Former Vice President and Principal Analyst

Constellation Research

Doug Henschen is former Vice President and Principal Analyst where he focused on data-driven decision making. Henschen’s Data-to-Decisions research examines how organizations employ data analysis to reimagine their business models and gain a deeper understanding of their customers. Henschen's research acknowledges the fact that innovative applications of data analysis requires a multi-disciplinary approach starting with information and orchestration technologies, continuing through business intelligence, data-visualization, and analytics, and moving into NoSQL and big-data analysis, third-party data enrichment, and decision-management technologies.

Insight-driven business models are of interest to the entire C-suite, but most particularly chief executive officers, chief digital officers,…...

Read more

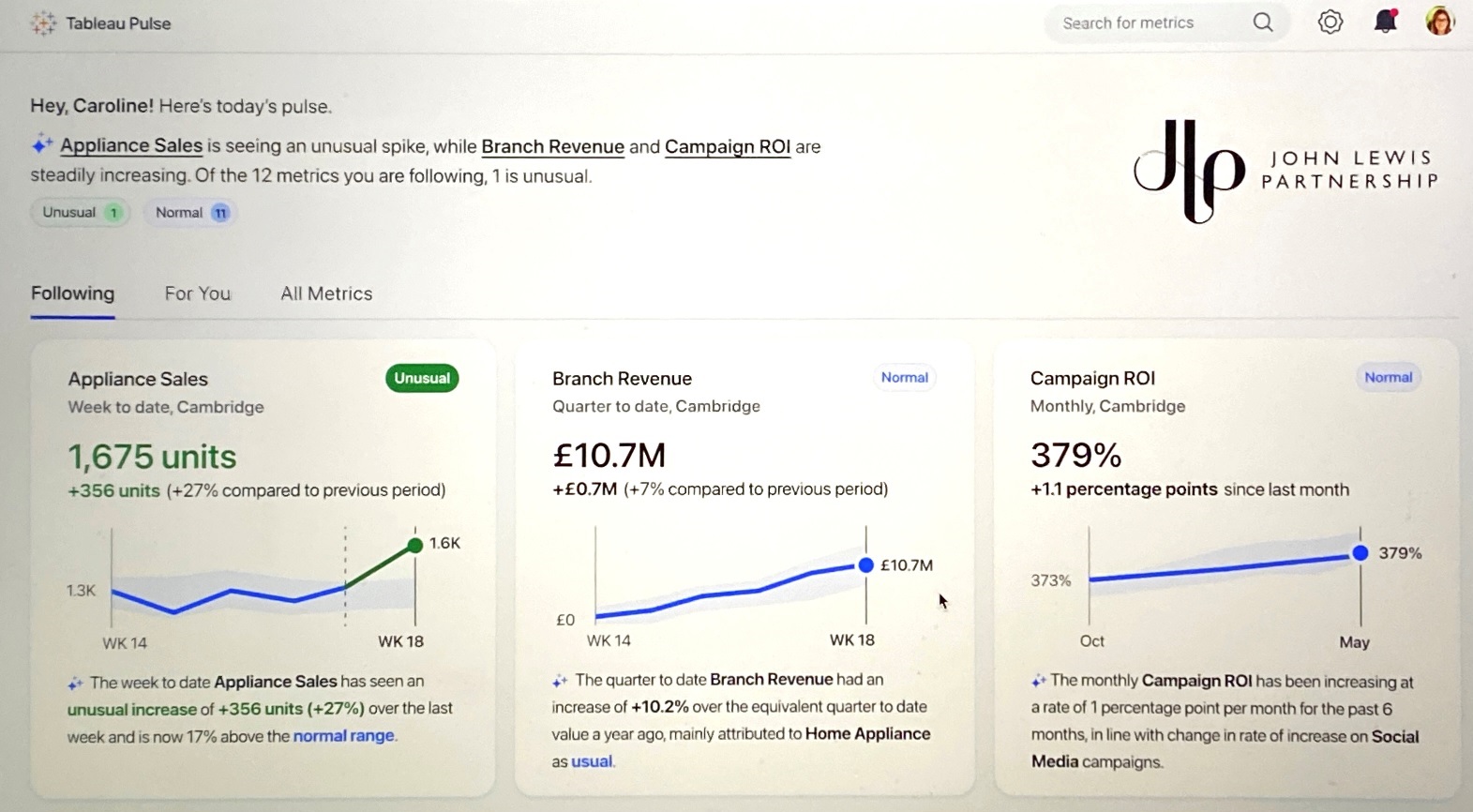

Tableau Pulse, Tableau GPT and a new VizQL Data Service will enable customers to deliver metrics and insights, natural language explanations, and event and workflow triggers in the context of work.

