Monday reported strong second quarter results, progress in landing enterprise accounts and AI products that are resonating. But a conservative outlook and other moving parts put the kibosh on the results.

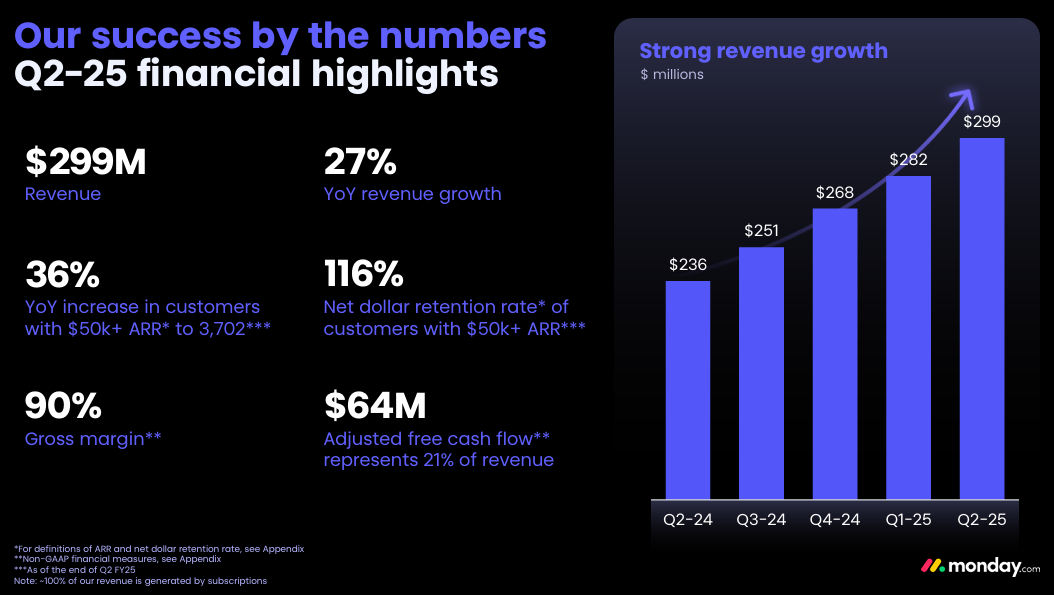

The company reported second quarter earnings of 3 cents a share on revenue of $299 million, up 27% from a year ago. Non-GAAP earnings were $1.09 a share, 23 cents a share better than estimates.

Monday projected third quarter revenue of $311 million to $313 million, up 24% to 25%, vs. Wall Street estimates of $313 million. Non-GAAP operating income will be $34 million to $36 million. For fiscal 2025, Monday projected revenue between $1.224 billion to $1.229 billion, up 26%. Wall Street was looking for $1.22 billion in revenue for the year. Non-GAAP operating income for fiscal 2025 will be between $154 million to $158 million.

Shares fell nearly 30% on Monday.

Monday is expanding its product lineup. In the second quarter, Monday saw 46 million AI driven actions since launching AI products. During the quarter, the company launched Monday Magic, Monday Vibe, and Monday Sidekick, three tools Co-CEO Roy Mann said, "mark a major step forward in our evolution from work management to work execution."

- Monday.com rides large enterprise accounts, AI features to move upstream

- Smartsheet vs. Asana vs. Monday: What you need to know

- Asana: AI-driven work orchestration promising, but CEO search, multiple transitions ahead

In July, Monday said the launch of the new products was the beginning "of a longer-term evolution" focused on enabling AI for all aspects of work.

AI-based products are also driving consumption revenue. Monday executives said more customers are surpassing the 500 AI credit limit and buying more for AI usage.

