HPE Q2 solid due to AI demand, hybrid cloud

Hewlett Packard Enterprise delivered better-than-expected second quarter earnings as it saw strong demand for its AI servers and hybrid cloud.

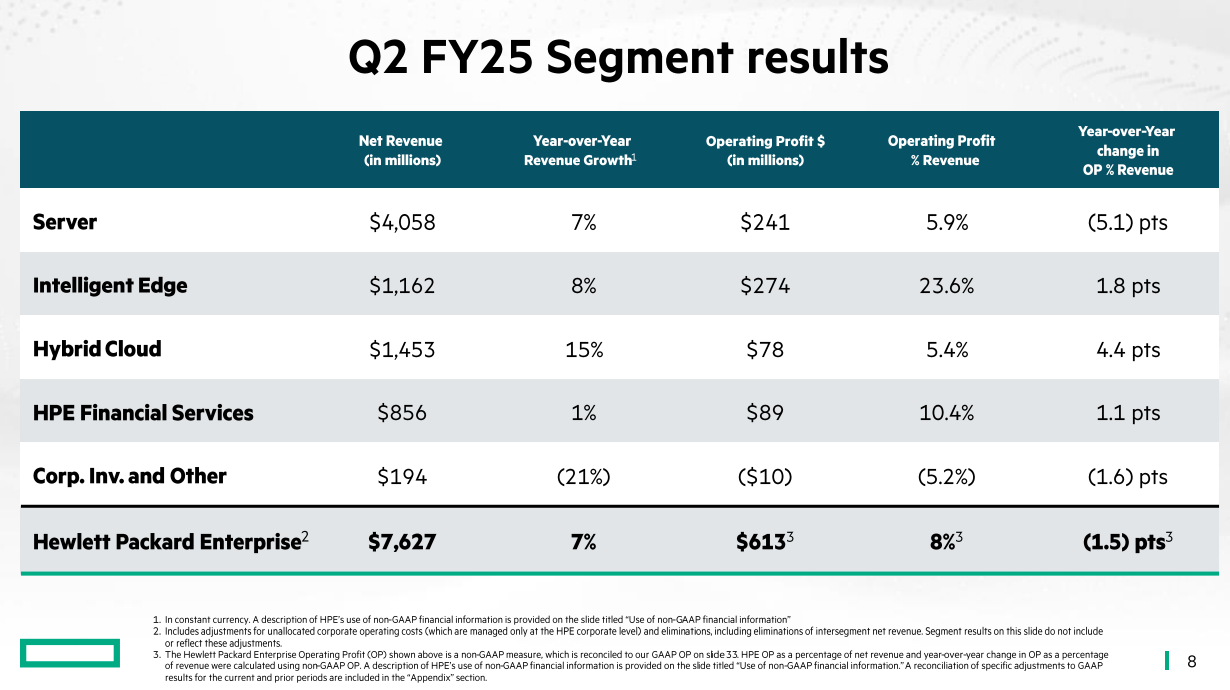

The company reported a second quarter net loss of 82 cents a share due to a goodwill write down. HPE reported second quarter non-GAAP earnings of 38 cents a share on revenue of $7.6 billion, up 6% from a year ago.

Wall Street was expecting HPE to report second quarter earnings of 33 cents a share on revenue of $7.5 billion.

HPE's first quarter results fell short of expectations and the company has delivered less AI growth than Dell Technologies. See: Dell Technologies continues to ride AI infrastructure wave with strong Q1

CEO Antonio Neri said, "in a very dynamic macro environment, we executed our strategy with discipline." CFO Marie Myers said the company is focused on streamlining operations and meeting its guidance for fiscal 2025.

By the numbers:

- HPE server revenue in the second quarter was $4.1 billion, up 6% from a year ago.

- Intelligent edge revenue was $1.2 billion, up 7% from a year ago.

- Hybrid cloud revenue was $1.5 billion, up 13% from a year ago.

As for the outlook, HPE said third quarter revenue will be between $8.2 billion to $8.5 billion with non-GAAP earnings of 40 cents a share to 45 cents a share. For fiscal 2025, HPE said revenue growth will be 7% to 9% in constant currency with non-GAAP earnings of $1.78 a share to $1.90 a share.

