Anaplan Steps Up Investment In Connected Planning

Anaplan says increased R&D investment will keep it ahead of cloud-based performance management arena. Here’s what connected planning is all about.

When Frank Calderoni, Anaplan’s new CEO, took the stage at the March 27-29 Anaplan Hub 17 event, he cited positive company statistics including signing 250 new customers in the last year (bringing the total count above 660) and more than 75 percent annual year-over-year subscription revenue growth to a $120-million-annual run rate. Just two months on the job, Calderoni also promised a “significant increase” in R&D investment, saying the company intends to stay ahead of the competition.

At Anaplan Hub 17, Frank Calderoni, who joined the company as CEO in January, promised

increased R&D investment. He was previously CFO at RedHat and Cisco, respectively.

Indeed, competition is tightening in the corporate performance management arena, in which the lion’s share of growth is going to cloud-based offerings. Incumbents including Oracle (Hyperion) and SAP (BPC) have introduced their own software-as-a-service options while SaaS rivals Adaptive Insights and Host Analytics have been courting larger and larger customers. Even partners are getting in on the act, with Workday adding Workday Planning to its cloud-based performance management application portfolio in 2016.

Anaplan stands apart among the cloud options in that it focuses on a broader range of business planning challenges than any of its competitors, most of which concentrate on the needs of finance departments. Financial planning and sales planning are Anaplan’s most mature use cases, but the company also supports supply chain, workforce, marketing, IT and other planning needs with more than 195 starting-point applications on its Anaplan App Hub. Roughly two thirds of these domain- and industry-specific apps are offered by partners, such as Accenture, Deloitte and Workforce Insight, who help customers build out and customize apps to their specific needs.

