The monopoly race is on between all key cloud IaaS players, the most prominent ones being AWS, Microsoft, Google, IBM and Oracle. There are always monthly press releases about new data centers being announced, opening etc. But seldom there is a 'bulk' announcement like the one that Google announced yesterday, in a blog by Treynor Sloss, that can be found here.

So, let's dissect the blog in our customary way:

At Google, we've spent $30 billion improving our infrastructure over three years, and we're not done yet. From data centers to subsea cables, Google is committed to connecting the world and serving our Cloud customers, and today we're excited to announce that we're adding three new submarine cables, and five new regions.

MyPOV – Capital Expenditure (CAPEX) fuels IaaS expansion, and the 30B claim stakes a ground for the other IaaS players to measure themselves on. Google is investing heavily in submarine cables by its own, that will drive up the tab. But it has advantages – read on.

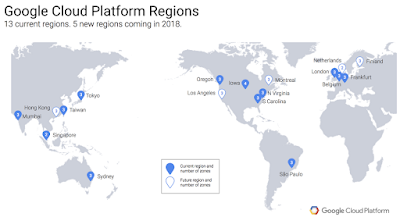

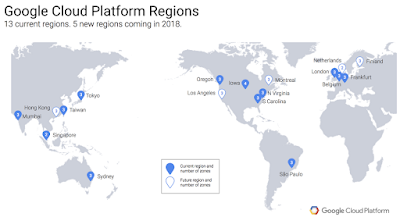

We'll open our Netherlands and Montreal regions in the first quarter of 2018, followed by Los Angeles, Finland, and Hong Kong – with more to come. Then, in 2019 we'll commission three subsea cables: Curie, a private cable connecting Chile to Los Angeles; Havfrue, a consortium cable connecting the U.S. to Denmark and Ireland; and the Hong Kong-Guam Cable system (HK-G), a consortium cable interconnecting major subsea communication hubs in Asia.

|

| Google Cloud Platform Datacenter Map - Source:Google |

MyPOV – 5 new regions are a frantic benchmark for all IaaS providers. With the competition not having shared their overall 2018 objectives this is certainly a high mark. But we will have to see. The remarkable difference are the three subsea cables that will come in 2019. They connect traditionally underserved regions (e.g. Denmark (and with that Scandinavia have no fast connection to North America) – or bypass expensive land connections (e.g. Chile to Los Angeles). Interesting that the latter is a private cable for Google (the others are consortiums).

Together, these investments further improve our network—the world's largest—which by some accounts delivers 25% of worldwide internet traffic. Companies like PayPal leverage our network and infrastructure to run their businesses effectively.

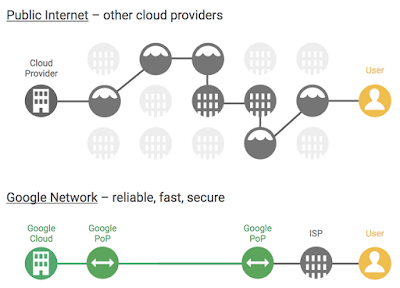

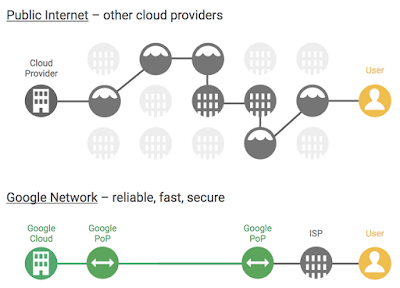

|

| Google Network - Source: Google |

MyPOV – 25% of the worldwide traffic is an impressive number. The scale of that helps Google further, but is also important to keep up good network quality and SLAs, consequently Google need to invest into the network and it's good to see it keeps doing that.

"At PayPal, we process billions of transactions across the globe, and need to do so securely, instantaneously and economically. As a result, security, networking and infrastructure were key considerations for us when choosing a cloud provider," said Sri Shivananda, PayPal's Senior Vice President and Chief Technology Officer. "With Google Cloud, we have access to the world's largest network, which helps us reach our infrastructure goals and best serve our millions of users."

MyPOV – Always good to have a customer using the announced system and services, bonus if well known and demanding a huge scale like PayPal.

Curie cable

Our investment in the Curie cable (named after renowned scientist Marie Curie) is part of our ongoing commitment to improve global infrastructure. In 2008, we were the first tech company to invest in a subsea cable as a part of a consortium. With Curie, we become the first major non-telecom company to build a private intercontinental cable.

MyPOV – Indeed an inflection point for Google again. I remember other tech players wondering why Google invested in 2008 into a consortium…why spend capital when you can rent later? The same questions may come up around the Curie cable. A fast North / South America connection is huge – both for Google and its customers. As South America grows, so does the need for bandwidth.