Constellation Research analyst Holger Mueller said:

"HPE had a solid quarter growing across its offering portfolio. Management decided to ‘hide’ the solid numbers with an impairment charge of the goodwill of its hybrid cloud portfolio, painting the quarter red. It feels more like a strategy to prepare for better quarters and take the charge now. The pressure on Q3 and Q4 will rise. The 2% average higher discounting should not come as a surprise in times of higher uncertainty and more challenging economic conditions."

Neri said the following on HPE's second quarter earnings call:

- "Through focused and disciplined execution, we have addressed the operational challenges we experienced in our Server segment last quarter. We expect these actions will contribute to margin improvement through fiscal year-end."

- "The IT industry continues to navigate significant uncertainty brought on by tariffs, the AI diffusion policy withdrawal and broad macroeconomic concerns. While this led to uneven demand during the quarter, we did not benefit from significant order pull-ins. We ended Q2 with a stronger pipeline compared to Q1."

- "I want to reinforce our commitment to closing the Juniper Networks transaction. We expect the proposed transaction will deliver at least $450 million in annual run rate synergies to our shareholders within 36 months of closing the transaction. The deal will help both companies deliver a modern secure AI-driven edge-to-cloud portfolio of networking products and services. We continue to expect to close the transaction before the end of fiscal year 2025."

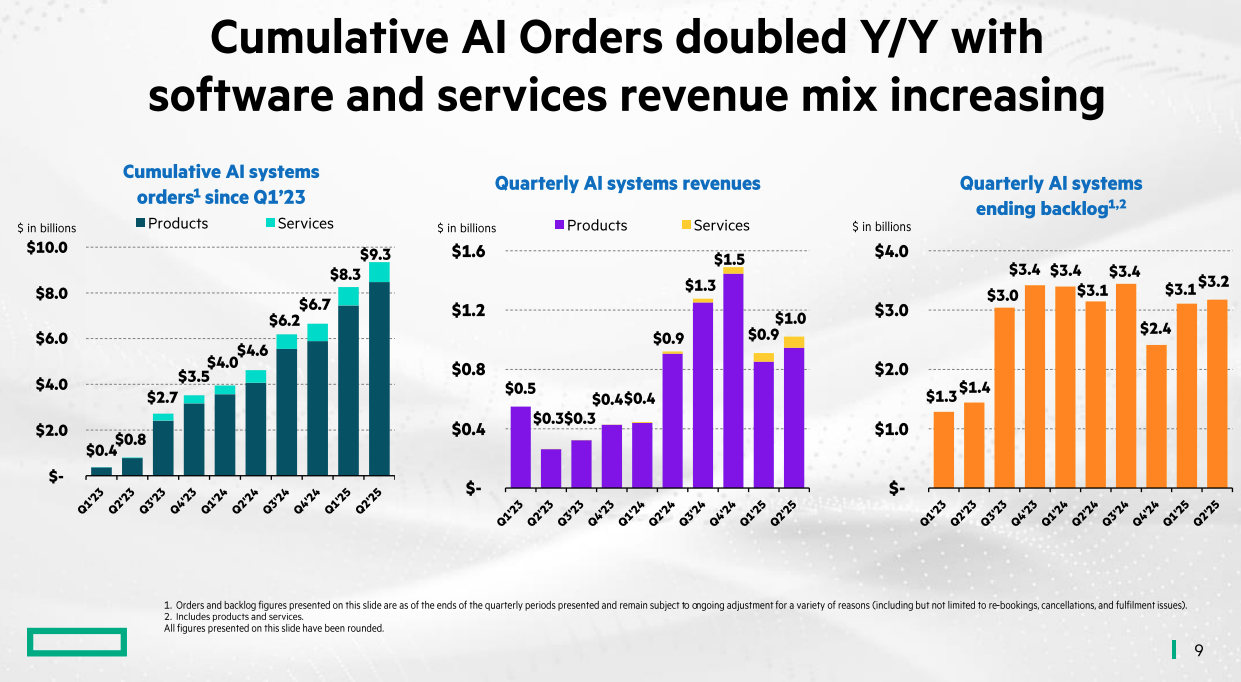

- "We reduced inventory by $500 million. We believe that the remaining actions will be addressed through the back half as we convert more revenue. In Q3, we're going to convert a very large deployment that we expect to be completed here soon."

- "A third of our orders in AI being now enterprise driven. So that's a very strong momentum there. It's driven by our servers."