Editor in Chief of Constellation Insights

Constellation Research

About Larry Dignan:

Dignan was most recently Celonis Media’s Editor-in-Chief, where he sat at the intersection of media and marketing. He is the former Editor-in-Chief of ZDNet and has covered the technology industry and transformation trends for more than two decades, publishing articles in CNET, Knowledge@Wharton, Wall Street Week, Interactive Week, The New York Times, and Financial Planning.

He is also an Adjunct Professor at Temple University and a member of the Advisory Board for The Fox Business School's Institute of Business and Information Technology.

<br>Constellation Insights does the following:

Cover the buy side and sell side of enterprise tech with news, analysis, profiles, interviews, and event coverage of vendors, as well as Constellation Research's community and…

Read more

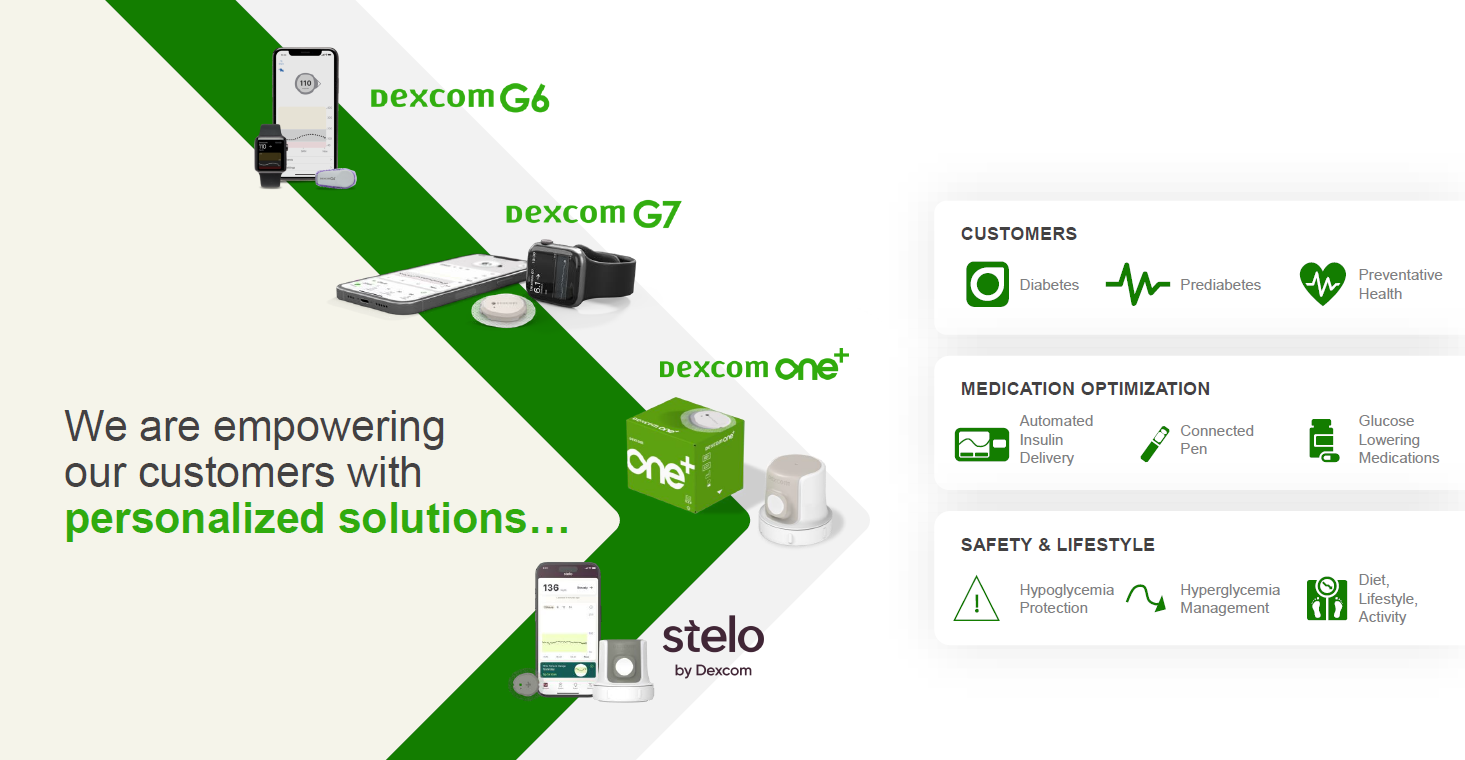

Dexcom, which makes glucose monitoring equipment and technology, is betting that it can dramatically expand its total addressable market for people with diabetes with a big assist from generative AI.

