AMD Q4 solid, outlook for Q1 disappoints

AMD's fourth quarter results were solid, but the outlook for the first quarter missed expectations.

The chipmaker projected first quarter revenue of about $5.4 billion, give or take $300 million. Wall Street was expecting $5.7 billion. AMD's guidance comes a week after Intel's disappointing outlook. AMD also said that its first quarter data center revenue will be flat with the fourth quarter due to a seasonal decline in server sales offset by ramping GPU sales.

For the fourth quarter, AMD reported net income of $667 million, or 41 cents a share. Non-GAAP earnings were 77 cents a share. Revenue for the fourth quarter was $6.2 billion.

Wall Street was expecting AMD to report earnings of 77 cents a share on revenue of $6.14 billion.

For 2023, AMD reported net income of $854 million, or 53 cents a share, on revenue of $22.7 billion. AMD is ramping up its AI-optimized processes as it chases Nvidia.

AMD CEO Lisa Su said, "demand for our high-performance data center product portfolio continues to accelerate, positioning us well to deliver strong annual growth."

- Supermicro tops already raised estimates in Q2 thanks to generative AI data center boom

- Nvidia launches H200 GPU, shipments Q2 2024

- Intel's AI everywhere strategy rides on AI PCs, edge, Xeon CPUs for model training, Gaudi3 in 2024

