HANA Cloud Platform - Revisited - Improvements ahead and turning into a real PaaS

But it’s time to revisit what is happening a few weeks before TechEd / dcode around HANA Cloud Platform (HCP) and SAP was gracious enough to recently brief me on progress, upcoming new features and latest uptake.

Improved – Purpose

For a PaaS platform it is key to understand what kind of applications can be built, potentially run, operated and built with. Naturally PaaS players with evolving PaaS capabilities prefer to be more nebulous than clear on this key area - as the capabilities of the platform expand and naturally vendors don’t want to lose developers to other platforms because of a too restrictive positioning.So credit goes to SAP to provide more clarity in this area, with three major usage scenarios being the focus of HCP now:

- New Cloud Apps - SAP wants a portion of the ‘born on the web’ apps, which makes sense - but is probably the most competitive area of the three scenarios.

- On-Premise Apps - Building cloud extension to on premise apps with the help of HCP is the most common scenario for SAP internally, and a good one to draft in as a potential HCP user.

- Cloud Apps - Building cloud extensions to cloud solutions. For SAP that would be e.g. putting new cloud based apps on top of SuccessFactors or Ariba, another scenario that is relevant for SAP and with that decision makers should have a relatively high comfort level HCP can help them for the same or similar project scenarios.

Improved – Platform Capabilities

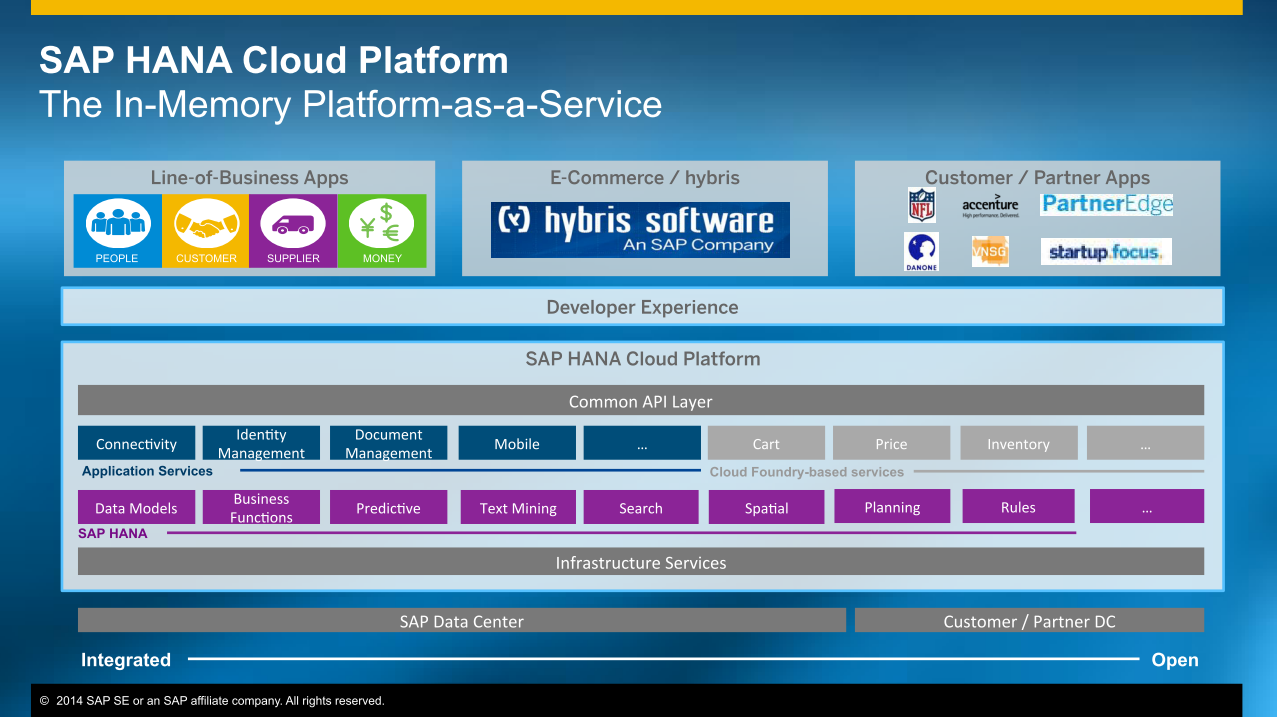

So the marketecture slide for HCP looks as below.

