FinancialForce Services-as-a-Business Is What Their Customers Need To Drive Growth

Service businesses must keep finding new ways to add value to existing clients while removing barriers that slow growth. Overcoming the challenges of outdated HR planning and human resource management (HRM), contract management, and CRM systems are table stakes for staying competitive.

FinancialForce's Summer 22 release aims to turn those weaknesses into strengths with one of the most comprehensive releases they've had lately. "Organizations continue to be buffeted by market disruptions, from spiraling inflation to new COVID variants and unanticipated supply chain issues," said Scott Brown, President and Chief Executive Officer of FinancialForce. "Our new Services-as-a-Business approach delivers the automation, intelligence, and innovation that services organizations need to become more agile so they can expertly turn disruption into opportunity."

Improving Opportunity-to-Renewal Is Key

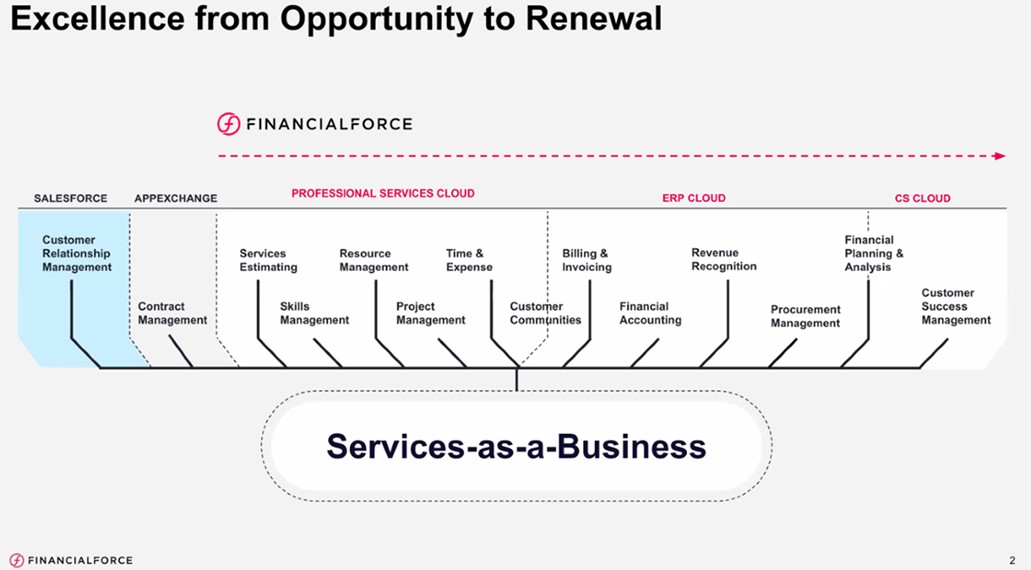

FinancialForce's Summer 2022 release reflects how services businesses need to gain greater visibility and control across to their opportunity-to-renewal process while growing more resilient to spiraling costs, uncertain supply chains, and chronic labor shortages. They need to take on these challenges and keep growing. FinancialForce believes its Business-as-a-Service unified platform can strengthen services' traditionally weak areas (integrated HR, CRM, & contract management) without giving up on how fast they can react to new opportunities.

CEOs and COOs running several leading professional services firms spoken with recently say that tight labor markets, rising prices, and blind spots in the opportunity-to-renewal cycles are hurting revenue. As a result, they're seeing a drain in Annual Recurring Revenue (ARR) and Customer Lifetime Value at risk. They also see that the blind spots in Contract Management, Configure, Price & Quote (CPQ), Resource Management, and Financial Planning & Analysis (FPA) across opportunity-to-renewal grow wider the more diverse their client bases become. What's needed is a 360-degree view of the opportunity-to-renewal process that encompasses every aspect of service operations, from sales to delivery to customer success management, financial management, and planning.

FinancialForce's Summer 22 release introduces Business-as-a-Service to bridge the gaps in the opportunity-to-renewal process, improving customer experiences, and driving faster growth by enabling greater real-time collaboration and visibility organization-wide.