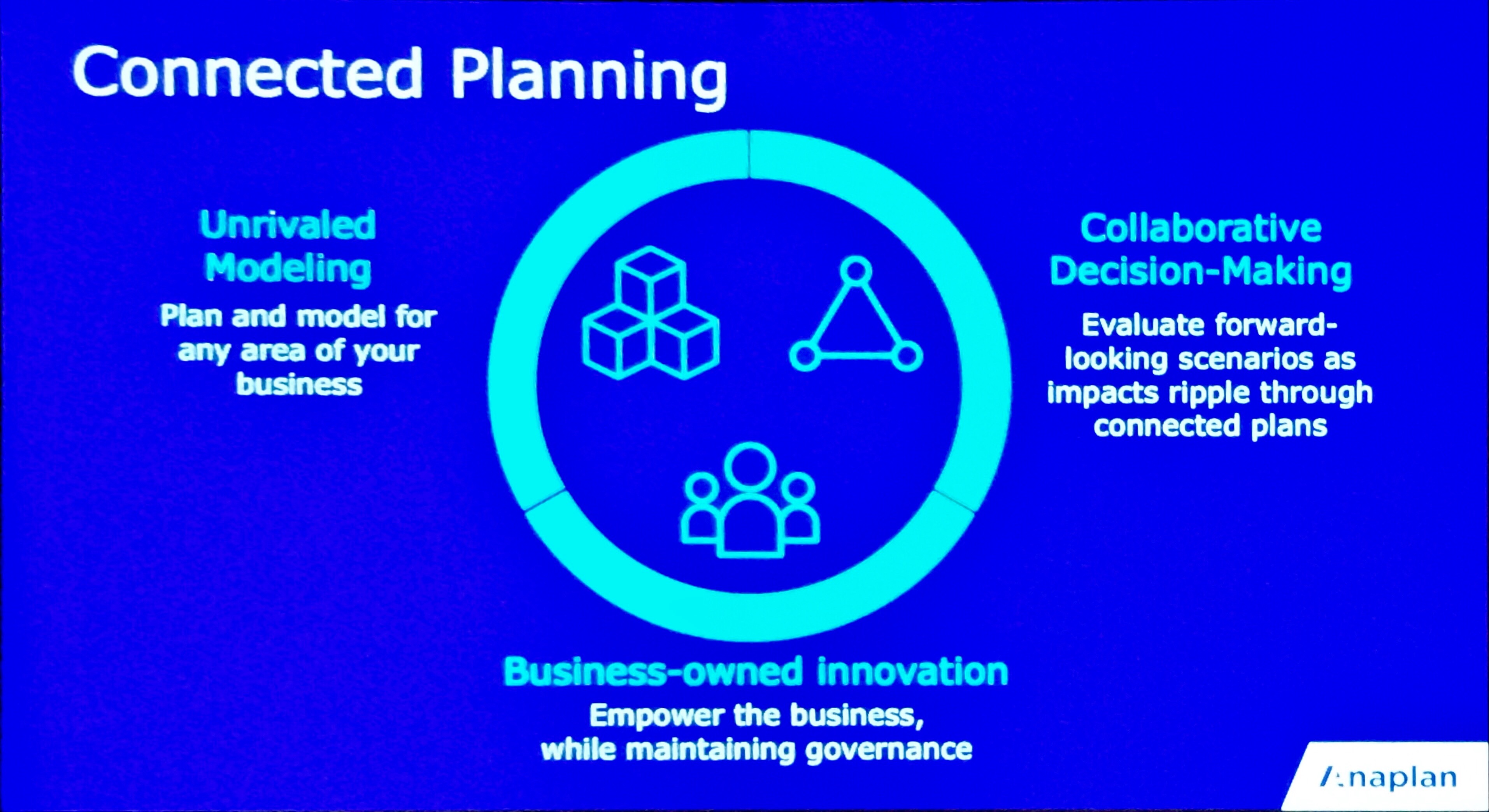

Customers typically start with one planning challenge, such as financial planning and analysis or sales planning, but Anaplan educates customers on the need for “connected planning” as part of its land-and-expand strategy. By connecting plans, companies can understand and account for interdependencies, cascading changes in plans and what-if scenarios across interconnected data, people and processes.

Why do companies need connected planning? Anaplan founder and CTO Michael Gould cited the example of U.K.-based companies that are now in the cross hairs of Brexit. Adequate preparation and forecasting demands more than a single plan; these companies need interconnected plans around possible changes in exchange rates, border tariffs, trade deals, supply costs, pricing and resulting demand. In the U.S. it’s easy to imagine the complex, interconnected planning healthcare organizations will need to come to grips with potential changes in the Affordable Care Act.

Of course, planning and forecasting challenges are more often triggered by routine business dynamics rather than legislative or geopolitical sea changes. Routine business changes such as mergers, acquisitions, digital disruption and emerging market opportunities all trigger complex planning and forecasting challenges. Anaplan customers are typically large companies and fast-growing companies – mostly in retail, banking, technology, healthcare and consumer packaged goods – that face complexity and constant change.

MyPOV on Anaplan’s Progress

There weren’t a lot of high-profile announcements at Anaplan Hub 17 in part because the company is still in the process of delivering capabilities promised at Anaplan Hub 16 (thus, Calderoni’s promise to step up R&D investment). For example, a Business Map feature announced at Hub 16 is still a few weeks away. The Business Map will support connected planning by giving customers a holistic view of all business planning activities, with tagging, searching and filtering by use case, business process and geography.

Also still in the works is a promised expansion of existing predictive capabilities to better support workforce optimization, supply planning, transportation assignment, product marketing, and risk modeling, among other forward-looking analyses. Anaplan did release a module in a limited private beta, but executives say they’re reworking the module to support mathematical optimization without requiring coding.

Late last year Anaplan did deliver on Application Lifecycle Management (ALM) capabilities promised at Hub 16. The new ALM capabilities brought an important productivity advance, enabling customers to split large models and synchronize model versions so they don’t have to replicate changes across development, testing and production instances.

At Hub 17, Anaplan did announce a new data-integration option called Anaplan HyperConnect, which is a licensed version of Informatica Cloud that Anaplan will sell and support under its own brand. It also announced reporting integrations with Tableau, and the company is days away from releasing a DocuSign integration that will take paperwork and, thus, time out of approval processes.

Anaplan didn’t play up the announcement, but in a roadmap session it unveiled plans for two important coming platform capabilities that will unlock yet more growth. A Bring-Your-Own-Key encryption requested by security-conscious banks and financial institution is due out later this year. And a lightweight workflow capability will improve planning throughput, governance and collaboration by routing tasks, approvals and alerts. Release dates weren’t disclosed, and one Anaplan executive quipped that the company wants to live down recent product delays by under-promising and overdelivering.

Anaplan has had its share of executive changes over the last year, as is common in any CEO regime change. But as Calderoni settles in and the company pours more of its considerable venture funding into development, I expect innovation to accelerate and the connected planning story to get stronger.

Related Reading:

Anaplan Scales Platform, Prepares for Prediction

SAP Feels Your Pain, ‘Storms Ahead’ on New Apps, Consumer Insights

Cloud-Based Performance Management: Why the Digital Era Demands Agile Planning