A look at Tesla's method to the innovation madness

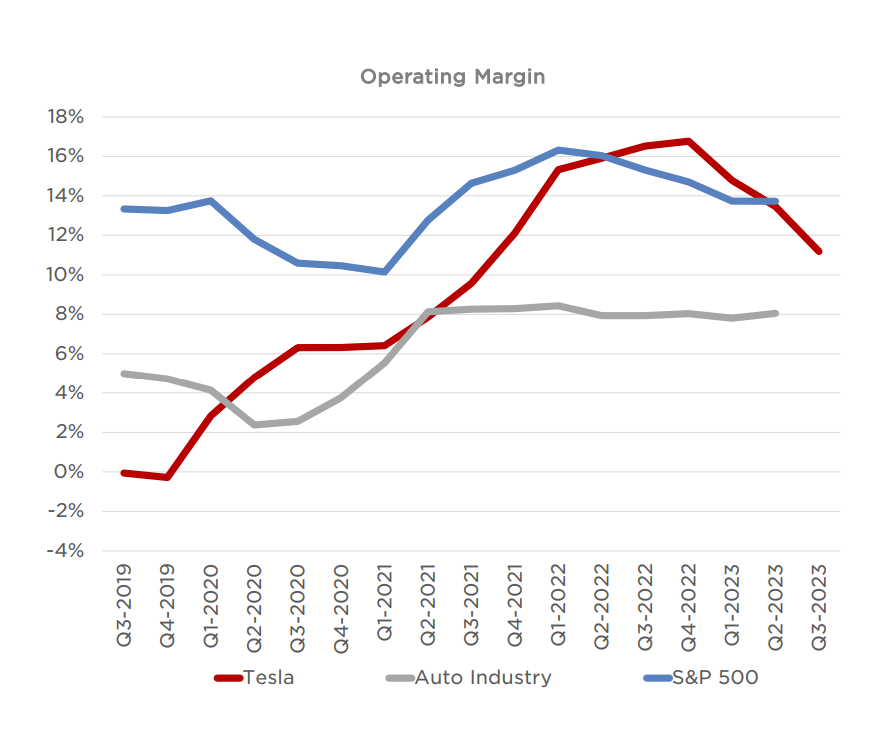

Tesla is sacrificing operating margins for market share with its electric vehicles and that reality is making it look like just another car maker. But the big picture looks more innovative.

Ultimately, the Tesla debate will be settled by what the company becomes. Tesla will either merely be an auto manufacturer or be seen as a technology company. For now, operating margins in the third quarter were 7.6%, down from 17.2% a year ago.

While this Tesla debate ensues, there are a bevy of innovation lessons to ponder for the rest of us. Here are some of the innovation takeaways from Tesla's earnings conference call.

It's about the data. It's always about the data. Musk realizes that Tesla is really a data company. It sold EVs to collect data and build autos with full self-driving (FSD) capabilities. Tesla said in an investor presentation: "Our large installed base of vehicles continues to generate anonymized video and other data used to develop our FSD Capability features."