Tableau was founded 20 years ago, and in its earliest days it disrupted the market with data visualization. It helped spark a movement toward self-service dashboards that changed business intelligence. Flash forward to 2023 and it’s not uncommon to hear comments about dashboards being dead.

At its annual user conference, held May 9-11 in Las Vegas, Tableau introduced a battery of new capabilities that will help customers deliver insights in the context of work rather than through dashboards. It’s important to note that Tableau is going beyond dashboards, not leaving them behind, as the death of dashboards has been greatly exaggerated. But with the announcements of Tableau Pulse, Tableau GPT, and the VizQL Data Service the company is pursuing the fast-growing embedded analytics trend that’s all about delivering concise insights where people work rather than through dashboards and reports.

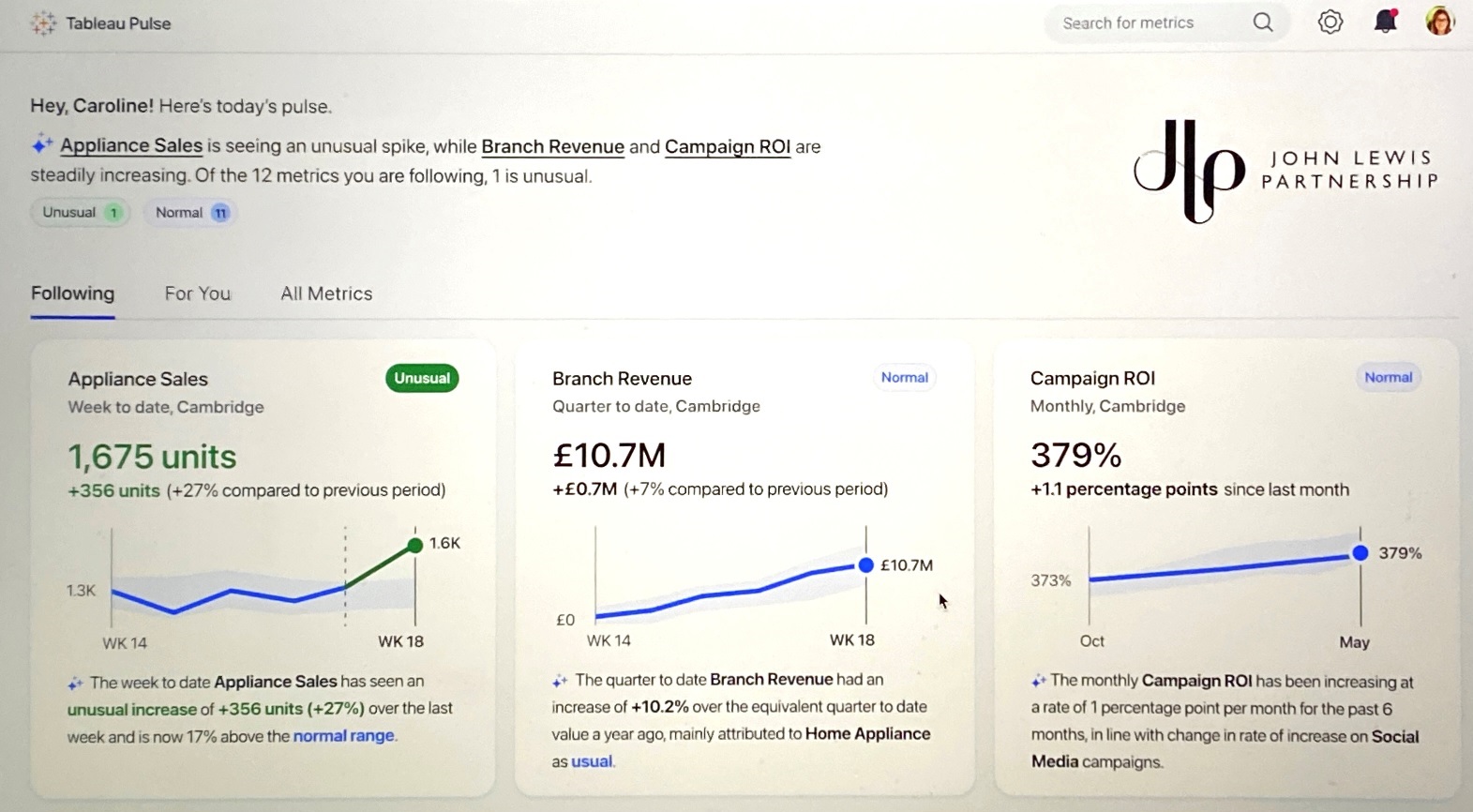

Tableau Pulse: A Stethoscope for Business

Tableau Pulse, as pilot tested by John Lewis Partnership, blends analyst-definedmetrics, business context, sparkline visualizations and generative AI explanations in card views that can be pushed to targeted users through email, Slack, or web landing pages.

