Bank of America: Why 'digital superiority' matters

Bank of America's second quarter was strong, the banking giant captured deposits and the company saw good operating leverage. Bank of America CEO Brian Moynihan said digital superiority is a big reason.

Speaking on the company's second quarter earnings conference call, Moynihan said:

"Digital superiority is key to our operating dynamics. First, it produces a great customer experience resulting in strong customer retention and strong customer scores. Second, it ensures our position as a lead transactional bank for our customers, whether they are consumers, companies, or investors. Third, it preserves a strong deposit balance. And last, but importantly not least, efficiency."

Research: Connecting Experiences From Employees to Customers

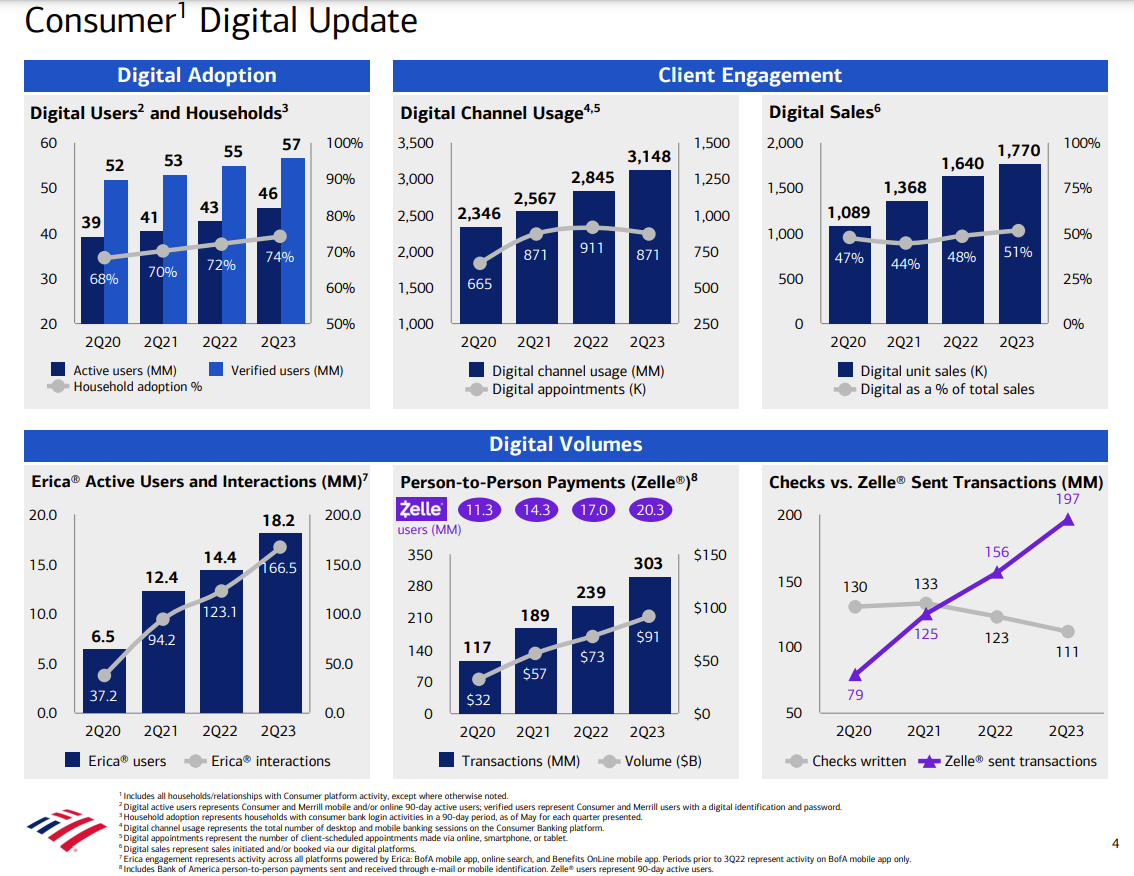

Moynihan outlined the following metrics:

- 46 million active consumer users digitally engaged and logged on 1 billion times a month.

- Interactions with Erica, the bank's natural language processing and AI bot, has now had more than 1.5 billion client interactions in its first five years. Erica interactions rose 35% in the past year.

- Zelle usage has grown 19% over the past year.

- Erica and Zelle have generated 20,000 digital leads for 7,000 advisors.

Bank of America also saw digital engagement gains in global wealth and investment management and global banking.

Alastair Borthwick, CFO at Bank of America, said digital superiority also means operating leverage and efficiency gains.

Borthwick said:

"You should expect us to continue to engineer by applying massive amounts of technology. Erica saves a lot of transactional activity, Zelle saves a lot of transactional activity deposits by mobile phone saves a lot of activity."

Those digital efforts save money and drive revenue.

Moynihan said digital prowess has enabled Bank of America to keep headcount flat to down and invest those savings back into developers.