IoT Vendors 2016 Partnerships and Acquisitions define the 2017 IT Vendor Positions

Product launches are always supported with marketing messaging, but that’s for immediate sales prospects, and not necessarily a guide to the strategic direction of the vendor. Examining new partnering agreements and acquisitions usually gives a much clearer strategic insight, as both usually require investment with Board approval. That kind of justification normally makes the move part of an agreed strategic direction. Viewed in this way 2016 was an interesting year and offers some clues to the various market positions of the major IT vendors.

For all except two major vendors, Google and Oracle, the last twelve months have revealed much about the market positions they see themselves aiming to dominant in the emerging and maturing IoT market. Of course this is not necessarily the full picture as they all, including Google and Oracle, will have invested in developing their own technology as well as acquiring or partnering, for some solution elements. Nevertheless clear focuses are starting to emerge, as each looks to build on their current installed base, existing products and experience.

With maturity of understanding a segmentation is developing between those who wish to supply the ‘new IoT infrastructure’, a mix of Network connectivity and Distributed Cloud Processing; and those who are focused on Business solutions that make use of this infrastructure usually by adding increased ‘intelligence’ in one form or another. SAP with its newly announced Leonardo grouping of IoT product stands out for its ambition to be a complete solution provider; whilst Salesforce stands out for its ability to make full use of IoT infrastructure to deliver high Business value People centric solutions.

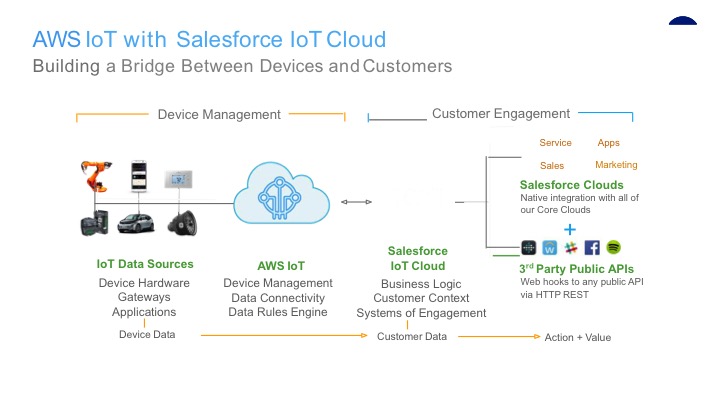

Having drawn attention to the increasing split between the new IoT Infrastructure and the Business focused capabilities it makes sense to start with a Partnership that clearly shows how this can work. The Salesforce announcement of a partnership with Amazon Web Services, surprised many commentators who rightly saw both as strong IoT players in their own right. Salesforce provided the diagram below to clarify the focus on the business use of IoT and their ability to connect to any IoT Infrastructure provider who could provide the required data. The diagram is a backdrop for considering other partnerships/acquisitions.

Having drawn attention to the increasing split between the new IoT Infrastructure and the Business focused capabilities it makes sense to start with a Partnership that clearly shows how this can work. The Salesforce announcement of a partnership with Amazon Web Services, surprised many commentators who rightly saw both as strong IoT players in their own right. Salesforce provided the diagram below to clarify the focus on the business use of IoT and their ability to connect to any IoT Infrastructure provider who could provide the required data. The diagram is a backdrop for considering other partnerships/acquisitions.

The split between the Business proposition, (Salesforce), the enabling IoT infrastructure, (Amazon Web Services), and the overall IoT solution integration including other interfaces is clear. Less obvious points include multiple IoT Infrastructure providers being integrated with multiple Business IoT consumers in an ‘any to any’ set of relationships as the overall scale of IoT moves towards the figures that some are keen to suggest, as well as a growing need for expertise in new forms of solution integration.

IoT Infrastructure vendors, called Hybrids by some, recognize the commonality of IoT networking and IoT Cloud processing being combined in a distributed manner to service IoT ‘activity pools’. First popularized by Cisco under the term Fog Computing, now more frequently referred to as Edge, or Activity Processing, the recognition of the need for localized processing, as well as the difficulties in over centralized Clouds, have made this a key aspect in acquisitions and partnerships for AWS, Cisco, Dell and HPE

Unlike the IoT Infrastructure providers the Business vendors recognize IoT for its ability to strengthen their core propositions rather than as a sales proposition in its own right. Salesforce focus on strengthening the combination of Customers, Employees and Events for stronger Revenues whilst partnering with IoT Infrastructure providers to provide the data. SAP wishes to increase IoT End Device integration into HANA for processing and sees value in offering its own Cloud Services to partners such as Siemens.