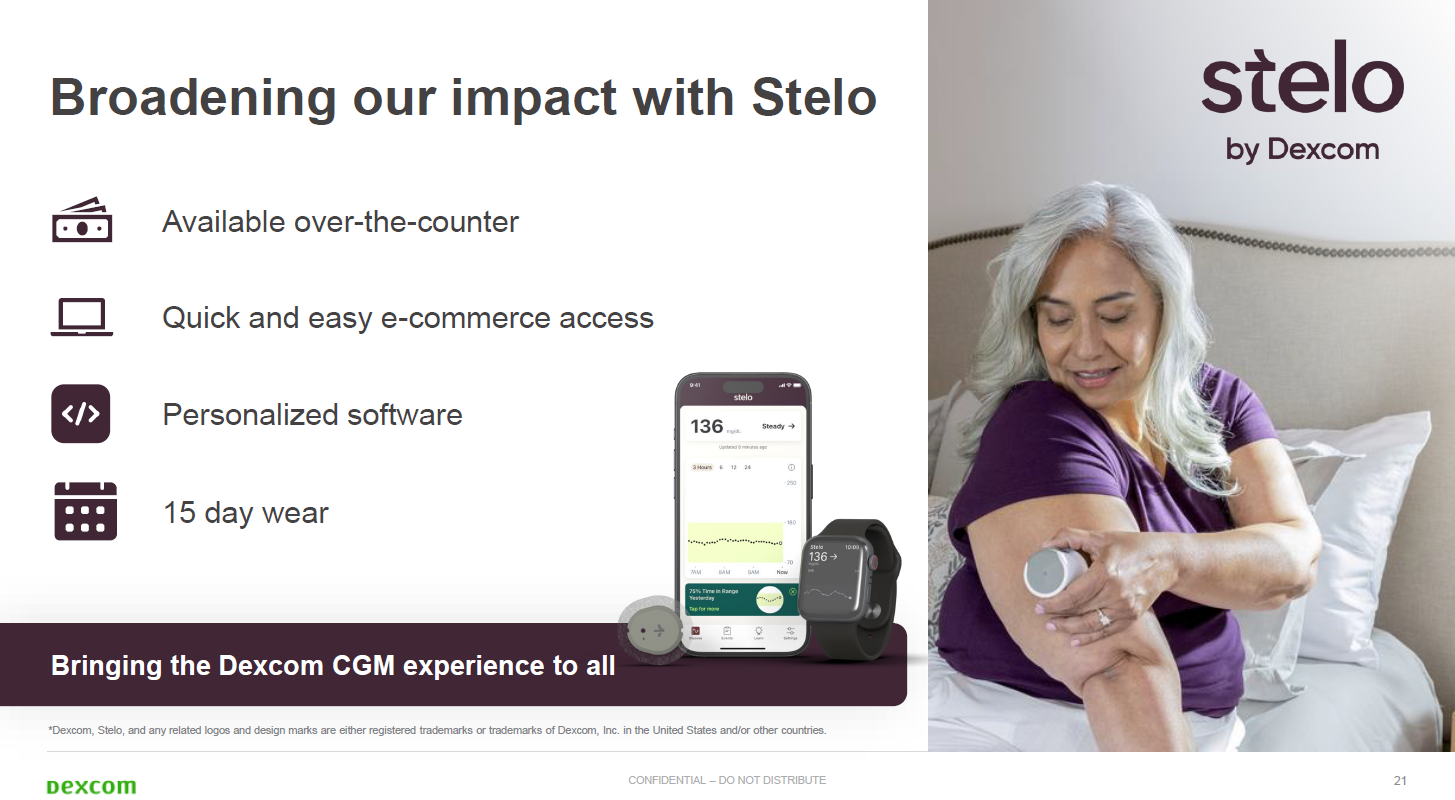

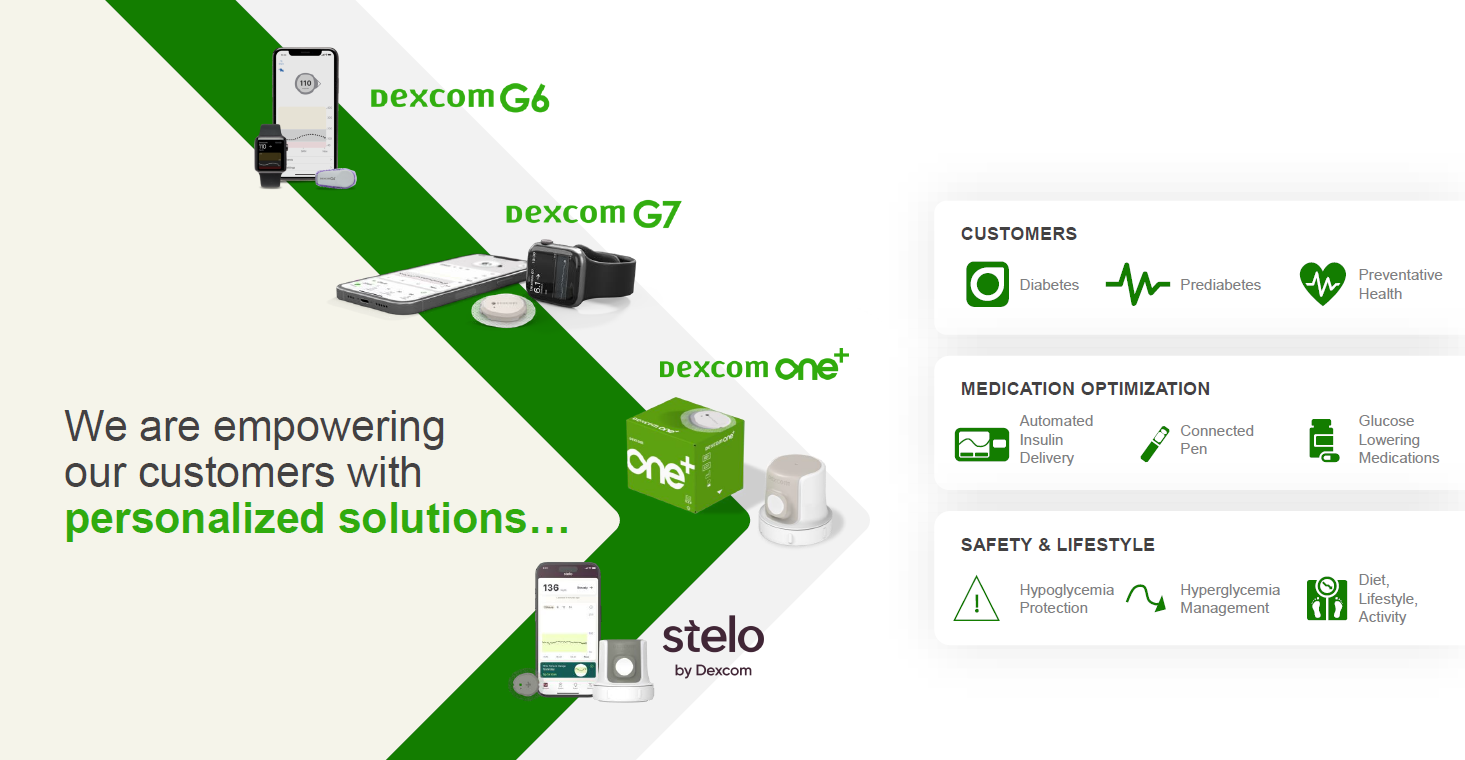

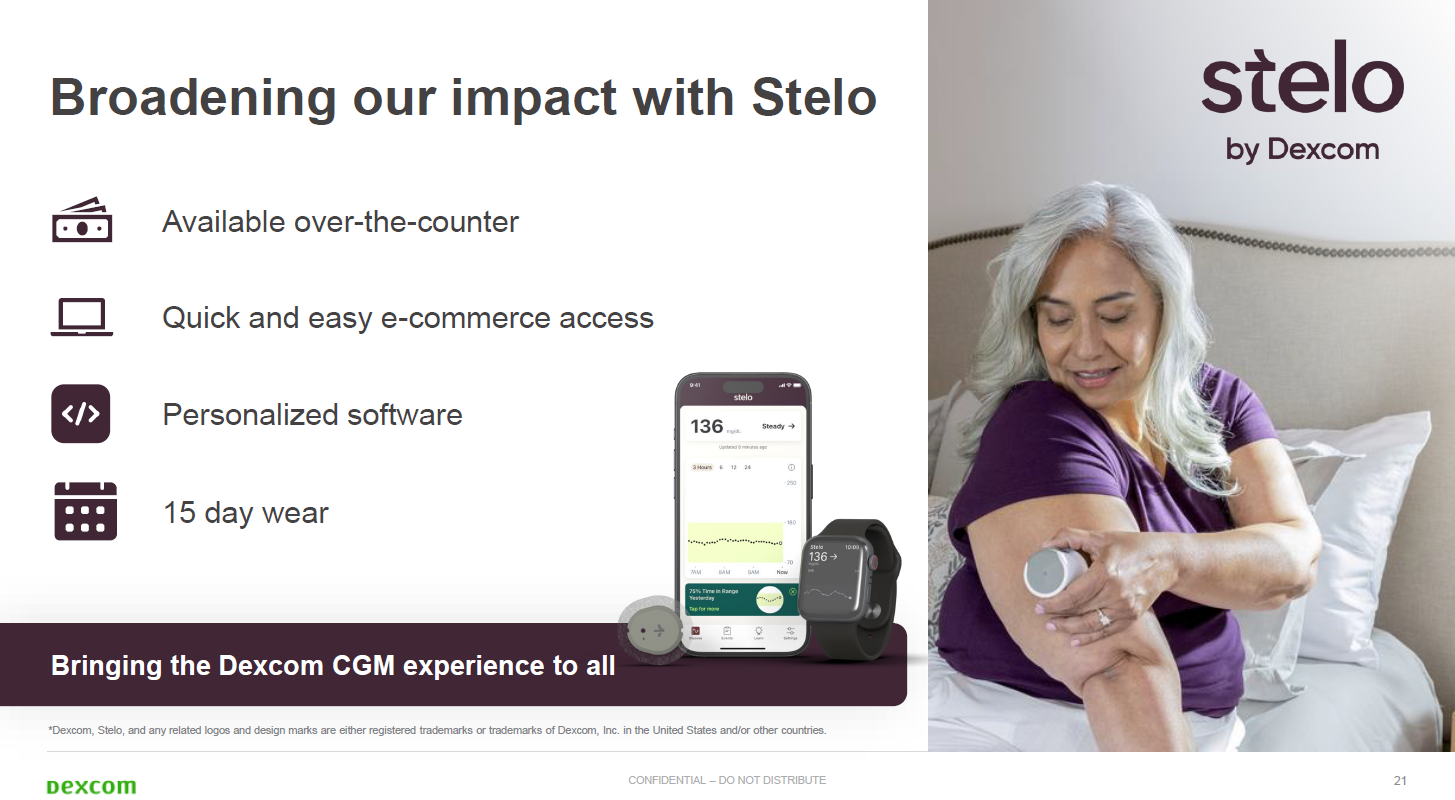

The company historically has been best known for its monitoring devices for type 1 diabetics, which need insulin injections. With the launch of an AI-powered app and biosensor called Stelo, Dexcom is looking to expand its total addressable market by targeting prediabetics as well as consumers with type 2 diabetes that don't need insulin. Stelo doesn't require a prescription, but is often covered by insurance.

