SAP's Q1: Net loss on restructuring, cloud revenue growth of 24%

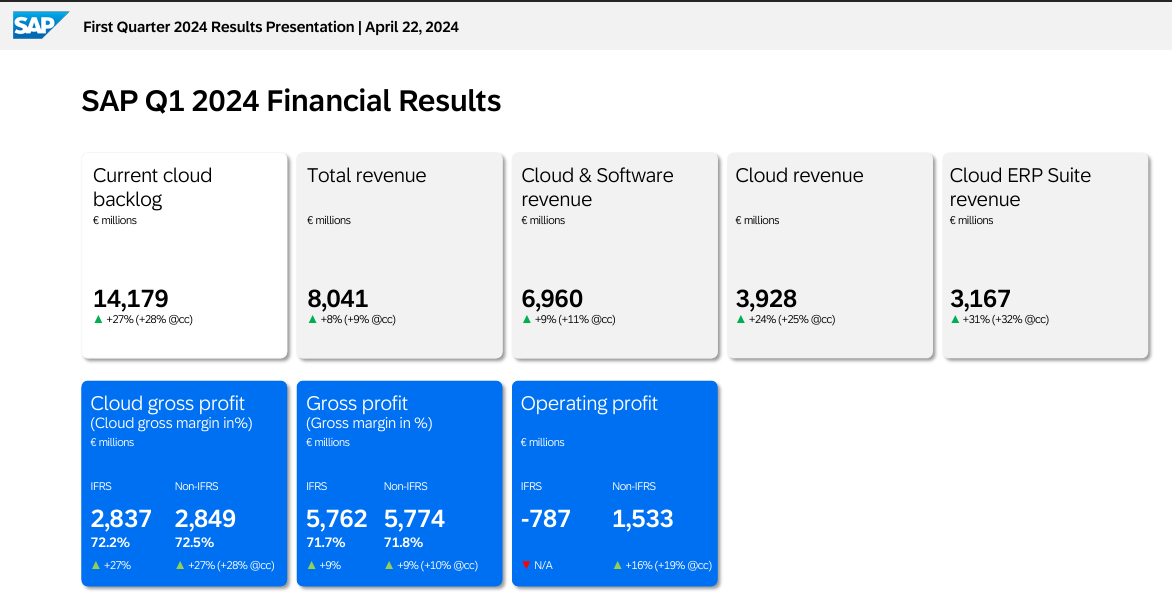

SAP reported a first quarter loss due to a restructuring charge but said its cloud revenue was up 24% with cloud ERP revenue growth of 32%. SAP said its cloud backlog was €14.2 billion, up 27% from a year ago.

The company's first quarter results come amid a restructuring effort that cut 8,000 jobs. SAP is also moving customers to S4/HANA through its SAP RISE program and looking to layer in business intelligence throughout its applications via generative AI.

SAP reported first quarter revenue of €8.04 billion, up 8% from a year ago with a net loss of €824 million. That sum included a €2.2 billion restructuring charge. Adjusted earnings were €944 million, down from €1.01 billion a year ago.

