P&G outlines Supply Chain 3.0, next digital transformation moves

Procter & Gamble's two-year restructuring includes a heavy dose of digital transformation, artificial intelligence and supply chain automation and optimization.

The headlines from Procter & Gamble's appearance at the Deutsche Bank Global Consumer Conference revolved around the company's move to cut 7,000 jobs. However, P&G Chief Financial Officer Andre Schulten and Chief Operating Officer Shailesh Jejurikar outlined the bigger picture.

P&G is navigating an uncertain economy, shifting tastes, inflation and tariffs. P&G's approach is to use productivity to fund growth initiatives over the years. Its next phase is focused on developing its systems and digital capabilities to support automation, data strategy, insights and analytics, said Schulten.

"We believe we now have the opportunity to step forward to enable the tremendous growth opportunities we have with an even more focused and efficient portfolio, supply network, and organization," said Schulten. "In fiscal 2026, we will begin a 2-year noncore restructuring program. This program includes 3 interdependent elements: portfolio choices, supply chain restructuring and organizational design changes."

P&G plans to shed brands in various categories and categories will be outlined more in July when the company reports its fiscal year end results.

Here's a look at the high level transformation moves from P&G:

- The company will right size its supply chain, optimize by locating production to drive efficiencies, speed up innovation and cut costs.

- P&G will make roles broader and shrink teams as the company leverages automation and digitization.

- P&G will cut up to 7,000 non-manufacturing roles, or 15% of its non-manufacturing workforce. Those job cuts are incremental to what P&G has outlined for its Supply Chain 3.0 savings.

"This restructuring program is an important step toward ensuring our ability to deliver our long-term algorithm over the coming 2 to 3 years. It does not, however, remove the near-term challenges that we currently face," said Schulten. "All the more reason to double down now on the integrated growth strategy that has enabled strong results over the past 6-plus years, executing our strategy and accelerating this opportunity, especially under pressure is our path forward."

According to Schulten, future success for P&G requires innovation for product, packaging, brand communication and marketing and retail execution. Schulten said all of those variables have to work together to deliver value. No one thing can carry the team. He explained:

"Superior performing products and superior packages provide noticeably better benefits to consumers. They become aware of and learn about these products through superior brand communication. This comes to life in stores and online with superior retail execution and deliver superior consumer value at a price that is considered worth it across each price tier in which we choose to compete."

Here's a look at the P&G plan:

Fund investment with productivity gains. Schulten said P&G can mitigate cost and currency headwinds by becoming more efficient across cost of goods sold to marketing to in-store and online execution.

Data and insights across the value chain. Jejurikar said the company was looking for "better consumer insights on what's required for the specific job to be done; integrated technical capabilities applied across formulated chemistry, assembled products and devices to deliver the superior solution; integrated communication across package, shelf, online and other channels; and at a value that balances price and performance for the consumer and the retailer."