Dexcom's G7 Continuous Glucose Monitoring (CGM) System is for adults with type 1 or type 2 diabetes on insulin or medications. Health insurance usually covers G7 CGM System.

Dexcom's growth is expected to come from Stelo, which has the potential to be new category of consumer wearable device. Stelo comes in a two-pack of biosensors for $99. A one-month subscription plan that includes two Stelo biosensors delivered monthly is $89. A three-month subscription with six Stelo biosensors with refills every 3 months is $252. Stelo biosensors have a 15-day life-span are worn on the back of your upper arm and transmit data to an app available on Apple iOS or Android.

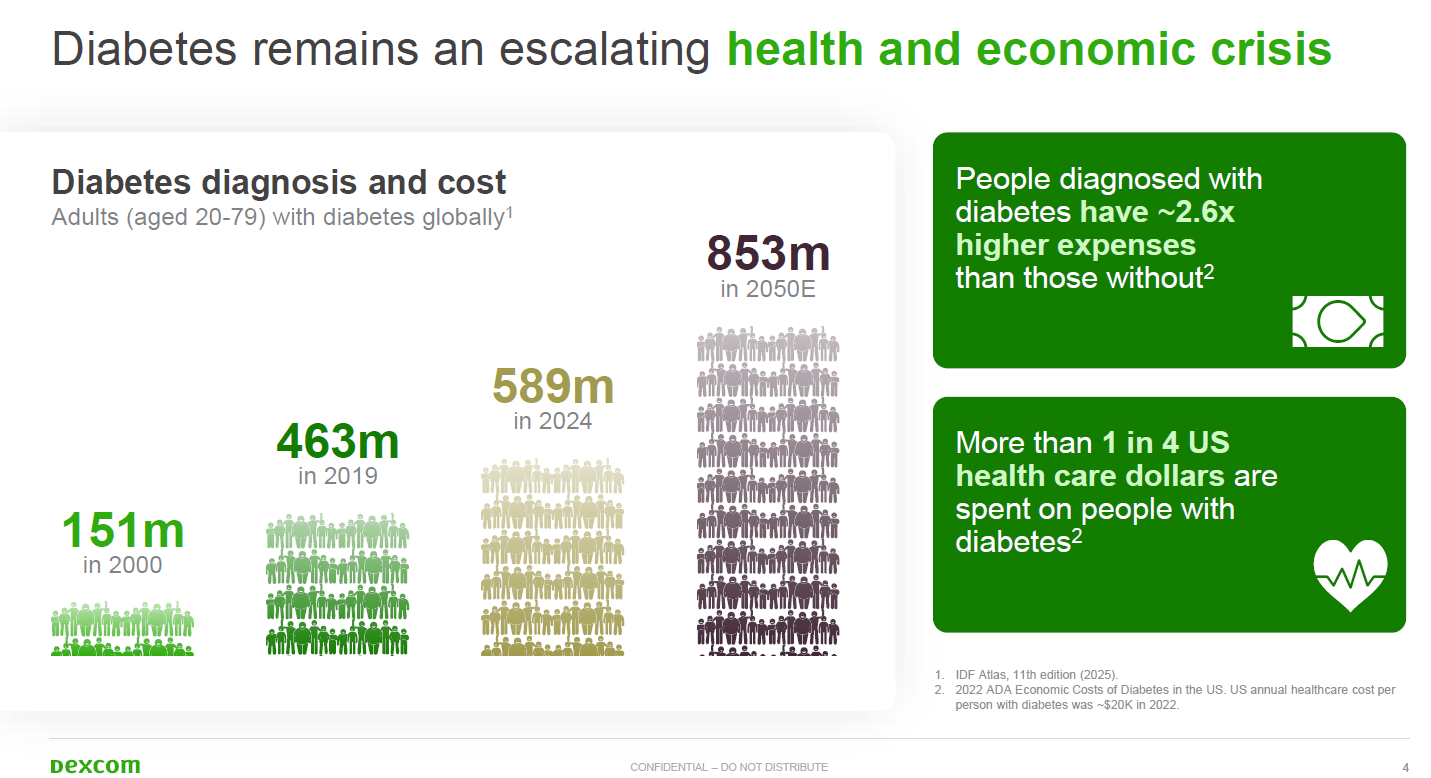

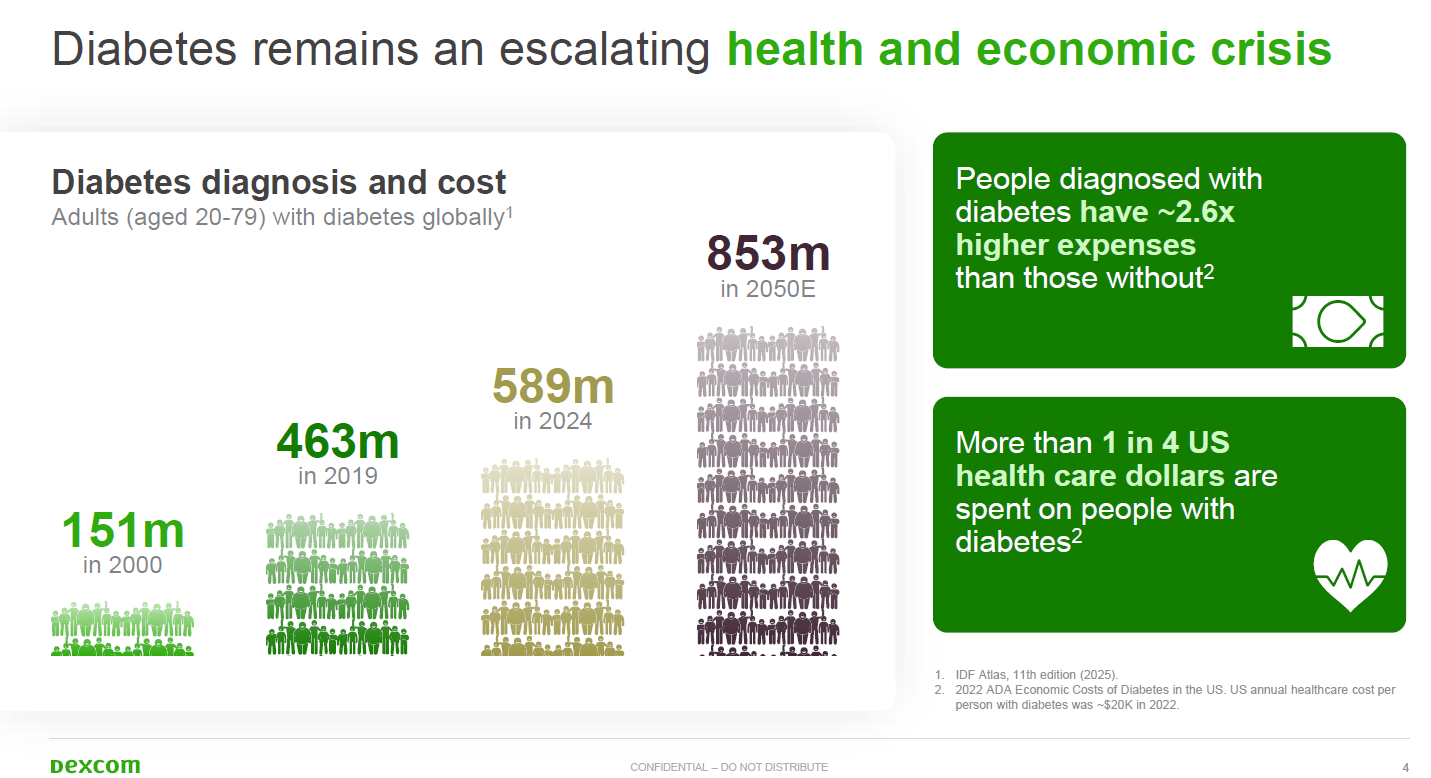

In 2024, 589 million adults aged 20 to 79 were diagnosed with diabetes globally, according to International Diabetes Federation Atlas. In the US, more than 1 in 4 US healthcare dollars are spent on people with diabetes, according to the American Diabetes Association. In 2050, 853 million adults will be diagnosed with diabetes.

Meanwhile, research has shown that continuous glucose monitoring has reduced risks for type 2 diabetes patients not on insulin therapy.

Health insurers also are on board with Dexcom's strategy as Stelo is getting broader coverage.

"As we continue to advocate for broader type 2 coverage, we have already greatly simplified access to Dexcom technology through the launch of our over-the-counter biosensor Stelo," said Dexcom CEO Kevin Sayer speaking on the company's first quarter earnings call in May. "Stelo continues to attract a wide range of new customers across the type 2 diabetes, prediabetes and health and wellness landscapes."

