So, take a look at my musings on the event here: (if the video doesn’t show up, check here)

No time to watch – here is the 1-2 slide condensation (if the slide doesn’t show up, check here):

Want to read on? Here you go:

Always tough to pick the takeaways – but here are my Top 3:

Hortonworks is doing well – The often-discussed challenges around the opensource based services model apparently are not too much of an issue for Hortonworks, that is showing healthy growth with 35%+ on revenue. All key metrics are up – so the vendor is doing something right. I asked the executive team on why the win and the list was long, but here it is (in the sequence they were mentioned): Native YARN support, Data Governances across products, one consistent Framework, Hybrid deployment, quality of Support, successful leverage of the ecosystem and delivering value to customers. All good value propositions to work with, the good news was – most of them were validated in the customer panel and customer conversations later.

|

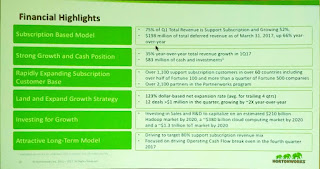

| Hortonworks Financial Highlights |

Hortonworks keeps pushing data in motion – A little more than year ago, Hortonworks surprised with a commitment to not only capture data at rest (with HDP), but also the plan to capture data in motion, aka steaming data with HDF. And Hortonworks keeps investing, rolling out HDF 3.0 at the conference, a release which most prominent features are Streaming Analytics Manager and new Schema Registry Capabilities The former is targeted at making the complex process of creating systems for streaming data more (end) user friendly, the latter is all about making HDF easier to implement. Both good moves to make HDF more attractive to enterprises building next generation applications. If this will tip the adoption challenge for HDF remains to be seen, oddly Hortonworks did not share any customer adoption numbers for HDF.

|

| Hortonworks Exec Team w (ltr) Gnau, Bearden, Davidson and Verma |

Partnership with IBM – IBM and Hortonworks, both founding ODPi members, are working even closer together. After more partnering in February around hardware, both vendors now create a common offering in data science / machine learning / Big Data Query on top of HDP. The partnership was the easiest to pull off for IBM, given the common ODPi partnership. The challenge would be for customers who are not using Hortonworks under IBM DSX, but that should be a smaller number. If Hortonworks can get a substantial part of the IBM Big Insights business to run on HDP it will be a win for the vendor. And customers profit with more scale of their vendors – IBM will be able to focus (or reduce?) R&D spend, Hortonworks gets more load on HDP, and IBM’s sales force is reselling HDP. Moreover, Hortonworks gets a SQL on Hadoop offering with BigSQL, that’s key in competitive situations with nemesis #1, Cloudera.

MyPOV

Substantial progress by Hortonworks, that is sticking to its strategy with HDP and HDF. Adding more capabilities to HDF should make it more attractive to enterprises, but the verdict is still out if enterprises will build streaming applications themselves – or license them. Right now, Hortonworks is betting on the former.On the concern side, HDF has not shown reasonable acceptable market adoption – at least that’s the interpretation since Hortonworks shared … no numbers on adoption. It’s going to be key for Hortonworks to get some traction, otherwise the return of R&D will be suboptimal for customers. On the brighter side HDP is doing well in the market, the IBM partnership will help further. It’s a departure from Hortonworks ‘open source only’ mantra, but reflects market realities and opportunities.

Overall good progress by Hortonworks, making good steps to offer its product in a more hybrid offering, both on premises and in the cloud. Let’s check adoption of products, partnerships and overall performance later in the year. Stay tuned.