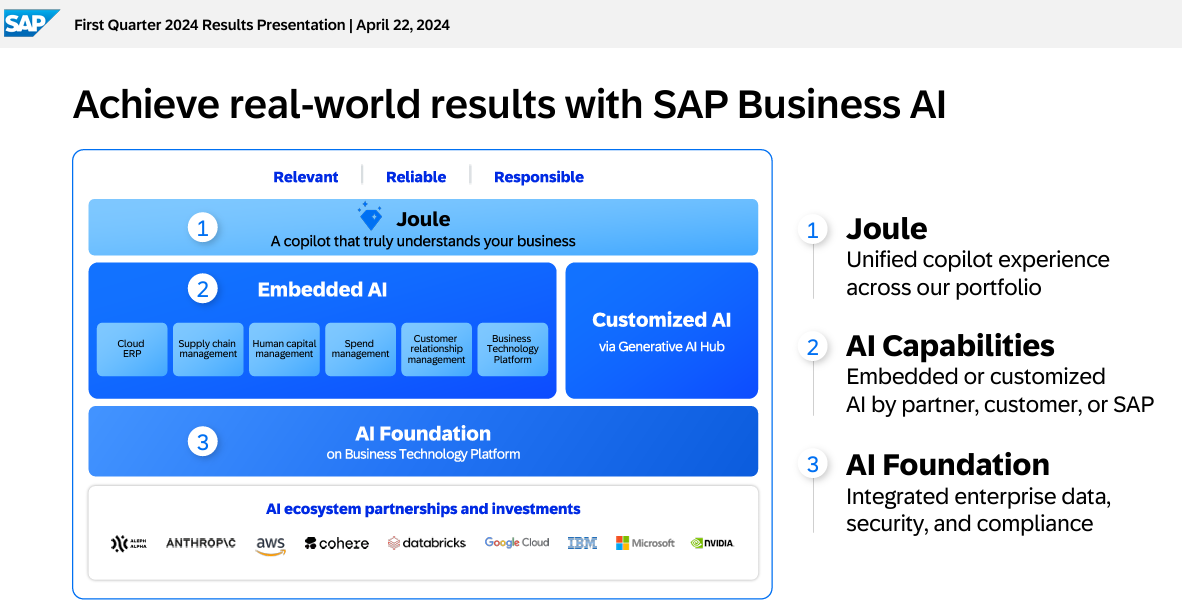

CEO Christian Klein said SAP was "off to a great start in 2024 and we’re confident we’ll achieve our goals for the year." SAP reiterated its outlook for the year. Klein said that Business AI, cross-selling and winning midmarket customers would drive growth.

Dominik Asam, SAP CFO, said the company's restructuring effort is designed to allow the company "to focus our investments on the Business AI opportunity while decoupling expenses from revenue growth."

SAP’s quarterly report lands as Constellation Research’s BT150 CXOs have gripes about SAP’s RISE program. Some of the feedback:

- One CIO asked the group for opinions on SAP's RISE program and being forced from on-premises to the cloud. The goal was to have a strategy for SAP in place by the end of the year.

- CXOs weren't thrilled about SAP RISE and items like licensing credits for legacy environments. A CIO wondered what would prevent a customer from moving away from SAP--especially since the enterprise operates in a space that doesn't garner investment from the enterprise software giant.

- SAP's RISE program is viewed as an exercise in financial engineering more than something that benefits customers.

Our BT150 CXOs aren't alone. SAP's German speaking user group takes aim at cloud contracts, BTP and more | SAP user group DSAG rips S/4HANA innovation plans, maintenance increases | SAP retools for generative AI, cuts 8,000 jobs, sets 2024, 2025 ambition

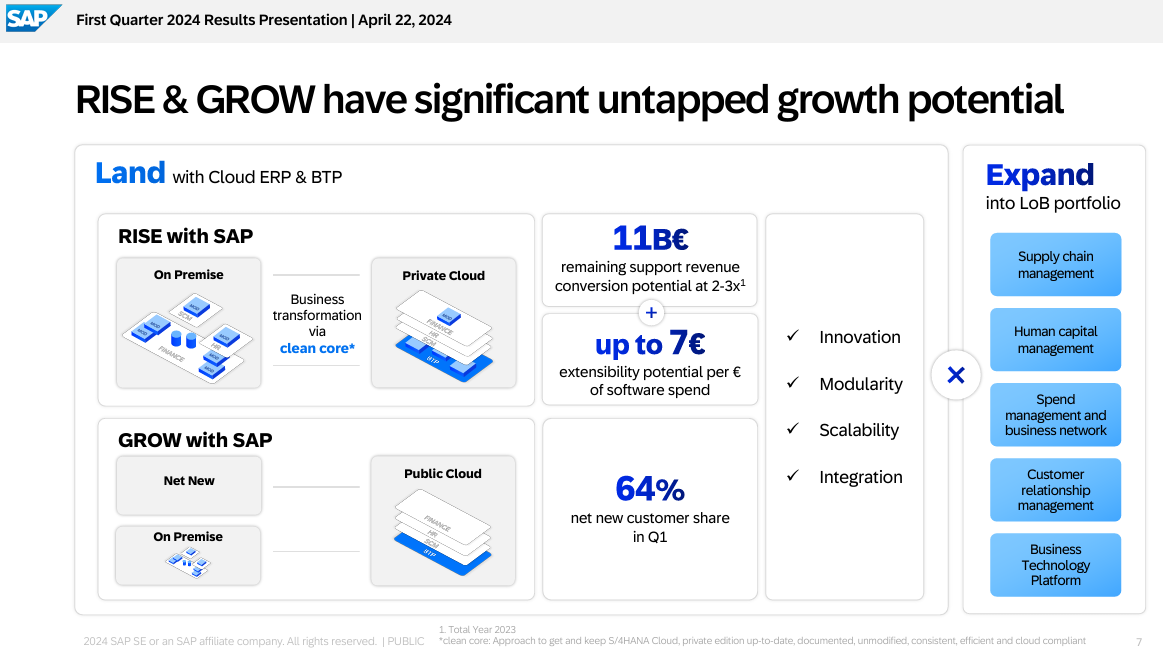

The company said SAP RISE has potential to convert customers to the cloud and enable SAP to increase wallet share.

