Dell Technologies continues to ride AI infrastructure wave with strong Q1

Dell Technologies reported strong first quarter results and provided a solid outlook due to strong demand for AI infrastructure.

The company reported first quarter earnings of $1.37 a share on revenue of $23.4 billion, up 5% from a year ago. Non-GAAP earnings were $1.55 a share.

Dell was expected to report first quarter earnings of $1.69 a share on revenue of $23.2 billion.

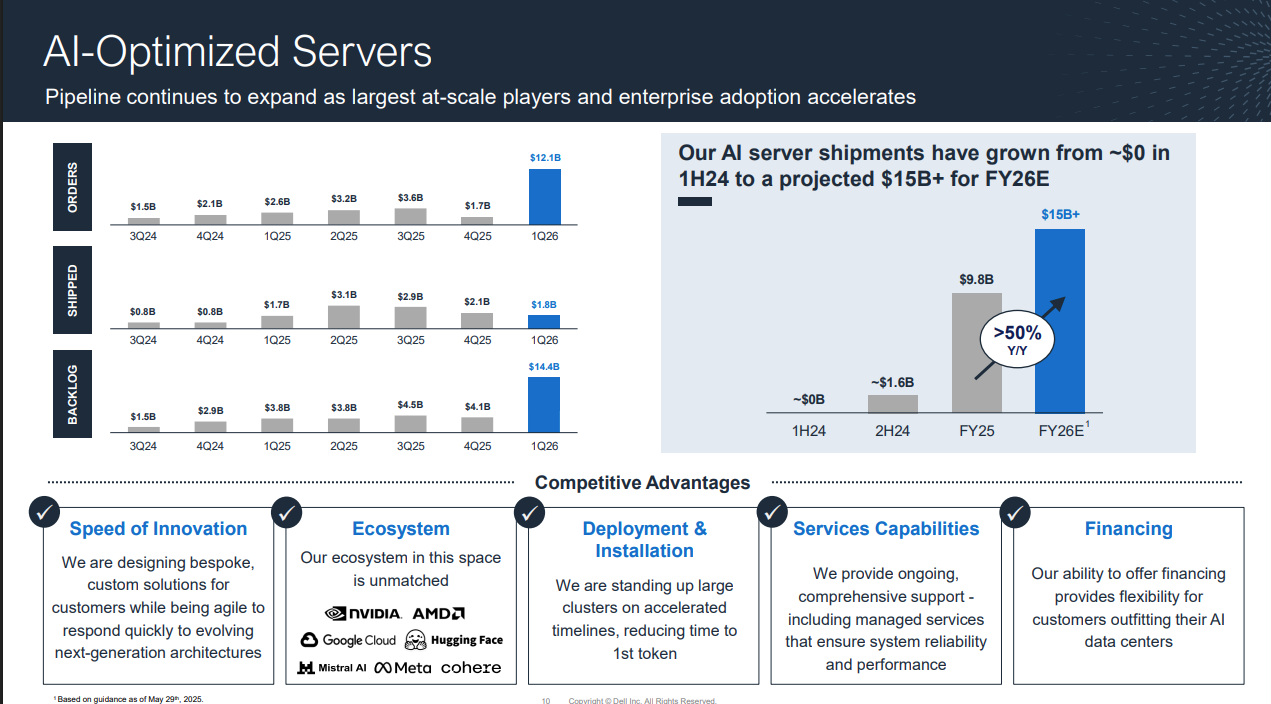

CFO Yvonne McGill noted that Dell's non-GAAP earnings grew three times faster than revenue. Chief Operating Officer Jeff Clarke said the company saw strong AI demand. "We're experiencing unprecedented demand for our AI-optimized servers. We generated $12.1 billion in AI orders this quarter alone, surpassing the entirety of shipments in all of FY25 and leaving us with $14.4 billion in backlog," he said.

- Dell Technologies: Welcome to the disaggregated data center

- Dell Technologies expands AI factory efforts with Nvidia, AMD, Intel, ecosystem

Indeed, AI infrastructure carried the quarter for Dell. The infrastructure solutions group (ISG) delivered operating income of $1 billion on revenue of $10.3 billion, up 12% from a year ago. Servers and networking revenue was a record $6.3 billion in the first quarter, up 16% from a year ago.