And while the bottom part is fairly know and stable since the launch of HANA, the top boxes are part of where I see news and changes:

- Line-of-Business Apps - It is now clear that SAP will develop its new Line of Business Apps with HCP. First products like Simple-Finance are being built on HCP. More will come.

- Hybris on CloudFoundry - Interestingly the recent SAP acquisition hybris will build its next generation platform on top of CloudFoundry, which becomes / is part of HCP.

- Customer / Partner Apps - SAP expects customers and partners to build their application – based on the three above mentioned scenarios with the help of HCP.

MyPOV – For the longest time SAP development and platform tools have been proprietary, despite all attempts to make ABAP and the ABAP platform a ‘standard’ business platform. . If there is a standard programming language these days for business applications, it is certainly more Java and Java byte code compatible languages…. than ABAP. So it is good to see that SAP is supporting these languages, but equally probably the most popular large enterprise PaaS, CloudFoundry (here is my News Analysis of the partnership announcement). That this happens as part of the hybris project should serve as a good confidence building point for users of HCP, as SAP needs to deliver the next version of hybris and wants to run that largely in its own (or partner) data centers. So the CloudFoundry integration into HCP has to succeed – otherwise SAP will be in a totally different challenge. Lastly – by building commerce functions as part of HCP, SAP creates another attractive reason to use HCP always - assuming SAP will provide good enough commerce functionality and will open it up to HCP users –as they key next generation application capabilities of commerce are ‘baked’ into the platform.

Notable is also the very bottom – with using both SAP and partner datacenters. And while SAP started out doing everything themselves, they have signed up partners on the data center side, will be good to check-in at another opportunity to see how these partners are supported and how successful they are at this early point of product life for HCP.

Lastly note the subtitle of the slide: “The in memory PaaS.” That is certainly a genuine statement as HANA runs on RAM – but also harbors some concerns, more on that below.

Improved – Licensing options

SAP has already – or will be changing soon – the licensing option for HCP, which is a major breakthrough in my view, as PaaS platform not only have to be purpose fit driven but also affordable.SAP is using the following three packages for HCP

- Infrastructure Services - This is the closest SAP will dabble into the IaaS world. If a customer has a HANA license, SAP will operate it – as part of the infrastructure services. It is BYOL as already earlier announced for HEC last year.

- DB Services - This is the package that will be key for enterprises who will want to build on HANA, and deploy to HEC, using HCP as the PaaS.

- Application Services - Here SAP throws in its weight around business APIs, and allows customers to build higher level applications (remember ‘composite apps’?) on top of these. Certainly with a different license construct than the other two packages, fair enough.

MyPOV – With these three packages SAP covers the key license needs of the most common usage scenarios. And it makes sense to break these into more granular packages as SAP has done as the cloud game is all about load derived economies of scale – so the more load SAP can get e.g. for its Infrastructure Services, the better for the overall success of SAP in the cloud.

Improved - Outlook

It is always key to look at the plans ahead when making a decision for a PaaS. And SAP has recently expanded these plans:MyPOV – It was already key to see SAP opening the runtimes to Java, node.js and standard support for HTML5 with SAP UI5. The ultimate test on the database side will be to see when SAP will not only support in-house databases (Sybase, MaxDB etc) – but also other leading databases (Oracle 12c, IBM DB2 etc.) and NoSQL databases (Hadoop, MongoDB, Couchbase etc). The opening of the database support will be key in terms of customers and developer classifying HCP as a general PaaS player or a SAP ecosystem play. The addition of docker is a very good move, again my preference is a load perspective. SAP as a later entry in the IaaS game needs to chase loads to drive up utilization of its data centers. And it may be the same customers that recently drove VMware to support docker that may have had a word with SAP, too. And certainly docker makes a nice developer story.

Finally the Apps Services area is an interesting differentiator. SAP will have to make clear how these APIs will be licensed, supported and operated, but a functionally rich enterprise Paas is a powerful value proposition that both Salesforce.com (see here) and IBM (see here) are already using.

But don’t pop open the champagne yet…

- SAP’s cloud vision is very database centric. .With the rest of the industry looking more at compute elasticity, SAP is going its own path. We discussed this previously, and it may work out for SAP one more time – but going a special path remains a risk for enterprises.

- We will have to see if SAP will open up to other vendor’s (= competitor) databases and the NoSQL databases – both capabilities enterprises want and need. In my view SAP cannot afford to lose potential HCP customers due to not supporting these usage scenarios.