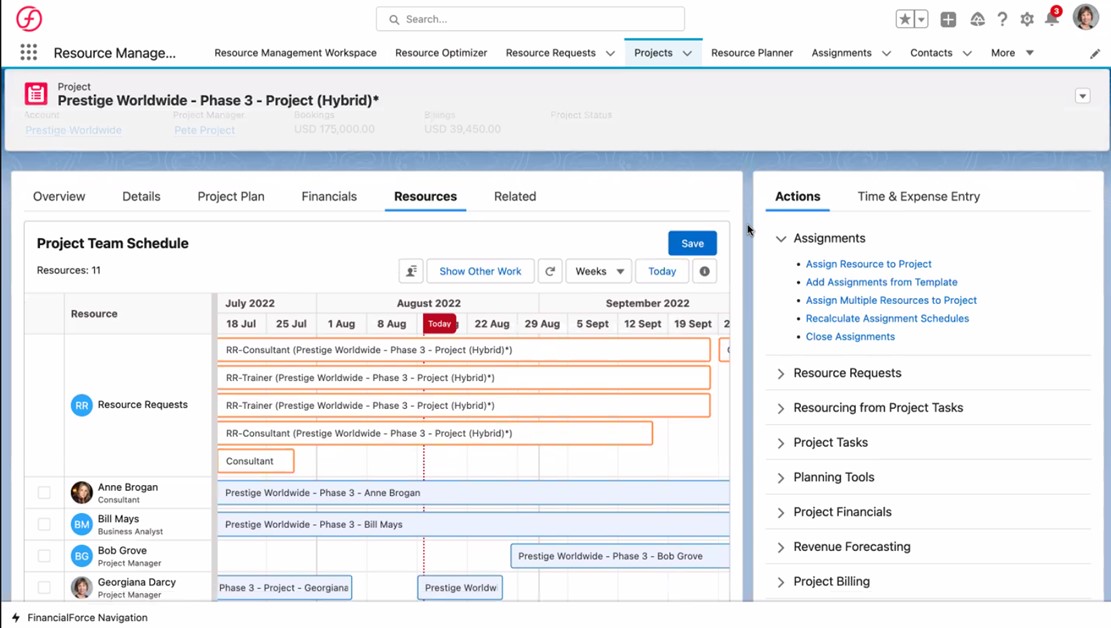

Skills Matching & Scheduling Speed Is A Services Killer App

In the Summer 22 Release, FinancialForce strikes at the heart of what challenges services businesses face the most regarding getting staffing right. Skills matching is new in the release, providing Resource Managers with the insights they need to identify skills related to open roles as either Essential or Desirable. The goal is to bring greater accuracy and speed into the assignment process to control for costs, usage rates, and margin impacts while assigning associates to one project versus another.

Optimizing project schedules and seeing potential scheduling conflicts in real-time helps improve scheduling efficiency by identifying potential project conflicts early and alleviating them by balancing available hours.