Clarke said:

"We experienced exceptionally strong demand for AI-optimized servers, building on the momentum discussed in February and further demonstrating that our differentiation is winning in the marketplace. Our pipeline continued to grow sequentially across both Tier 2 CSPs and private and public enterprise customers - and remains multiples of our backlog. Enterprise AI customers grew again sequentially with good representation across key industry verticals."

Clarke did note that demand and shipments are likely to be lumpy for the foreseeable future.

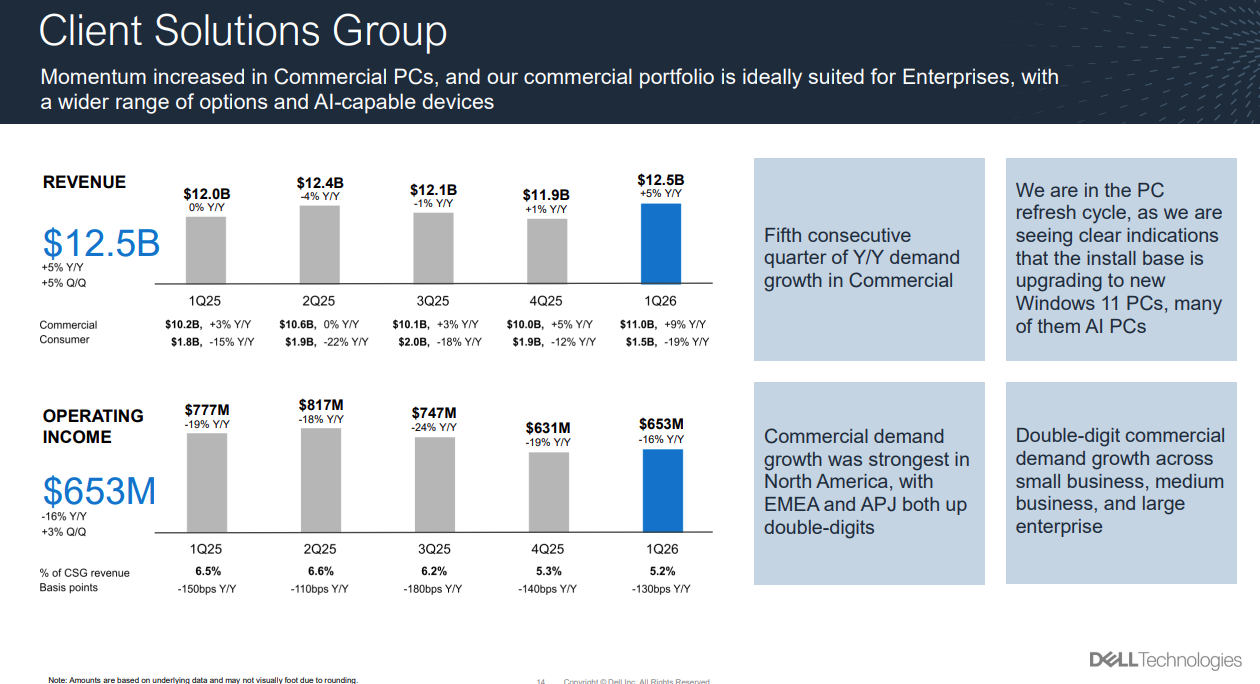

For the PC unit, also known as the client solutions group (CSG), revenue in the first quarter was $12.5 billion, up 5% from a year ago, with operating income of $653 million. Commercial client revenue was $11 billion, up 9% and consumer revenue was down 19% to $1.5 billion. Dell is primarily focused on business PCs.

As for the outlook, Dell projected second quarter revenue of $28.5 billion and $29.5 billion, up 16% from a year ago. Non-GAAP earnings will be $2.25 a share. For fiscal 2026, Dell projected non-GAAP earnings of $9.40 a share on revenue of $101 billion to $105 billion.

McGill hinted that the outlook could turn out to be conservative but the economy is the big unknown. "We’re optimistic on our portfolio and our ability to execute - however, we want to be thoughtful of how customers think through their IT spend relative to the macro environment," she said.

Holger Mueller, an analyst at Constellation Research, said:

“Dell had a good quarter, benefitting from the inference demand of AI. That's easy to see as servers and networking were up respectable 16%, storage barely beat inflation at 6%. If Dell customers were training AI models locally we should see more storage sales. Or Dell is not participating on the increased demand for data lakehouses. We will know more in the next quarter.â€