Not all Cloud players believe that IoT requires specialized acquisitions, or partnerships, Amazon Web Services focused both its 2016 acquisitions on adding Technology expertise to improve its core Business focus on Cloud operations rather than specifically adding any form of external IoT expertise.

It is a strange fact that IoT End Point connectivity and management, the so called Final Mile, is curiously missing in the above diagram, but then that is reflective of the IoT market overall. Cisco moved to widen its own capabilities with the acquisition of Jasper Networks adding 3/4G IoT network connected IoT End Device services. This acquisition also provided Cisco with a proven IoT Device management platform operating some 25,000 plus devices, together with big Enterprise customer relationships, and into some Telcos IoT operations. Cisco strategy to build expertise into the high layers of the Technology stack, above its traditional connectivity functions, were boosted by a further six acquisitions. Cisco’s vision for IoT Infrastructure positions the Router as also providing the localized data processing capabilities.

The Dell acquisition of EMC strengthened Dell’s already strong, but often under rated, role in IoT. Dell EMC together provides a full range of IoT Infrastructure products, and an existing customer base of references, to support mix and match custom solution integration. Dell have long supplied Industrial Vendors, (the sector who are leading in deploying IOT), with inbuilt processors, edge computing and network gateways, adding EMC brought the expertise in Cloud operations and security, to create a well established IoT Infrastructure business.

Hewlett Packard Enterprises, HPE, in-house development had led to a product range of distributed processing hardware so the acqusition of SimpliVity in January 2017 brought a specialization in ‘software-defined, hyper converged infrastructure’. HPE describes their vision as building the Infrastructure to support ‘Hybrid IT’ – the right platform for each App, Workload, and Service.

Amazon Web Services, Cisco and Dell-EMC actions seem to clearly relate to their position in the new IoT Cloud Infrastructure market, just as Salesforce make it just as plain that the use of IoT data for Business is there focus. It’s less easy to characterized Microsoft as Azure positions Microsoft for the IoT Cloud Infrastructure market, but the 2016 acquisition of Solair brought Technology, Customers and expertise in connecting IoT devices to Azure. Additionally Microsoft has invested extensively in IoT vertical Industry templates seeming to build on its relationship with Developers to build Business IoT solutions on the Azure Cloud.

A complex relationship with Samsung was a particular feature of 2016 for Microsoft with January 2016 marked by an announcement of a partnership based on Samsung position in the Industrial market to use Windows 10 as Samsung IoT End Device development platform. In April 2016 Samsung was busy establishing Artik, its own version of Microsoft Azure, in direct competition to Azure.

SAP has, like Salesforce, no doubt about its focus on using IoT to transform the Business capabilities of an Enterprise with its Leonardo IoT suite. However, SAP is aiming to provide a full IoT solution capability spanning both IoT Infrastructure and Business. The acquisition of Plat.One saw SAP making its own addition of IoT connectivity, Technology, customers and expertise to its current capabilities including Cloud processing and HANA based Intelligence. SAP added strategic partnerships with Vodafone to add 3/4G based IoT Services and in a currently almost unique partnership jointly supports the Industrial market in a partnership with Siemens. An extension to this is an Industrie 4.0 ecosystem play through participation in Open IoT, which aims to develop new standards for IoT integration to support manufacturing industry.

IBM continued to take a different path placing the emphasis on intelligent handling of mass data under its Watson Intelligence strategy. Claiming weather data as a core input to many types of Business activities part of its IoT strategy was to acquire The Weather Channel as a part the new Global IoT business unit. A Strategic Partnership were announced with Schaeffler a leading Automotive industrial company, but the boldest move was in IoT Open Source by leading with support to a development ecosystem to development HyperLedger as an Open Source Block Chain initiative.

This list is not intended to provide an exhaustive listing of vendor’s acquisitions in 2016, merely to highlight the most notable vendors actions to illuminate the direction their strategy seems to lay.

By focusing purely on acquisitions and partnership directly related to IoT means that two major IT Technology vendors don’t appear in the above listing. Though both continued to make numerous acquisitions Google and Oracle targeted other areas, looking to increase their respective efforts to lead on Clouds or Data.

Entering 2017 it seems unlikely that the acquisition boom is over. Innovation across a wide range of topics covering both IoT technology and business use is still creating many interesting new companies with specialist propositions. Some have already who cornered an area of the market, and even become relatively sizable Enterprises.

2016 was a great year of IoT startups as a look at Postscapes listings complete with the individual propositions and funding amounts quickly proves, at least some of these companies will appear in 2017 as part of the next round of market development.