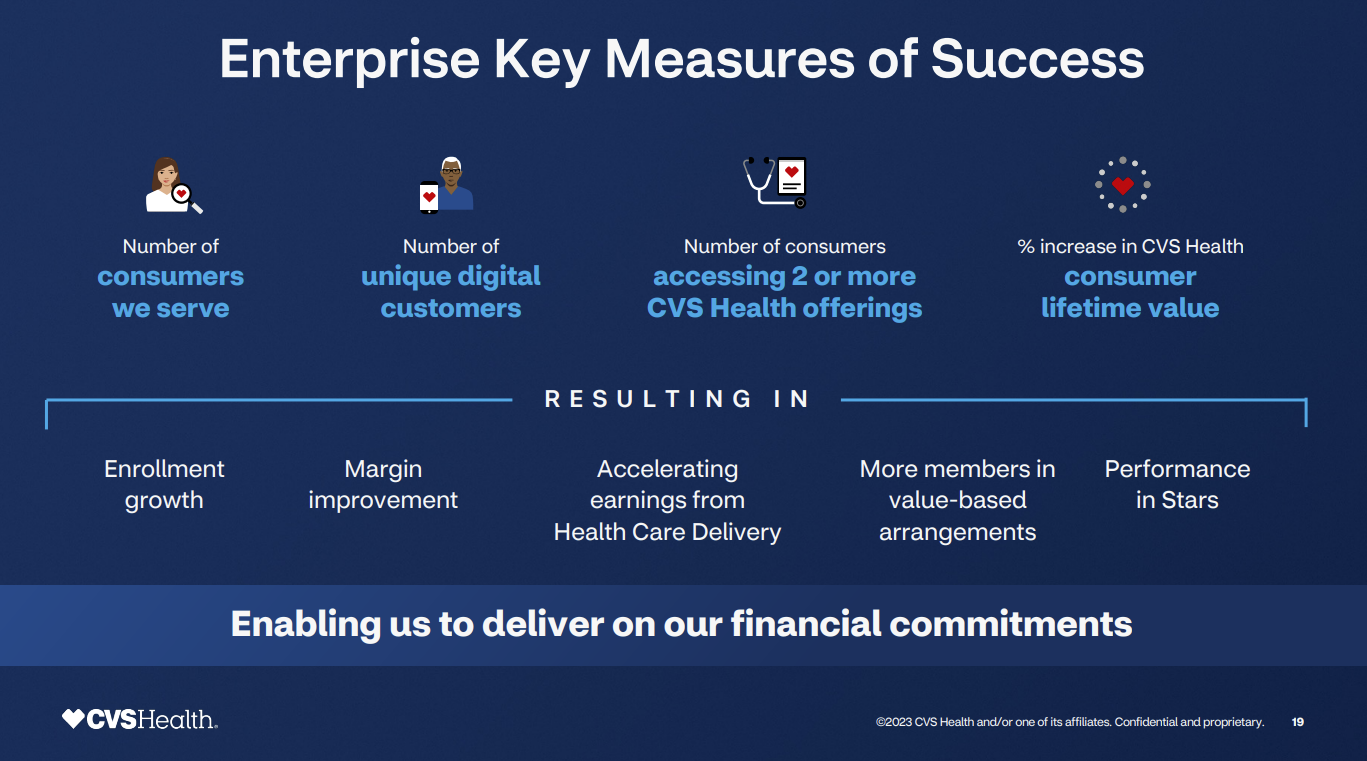

The economic gain from this customer experience effort is straightforward: Increase the lifetime value of a customer.