- The CloudFoundry integration is new and SAP needs to address it in much more detail what the integration in general and how it looks like on a developer day to day life basis. Do you develop in CloudFoundry, deploy to it – what about the other Pivotal databases etc. are just some questions that immediately come to mind.

- Analytics are a key ingredient to next generation applications and SAP always positions HANA for this. And while there are use cases that have merits to run in memory, there are others that need close to application deployment and with that need support for different platforms.

- Social is a key capability of a 21st century platform and SAP has Jam, but the platform message is just being developed now and delivered now. At Sapphire that messages was pretty non existent, and it was good to hear Bernd Leukert mention that capability on the SAP Cloud update webcast on September 15th.

- Mobile is equally important for next generation applications and SAP has a good story here – it needs to be clarified how to transport applications and how much native support for emerging platforms (think wearables) there will be and needs to be. SAP could take a playbook from Microsoft here – with its Windows Universal App. How about a Universal SAP App being built on HCP?

- Not a problem for HCP to solve – but an overall challenge SAP has with HANA is to support Hadoop et al. If critical information lives in Hadoop and enterprises need fast in memory access for it to power next generation analytical applications, why not allow them to run Hadoop in memory in an overall HANA framework?

- SAP has done good progress becoming more open source driven and using more open source (well, what is the alternative?). On the other side it has still ambition with its new programming language River – I haven’t heard from the River folks in a while – so SAP will have to balance open source vs proprietary at some point.

MyPOV

There is a German saying ‘Gut Ding will Weile haben’ – which translates into ‘Good things take their time’ – and in my view it is indicative for the HCP progress. It took some time, a lot of clarification, but now HCP is moving to become a generally viable PaaS offering for enterprise applications. It would not hurt SAP to start calling it what it is, a PaaS and tackle the remaining strategic directional questions asap. Looking forward to TecheEd / dcode.Update - On the September 15th Cloud Webcast SAP called HCP a PaaS multiple time - good to call a spade a spade.

And more on overall SAP strategy and products:

- Event Report - SAP SuccessFactors picks up speed - but there remains work to be done - read here

- First Take - SAP SuccessFactors SuccessConnect - Top 3 Takeaways Day 1 Keynote - read here.

- Event Report - Sapphire - SAP finds its (unique) path to cloud - read here

- What I would like SAP to address this Sapphire - read here

- News Analysis - SAP becomes more about applications - again - read here

- Market Move - SAP acquires Fieldglass - off to the contingent workforce - early move or reaction? Read here.

- SAP's startup program keep rolling – read here.

- Why SAP acquired KXEN? Getting serious about Analytics – read here.

- SAP steamlines organization further – the Danes are leaving – read here.

- Reading between the lines… SAP Q2 Earnings – cloudy with potential structural changes – read here.

- SAP wants to be a technology company, really – read here

- Why SAP acquired hybris software – read here.

- SAP gets serious about the cloud – organizationally – read here.

- Taking stock – what SAP answered and it didn’t answer this Sapphire [2013] – read here.

- Act III & Final Day – A tale of two conference – Sapphire & SuiteWorld13 – read here.

- The middle day – 2 keynotes and press releases – Sapphire & SuiteWorld – read here.

- A tale of 2 keynotes and press releases – Sapphire & SuiteWorld – read here.

- What I would like SAP to address this Sapphire – read here.

- Why 3rd party maintenance is key to SAP’s and Oracle’s success – read here.

- Why SAP acquired Camillion – read here.

- Why SAP acquired SmartOps – read here.

- Next in your mall – SAP and Oracle? Read here.

And more about SAP technology:

- News Analysis - SAP commits to CloudFoundry and OpenSource - key steps - but what is the direction? - Read here.

- News Analysis - SAP moves Ariba Spend Visibility to HANA - Interesting first step in a long journey - read here

- Launch Report - When BW 7.4 meets HANA it is like 2 + 2 = 5 - but is 5 enough - read here

- Event Report - BI 2014 and HANA 2014 takeaways - it is all about HANA and Lumira - but is that enough? Read here.

- News Analysis – SAP slices and dices into more Cloud, and of course more HANA – read here.

- SAP gets serious about open source and courts developers – about time – read here.

- My top 3 takeaways from the SAP TechEd keynote – read here.

- SAP discovers elasticity for HANA – kind of – read here.

- Can HANA Cloud be elastic? Tough – read here.

- SAP’s Cloud plans get more cloudy – read here.

- HANA Enterprise Cloud helps SAP discover the cloud (benefits) – read here.