Musings - SAP democratizes Product Development & what it means for Customers

This is an overdue post, which I should really have written back when it was announced that Bernd Leukert was changing roles starting in 2019… now reality has caught up, and Leukert is leaving not only the executive board – but also the company.

In the course of five years SAP has moved from having a single leader for product with then CTO Sikka, who handed over things to Leukert. Single product leaders – who can get it done – work well for enterprise software vendors – as Oracle has shown with Kurian (but also departed, for Google, that's another overdue post).

|

| Some SAP product logos (source www) |

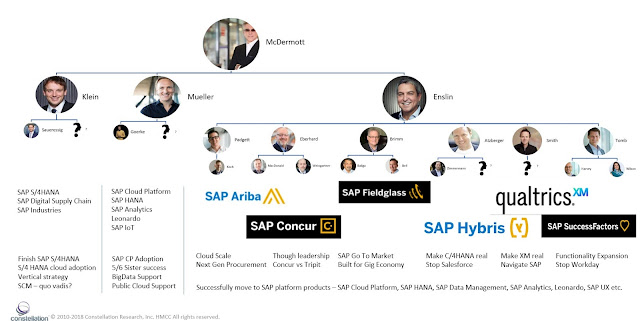

Meet the Product Leaders at Board Level

Well on the board it's three members… and what are their responsibilities? |

| Christian Klein (source: www.sap.com) |

- Christian Klein, COO - Intelligent Enterprise (Development and delivery of SAP's core applications, including S/4HANA and SAP Digital Supply Chain) and leads the cross-board area mandate for SAP’s global business operations. Germany's system of dual study for cooperative education makes it possible. SAP never had such a young leader for all its core products. Remarkably Klein's background at SAP is not in product development, but finance and support operations.

- Juergen Mueller, CTO – SAP Cloud Platform, SAP HANA, SAP Analytics and SAP Leonardo. He joined SAP little more than 5 years ago, in 2013. Previously he was SAP's Chief Innovation Office driving the research agenda and increasingly SAP Leonardo. He isn't 40 either, even younger than Klein.

|

| Robert Enslin (source: www.sap.com) |

- Rob Enslin, President (Cloud Business Group) – SAP Ariba, SAP Concur, SAP Fieldglass, SAP Customer Experience (the former SAP hybris), SAP C/4HANA, SAP SuccessFactors and now also Qualtrics. The group I call 5 sisters that are now… six sisters. It's a marvel by itself, with six presidents and at least 6 heads of product reporting to them. Six different (and more) product architectures underneath them. Enslin has to balance revenue and product needs for all six sisters. Enslin joined SAP in 1992, when Klein and Mueller were barely in high school. He even worked 11 years somewhere else before joining SAP. We won't reveal his age, but he could well be a father to Klein and Mueller.

When SAP announced the Qualtrics acquisition I joked with McDermott on a briefings call, how he felt as head of product. He hesitated a moment, then laughed it off…. But the new reality at SAP is now that falls into three large product development areas – something that has not happened in over 20 years.

For the SAP history buffs: Back in the 1990ies, SAP was a true matrix organization, with each of the then board members (Hopp / Kagermann, Plattner, Zencke, Heinrich, Tschira) having product development and go to market responsibilities (except for Tschira, if memory does not fool me). That ended up badly when SAP missed earnings and SAP moved to a functional organization. Kagermann regretted to have to give up product development and move on to… worldwide sales.

In 2019 SAP is back to a matrix – across three products and two sales leaders. This is a complex structure and needs a lot of goodwill and potential hands on management by the CEO.

To understand the task – lets look at the key challenges for each of the product leaders:

- Klein –He and the development organization have to make the Intelligent Enterprise real, SAP's big news from Sapphire 2018. No easy task, since I largely contribute the departure of Leukert to the lack of resources dedicated to S/4HANA. SAP realized in spring of last year that it cannot deliver on the SAP S/4 value proposition – which was R/3: The integrated end to end ERP+ suite. It was taking Leukert and team too long, Salesforce was gaining, C/4HANA was created. All this is history – but it does not make Klein's job easier. S/4HANA will likely be the SAP Finance system, everything more is on the test stand.

