But before presenting my Top 3 takeaways – let’s put things into perspective. Back in 1992 R/3 was a ‘gimmick’ in the eyes of most industry observers. It was Plattner’s project to run SAP enterprise software on a relational RDBMS in ‘client server’ mode, it was positioned to target the large German economy of Mittelstand businesses that could not afford the mainframe based flagship R/2. In hindsight it worked out all well for SAP – Moore’s Law made R/3 feasible and so affordable that large enterprises used it more than the SMBs. And Plattner was gets kudos for foresight – choosing Oracle was a winner on the RDBMS side (not that clear in the early 90ies) and SAP was years ahead of the competition on the USA, anyone remembers D&B as a software vendor, AMS etc.? And SAP’s desire to automate every corner of the enterprise was also exactly what enterprises caught in Hammer’s process re-engineering wanted. One common system to lay out new processes and best practices. That helped SAP to a leadership position in enterprise software that the vendor still has today.

But before presenting my Top 3 takeaways – let’s put things into perspective. Back in 1992 R/3 was a ‘gimmick’ in the eyes of most industry observers. It was Plattner’s project to run SAP enterprise software on a relational RDBMS in ‘client server’ mode, it was positioned to target the large German economy of Mittelstand businesses that could not afford the mainframe based flagship R/2. In hindsight it worked out all well for SAP – Moore’s Law made R/3 feasible and so affordable that large enterprises used it more than the SMBs. And Plattner was gets kudos for foresight – choosing Oracle was a winner on the RDBMS side (not that clear in the early 90ies) and SAP was years ahead of the competition on the USA, anyone remembers D&B as a software vendor, AMS etc.? And SAP’s desire to automate every corner of the enterprise was also exactly what enterprises caught in Hammer’s process re-engineering wanted. One common system to lay out new processes and best practices. That helped SAP to a leadership position in enterprise software that the vendor still has today.

|

| R/3 CDs back then (from SAP website here) |

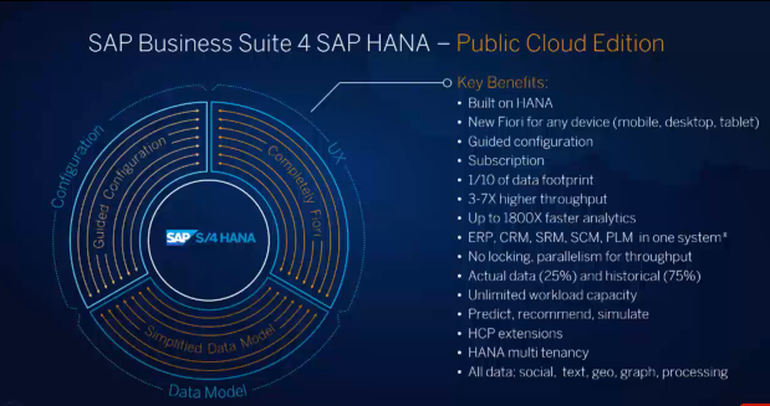

Fast forward to 2015 and the launch of S/4HANA is different for a number of reasons:

- While R/3 was a 2nd product to the main product R/2 – S/4HANA is SAP’s go to product that needs to evolve fast and carry revenue load quickly.

- While SAP was ahead with ‘client / server’ architecture it is no longer ahead in terms of re-writing its applications for the 21st century. SAP has certainly innovated first with in memory / HANA – it has been busy for the longest to make its existing applications work with HANA – and not write its next generation applications. Oracle is 10 years into Fusion (one could argue even maybe too long), Infor announced rebuilding of Finance and HCM last year etc.

- SAP stayed away from the database and partnered successfully with all hardware vendors. Its partner’s strategy for database, hardware and implementation was definitively a success ingredient. Today S/4HANA will only run on HANA – no surprise – but a big difference with ecosystem implications.

- Open Source was nothing even thinkable or serious in the early 90ies. Today even the largest vendors (think IBM) need to embrace open source and use it in their next generation products. Building an architecture somewhere in a remote R&D location won’t happen anymore and come out with a big surprise – won’t happen anymore.

- We are at the beginning of the BigData era – it is not guaranteed than in-memory columnar architectures will dominate the future of enterprise software as close as the relational database has in the past.

- Most importantly R/3 was positioned as a TCO leader for enterprise software – cheaper and more affordable than the mainframe based solutions of the time. HANA and now S/4HANA had to justify investment as in memory is not intuitively a leading TCO option.