By deploying our own private subsea cable, we help improve global connectivity while providing value to our customers. Owning the cable ourselves has some distinct benefits. Since we control the design and construction process, we can fully define the cable's technical specifications, streamline deployment and deliver service to users and customers faster. Also, once the cable is deployed, we can make routing decisions that optimize for latency and availability.

Curie will be the first subsea cable to land in Chile in almost 20 years. Once deployed, Curie will be Chile's largest single data pipe. It will serve Google users and customers across Latin America.

MyPOV – Good explanation of why Google is building its own cable... and the unique benefits it brings to Chile and Latin America.

Havfrue cable

To increase capacity and resiliency in our North Atlantic systems, we're working with Facebook, Aqua Comms and Bulk Infrastructure to build a direct submarine cable system connecting the U.S. to Denmark and Ireland. This cable, called Havfrue (Danish for "mermaid"), will be built by TE SubCom and is expected to come online by the end of 2019. The marine route survey, during which the supplier determines the specific route the cable will take, is already underway.

MyPOV – Interesting update on Havfrue – and shows that Google can partner with competitors – like Facebook. While there is plenty of options to network to Ireland, avoiding the land / sea / land /sea way most routes take from Ireland to the rest of Europe is an advantage.

HK-G cable

In the Pacific, we're working with RTI-C and NEC on the Hong Kong-Guam cable system. Together with Indigo and other existing subsea systems, this cable creates multiple scalable, diverse paths to Australia, increasing our resilience in the Pacific. As a result, customers will experience improved capacity and latency from Australia to major hubs in Asia. It will also increase our network capacity at our new Hong Kong region.

MyPOV – I think this is more about Hong Kong, and some appeasement for traditionally bandwidth starved Australia, something likely mot changing till someone puts more North America to Australia direct sea cable on the bottom of the Pacific.

Google has direct investment in 11 cables, including those planned or under construction. The three cables highlighted in yellow are being announced in this blog post. (In addition to these 11 cables where Google has direct ownership, we also lease capacity on numerous additional submarine cables.)

MyPOV – A good summary, showing the unique position of Goggle.

What does this mean for our customers?

These new investments expand our existing cloud network. The Google network has over 100 points of presence (map) and over 7,500 edge caching nodes (map). This investment means faster and more reliable connectivity for all our users.

MyPOV – Good to have a taxonomy and the 100 points of presence and over 7500 edge

nodes are impressive. And likely the leading network.

Simply put, it wouldn't be possible to deliver products like Machine Learning Engine, Spanner, BigQuery and other Google Cloud Platform and G Suite services at the quality of service users expect without the Google network. Our cable systems provide the speed, capacity and reliability Google is known for worldwide, and at Google Cloud, our customers can make use of the same network infrastructure that powers Google's own services.

While we haven't hastened the speed of light, we have built a superior cloud network because of the well-provisioned direct paths between our cloud and end-users, as shown in the figure below.

MyPOV – Indeed the opportunity for Google is that it can run services and products on its network – that potentially other IaaS competitors cannot achieve. Or can only achieve with lengthy negotiations with network providers.

We're excited about these improvements. We're increasing our commitment to ensure users have the best connections in this increasingly connected world.

MyPOV – You bet. 😉

|

| How Google sees the Google network vs the options of other IaaS players - Source: Google |

Overall MyPOV

In general, there is a trend of commoditization between the IaaS vendors – with differentiation getting harder to determine. One area that sticks out is the Google network. Anyone who lands in a country on this planet and turns on their smartphone can see the benefits: Gmail arrives not seconds, but often full minutes earlier than other email accounts. And of course, there are much more benefits beyond simple email – but Gmail is a tangible example that everybody can test themselves. Where it gets exciting is around use cases like Cloud Spanner. Achieving transactional consistency in under sub second is a key quality for many critical next generation applications, e.g. in the are of IoT.

This blog post is doing an excellent job at explaining Google investment and the benefits, but Google will have to keep pushing messaging and awareness that enterprise decision makers can evaluate these capabilities, and realize how critical they maybe for their next generation applications running on Google Cloud Platform.

Lastly, exciting times for the worldwide IaaS rollout. All too often users and enterprises are overseeing the heavy lifting that is necessary behind the scenes to make the 'cloud' happen. If you are lucky and every visited an undersee cable trawler / ship – you realize that there is m any aspects that go into a great user experience. Some of them salty. But for now, congrats to Google to keep investing in one of the core differentiators for Google Cloud, the Google network.