Nvidia data center revenue, outlook strong due to AI infrastructure boom

Nvidia, which is considered one of the primary infrastructure plays for artificial intelligence, reported a better-than-expected first quarter and raised its outlook.

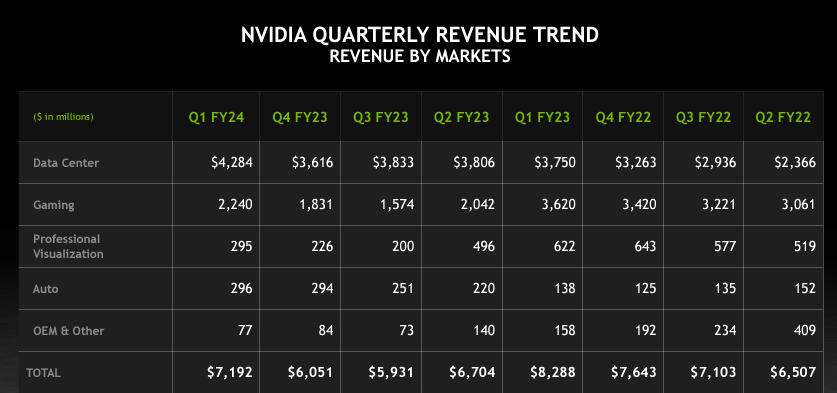

The company reported first quarter earnings of 82 cents a share on revenue of $7.19 billion, down 13% from a year ago. Non-GAAP earnings were $1.09 a share. Wall Street was expecting Nvidia to report first quarter non-GAAP earnings of 92 cents a share on revenue of $6.53 billion.

Nvidia's second quarter outlook also reflected a boom in AI infrastructure investment. Nvidia projected revenue in the second quarter of $11 billion. For the second quarter, Nvidia was expected to report earnings of $1.07 a share on revenue of $7.17 billion.

Jensen Huang, founder and CEO of Nvidia, said:

"The computer industry is going through two simultaneous transitions — accelerated computing and generative AI. When generative AI came along it triggered a killer app for accelerated computing. In the future, it's clear now that generative AI will be primary workload and that the budget of a data center will shift toward accelerated computing. We're seeing incredible orders to retool the world's data centers. It's a 10-year transition to reclaim the world's data centers."

Add it up and Nvidia is seeing a data center surge in spending and racing to provide supply of its H100, Grace CPU, Grace Hopper Superchip, NVLink, Quantum 400 InfiniBand and BlueField-3 DPU lineup.

Speaking on an analyst conference call, CFO Colette Kress said "generative AI is driving exponential growth for our accelerated computing." She said visibility into demand goes out a few quarters and Nvidia has been busy procuring supplies to meet it.

Specifically she noted:

- Cloud service providers are driving strong demand/

- Consumer Internet companies are investing in generative AI and infrastructure.

- Enterprise demand for AI infrastructure is strong from industries such as automotive and financial services as companies develop their own models.

Constellation Research CEO Ray Wang weighed in on the Nvidia results:

"Nvidia is in the right place at the right time. GPU's are the best price/value equation today for Generative AI The future may be TPU’s but the price value equation is not as competitive yet. Both Gaming and Data center markets are entering a new product cycle with H100 GPUs. As we get to Chat GPT 5.0, a trillion parameters won’t be possible without GPUs."

Data center revenue was $4.28 billion in the first quarter, up 14% from a year ago.

In recent months, Nvidia has outlined a series of key enterprise AI partnerships as it plays the long game with generative AI and cloud giants. These partnerships include:

- Nvidia said it will integrate its AI Enterprise software into Microsoft's Azure Machine Learning.

- ServiceNow and Nvidia formed a partnership to develop large language models formed specifically for the ServiceNow Platform, which automates workflows.

- Google Cloud said it would offer new A3 Virtual Machines based on Nvidia's H100 GPUs.

Google I/O 2023: Google makes its generative AI case, Bard becomes ingredient brand | At Google I/O 2023, Google Cloud launches Duet AI, Vertex AI enhancements

While AI optimism has been driving Nvidia shares, it has also made a few quantum computing advances. NVIDIA, Rolls-Royce and Classiq, a quantum software company, said they designed and simulated the largest quantum computing circuit for computational fluid dynamics. Nvidia also announced a new system built with Quantum Machines to bring together quantum computing and its accelerated computing platform.

Ray Wang's take

The AI narrative is driving valuations.

"The war for AI mindshare in a post ChatGPT world is what’s driving tech valuations higher. While Microsoft kick started a war with Google, the reality is that Microsoft may not win the war as it’s servers are the oldest and it’s not taking a responsible approach to AI. We've had numerous reports of performance issues on Teams, Office 365, and other Microsoft services."

"Google has the best team, the best tech, but has been too slow to roll out offerings. The recent Google I/O event showed why they have the lead with better language models, higher precision in data, and more modern data centers. They had to create a division to get it all together, so this horse race is now more interesting."

Winners and losers

1. General AI: Big race between Google and Microsoft

2. AI chips: Nvidia’s GPU’s and Google’s TPU’s will play a bigger role over time.

3. Business software:

- Oracle – a lot of capabilities embedded in their offerings.

- C3 – true enterprise AI platform.

- ServiceNow – a platform for building AI offerings.

4. Internet

- Meta – Using AI to drive better offers.

- Amazon – From warehouse to cloud offerings.