The company is also betting on its Joule copilot experience to drive demand in the future, but first it needs to convert customers to S4/HANA.

Key items in the quarter include:

- Software license revenue fell 26% in the quarter.

- Service revenue of €1.08 billion was flat from a year ago.

- SAP expects to exit 2024 with a headcount total on par with 2023. The company eliminated 8,000 positions but plans to fill new ones focused on future business needs via new hiring and internal reskilling.

- SAP’s restructuring depends on the uptake of voluntary leave programs, but the company doesn’t have visibility into its German workforce.

- SAP reiterated its previous 2024 outlook of €17.0 billion to €17.3 billion cloud revenue at constant currencies, up 24% to 27%. Full year cloud and software revenue will be €29 billion to €29.5 billion at constant currencies, up 8% to 10% at constant currencies.

- The company is expecting a Net Promoter Score of 9 to 13 for 2024. Scores above 50 are excellent with scores above 80 considered world class.

Klein on RISE progress

On a conference call with analysts, Klein said there's a lot of runway with RISE with SAP and said companies will need to upgrade to transform. SAP is also offering incentives to migrate to S/4HANA across its portfolio. He said:

"Our installed base is large with over EUR11 billion remaining support revenue to be converted to the cloud. Typically, by a factor of around two to two. On top, the EUR700 billion Cloud ERP market offers significant cross selling opportunities, and I have no doubt that SAP's integrated best of suite capabilities will win in the core business of our customers. As part of RISE and via the clean core journey, SAP and our ecosystem will help our customers to remove the ERP custom code and instead develop integrated ERP extensions on BTP. This gives us an immense additional revenue potential considering that customers in the on premise world spend up to EUR7 on custom code for every euro they invest in ERP software."

He also said GROW with SAP as potential for smaller enteprises.

"As SAP's greenfield cloud ERP offering for net new customers or new business units of large enterprises, GROW delivers go lives in weeks for every business model in every industry in every country. With our ERP solution, SME customers can grow and scale their business without migrating to a new ERP. Ultimately, RISE and GROW offer customers similar advantages, innovation, modularity, scalability, and integration."

SAP Business AI is another growth driver for the company and Klein said the plan is to infuse Joule and Business AI across te portfolio. "Joule will be our new user experience via natural language, our one front end. We have based our Joule roadmap on an analysis of the most frequent business and analytical transactions of our end users. This way, we make sure that the most heavily used transactions will be fully AI enabled by the end of this year," said Klein.

He added that SAP is embedding genAI in its cloud portfolio and has released more than 30 new AI scenarios across the cloud portfolio and has more than 100 in the pipeline.

Klein was asked about SAP customers migrating to S/4HANA. The CEO said that SAP is taking a modular approach with megadeals for faster time to value. Custom code has hampered migrations.

"When customers decide to move to RISE, they're not just doing a move of their current environments and replicating the same capability. In fact, far from it. They're trying to transform, operationally process all of their data, all of their capability to serve now and into the future," said Klein. "They're setting their business up. And so when they look at these, which is why, to answer your question, the larger deals are because they look at a multi-year roadmap of capability transitioning from an older state, including non-SAP."

Constellation Research's take

Constellation Research analyst Holger Mueller said:

​

"SAP has its work cut out this financial year. It needs to get going on its new go-to-market setup for S/4 HANA upgrades, aka the Thomas Saueressig organization. It is shuffling 10%+ of its employee base (8,000 as part of the reshuffle and then attrition), make S/4 HANA more interesting, show value of AI, and grow. These are all necessary steps for Christian Klein and team – but a lot of things to master at the same time. All eyes will be on the 2027 ECC upgrade deadline, that at this point is no longer plausible for large scale SAP customers. Will these core SAP customers (many in Germany) move because of the AI promise anyway – or will they wait and 2029 or even 2030, which will be the new deadline. Time will tell."