- Why enterprises will want Nvidia competition soon

- Lead times for generative AI systems extending into 2024

- AMD sees strong data center demand for Q4

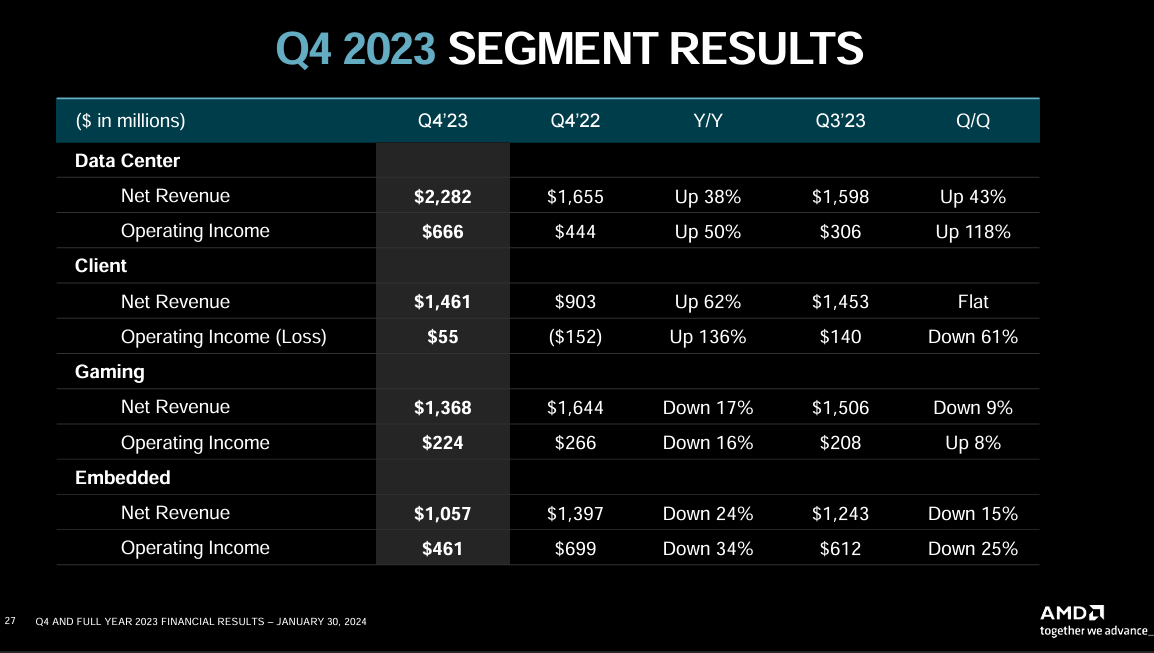

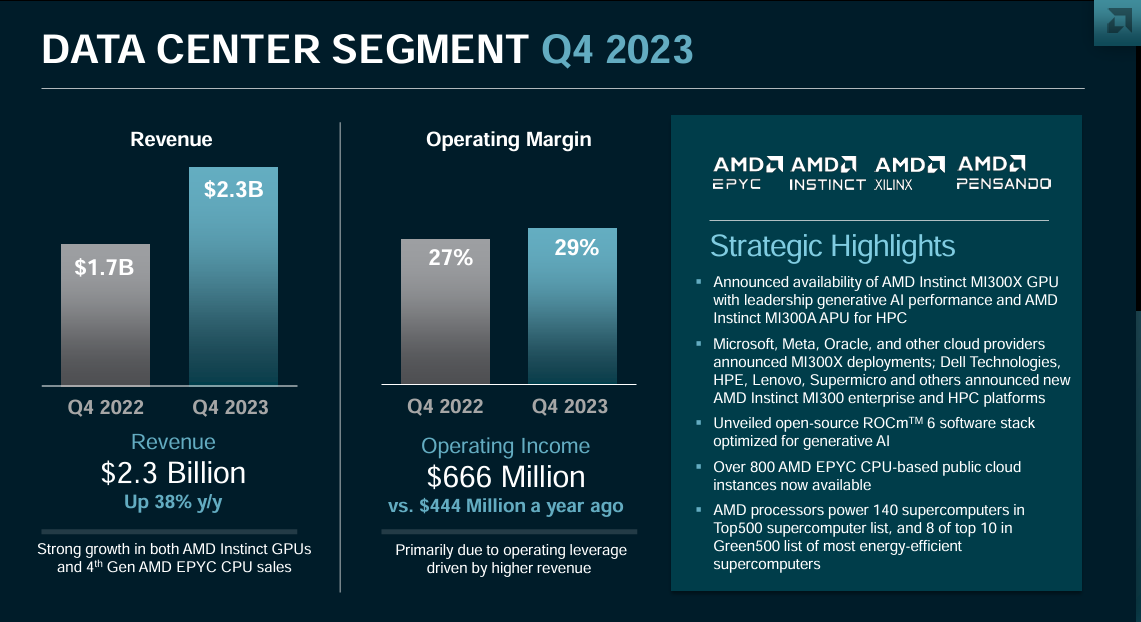

Data center revenue in the fourth quarter was $2.3 billion, up 38% from a year ago. Sales were driven by EPYC CPUs and AMD Instinct GPUs.

AMD's PC group delivered revenue of $1.5 billion, up 62% from a year ago. Those gains weren't enough to reverse a rough 2023 as annual revenue fell 25%. Gaming revenue was $1.4 billion, down 17% from a year ago. Embedded revenue in the fourth quarter was down 24% from a year ago.

Speaking on a conference call, Su said:

"Based on a strong customer pool and expanded engagements, we now expect datacenter GPU revenue to grow sequentially in the first quarter and exceed $3.5 billion in 2024."

Other comments of note:

- AMD sees AI PCs driving an upgrade cycle. "Looking at 2024 we are planning for the PC total addressable market to grow modestly year on year weighted towards the second half as AI PCs ramp," said Su.

- "We believe AI is a once in a generation transition that will reshape virtually every portion of the computing market starting in the data center and then expanding into PCs and across multiple embedded markets," she said.

One point worth noting is what Su said about AI workloads beyond the hyperscalers. When asked about the MI300 demand, she said:

"On the MI300 trajectory. I think you would expect that revenue should increase every quarter from now through sort of the end of the year, but it will be a bit more second half weighted and part of that is just customers as they're finishing up their qualifications as our supply chain is ramping. We are engaged with all of sort of the large customers. These are all folks that know us really well, given our deep relationships in EPYC. I think people just have different adoption cycles as they consider what they're trying to do in their roadmap. This is very, very early innings for us in this space. This is not just about MI300 conversation, but our long-term multi-generational roadmap. There's a lot of demand coming from folks that are more AI centric and not necessarily typical cloud customers, but more enterprise or let's call it AI-specific companies that we're also very well engaged with."