- Mueller – He has to make sure that Klein and Enslin's teams can build innovative software. With the SAP Cloud Platform he needs to make the SAP PaaS competitive, beyond the SAP internal use case. He also has to keep AWS, Google and Microsoft (and likely more IaaS vendors) happy with SAP's multi-cloud strategy. Kubernetes offerings are well portable – but much more needs to happen to make HANA run on the popular IaaS platforms. And then he has to get the intelligence into the intelligent suite… via Machine Learning / AI.

- Enslin – He is leading (as predicted here) the 'functionality death marsh' of the five sisters to the common SAP platform – with SAP HANA / Cloud Platform and Analytics. Basically, he is putting the 5 sisters on SAP technology. I call it a 'functionality death marsh' because platform work always slows down functionality – and the degree of innovation that is coming out on the functional side of Ariba, Concur, Fieldglass, Customer Experience, C4/HANA and SuccessFactors – has taken a break. SAP will deny this, but every technology knows this: When the platform changes, functionality enhancements takes a breather as all hands are on deck to get the product on the new platform live.

|

| SAP Product Leaders, responsibilities and challenges |

So what does it mean for SAP Customers?

As usual, when you can live with standard functionality – you are in good shape. But if you need anything new / strategic / co-development wise from SAP – you have to navigate the complexity.Say for example you want something strategic from SAP Ariba. So you want to get the buy-in from Darren Koch (Chief Product Officer at Ariba). Better get his bosses' buy in as well, that's Barry Padgett, who works for Rob Enslin. Assume the new functionality is innovative and needs something from machine learning, and it runs on e.g. Azure. In comes Juergen Mueller with his team. And say it needs to feed back into your SAP Finance system – in come Christian Klein (and Thomas Saueressig, who is in charge of S/4HANA and more). You quickly run out of seats in the minibus or conference call lines. Customers who want to cut the chase and look for Bill McDermott's commitment, may well try to (and likely get it). But let's not forget that for McDermott to get this done, he needs to coordinate at least three, if not 7 executives (his three board members, the Ariba executives, and for making it easy – just one additional one from Klein and Mueller. For instance, SAP SuccessFactors has two product leaders – Amy Wilson and James Harvey. That makes it 8 executives. Add to that the usual strategic deals that Adaire Fox-Martin and Jennifer Morgan will throw in, especially in Q4. I can see 50% of board meetings being about product ad product development coordination. How often do you have all these executives in the room (or the video conference) to make real time trade-offs between road maps, headcount and customer demands.

On the flipside, customers used to commitments made and delivered for instance by the presidents of the 5 sisters (or also Qualtrics) – need to double check that the rest of the SAP development organization is on board.

The recommendation for customers can only be to take the road maps for granted, hold SAP to it and to take any executive commitments… with a grain of salt. The only way SAP can make this happen is with … vetoing any special projects and commitments. Road map is the new religion. That has never happened, now might be the time to get this installed and live by it.

MyPOV

SAP will have to find a very efficient way to manage this, otherwise there is a high chance it may not be able to deliver. Not planning succession for Leukert (as SAP has almost a tradition – see succession og Agassi, Sikka) is a repeated mistake. To be fair – that is never easy. The board (and owner / operator Plattner) may think that they have the right mix in place between experience and "Sturm und Drang" but it now has all to work. Trips to Potsdam (where Plattner usually is, when in Germany) will be common. SAP has also a tradition to put "x in the box" as we saw with McDermott / Hagemann Snabe – or just last year with Enslin / Leukert. Will we see "three in the box" with Enslin, Klein and Mueller? I am pretty sure, watch the Sapphire keynote?If it all works, the good news is that Enslin is the succession plan / insurance for McDermott, and we will see how things will get split up between Klein and Mueller. Klein was CFO at SuccessFactors, so he maybe the succession for Mucic, his role as a caretaker of S/4HANA may give him also the exposure to become the next CEO of SAP. Mueller is the executive with the most product DNA, so he may well get the job that Agassi, Sikka, Leukert had before him. But that will be not before 2-3 years from now.

But for now – it's going to be interesting to see if SAP can deliver all the product it promised to deliver, faster. The competition certainly has simpler product organization operating models. But then… never discount SAP, there is a lot of talent and major investment at play... and a lot of German corporate DNA and rigor to deliver to a committed roadmap. On the other side it's the biggest challenge SAP's product organization is in since… building R/3 in the first half of the 1990ies. Exciting times ahead.

[For additional reference checkout my analysis of SAP's last major board reorg, in April 2017, which created the cloud business group - here.]