Grammarly gets more interesting with Coda, Superhuman deals

Grammarly built a strong business by bringing its AI writing assistant to wherever you work, but recent acquisitions of Coda and Superhuman and new capital point to much larger ambitions.

The company's acquisition this week of Superhuman, which gives Grammarly a native email platform, is just the latest in a series of moves to redefine the company in the AI age. Grammarly is best known as a handy writing tool, but large language models (LLM) threaten to usurp it.

The fix? Grammarly, which has annual revenue of more than $700 million, is going to become an AI-native productivity platform.

Here's the recap of recent events:

- Grammarly acquired Coda, a productivity platform, and named Coda Co-Founder Shishir Mehrotra CEO of the combined company. Coda was acquired to transform Grammarly into an AI productivity platform. Typically, Grammarly was used as an assistant that plugged into whatever app you were using.

Mehrotra, former CTO and product chief at YouTube, noted that Grammarly has "a massive opportunity to reinvent productivity as we know it." Grammarly with Coda set out a mission to focus on how AI agents can improve applications and work across the enterprise.

Grammarly's writing assistant is used across 500,000 apps and more than 40 million people daily. Coda brought Coda Docs, a productivity suite, and Coda Brain, which surfaces corporate knowledge, to Grammarly.

- The company raised $1 billion in funding from General Catalyst. The funds will be used to scale sales and marketing and acquisitions.

- Grammarly acquired Superhuman, an AI driven email application that is designed to save workers time. Grammarly's Superhuman purchase is a bet that email is "a critical communication surface in the company's vision of an agentic future."

Mehrotra said Superhuman will give Grammarly customers a place to collaborate and be a staging ground for orchestrating AI agents. Grammarly works across more than 20 email providers, but it can do more with a native email platform.

The vision here is that the Grammarly platform will use AI agents to triage your inbox, schedule meetings, analyze your content and write full emails in your voice.

As for the future, Grammarly said the following:

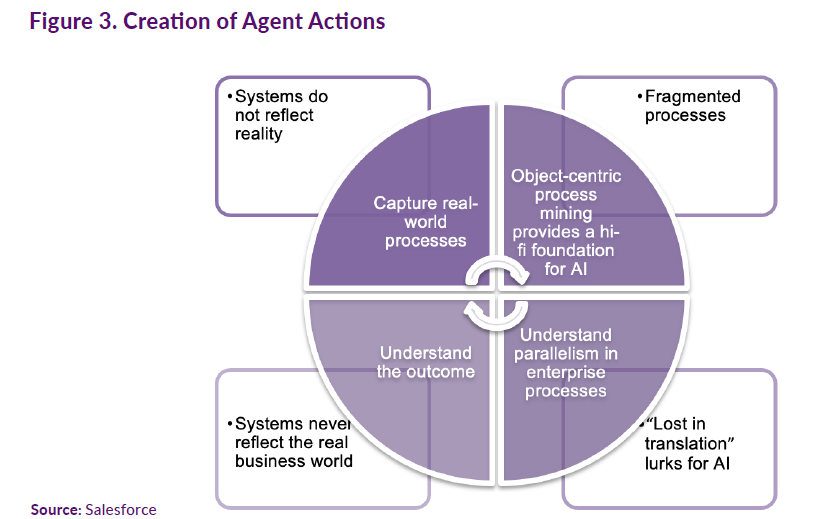

"The future platform will enable scenarios where users can work with multiple agents simultaneously. For example, while writing a customer memo, users could have Grammarly’s trusted communication agent handle spelling and grammar, while a sales agent ensures accuracy of sales facts, a support agent provides context about recent customer issues, and a marketing agent suggests optimal feature positioning."

Now what?

Grammarly clearly has the parts for a broad productivity platform and now has to integrate them. Grammarly is selling its various parts separately, but the magic will really happen with an integrated platform.

Rest assured that a platform launch is on deck.

It's also possible that Grammarly is going to need a rebrand. Grammarly is certainly handy enough to drive $700 million in annual revenue, but sounds like a feature more than a productivity suite. Perhaps, Grammarly simply becomes Superhuman or comes up with a new moniker.

Constellation Research's take on Grammarly's moves were generally positive and strategically on point. It remains to be seen whether Grammarly can pull its users into a broader productivity platform.

Estaban Kolsky, an analyst at Constellation Research, said Grammarly's recent moves are a "way to ensure survival in AI world." He added that "Grammarly's core offering is superseded by AI now so the company needed a new hook. Superhuman is a decent one, but unclear if too little too late."

Holger Mueller, an analyst at Constellation Research, said that Grammarly needed to have more native email support and Superhuman fills the void. The ability to integrate with multiple email systems was useful, but Grammarly needed native support for email, which is the most written document type and natural collaboration space.

Liz Miller, an analyst at Constellation Research, noted that Grammarly just got a lot more interesting with the Superhuman purchase since it makes its future of work mantra more of a reality. Don't understate Grammarly's core offering though.

"Users like it, it delivers the exact value they believe they are opting in for and Grammarly's understanding of language and its imperfections is a tangible and sellable asset to anyone," said Miller, who agreed with the idea that Grammarly needed a new hook.

Constellation Research analyst Michael Ni added:

Data to Decisions Future of Work Innovation & Product-led Growth Next-Generation Customer Experience Tech Optimization New C-Suite Chief Information Officer Chief Experience Officer"This Superhuman purchase isn’t just Grammarly buying an email client—it’s a full-blown AI productivity fabric play. Start with always-on assistance that already has mass appeal, drop into real-time action in Superhuman, and pull it all together in Coda. Boom. It’s AI at the point of thought, decision, and execution. Expect this to challenge those who are playing for the worker "pane of glass" for where work gets done and how it gets measured."