Citigroup CEO Jane Frasier said the bank has launched a pilot of AI agents for 5,000 employees. The agentic AI pilot is designed to complete multi-step tasks with a single prompt.

Frasier, speaking on the company's third quarter earnings call, said the pilot launched in September. In September, Citigroup announced that Citi Stylus Workspaces, a proprietary AI platform now uses agentic AI and is integrated with various systems. Citigroup leverages Google Cloud and its Gemini models, Vertex AI and Anthropic's Claude models. Citigroup and Google Cloud announced a strategic partnership a year ago and the banking giant presented at Google Cloud Next earlier this year.

"The early results are very promising and we'll expand access to this in the months ahead," said Fraser. "We have launched a firm-wide effort to systematically embed AI in our processes end-to-end to drive further efficiencies, reduce risk and improve client experience."

- Here’s what technology buyers say about AI, technology, transformation

- What we learned from enterprise tech buyers in first half of 2025

- Financial services firms: The only certainty is investing in AI transformation

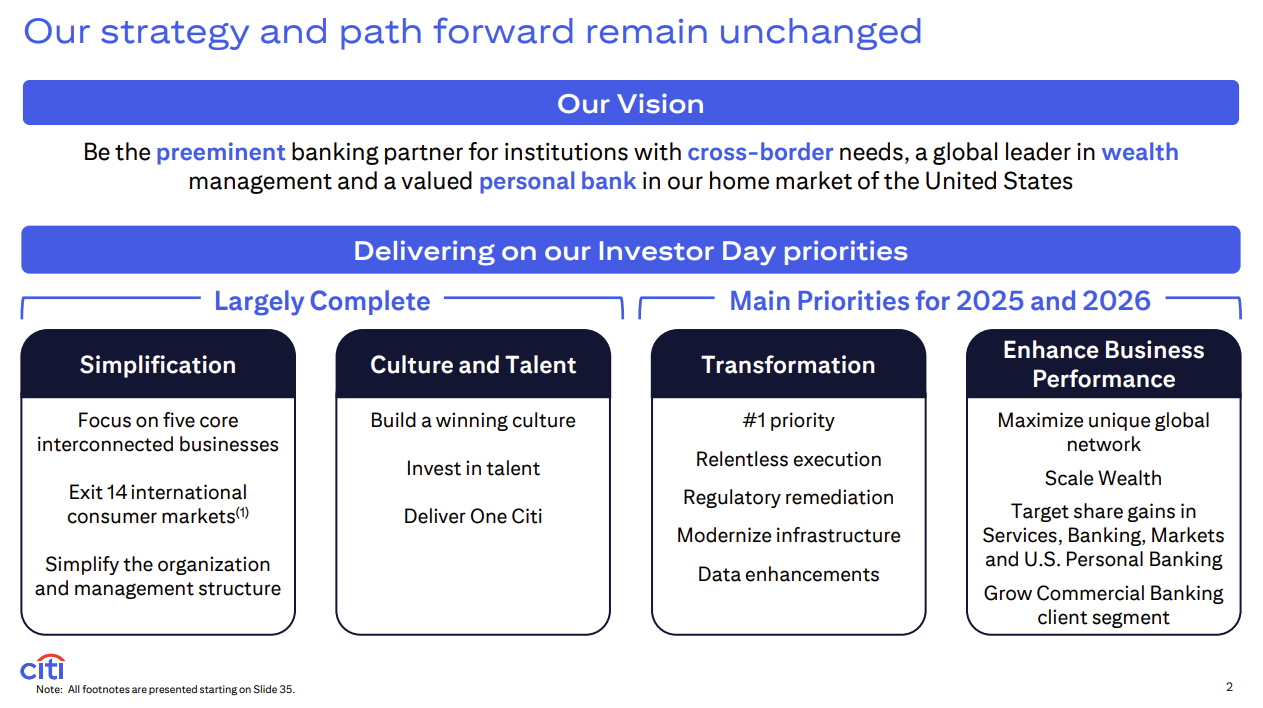

Citigroup will outline the next phase of its technology and AI transformation at an investor day in 2026, but Fraser said two-thirds of the company has been revamped.

"As we simplify, we continue to invest in technology to catalyze our transformation and become a more agile and modern bank. We have been relentless in our execution, and it is creating results. Over two-thirds of our transformation programs are at or are close to our target stage, and we're making very good progress in the remaining areas," said Fraser.

Citigroup is using its productivity gains and technology returns to self-fund investments in transformation, AI and technology.

A few examples of the transformation and AI usage include:

- Nearly 180,000 employees in 83 countries have access to Citigroup's proprietary AI tools and have used them 7 million times this year. "These tools save hours each day by automating routine work, analyzing data and creating materials in minutes instead of hours," said Fraser.

- Citigroup is using AI to resolve client queries faster. In the wealth group, advisers are receiving AI-driven insights to deliver personalized advice.

- AI-driven automated code reviews have been used more than 1 million times this year to improve developer productivity. Fraser said the automated code reviews have created 100,000 hours of weekly developer capacity.

- Citigroup has retired or replaced 384 applications so far in 2025.

The other takeaway is that the AI transformation is never complete. Fraser added that "there is still so much upside left for us to capture."