Cisco's Q3 posts strong networking gear sales, ups outlook

Cisco reported better-than-expected third quarter earnings and raised its fourth quarter outlook as its networking portfolio revenue surged 29% from a year ago.

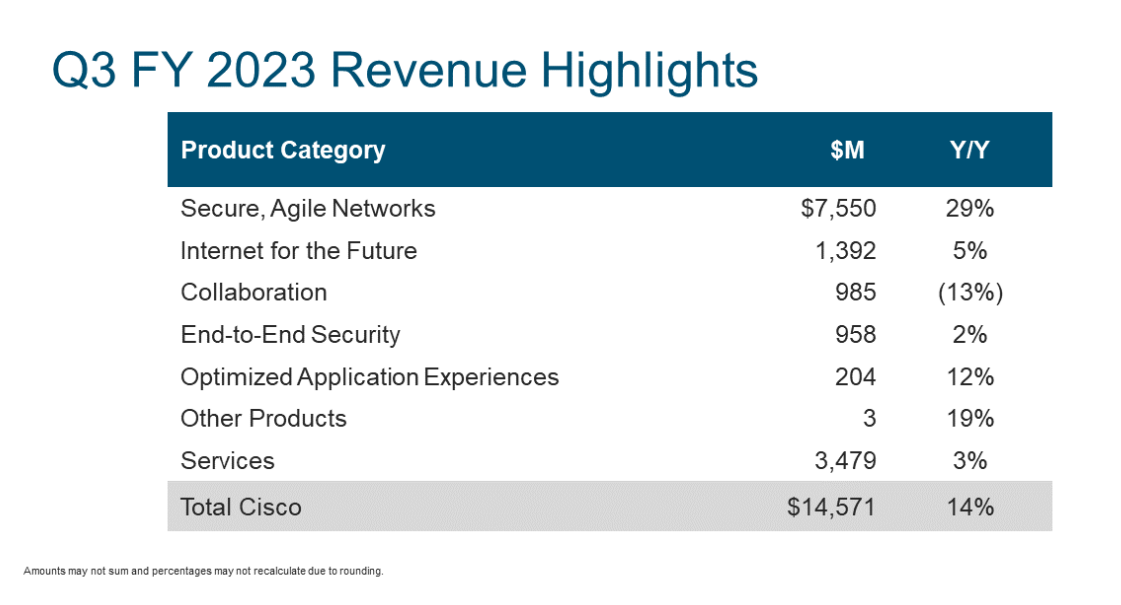

The company reported fiscal third quarter earnings of 78 cents a share on revenue of $14.6 billion, up 14% from a year ago. Non-GAAP earnings were $1 a share. Wall Street was expecting Cisco to report a third quarter adjusted profit of 97 cents a share on revenue of $14.38 billion.

Cisco projected fourth quarter revenue growth of 14% to 16% with non-GAAP earnings of $1.05 a share to $1.07 a share. For fiscal 2023, Cisco projected revenue growth of about 10%. For fiscal 2024, Cisco said non-GAAP earnings will outpace modest revenue growth due to strong comparisons.

Speaking on an earnings conference call, CEO Chuck Robbins said the company's transition to software is accelerating with software revenue checking in at $4.3 billion in the third quarter. Forty two percent of Cisco's revenue is software.

Robbins also said that it has a big opportunity in security, and it will outline new products at its Cisco Live conference. Robbins also said Cisco is moving rapidly to leverage generative AI in its own products.

Cisco's results were helped in part by moves last year to simplify its supply chain, so it had the parts to build its networking gear. Lead times for product shipments have improved 40% over the last two quarters. Going forward, Cisco customers are likely to digest systems that have been bought.

"As we expected, the actions we took in supply chain last year have paid off," said Robbins. "Customers continue to invest in key technologies core to their overall strategy. We will end the fiscal year with double our normal backlog."

Cisco's networking unit was the star of the quarter with revenue up 29% from a year ago. Demand was strong across multiple switch and router products. Cisco's Secure, Agile Networks unit delivered third quarter revenue of $7.55 billion. Secure, Agile Networks consists of hardware and software for switching, enterprise routing, wireless and compute products. Robbins said Cisco is in a much better position to play a role in AI workloads than it was with the cloud transition.

Cisco saw gains in other product lines except for collaboration sales, which fell 13% from a year ago.