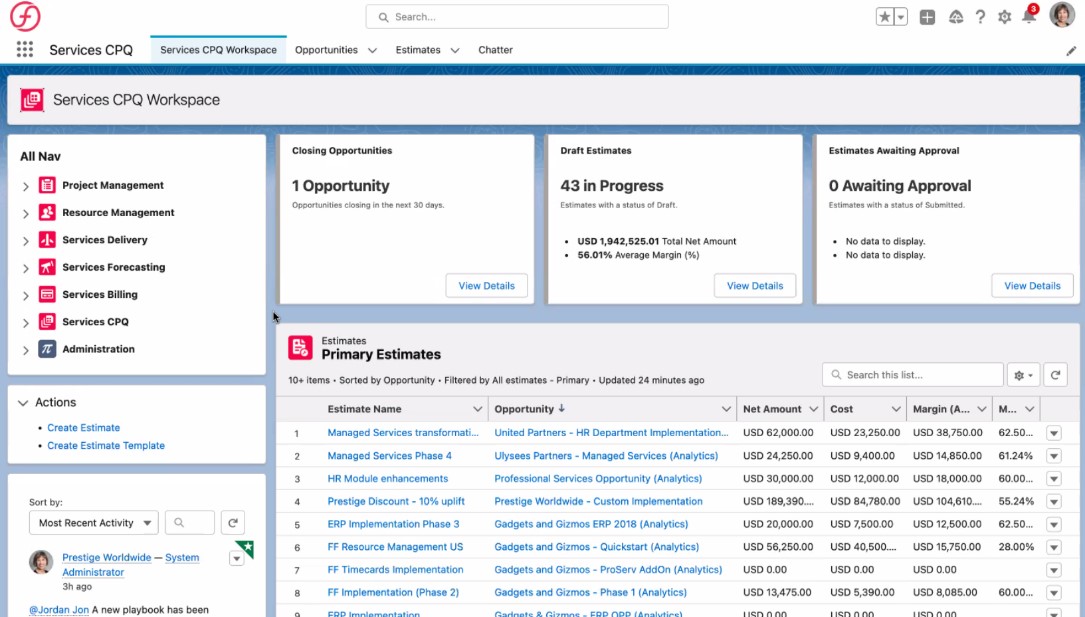

A New Streamlined UX Pays Off For Services CPQ

The Summer 22 release marks the first time FinancialForce ERP Cloud and Professional Services (PS) Cloud run entirely on the Salesforce Lightning Experience (LEX). During the FinancialForce analyst briefing, Heidi Minzner, Vice President, Product Management (ERP Cloud) at FinancialForce, demonstrated how users could create, manage and update line-level data on requisitions and purchase orders in a single view. Additionally, LEX is evident across the entire platform.

Of the many improvements announced in the Summer 22 release, updates to Services CPQ are noteworthy. The updated Services CPQ interface built on LEX has streamlined estimates creation and provides options for defining date-driven rates. Reflecting how services businesses need more role management capabilities, the Summer 22 release can enable role requests from templates and also supports pass-through of needed skills.

Services' CPQ improvements are based partly on the platform's flexibility LEX provides.

William Spice, Senior Director of Product Management, says that Services CPQ and Customer Success Cloud are born in LEX, providing FinancialForce with the flexibility of using the latest Salesforce visual UI to deliver greater simplicity of workflows.

"Services CPQ shows us extending the footprint across the whole services lifecycle, allowing our customers to build up a range of different estimates for professional services work, widen the selling and opportunity phase, and then seamlessly be able to transition these into a delivery model," William said.

"Customer Success Cloud is really focused on making it simple and automatic to create playbooks, which are means for anyone across the organization to help ensure that we're treating our customers with all the respect and impact they would expect from us. And finally, performance to scale sees us continuing to invest and make sure that our applications scale faster than any of our customers can, and focusing on enterprise-level integrations like linking out of the box with JIRA and Concur, for example," William concluded.

Improving Opportunity-to-Renewal With More Intelligence

Services CPQ's improvements reflect revenue managers' need for greater visibility into their sales pipelines and more insights into the propensity to close by clients. FinancialForce takes that a step further by providing insights into which factors are most and least affecting opportunity-to-renewal performance. Current FinancialForce customers have access to dashboards that deliver utilization performance and staffing efficiency and can be configured to provide revenue forecasting. Also announced is a project burn-up dashboard that visualizes work completed and enables teams to be more cost-efficient during project delivery.

Improving Services Revenue With Real-time Visibility And Control

Business-as-a-Service is predicated on the design goal of enabling any business to migrate into providing services profitably. As a result, product-centric companies' transition to services is commonplace. Nearly every major equipment manufacturer is now selling the value delivered by their machinery as a service.

The many improvements FinancialForce has made in their platform's Financial Planning & Analysis (FP&A) areas reflect how this area is core to getting service revenue right. Of the many announcements made in this area of their platform, highlights include providing FP&A teams with the option of performing headcount planning at the resource level to understand better how compensation adjustments will impact future budgets. In addition, flexible budget templates for improving headcount planning alignment with company goals and objectives are now included.

Also announced is a new Planning Workspace where FP&A teams can collaborate and analyze budget information and potential scenarios. The value of having the entire platform on LEX is evident in how FP&A managers can immediately use financial data to accelerate planning cycles which also drives more accurate forecasting within the Planning Workspace. Also introduced is a new machine-learning-based component to the ERP product suite. Its Intelligent bank reconciliation solution provides accounting teams the agility to match a single bank statement transaction to multiple accounting transactions. It's also supporting a more extensive end-to-end intelligent transaction matching that streamlines reconciliation procedures. That's welcome news for accounting teams that need the time for more intensive tasks and would like to be free from the repetitive nature of reconciliation work.

Conclusion

FinancialForce’s decision to change its cadence from four to three releases a year shows its product strategy is delving further into where the gaps are in the opportunity-to-renewal process. Concentrating on three significant releases gives their DevOps and engineering teams the time they need to develop new features while revamping the entire platform to the Salesforce Lightning Experience (LEX). Leading with usability on Services CPQ and Customer Success Cloud makes sense as services businesses need to excel in each area to grow and retain customers. Additionally, a new UX will help accelerate the ramp-up times of new users. FinancialForce enters a new era with the Summer 22 Release, closing gaps in platform strategy while helping customers do the same.