With that in mind – here are my top 3 takeaways from what we understand S/4HANA is today:

- A Fresh Start – For the first time SAP executives have openly stated that they are building a new product, on a new code line, with new unique capabilities and a (not discussed and likely not set yet) price / license point. SAP has been a victim of the R/3 architecture success that the vendor was able to salvage across the more recent architecture turmoil of internet and cloud architectures. Being able to keep running R/3 and R/3 related assets for such a long time is an accomplishment, but also forces the vendor now – 20+ years later – into a re-write. Most vendors did not have that much time to run on the same platform, they had to innovate (and potentially fail) earlier. But SAP is not starting with Line 1- but re-using assets from the R/3 world. E.g. the Document system that was one of the key success designs for R/3 finds itself again in S/4HANA. EmployeeCentral will become the core of HCM at some undisclosed point in the future. And there is certainly nothing wrong with re-using proven assets and re-implement and re-use them – but SAP will have to be careful to not go too far, especially when falling under time pressure to complete S/4HANA (anyone remember the R/3 ‘death marches’ to bring R/3 to functional parity with R/2 – something never intended originally. But a fresh start was (badly) needed and good for SAP to now talk about it publicly. It looks like the start for S/4HANA was about two years ago when work for Simple Finance started in earnest.

| The three S/4HANA Design Principles |

- Best Practice Concerns - We live in exciting times. For the first time technology is capable and affordable to do more than what business best practice demands. We are moving fast to the barrier of what humans can comprehend. The underlying IT paradigm has switched forever from constrained systems that were ‘sized’ to their specific purpose. In the new (theoretically) infinite scalable new reality and completely different business best practices are emerging, Vendors like SAP need to be careful not to step into the traps of rebuilding what worked in the 20th century – only better / faster – and need to switch from following business practice to create and lead with best practices. A monumental challenge for the years to come. The good news is that the technology is there, the bad news is that it is hard to break old habits and keep asking the business users for best practices. They don’t know them in most places (yet). SAP will have to pay attention to this dilemma. As a former engineer I can only imagine the drawers full of product plans that were not possible then – but are now possible – though only automate the 20th century world that operated on the constrained IT paradigm. A risk not to underestimate.

- In Memory And In Memory Only - My biggest concern remains that SAP locks itself out of the transformation of the BigData era with an over reliance on HANA being RAM based. Yes we know all the DLM / Smart Data Access tools SAP has to mitigate them – but all vendors that preached a co-existence strategy with BigData had to fold that approach. Even the remote query option vendors are creating a risk to limit vital insights. When enterprises face the choice between an in memory platform that has to shuffle data insight it out of Hadoop clusters for insights – vs a SSD based Hadoop only project – they all pick the latter. Even enterprises that want and will use in memory databases still pursue the Hadoop on SSD path as they know they can decide to ‘dump’ their ERP data in the Hadoop clusters anyway later. Not a challenge from a pipe and storage perspective – even a lower cardinality problem for most BigData projects. The longer SAP ignores this situation, the more it risks to build a very good in memory solution, but risks to not ultimately win the enterprise software wars (again). And the same argument is there for the code, too – SAP should allow Hadoop processes in HANA – if customers have the use case, why not run Hadoop style processes in memory next to S/4HANA?

|

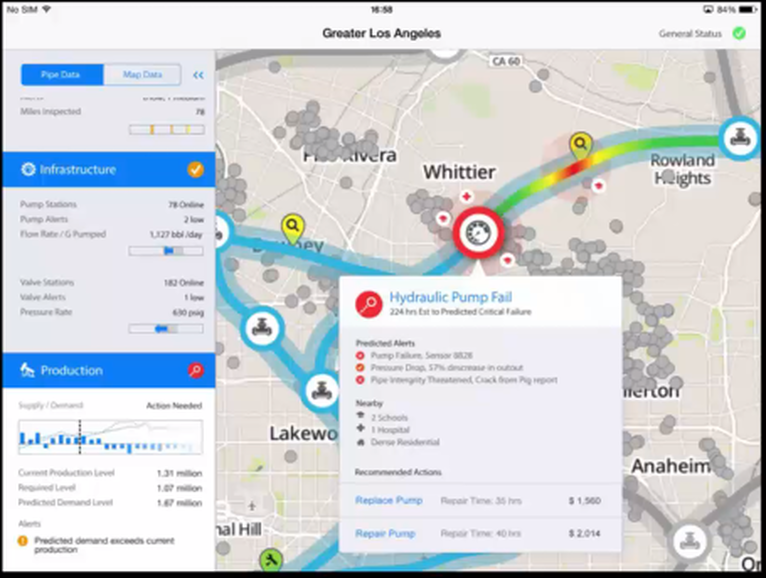

| S/4HANA Demo - Water Management in LA on an iPad |

Implications, Implications

Implications for SAP customers

S/4HANA is good news for SAP customers, as it (finally) makes a new start official. Deep down customer know SAP needed to re-invent – or to borrow form the slides re-imagine itself again – at some point. The attentive SAP customers will of course have heard that S/4HANA is a new product and as such SAP will try to make it a new license. SAP customers should look at contracts and prepare for the ‘return of maintenance’ conversation with their account manager. Customers will also note that with S/4HANA SAP gave up database independence, but that was a writing on the wall for quite some time.