When Dexcom reports its second quarter earnings July 30, Wall Street will be closely watching traction for Stelo. Dexcom has been expanding sales capacity and distribution and went live with an Amazon storefront.

Girish Naganathan, CTO of Dexcom, said the company's AI strategy rolls up to a broader growth plan that features AI for product features as well as efficiency. "We start with a patient and customer first approach, and when we look at transformation plans, AI is a tool," he explained. "Technology is pervasive and we generate data that's used to solve problems and helps us bring innovation faster to patients, improve our product and deliver our solutions."

Dexcom's financial performance has been lumpy as it expands its market. Revenue growth has ranged from 3% to 25% in the last five quarters. Sayer said Dexcom is on its way to returning to growth on a steady basis as it has expanded its sales coverage and now has the largest Pharmacy Benefit Managers (PBMs) covering Stelo.

The company is projecting fiscal 2025 annual revenue of $4.6 billion. For fiscal 2024, Dexcom had to cut its outlook as products for type 1 diabetes fell short of expectations. A year ago, Dexcom shares fell 41% in one day.

Sayer said Dexcom is laying the foundation for reaccelerating revenue growth. The company has had to manage through a lot of disruption. In the first quarter, Dexcom faced supply chain disruptions when a shipment of sensors were damaged in the fourth quarter.

Dexcom CFO Jereme Sylvain said the company charted its direct flights and retooled processes to bring its supply chain back up to speed in the first quarter.

