Zoom reports strong Q4, outlook, sees contact center traction

Zoom Video Communications reported a better-than-expected fourth quarter, raised its first quarter outlook and said it would buy back $1.5 billion in shares.

The company reported fourth-quarter revenue of $1.15 billion, up 2.6% from a year ago, with net income of $299 million, or 95 cents a share. Non-GAAP earnings for the fourth quarter were $1.42 a share.

Wall Street was expecting Zoom to report fourth quarter non-GAAP earnings of $1.15 a share on revenue of $1.3 billion.

Zoom expands reach, generative AI use cases with pricing that aims for market share

Zoom said enterprise revenue in the fourth quarter grew nearly 5% as online revenue, typically individuals and small businesses, fell less than 1%.

In prepared remarks, Zoom CEO Eric Yuan said:

"Since its launch only five months ago, we expanded AI Companion to six Zoom products, all included at no additional cost to licensed users. But we are far from done. Our future roadmap for AI is 100% guided by driving customer value. We are hard at work developing new AI capabilities to help customers achieve their unique business objectives and we’ll have more to share in a month at Enterprise Connect."

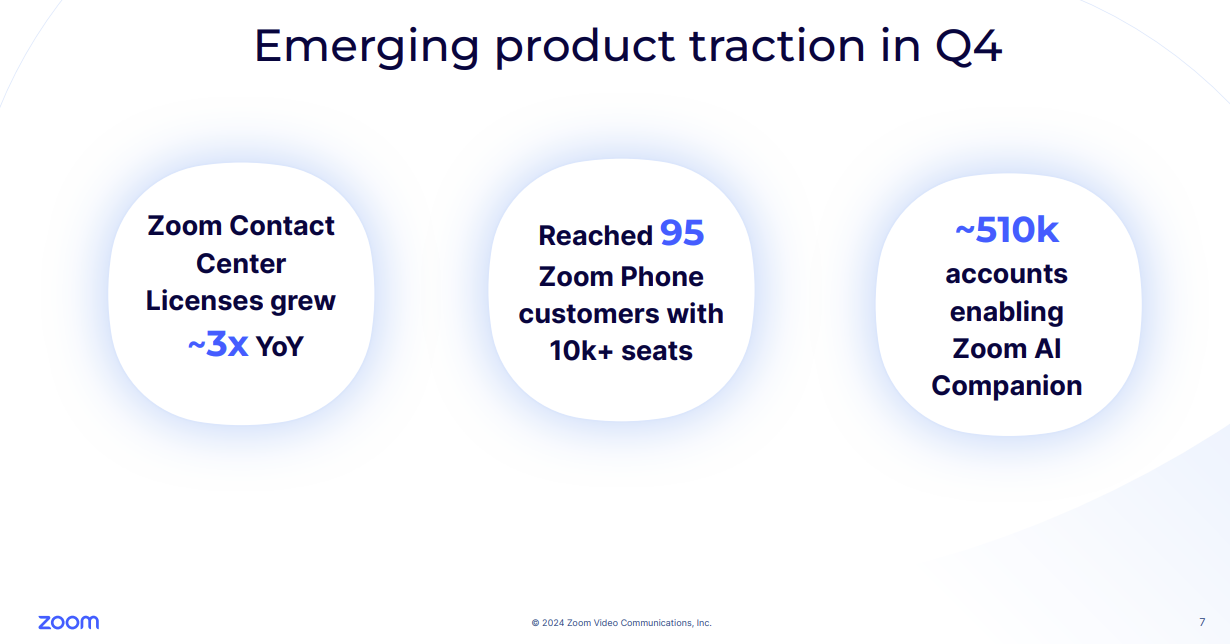

Yuan added that Zoom's Contact Center suite is beginning to win against incumbents.

For fiscal 2024, Zoom reported net income of $637.5 million, or $2.07 a share, on revenue of $4.53 billion, up 3.1% from a year ago.

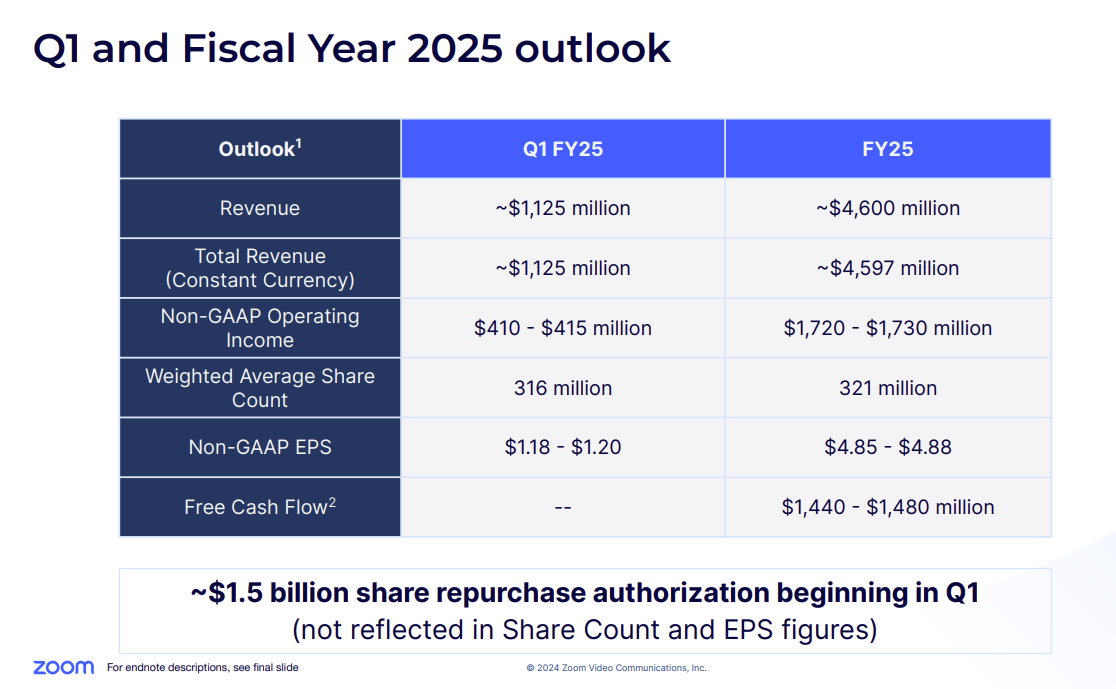

As for the outlook, Zoom said it expects first quarter non-GAAP $1.18 a share to $1.20, compared to estimates of $1.15 a share. Zoom said first quarter sales will be $1.13 billion.

Zoom said it had about 220,400 enterprise customers, up 3.5% from a year ago. Fourth quarter average monthly churn was 3%, down 40 basis points from a year ago.