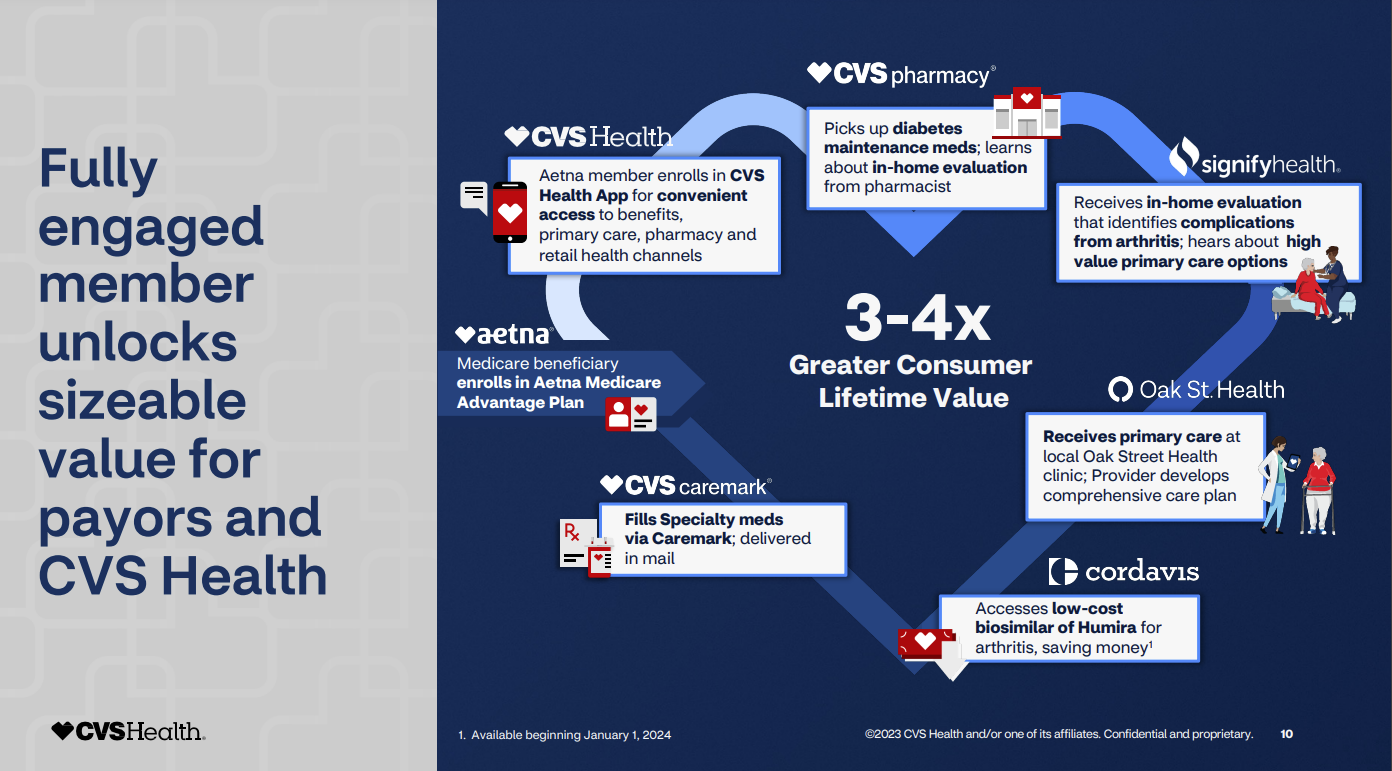

Here's an example of how CVS Health wants to move customers through its touch points.

Interim CFO Thomas Cowhey explained how this flywheel delivers returns.

"Once you understand how that flywheel works, understanding how we unlock value is pretty straightforward. We have to increase the number of interactions and the number of people we serve. Once they're in our ecosystem, we have to engage them. We have to make them help them play an active role in managing their health. We have to expand those interactions. We have to surround them with integrated services. And if we do that, we'll see enhanced persistency and more enhanced the value of those customers."

While CVS Health can drive returns with better engagement and cross-marketing of services, executives said the company can also drive better health outcomes.

Mike Pykosz, Interim President of Health Care Delivery at CVS Health, said patient and consumer engagement drives value on multiple fronts.

"One of the keys to increasing quality is improving patient engagement. You can't change a patient's health trajectory, if they're not engaged in their care," he explained. "Better quality and value-based contracts lead to your surplus and lead to savings that drives your economic model. And that means you can afford to invest in the innovative model. So, these things are all related."

Indeed, CVS Health estimates that when a member uses more than one of the company's services, she creates an integrated value that's up to 10% greater than the sum of the company's parts.

