Adobe reported better-than-expected third quarter earnings and raised its outlook for the rest of the fiscal year.

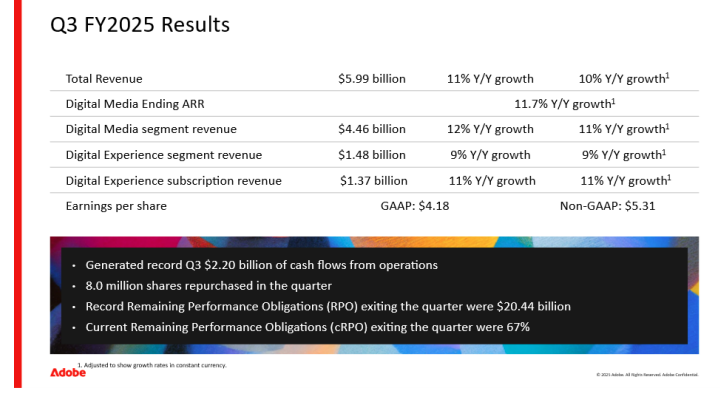

The company reported third quarter net income of $1.77 billion, or $4.18 a share, on revenue of $5.99 billion, up 11% from a year ago. Non-GAAP earnings were $5.31 a share.

Wall Street was expecting third quarter non-GAAP earnings of $5.18 a share on revenue of $5.91 billion.

Adobe CEO Shantanu Narayen said "AI-influenced" annual recurring revenue topped $5 billion and AI-first ARR topped $250 million. Narayen said Adobe was raising its outlook due to AI product innovation and go-to-market execution.

Narayen said:

"AI represents a tectonic technology shift and presents the biggest opportunity for Adobe in decades. Our strategy to harness AI is focused on infusing it across our category-leading applications to provide more value and delivering innovative new AI-first products. We’ve done a great job executing this strategy by accelerating innovation with a focus on offering greater value to Creative and Marketing Professionals and Business Professionals and Consumers."

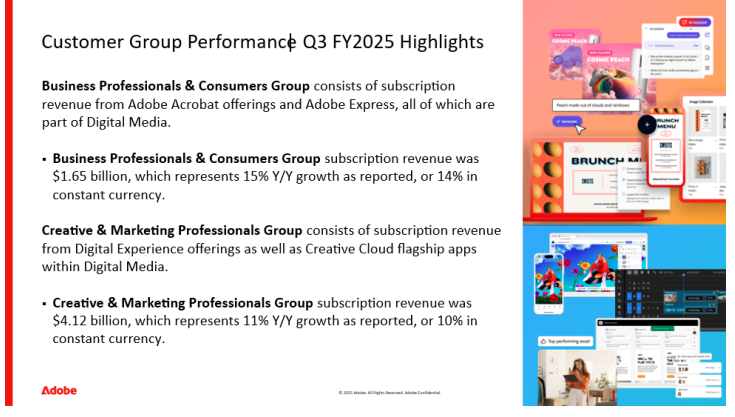

The company saw strong subscription growth across its digital media and digital experience units. Remaining Performance Obligations was $20.44 billion exiting the quarter. Adobe's digital media unit delivered revenue of $4.46 billion, up 12% from a year ago. Digital experience revenue was $1.48 billion, up 9%. Digital experience subscription revenue was $1.37 billion, up 11%.

- Adobe launches LLM Optimizer, GenStudio and Firefly updates

- Adobe's AI strategy, monetization 'feels really good right now'

- Adobe's plan: Leverage agentic AI for CX, unify platform

Adobe's quarter didn't include uplift from its latest agentic AI additions. The company, which is facing increased competition from Canva and newly-public Figma, announced general availability of its AI agents for customer experience Sept. 10. Adobe said the new agents, powered by the Adobe Experience Platform Agent Orchestrator, will be able to understand context, plan multi-step actions and refine responses.

The out-of-the-box agents in Adobe Experience Platform include:

- Audience Agent for audience optimization and personalization.

- Journey Agent to create and orchestrate customer journeys across multiple channels.

- Experimentation Agent to leverage performance data and optimize on the fly.

- Data Insights Agent to aggregate signals across an enterprise.

- Site Optimization Agent to manage brand websites and optimize for performance.

- Product Support Agent, which can give answers based on knowledge bases and enterprise data.

As for the outlook, Adobe said fourth quarter revenue will be $6.075 billion to $6.125 billion with non-GAAP earnings of $5.35 a share to $5.40 a share. For fiscal 2025, Adobe projected revenue of $23.65 billion to $23.7 billion with non-GAAP earnings of $20.80 a share to $20.85 a share.