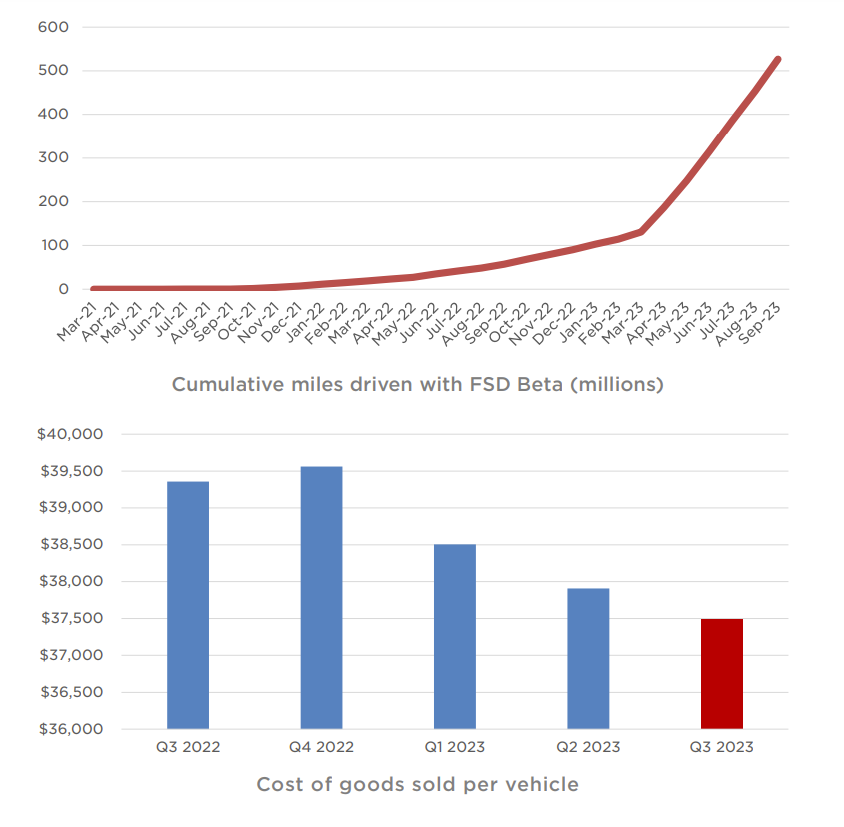

Musk elaborated on Tesla's earnings call. "Our vehicles are now driven over 0.5 billion miles with FSD beta, full self-driving beta, and that number is growing rapidly," said Musk.

Data doesn't matter without compute. Tesla is building out AI infrastructure at a rapid clip. "We recently completed a 10,000 GPU cluster of (Nvidia) H100s. We think probably bring it into operation faster than anyone’s ever brought that much compute per unit time into production, since training is the fundamental limiting factor on progress with full self-driving and vehicle autonomy," said Musk.

Tesla has also built Dojo, a supercomputer for vision video processing and recognition. Will this AI compute be a service at some point?

Related: Nvidia, Foxconn aim to build AI factories, collaborate on EVs, robotics | How Kinetic aims to transform digital EV repair, maintenance and aftermarket

Keep it simple or be ready to pay the price for complicated. Tesla shares are under pressure largely due to Musk's comments about the Cybertruck, which has 1 million reservations even though the vehicle looks as if a DeLorean and Pontiac Aztec had a love child.

Musk on the earnings conference call moved to temper Cybertruck expectations. He said:

"I’ve driven the car. It’s an amazing product. I do want to emphasize that there will be enormous challenges in reaching volume production with Cybertruck, and then in making Cybertruck cash flow positive. This is simply normal for when you’ve got a product with a lot of new technology or any new vehicle, brand new vehicle program, but especially one that is as different and advanced as the Cybertruck, you will have problems proportionate to how many new things you’re trying to solve at scale. So, I just want to emphasize that while I think this is potentially our best product ever and I think it is our best product ever, it is going to be -- require immense work to reach volume production and be cash flow positive at a price that people can afford."

Some Cybertruck scale won't appear until 2025, but that timeline is Musk's best guess at this point. "It's not a demand issue, but we have to make it and we need to make it at a price that people can afford," said Musk.

The original business may just be the beginning. Amazon started as a bookstore and now it is a retail giant and cloud computing provider. Uber was a glorified taxi service and now it is about mobility as broadly defined as possible. Tesla is killing margins on its cars to gain share, but in the future, it can extend into multiple businesses including robotics and AI services as well as mobility via a fleet of autonomous vehicles.

If you view Tesla's EV business as just a precursor to other businesses, Musk's strategy to lower prices doesn't look too shocking. After all, you need to make your innovation affordable to collect the data needed for the next phases of the business. Musk said:

"If interest rates remain high or if they go even higher, it’s that much harder for people to buy the car, they simply cannot afford it. And we are tracking Model Y to be the bestselling car on earth, but not just in revenue, but in unit volume. If you compare that to the other vehicles that are number two and number three and whatnot, they cost much less than our car...

The thing that must be solved is to make the car affordable or the average person cannot buy it."

Companies need to evolve. Tesla's more interesting businesses have little to do with cars. The company's Optimus robot effort is notable as is its energy storage business, which along with services contributes more than $500 million in quarterly profit.

In the third quarter, Tesla's energy generation and storage business had revenue of $1.56 billion, up 40% from a year ago. Services and other revenue were $2.17 billion, up 32%. And total automotive revenue was $19.62 billion, up 5% from a year ago.

"We’ll continue to invest significantly in AI development, as this is really the mass game changer. And I mean success in this regard in the long term I think has the potential to make Tesla the most valuable company in the world by far. If you have fully autonomous cars at scale and fully autonomous humanoid robots that are truly useful, it’s not clear what the limit is," said Musk.