HPE ups savings targets for Juniper Networks integration

HPE raised its savings target for the Juniper Networks acquisition, set its integration teams, said no customer will be left behind and provided the first installment of vision for the combined companies.

Antonio Neri, CEO of HPE, said on a conference call with Wall Street analysts that the integration of Juniper Networks is underway. HPE's networking business will be run by former Juniper Networks CEO Rami Rahim. HPE closed the Juniper Networks deal last week.

The company didn't outline revenue projections but said it will provide three-year guidance at its analyst meeting in October.

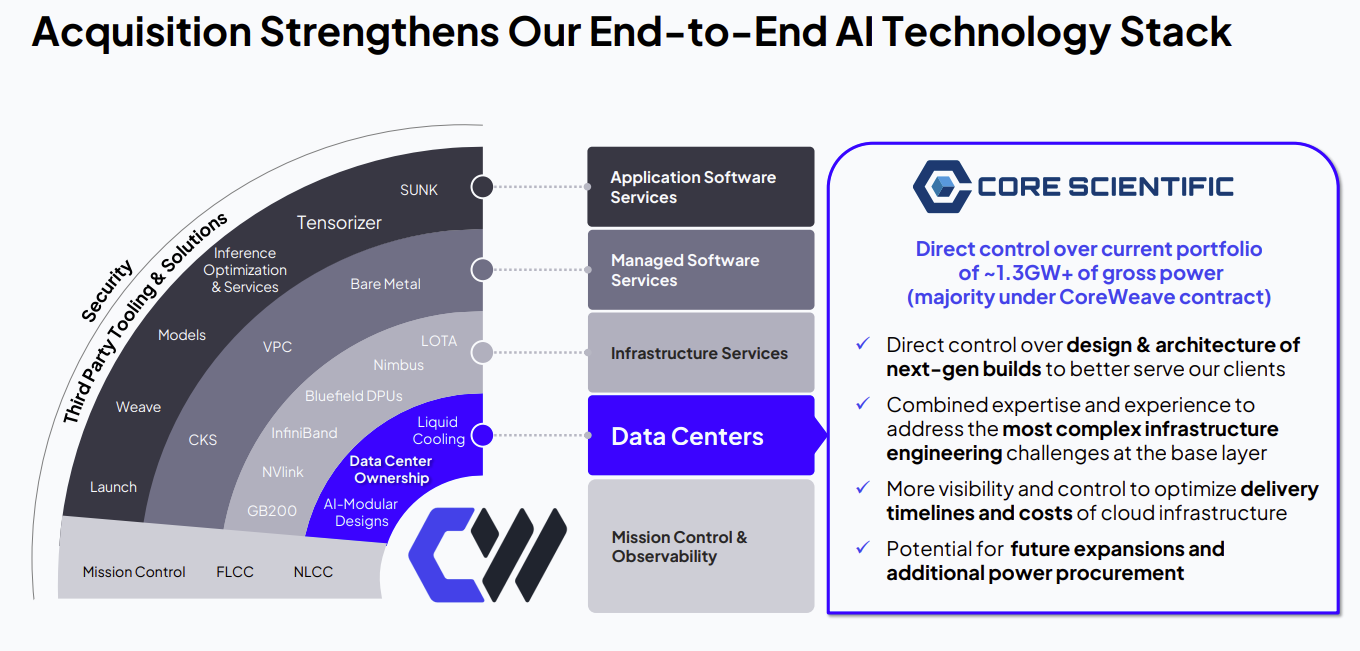

"HPE will offer a full stack solution for AI data centers at scale that spans high performing routers and switches, firewall servers, storage and services, with our data center and liquid cooling it and design expertise," said Neri. "We will simplify the deployment and management for AI training and inference."

For now, HPE is focused on the workstreams behind the integration of Juniper. In addition to Rahim running HPE Networking, Neri outlined the following:

- Phil Mottram, who led HPE Aruba, will focus on growth in emerging markets.

- John Schultz, Chief Operating and Legal Officer, will lead the integration of Juniper. He has been involved in the split of HPE and HP, the spinoff of HPE's software and enterprise services unit and GreenLake launch.

Neri said:

"Our first integration priority is to maintain continuity momentum across the traditional HP, Aruba and juniper networking businesses. We are fully committed to supporting the life cycle of existing products and protecting the investments our customers have made. No customer will be left behind. Our second priority is to thoughtfully converge our cloud product roadmaps and integrate our go-to-to-market coverage strategies. This will enable us to accelerate cross-selling and upselling across our combined portfolio. Over time, we will align our offerings around a single secure AI native and cloud native architecture."

HPE said it will realize at least $600 million in annual run rate savings over the next three years, up from the original projections of $450 million. A third of the savings will come in year one with the rest spread out evenly over the next two years.

Other key points from the update call:

- Rahim said Juniper's second quarter finished strong with orders growing 40% from a year ago and revenue up 20%. Enterprise is becoming a strong market.

- HPE plans to use its scale to leverage Juniper Networks' portfolio globally. HPE has a substantial international footprint.

- HPE said its savings target was raised due to supply chain efficiencies. HPE's supply chain scale will help Juniper's cost of goods sold. AI and automation will also drive increased savings.