Data and generative AI

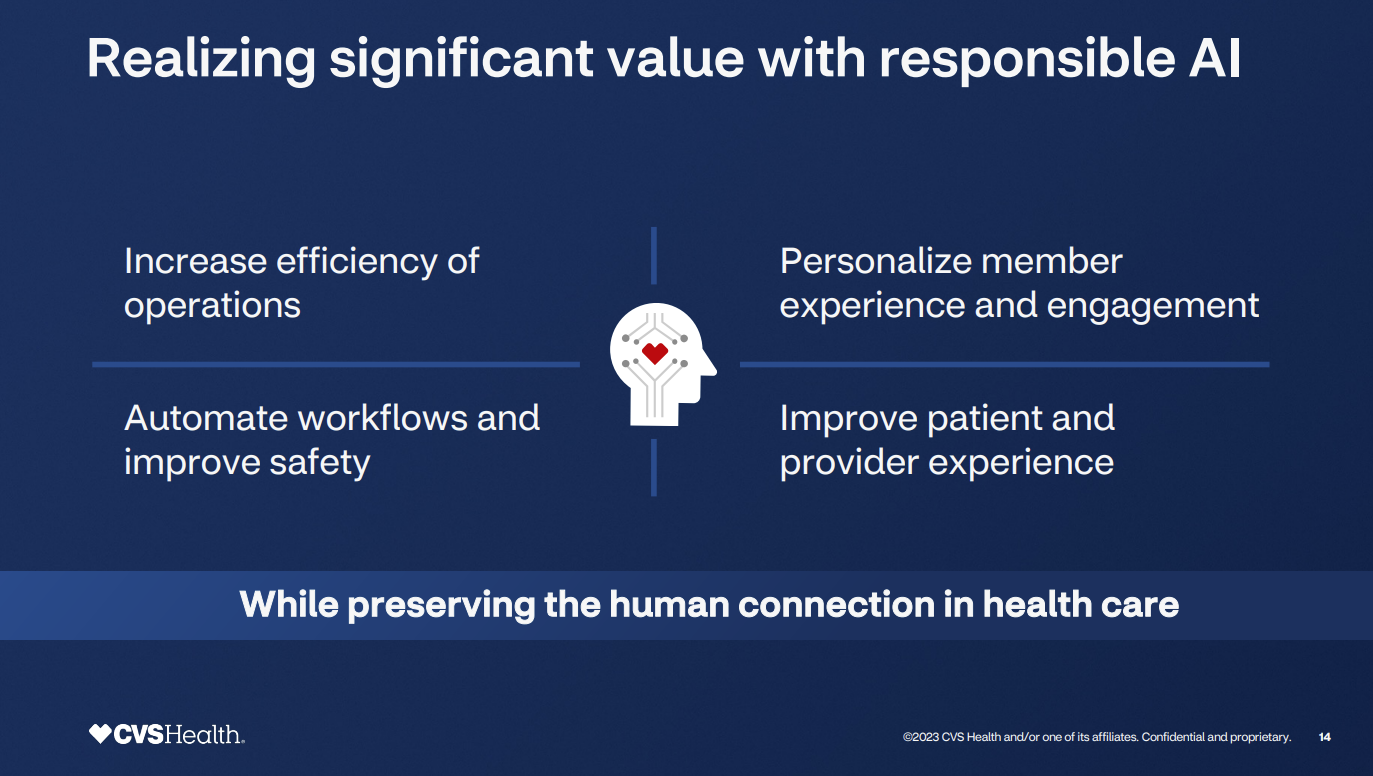

To reach its customer experience nirvana, CVS Health is betting on data, analytics and generative AI.

"We believe that AI and generative AI will transform healthcare," said Lynch. "We're applying technology, data and analytics to every single aspect of our business. The effects will be positive and profound."

Lynch added that the use of technology has preserved the importance of human connection. She added that AI will impact the following:

- In the CVS Caremark unit, AI is being used to automate underwriter and client contracting.

- Aetna is using AI to improve and automate operations.

- CVS Pharmacy is using AI to automate pharmacists’ workflows and improve experiences.

- Care delivery systems will use generative AI to summarize cases.

- CVS Health's Signify unit, which conducts home visits, has invested in a logistics and routing platform to optimize travel time and supply chains needed to transport vaccines and immunizations.

Prem Shah, Chief Pharmacy Officer at CVS Health, said the company is using technology to streamline workflows in pharmacies.

"We've launched a clinical decision support tool that generates patient specific alerts to support our pharmacists' clinical conversations at the counter with their patients," said Shah. "We leverage AI and we've augmented our capabilities and our pharmacists to support key tasks, such as the ability to perform prescription verification."

A pharmacy operating platform called RX Connect is also designed to enable CVS Health's more than 9,000 stores as one fleet and integrate digital engagement from the CVS Health app, according to Shah.

CVS Health is also looking to digitally engage with customers to improve satisfaction, improve Net Promoter Scores and reduce calls that can be handled with AI or digital tools.

These digital engagements can enable CVS Health to reach consumers over time since the average tenure of a CVS pharmacy patient is about 10 years.

Ultimately, CVS Health plans to integrate these touch points with last mile care health services from its CVS Healthspire brands, including Oak Street Health, Signify Health and MinuteClinic.

Shah said CVS Health has already lowered the acquisition cost of an Oak Street Health customer via engaging customers and leveraging its retail footprint.

"We're going to engage more consumers in the moments that matter to their health where and how they want to engage us in a local setting," said Shah. "We're going to harness the power and engagement and trust to build connections across the full breadth of our enterprise and care delivery assets."

The tech stack

CVS Health executives did not get into specifics about its technology stack, but like large enterprises built by acquisition the company has a bit of everything.

The operating environment includes public, private and hybrid cloud as well as several business transaction systems. And there are plenty of positions for mainframe developers and engineers and even a bit of COBOL is required.

A tour through three dozen job listings revealed the following about the CVS Health stack.

- Google Cloud is CVS Health's preferred platform, but AWS and Azure are listed in many job roles too. Multiple Google Cloud database, data services including BigQuery listed. CVS has talked about data discovery strategies with Google Cloud as well as working with Azure.

- BI platforms include MicroStrategy as well as Tableau.

- Databases include Oracle, PostgreSQL, MS SQL, MongoDB, Cosmos, Hadoop, Redis.

- SAS programming skills often cited.

- Snowflake and Teradata database integration skills are often required. Databricks or Jupyter Notebooks experience a plus for many positions.