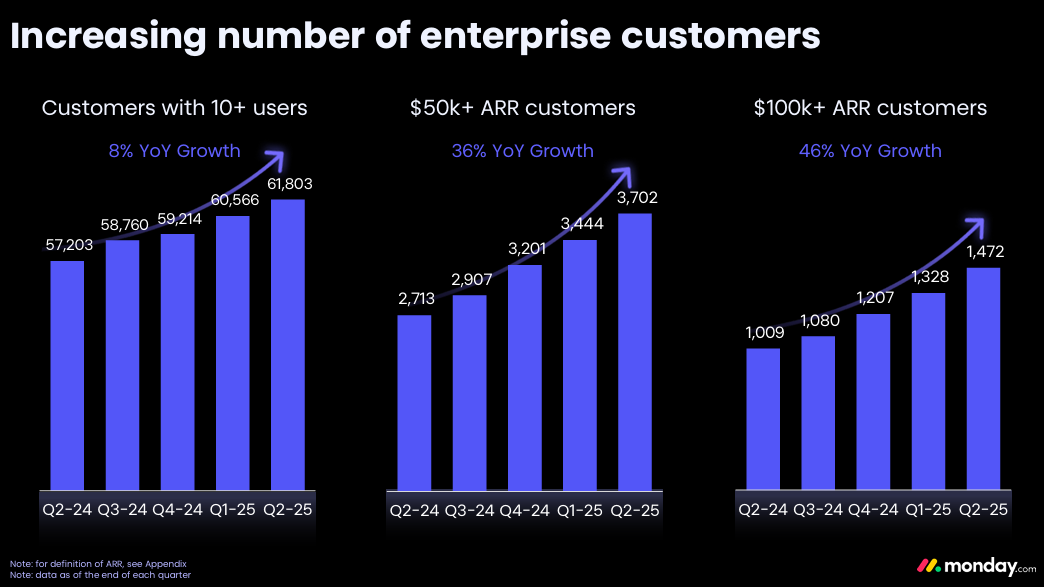

Monday is looking upstream to enterprise accounts. Co-CEO Eran Zinman said Monday saw a record number of new net adds of customers paying more than $100,000 annually. Much of this move into the enterprise revolves around Monday CRM, which hit $100 million in annual recurring revenue. "This achievement underscores the strong demand for a flexible, customizable CRM platform," said Zinman.

The company is retooling its management team to sell enterprise accounts. Monday named Google, Waze and Vimeo alum Harris Beber as CMO, and appointed Adi Dar as Chief Customer Officer. Dar is Monday's chief operating officer until a successor is named. In April, Monday named Casey George as Chief Revenue Officer. George had been at Qlik as well as Talend and Verint.

Monday is projecting headcount growth of 30% in fiscal 2025.

Zinman said:

"While work management is very mature for enterprise customers and kind of high end of mid-market, the newer products, the CRM, dev and service are currently more serving the SME segment. So, on one hand, we feel the multiproduct strategy really help bundling and selling more products to kind of more of the lower-tier SMB mid-market part of the business, while the changes we've done to go- to-market team and organization and a lot of other things is driving upmarket expansion."

Google search changes are hampering low-funnel activity for smaller accounts. Mann said Monday has seen fluctuations due to Google algorithm changes before. The company is now optimizing AI Mode.

Mann said the impact from Google changes isn't big but is part of a funnel for smaller businesses. There's also an impact for larger customers too. He said:

"The better, high- quality customers still click on Google and ads. If you're looking for solution such as a CRM or project management, you're going to reach us. So, the drop that we see is just on volume because they are experimenting with AI on top. And it's not that significant for the higher quality of customers. It's more volume than quality."

CRM growth. Wall Street analysts asked multiple questions about traction in CRM. Executives said that customer counts for CRM may not be a perfect indicator since Monday is landing larger accounts. Mann said Monday CRM is becoming more of a suite and that is landing larger accounts after a start focused on smaller businesses. Mann said Monday CRM is selling well because it offers the flexibility to "build anything you want with it."

"The platform is open. It's built out of building blocks. It's all modular. And that gives us a huge head start into building enterprise- grade applications that really work seamlessly. And that is also connected to the rest of your workflow," said Mann.

What's next? The company said that it will hold its Investor Day in New York Sept. 17 when it will outline more on its strategy and roadmap.