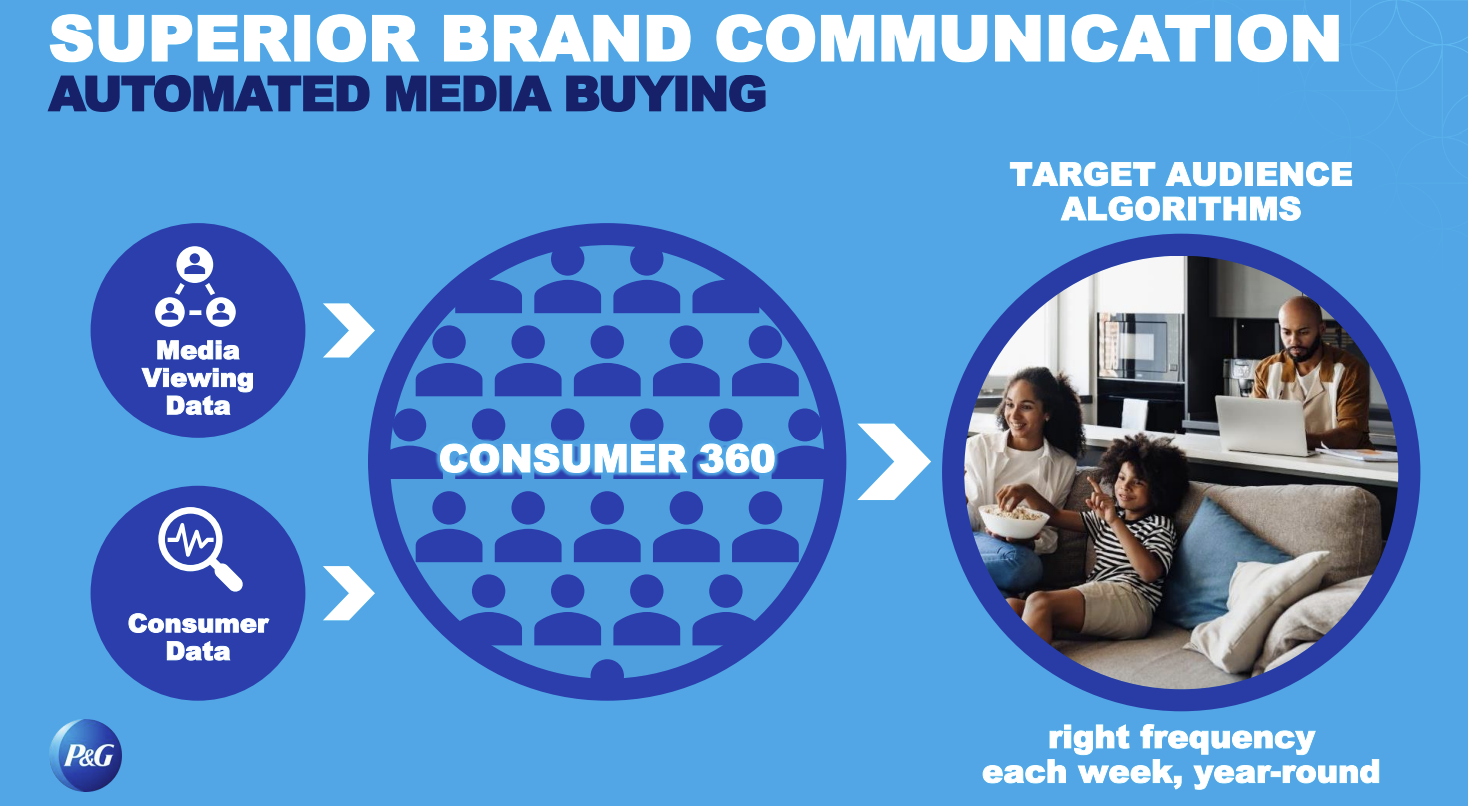

Use AI to make the marketing and advertising spend more efficient. Jejurikar said the company is using programmatic and algorithm-based media buying to find consumers most likely to be receptive to messaging. "Our proprietary Consumer 360 data platform enables brand to use target audience algorithms to serve ads at the right frequency each week, all year round, more effective reach and more cost efficient," he said. P&G's media reach in the US has grown to 80% from 64% over five years. Reach in Europe is now 75%.

He added:

"We are driving advertising effectiveness, starting with superior consumer insights and leveraging AI as a tool to deliver superior content creation. We're improving efficiency using AI tools for ad testing improving quality, cost and speed. Ads can now be tested and optimized in just a few days versus weeks at 1/10 of the cost versus prior methods."

In-store optimization via data and computer vision. Jejurikar said P&G was combining point-of-sale data with millions of retail shelf images to optimize shelf design. P&G has proprietary tools that enable the company to analyze assortment online and offline.

Supply Chain 3.0. Jejurikar said P&G is looking to extend that supply chain data from suppliers to customers to retail shelves. "We are investing in advanced supply planning technologies to better anticipate consumer demand and adjust production and inventory levels, accordingly, helping minimize stock-outs overproduction and waste," said Jejurikar.

The supply chain transformation will have a heavy dose of automation in manufacturing sites. P&G is capturing images and visual data on manufacturing lines to improve quality.

According to Jejurikar, P&G's warehousing center of excellence will be the hub for the company's 50 distribution centers. This hub will coordinate warehouse activity from the moment a truck enters the gate until it leaves. This coordination is improving productivity 50% on indirect administrative work at each site.

Jejurikar also outlined the KPIs for Supply Chain 3.0:

- 98% on-shelf and online availability.

- Up to $1.5 billion before tax in gross productivity savings each year.

- 90% of free cash flow productivity.

Those targets are in addition to savings of $1.5 billion in cost of goods sold and $500 million in marketing previously outlined.