"As we continue to rebuild our inventory levels while addressing increasing demand, we have factored in an additional 100 basis point impact to our global freight costs to support expedited shipping," said Sylvain, speaking on Dexcom's first quarter earnings call in May. "We expect that this impact will lessen as we move throughout the year. We have also built into this gross margin guidance a 50 basis point impact of inflationary pressures from tariffs in the supply chain."

In addition, Dexcom is currently an FDA recall of more than 700,000 devices after as receivers may not provide audible alerts due to a manufacturing problem.

To comply with the recall, Dexcom is replacing Dexcom's G7, G6, One and One+ CGMs.

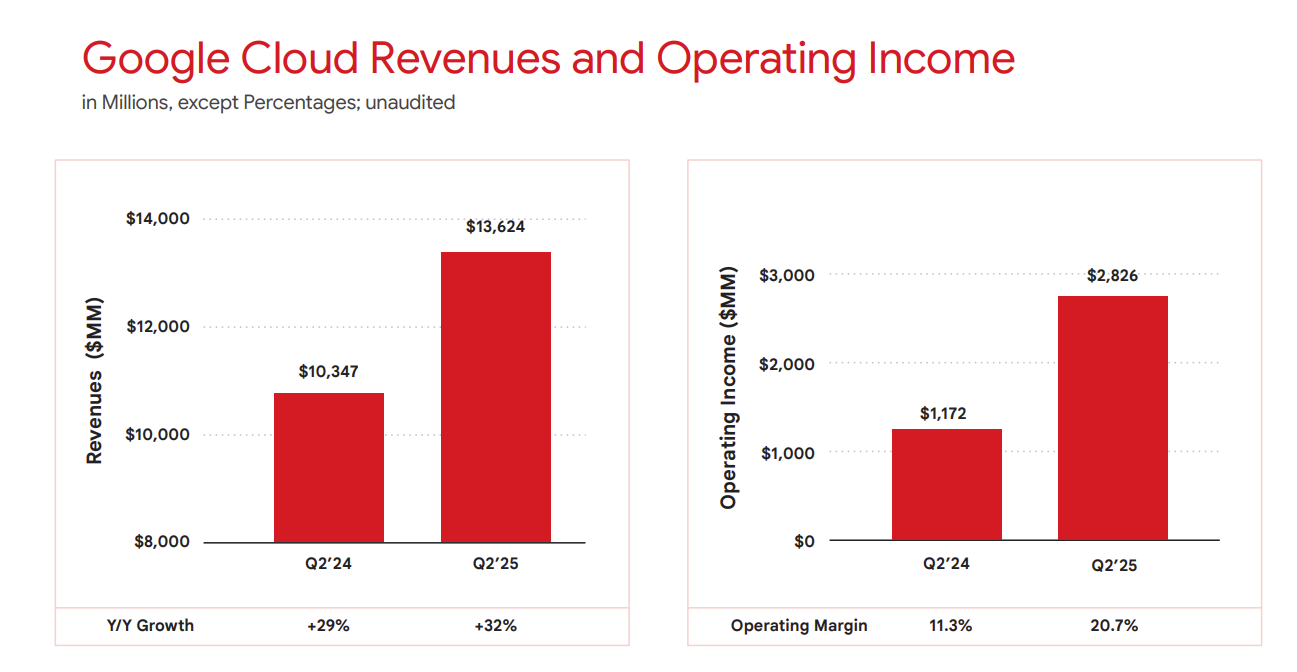

Data, AI, partnership with Google Cloud

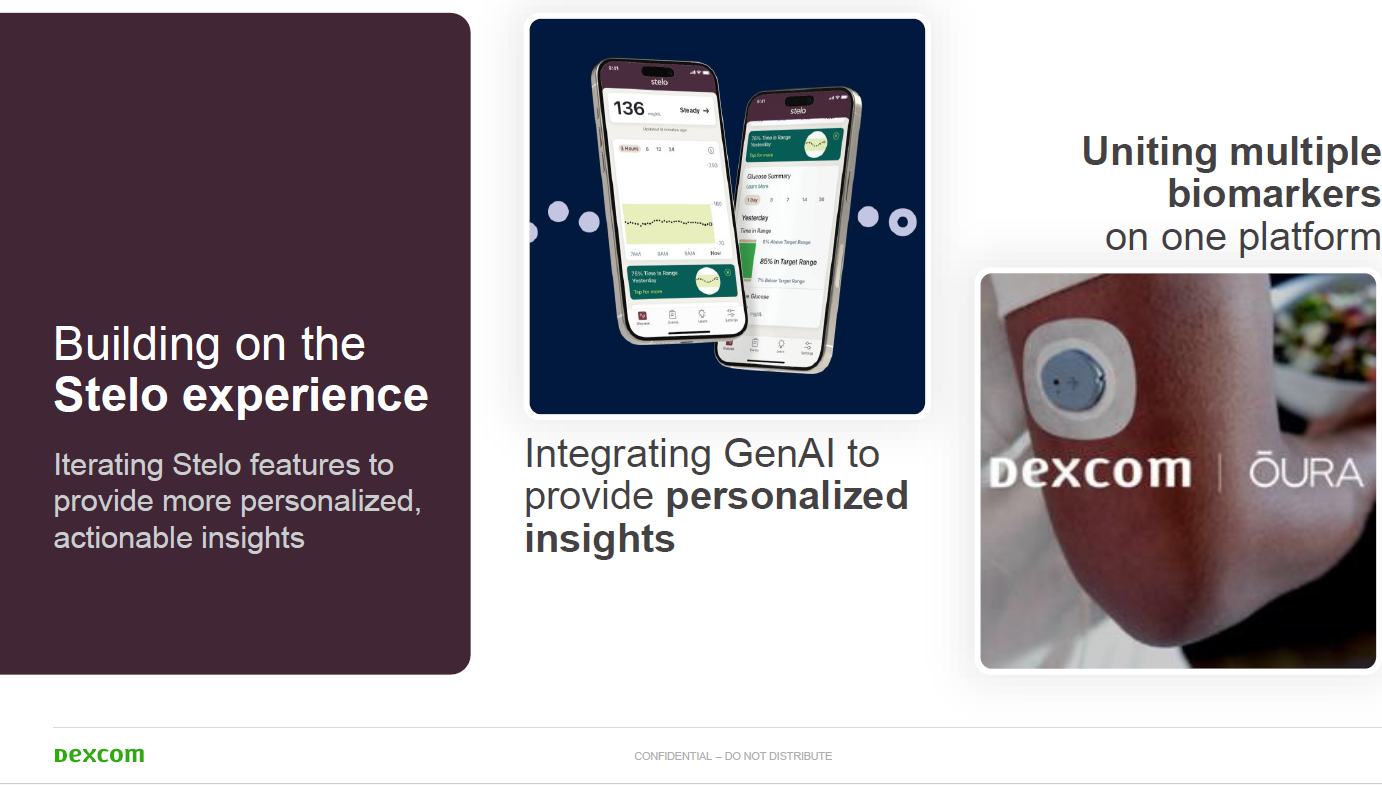

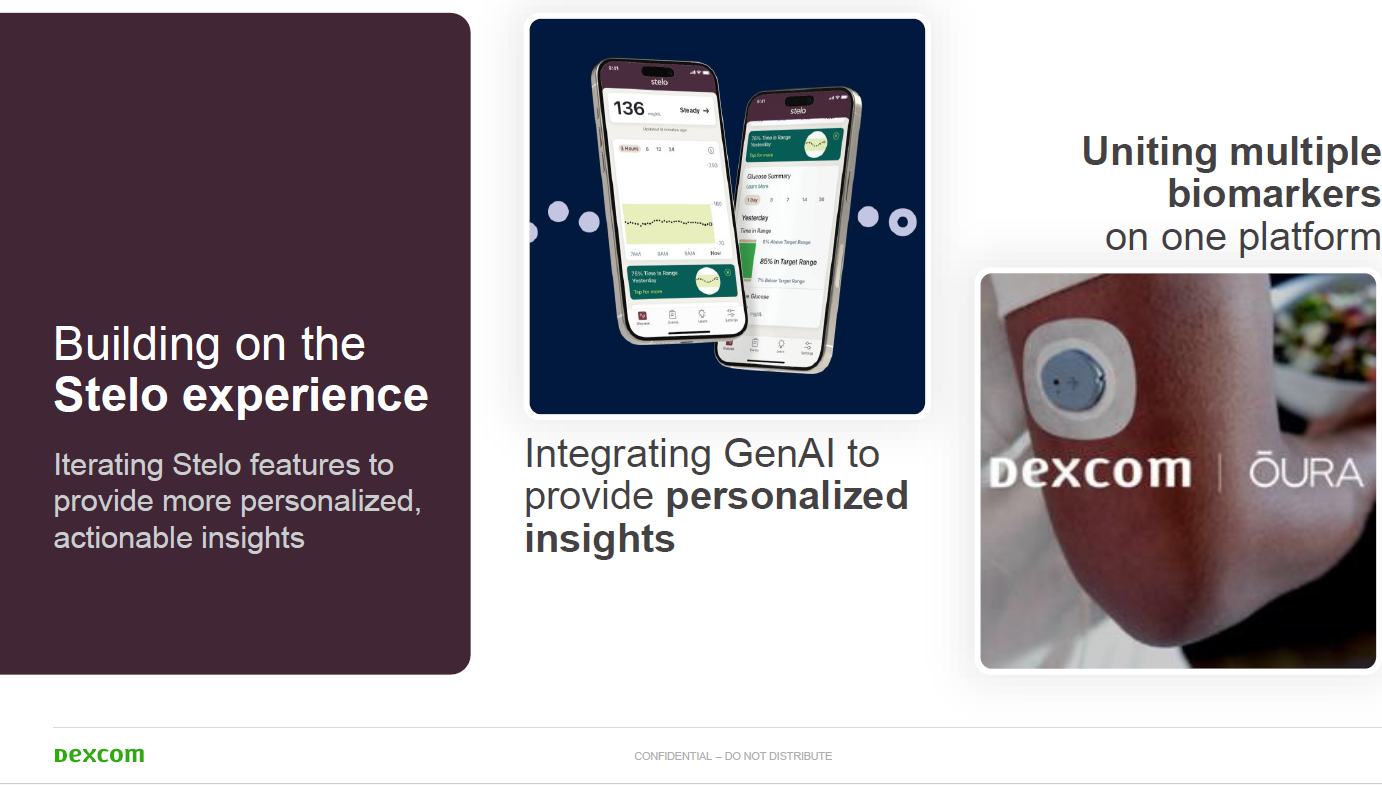

In December 2024, Dexcom launched its generative AI platform for glucose monitoring that would combine its Stelo application with its biosensing technology.

