Shopify eyes offline, B2B markets for commerce growth

Shopify is best known for its online commerce platform, but future growth is increasingly coming from offline brick-and-mortar merchants and point-of-sale terminals as well as new channels such as business-to-business companies.

Those takeaways were highlighted on Shopify's fourth quarter conference call. For those keeping score at home, "offline" was mentioned seven times on Shopify's earnings conference call. "Generative AI" was mentioned three times although Shopify Magic, the brand for genAI tools at Shopify, was mentioned six times.

Shopify reported fourth quarter revenue of $2.14 billion, up 24% from a year ago, with net income of $657 million. For 2023, Shopify reported revenue of $7.06 billion with net income of $132 million. For the first quarter, Shopify projected revenue growth of the low 20 percent range.

To keep that growth going, Shopify is looking to grab more of the commerce stack and that means moving offline as well as being the mobile payments and online vendor. Shopify launched new point-of-sale (POS) terminals as well subscriptions for brick-and-mortar merchants. The company is also expanding its enterprise footprint.

As a result, Shopify POS delivered offline revenue of $441 million, up 5x from 2019. Shopify added big brands like Carrier, Nike Strength, Banana Republic Home and others to its customer roster.

Harley Finkelstein, President of Shopify, said on the company's conference call:

"In order to discover new customers and build deeper connections with existing ones, you need to be online, offline and everywhere in between. And this is one of our superpowers, and why merchants of all sizes are coming to Shopify to build their own future. Starting with our off-line channel. Our go-to-market efforts, combined with enhancements to our product offering continue to resonate with more merchants that operate both off-line and online presences."

Finkelstein said Shopify is already the e-commerce platform for many big brands but offline operations were elsewhere. As digitally native brands move to physical stores, Shopify becomes the infrastructure. Other merchants are looking to Shopify to consolidate vendors. The goal for Shopify is to be "the unified commerce operating system for merchants whether they come to us to sell online, offline or anywhere in between."

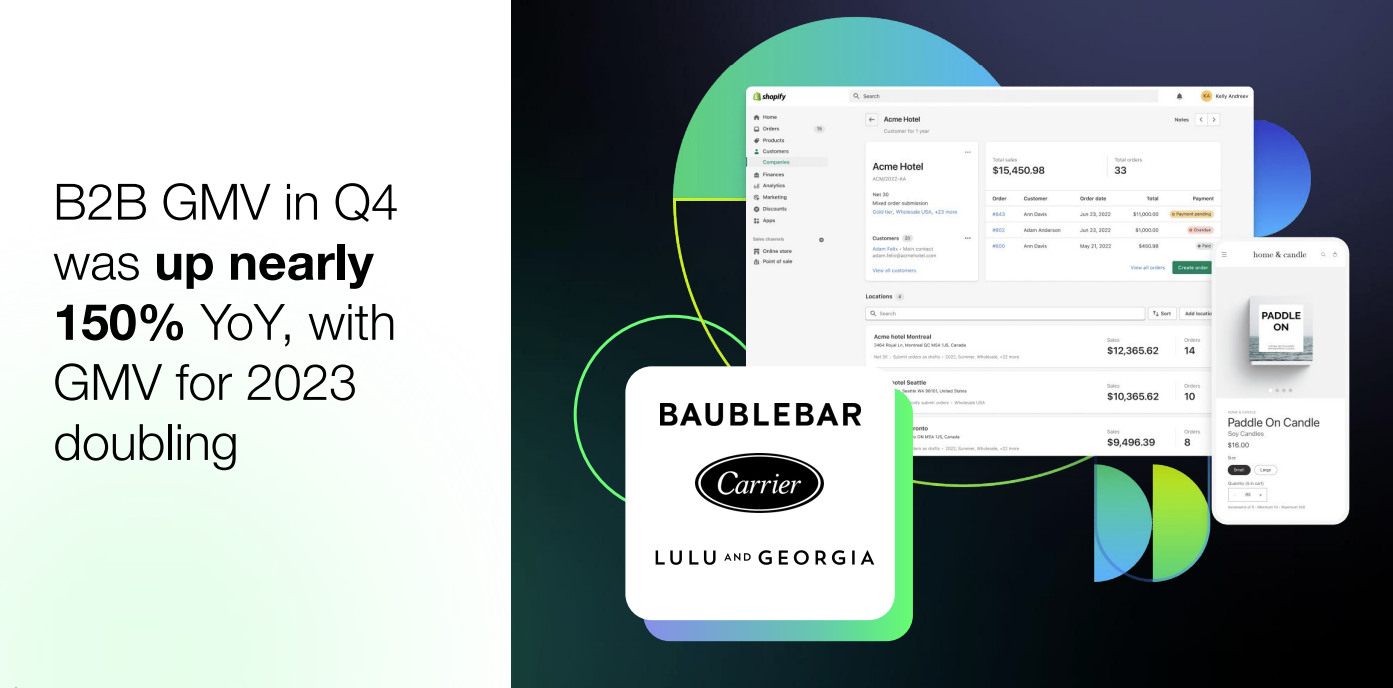

Similar to the offline retail play, Shopify is looking at B2B merchants so it can connect merchants.

"In 2024, we will continue to focus on growing our merchant base by catering to businesses who conduct only B2B transactions that were differentiated B2B offering," said Finkelstein. "We are building on our commitment to help merchants sell to all of their customers from a single unified commerce platform with upgrades to our B2B offering, including headless B2B storefronts, and support for sales reps in the admin, among others, as we look to establish our B2B offering as a leader in commerce."

Shopify said it plans to build out the offline and B2B efforts and target core verticals. Finkelstein said Shopify's headless commerce platform capabilities, composable commerce and broad software stack is also appealing to enterprises.

Add it up and Shopify's battle is likely with vendors focused on smaller businesses such as Square, Toast and Clover. But as Shopify moves up the stack it'll run into Oracle Micros and NCR Voyix.

More commerce: