Palantir's commercial business scales with help of AI boot camps

Palantir's commercial annual revenue run rate is closing in on the company's government business as Palantir Artificial Intelligence Platform (AIP) gains enterprise traction.

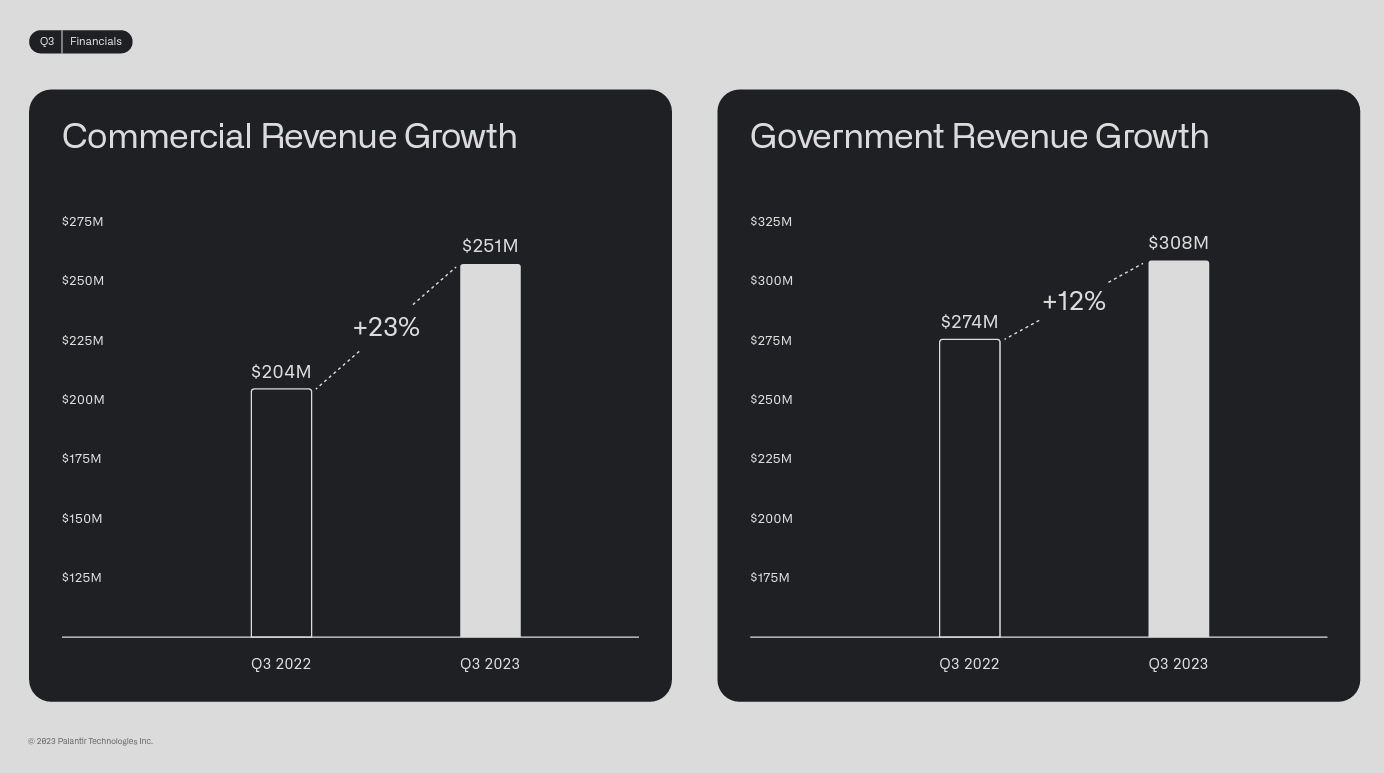

The upcoming parity point between commercial revenue and Palantir's core government business is worth watching. In the third quarter, Palantir commercial revenue grew 23% to $251 million with US revenue growing 33% to $116 million. Government revenue grew 12% to $308 million in the third quarter.

Overall, Palantir reported third quarter earnings of $72 million, or 3 cents a share, on revenue of $558 billion, up 17% from a year ago. Adjusted earnings were 7 cents a share. The results handily topped expectations.

Palantir has been trying to grow its enterprise revenue base for years and now has 181 commercial customers, up 37% from a year ago. As for the outlook, Palantir is projecting 2023 revenue between $2.216 billion and $2.22 billion. J.D. Power, Palantir team up on generative AI apps for auto value chain

On a conference call with analysts, Ryan Taylor, Palantir's Chief Revenue Officer, said the company closed 80 deals including 12 worth $10 million or more across 11 industries.

Taylor said:

"We're also seeing the acceleration of larger deals and shorter times to conversion and expansion, including a multiyear deal in excess of $40 million with one of the largest home construction companies in the U.S. to start up pilot and converted all within Q3. This growth is in part due to AIP's continued transformation of the way we partner with and deliver value for our customers, and we expect AIP's impact to continue to intensify."

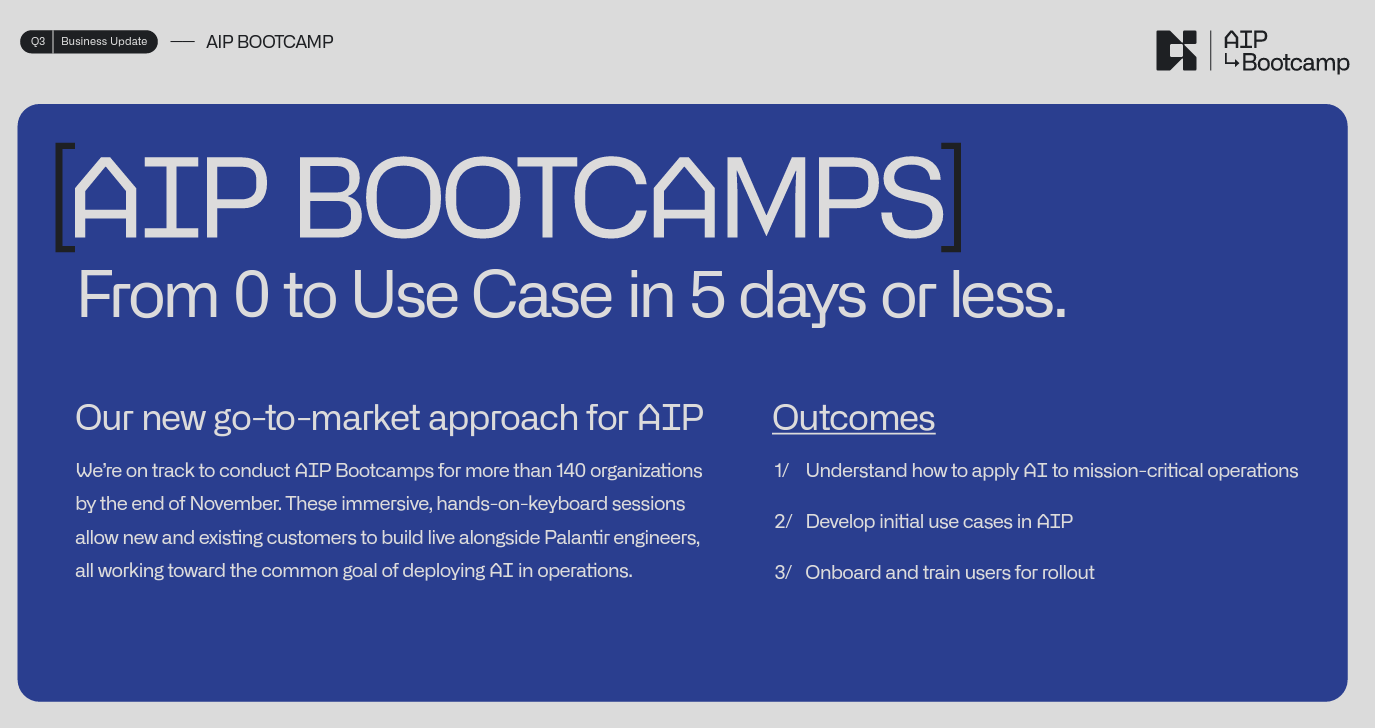

Palantir has seen traction with "AIP boot camps," which deliver real workflows on customer data in 5 days or less. That approach is driving contract expansions. "We're on track to conduct boot camps for more than 140 organizations by the end of November, nearly half of those are taking place this month alone, which is more than the number of U.S. commercial pilots we conducted all of last year," said Taylor. "We almost tripled the number of AIP users last quarter and nearly 300 distinct organizations have used AIP since our launch just five months ago. We will continue investing meaningfully in boot camps as our go-to-market strategy for AIP."

Of course, Taylor noted that Palantir's government business remains strong and should accelerate going forward.

Shyam Sankar, Palantir's CTO, said AIP boot camps are driving the point home that you can't use LLMs without tools to provide algorithmic reasoning. Sankar recently gave a talk on the topic.

According to Palantir CEO Alex Karp the commercial success isn't surprising if you zoom out and consider the company's military experience. Karp said:

"AIP and U.S. commercial is not only is disrupting the market, it's setting a standard that I don't believe any other software company will be able to reach partly because they misunderstood the value of LLMs and their relative importance, and lack of importance, partly because they don't have decades of experience on the frontline as we do in the military with managing the core ways in which you make these things precise, the way in which you provide governance."

Karp added that AIP enables enterprises to manage LLMs and "basically pen test your enterprise." "My view of what we should do is build products that are so good that the competition stops competing, whether that's in commercial or on the battlefield and that's what we're doing. And that's what we're seeing in AIP," said Karp.