The company also was a headliner at CES 2025 with a session on the future of health AI. Dexcom's generative AI technology is built on Google Cloud Vertex AI and Gemini models.

Naganathan said on a Google Cloud webinar that the company pivoted to focusing on glucose monitoring for diabetes 2 patients and is focused on transforming healthcare delivery.

The bet is that Dexcom can change health, patient habits and outcomes by enabling them to connect the dots between lifestyle choices and glucose outcomes. Dexcom began integrating generative AI into its products and Stelo in 2024.

"We believe that AI will play a transformative role within diabetes management and healthcare by significantly providing a more personalized experience, sharing more actionable insights and eventually empowering people to make decisions to improve their health outcomes," said Naganathan.

For Dexcom, generative AI and data insights could be a differentiator in a competitive market. Dexcom competes with Abbott Labs, Medtronic, LifeScan and others. In regulatory filings, Dexcom noted that it could compete with large publicly traded companies that operate outside of the traditional medical device sector.

Dexcom is using AI tools such as Google Cloud Vertex and Gemini models to synthesize complex data into actionable insights for healthcare providers and patients. The plan for Dexcom is to develop personalized offerings for Stelo for type 2 diabetes patients.

Going forward, Naganathan said AI is becoming more intuitive and combines voice, video, text and images. "You can envision AI in different aspects of the business in development to manufacturing to customer service," he said. "We're also seeing improvements in device performance with AI. Devices can also adapt to user behavior in real time. We see AI evolving from a tool to a true partner in tech, health and lifestyle."

The strategy and stack

Dexcom's AI and machine learning layer is fed by a data flywheel and technology stack that includes the following:

- Dexcom's stack for continuous glucose monitoring is integrated between hardware and software.

- Sensors. Dexcom's sensors include biomaterials, membrane systems and low-power electronics designed to track glucose.

- Receiver and transmitters. Dexcom devices wireless transmit information from the transmitter to receivers to a compatible mobile device.

- Dexcom Real-Time API. The Dexcom Real-Time API gives authorized third-party software developers the ability to integrate real-time CGM data into health apps and devices for permitted use cases.

Various applications including ones that share a patient's glucose data with wearable devices.

For good measure, Dexcom also has a collaboration agreement and exclusive license for patents and intellectual property with Verily Life Science, which is a unit of Alphabet, owner of Google Cloud.

The data provided by Stelo is what will drive biosensor subscriptions.

Sayer said: "The type 2 patients who are purchasing Stelo are reordering quite regularly and staying on their subscription patterns and are much more likely to sign up for subscriptions. When we have reimbursement and even just those having the experience who are paying cash, we're seeing good retention and good utilization in these populations because the information is incredibly valuable."

In addition, Naganathan said Dexcom is focused on being thoughtful with implementing AI to build trust in the long run. Naganathan said by leveraging AI and data from its devices to power Stelo, Dexcom is hoping to change patient behavior.

"Changing consumer behavior is really challenging," said Naganathan, adding that Dexcom is working to "arm users with more personalized insights based on their health and habits."

With Stelo, Dexcom said in regulatory filings that it will also pursue development partnerships with consumer technology partnerships to bring metabolic health insights to more customers.

Naganathan said Dexcom strategy with AI and its patients has the following tenets.

- Target type 2 diabetics and Americans with prediabetic conditions.

- Connect lifestyle choices for sleep, activity and nutrition and connect it to glucose outcomes.

- Use insights to "nudge not judge" to encourage change.

- Derive insights from multiple data points including sleep, food and how it connects to glucose.

- Provide education, resources and tools to enable patients to take care of their health.

- Provide data to healthcare providers with connections to electronic health record systems. The general idea is that glucose data over time can give primary care physicians a better view of the patient.

Naganathan said that Dexcom's AI journey started with Stelo but is expanding throughout the company's product portfolio.

Dexcom is also deriving internal benefits with AI. Naganathan said Dexcom has used genAI for automating documentation and multiple administrative activities to improve engineering processes. "AI has not only improved efficiency, but also our product development velocity," Naganathan said.

Indeed, Dexcom has been adding features to Stelo including updates for 180-day lookback feature. Sayer said Stelo's customer experience metrics are improving due to the updates. Dexcom also recently received FDA clearance for its 15-day Dexcom G7 system that will roll out later this year.

He added that Dexcom will take a step-by-step approach to adoption of AI. "We're taking a very thoughtful, step-wise approach, starting with retrospective insights and then moving eventually to real time coaching, progressively building confidence and trust as the technology matures. We're also working very closely with the regulatory bodies on this front as we add these insights," said Naganathan.

According to Naganathan, Dexcom is looking at agentic AI, but said it won't happen in one big bang. "I see it happening in sequence as the technology matures and as problems get solved in different parts of the organization," he said.

Data to Decisions

Next-Generation Customer Experience

Innovation & Product-led Growth

Future of Work

Tech Optimization

AR

Chief Information Officer