Implications for SAP partners

New products always mean business for partners, as the ecosystem needs them to be successful on the new products. The only category that will not be happy are going to be the system integrators – already struggling with the shrinking implementation budgets caused by SaaS. But that is the course of things and SAP does right enabling customer and ideally business user self-service setup of the S/4HANA applications.

Implications for SAP competitors

We are off to the races – and in the meantime they can’t make fun of SAP running old, last century code on even older best practices. It is intriguing that what used to be a 5 year gap between SAP and Oracle is now more of a 10 year gap. Infor as vendor #3 somewhere in the middle. Assuming all vendors will succeed it sets a very interesting takt for the enterprise software market.

MyPOV

An important day for enterprise software. Good to see SAP innovating back at the core of its competencies, enterprise software, and making the effort official with S/4HANA. As with all product launches many questions remain and will have to be addressed in due course. I mentioned the risks I see that are common for all vendors in finding the 21st century business best practices. The in memory aspect of S/4HANA is a unique risk for SAP. But so was a bet on R/3 at the time. And who knows – with staunchly supporting in memory as the delivery platform for SAP – Plattner may be right one more time. Only the future can and will tell.

------------

- First Take - SAP's IoT strategy becomes clearer - read here

- SAP appoints a CTO - some musings - read here

- Event Report - SAP's SAPtd - (Finally) more talk on PaaS, good progress and aligning with IBM and Oracle - read here

- News Analysis - SAP and IBM partner for cloud success - good news - read here

- Market Move - SAP strikes again - this time it is Concur and the spend into spend management - read here

- Event Report - SAP SuccessFactors picks up speed - but there remains work to be done - read here

- First Take - SAP SuccessFactors SuccessConnect - Top 3 Takeaways Day 1 Keynote - read here.

- Event Report - Sapphire - SAP finds its (unique) path to cloud - read here

- What I would like SAP to address this Sapphire - read here

- News Analysis - SAP becomes more about applications - again - read here

- Market Move - SAP acquires Fieldglass - off to the contingent workforce - early move or reaction? Read here.

- SAP's startup program keep rolling – read here.

- Why SAP acquired KXEN? Getting serious about Analytics – read here.

- SAP steamlines organization further – the Danes are leaving – read here.

- Reading between the lines… SAP Q2 Earnings – cloudy with potential structural changes – read here.

- SAP wants to be a technology company, really – read here

- Why SAP acquired hybris software – read here.

- SAP gets serious about the cloud – organizationally – read here.

- Taking stock – what SAP answered and it didn’t answer this Sapphire [2013] – read here.

- Act III & Final Day – A tale of two conference – Sapphire & SuiteWorld13 – read here.

- The middle day – 2 keynotes and press releases – Sapphire & SuiteWorld – read here.

- A tale of 2 keynotes and press releases – Sapphire & SuiteWorld – read here.

- What I would like SAP to address this Sapphire – read here.

- Why 3rd party maintenance is key to SAP’s and Oracle’s success – read here.

- Why SAP acquired Camillion – read here.

- Why SAP acquired SmartOps – read here.

- Next in your mall – SAP and Oracle? Read here.

And more about SAP technology:

- HANA Cloud Platform - Revisited - Improvements ahead and turning into a real PaaS - read here

- News Analysis - SAP commits to CloudFoundry and OpenSource - key steps - but what is the direction? - Read here.

- News Analysis - SAP moves Ariba Spend Visibility to HANA - Interesting first step in a long journey - read here

- Launch Report - When BW 7.4 meets HANA it is like 2 + 2 = 5 - but is 5 enough - read here

- Event Report - BI 2014 and HANA 2014 takeaways - it is all about HANA and Lumira - but is that enough? Read here.

- News Analysis – SAP slices and dices into more Cloud, and of course more HANA – read here.

- SAP gets serious about open source and courts developers – about time – read here.

- My top 3 takeaways from the SAP TechEd keynote – read here.

- SAP discovers elasticity for HANA – kind of – read here.

- Can HANA Cloud be elastic? Tough – read here.

- SAP’s Cloud plans get more cloudy – read here.

- HANA Enterprise Cloud helps SAP discover the cloud (benefits) – read here.