Alteryx Does Self Service, Big Data Processing, Too

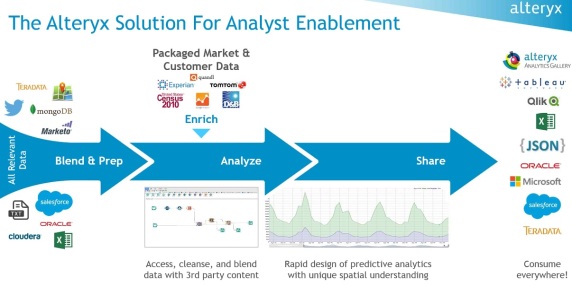

Alteryx Analytics 10.0 brings self-service data prep and analysis to high-scale platforms with in-database processing on Amazon Redshift, Cloudera Impala, Microsoft SQL Server, Oracle Database, Spark and Teradata.

Can analytics upstart Alteryx give data analysts the best of both worlds?

On the one hand, Alteryx Analytics 10.0, the company’s software release announced last week, supports self-service data prep and data analysis with simplified desktop software. At the same time the product gives customers options for broad collaboration and big-data processing power on centralized platforms. Here’s how Alteryx is attempting to do it all.

Founded in 2010, Alteryx started out as predictive and geospatial analytics specialist with self-service data-prep and analysis capabilities. The trouble was it was growing slowly with an all-or-nothing entry-level deployment that started at $60,000, including an analytical designer, data-blending capabilities and third-party geospatial and enrichment data.

In 2014 Alteryx totally changed its go-to-market strategy, borrowing a page from the land-and-expand playbook of partner Tableau Software. Instead of the all-in approach, the vendor decided to offer the Alteryx Designer desktop at $4,000 per user. For collaboration around analytic apps and workflows created on the Designer, there are two options. The cloud-based Alteryx Gallery, which runs on Amazon and costs $1,500 per user, per year, lets you publish unlimited private galleries. Alteryx Server, which costs $45,000 for the server software (unlimited users), is the on-premises option.

Alteryx Analytics gives data analysts tools for building and sharing self-service data-prep and geospatial- and predictive-analysis workflows and applications.

The land-and-expand approach has worked. Two years ago Alteryx had roughly 200 customer firms, but today that figure is over 1,000, with more than 350 new customers in the first half of this year alone. Customers typically start with two to four Designer seats for data-analyst types and quickly add more as the word spreads.

Designers build analytic apps and reports for a broader community of end-user consumers, such as salespeople or marketing staff. As demand for these apps and reports grows, companies add Alteryx Gallery users or the Alteryx Server so analysts aren’t bogged down emailing copies. Gallery and Server users just need a browser to run apps, workflows and reports on their own.

Many customers use Alteryx entirely for its self-service data-prep capabilities, running workflows to serve up fresh data sets that are analyzed in other tools. Tableau and Qlik, for example, are both partners, and one or the other is used by roughly 30 percent of Alteryx customers.

The Alteryx Analytics 10.0 release delivers two big advancements. First, to make the product easier for newbies and increase the likelihood they’ll buy the product after a 14-day free trial download, the company has updated and simplified the interface (see screen shot below). The new menu eliminates the bells and whistles, but once accustomed to the basics, user can hit the “+” button to access advanced predictive and spatial-analysis capabilities.

The Alteryx Analytics 10.0 release features a simplified interface aimed at speeding adoption by trial customers.

A second big push with Alteryx Analytics 10.0 is extending high-scale data-analysis capabilities. Alteryx introduced in-database processing capabilities in the 9.5 release whereby users could push high-scale data-blending or data-analysis jobs down into Microsoft SQL Server or Oracle Database. The 10.0 release extends this in-database processing to Amazon Redshift, Cloudera Impala, Apache Spark and Teradata.

The idea with in-database approaches is to push the processing to the center of data gravity. The obvious advantage is avoiding data movement, taking advantage of the processing power of a big, honking database and avoiding investments in yet more infrastructure.

MyPOV on the Alteryx Self-Service Approach

The standing criticism of all self-service-oriented products has always been the danger of misinterpretation and misuse of “ungoverned” data. I’ve always thought this issue, which is always raised by incumbent vendors with IT-centric systems, is a bit overblown, but it is worth thinking through. An Alteryx exec made the point that IT is completely in control of corporate data sources, and data-analyst types (who are the users of Alteryx Designer) aren’t likely to be granted access unless they’re knowledgeable about the source in question.

It may be that analysts in this or that department may know their stuff. But the more data you’re likely to blend and the more important the predictions and analyses, the more you’d want and need consistent data models and data definitions. So in my view, with great freedom to explore, blend and analyze comes great responsibility to make sure that data is interpreted and analyzed in consistent ways across departments and locations.

A second issue to keep in mind with Alteryx is its close relationship with both Tableau Software and Qlik. That tie has kept Alteryx out of the basics of data-visualization and reporting (although 10.0 does bolster interactive visualization in support of validating predictive models). At the same time, recent Qlik and Tableau releases have introduced very basic built-in predictive capabilities — though they pale in comparison to what Alteryx offers.

My point is that many customers might want to have a comprehensive data discovery, analysis, visualization, reporting and advanced analytics environment from a single vendor. That’s what SAS is going after with its built-from-scratch, Web-based SAS Visual Analytics/Visual Statistics product. Others pursuing this combination include IBM with IBM Watson Analytics and SAP with Lumira and SAP Predictive Analytics.

Long term, I wouldn’t be shocked to see a Qlik or Tableau acquire Alteryx. On the other hand, all three vendors have done quite well by keeping things simple, focused and distinct from the consolidated legacy suites that have mashed together multiple BI and analytics products and ended up being expensive, complex and anything but consistently integrated.

Alteryx is certainly thriving in its current form, with clear, competitive pricing and focused products and options aimed at specific uses and users. Alteryx can’t take credit for starting the self-service movement, but it has been a leader in bringing it to data prep and advanced analytics.