AMD sees strong data center demand for Q4

AMD's third quarter financial results were better than expected, but the outlook for the fourth quarter was lighter than expected. AMD CEO Dr. Lisa Su said "our data center business is on a significant growth trajectory" due to its EPYC server processors and Instinct MI300 accelerator shipments.

The company reported third quarter earnings of $299 million, or 18 cents a share, on revenue of $5.8 billion, up 4% from a year ago. Non-GAAP earnings for the quarter were 70 cents a share.

Wall Street was expecting AMD to report third quarter earnings of 68 cents a share on revenue of $5.69 billion.

As for the outlook, AMD projected fourth quarter revenue of $6.1 billion, give or take $300 million. That outlook would equate to 9% revenue growth from the fourth quarter a year ago. Non-GAAP gross margin guidance of 51.5% was in line with expectations. That outlook is based on strong growth in AMD's data center unit and momentum in the client business with lower sales in gaming and embedded markets.

Like Intel, AMD saw stabilization in the PC business. Su said AMD saw record sales of its Ryzen 7000 series PC processors as well as server processors.

- AMD sees AI interest, AMD Instinct MI300A and MI300X GPUs on track

- AMD makes its case for generative AI workloads vs. Nvidia

- Oracle Cloud Infrastructure launches AMD 4th gen EPYC instances

- Why enterprises will want Nvidia competition soon

- Oracle’s Data Platform Gets an EPYC™ Boost

- Intel's Q3 better than expected as PC business stabilizes

Key items from AMD's analyst conference call:

- "Based on the rapid progress we are making with our AI road map execution and purchase commitments from cloud customers, we now expect Data Center GPU revenue to be approximately $400 million in the fourth quarter and exceed $2 billion in 2024 as revenue ramps throughout the year. This growth would make MI300 the fastest product to ramp to $1 billion in sales in AMD history. I look forward to sharing more details on our progress at our December AI event," said Su.

- "We've been planning the supply chain for the last year and we're always planning for success. So certainly, for the current forecast of greater than $2 billion, we have adequate supply. But we have also planned for a supply chain forecast that could be significantly higher than that, and we would continue to work with customers to build that out," said Su.

- "Looking at the next couple of quarters, we expect strong growth in our Data Center business, driven by both EPYC and Instinct processors. This growth will be partially offset by softening demand in our Embedded business and lower semi-custom revenue, given where we are in the console cycle," said Su. "As the PC market returns to seasonal patterns, we believe we are well positioned to gain profitable share in the premium and commercial portions of the market based on the strength of our product offerings."

- Su said the fourth quarter revenue for its Instinct processors will initially be HPC, but then become mostly AI through 2024. "Within the AI space, we've had very good customer engagement across the board from hyperscalers to OEMs, enterprise customers and some of the new AI start-ups that are out there," she said. "From a workload standpoint, we would expect MI300 to be on both training and inference workloads. We're very pleased with the inference performance on MI300, so especially for large language model inference, given some of our memory bandwidth and memory capacity. We think that's going to be a significant workload for us. But I think we would see a broad set of workloads as well as broad customer adoption."

By the numbers for the third quarter:

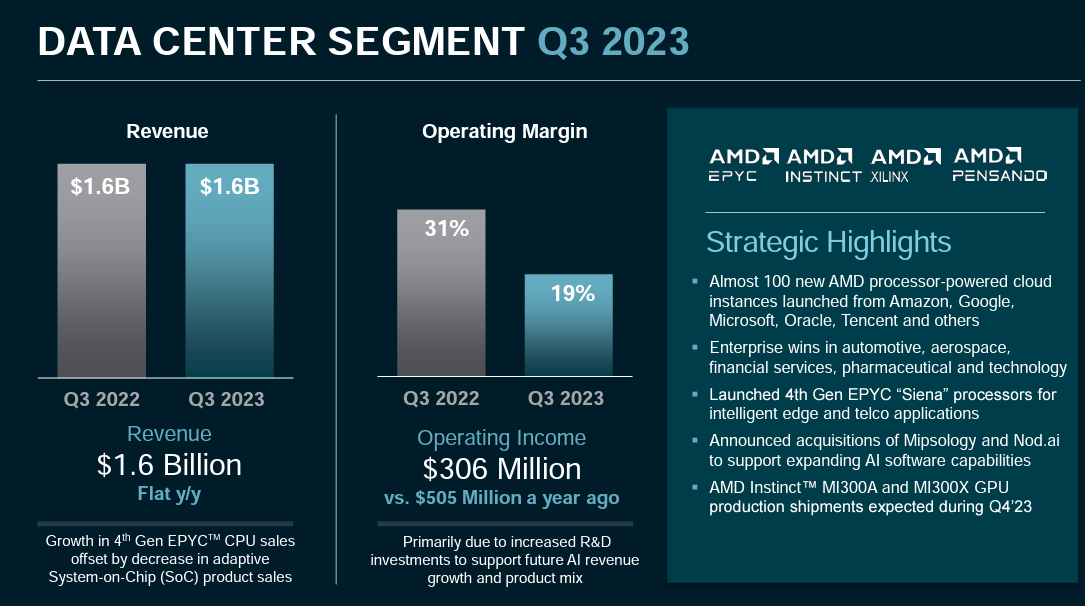

- Data center revenue was $1.6 billion, flat on a year ago. 4th generation AMD EPYC CPU sales were up 21% sequentially but offset by system-on-a-chip data center products. AMD said it added almost 100 new instances for its AMD EPYC processors across cloud hyperscalers.

- AMD Instinct MI300A and MI300X GPUs are on track for volume production in the fourth quarter.

- Client revenue was $1.5 billion, up 42% from a year ago. AMD Ryzen 7000 Series sales were up 46% from a year ago.

- Gaming revenue was down 8% from a year ago to $1.5 billion in the quarter.

- Embedded sales were $1.2 billion, down 5% from a year ago.

- AMD acquired Nod.ai and Mipsology to build out its AI software offerings.