Organizations have been investing in analytics and BI for a long time, yet deployments too often suffer from low adoption. Tableau Pulse, expected to preview in Q4, is a cloud-based service that starts with an-AI based understanding of how individual users and teams interact with data and Tableau analytics. Importantly, Pulse introduces a metrics layer and simple authoring user interface (UI) that enables analysts to define business measures and add business context, such as whether an increase or decrease in a particular metric is a good or bad thing. To avoid the cold start challenge, Pulse is said to leverage existing curation and configuration of measures already set up in Tableau.

The Pulse UI is also used to author simple cards (shown above) that combine sparkline visualizations and concise, natural language descriptions. These descriptions, which will be generated by Tableau GPT (detailed below), get to the point about good or bad changes, with root cause analysis as to why they are changing. Rather than asking users to seek out these insights, Pulse cards will be proactively delivered to targeted users via email, Slack, a Web-based landing page, and/or a mobile experience. It’s a form of embedding that brings urgent, business-relevant insights to users rather than asking them to log into an analytics and BI platform and interpret a dashboard.

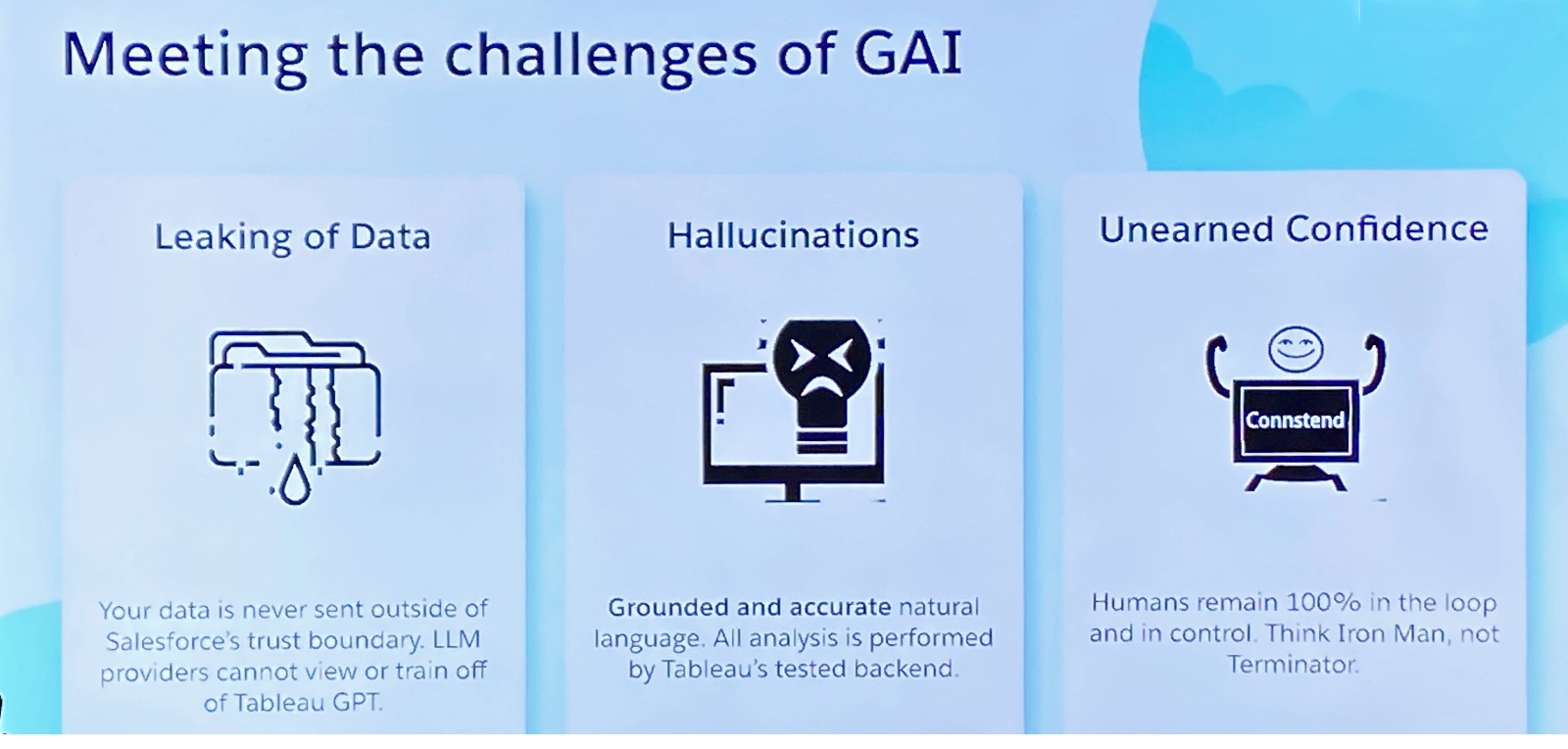

Tableau GPT: Better Explanations for Trustworthy Facts

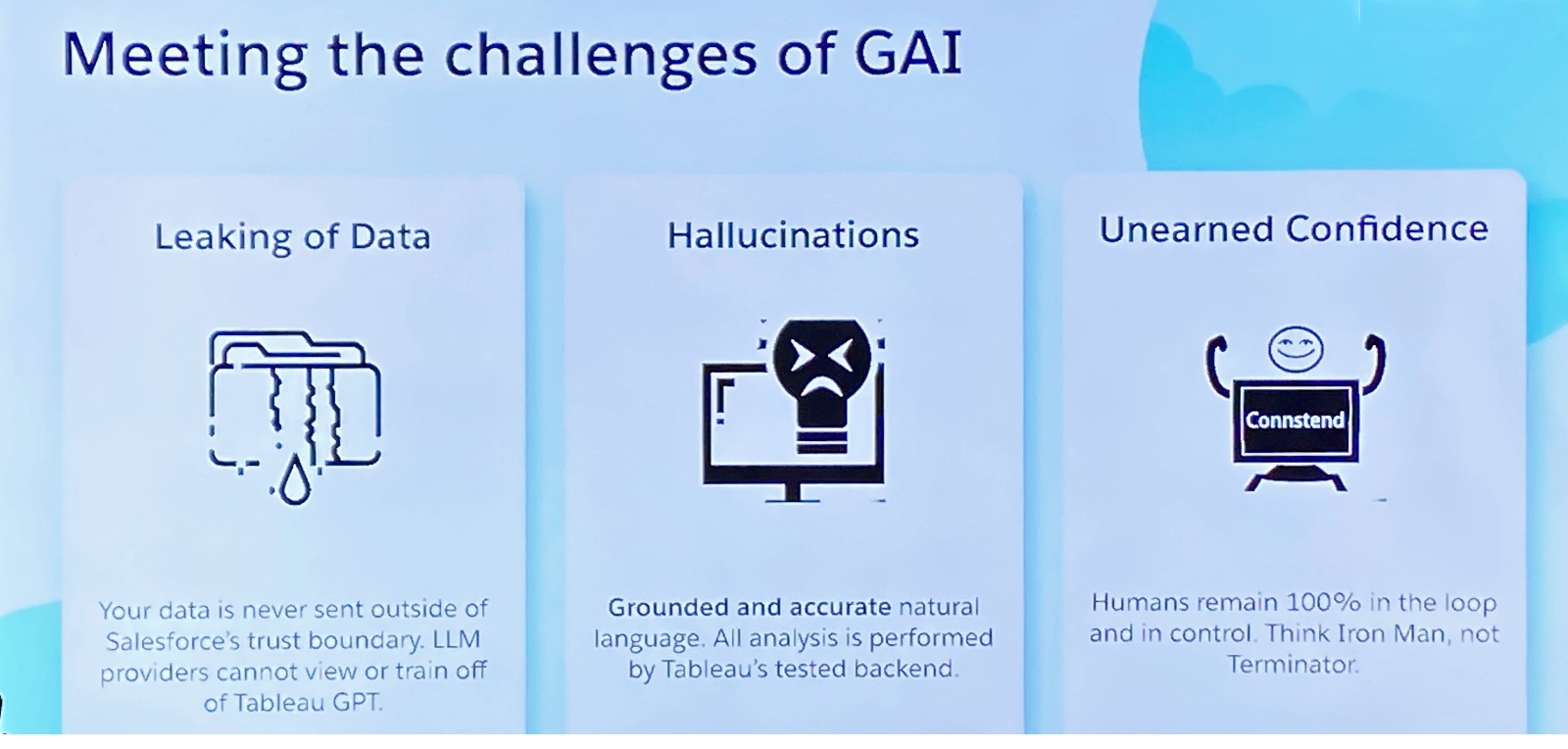

Tableau has addressed three key concerns about the use of generative AI: data security, trust and human oversight.

Much has been written about what generative AI does well (language generation) and what it does not do well (math, for one). Tableau emphasized that it will point Tableau GPT at the Tableau analytics engine as the source of facts and mathematical analysis. Tableau GPT will then use a choice of underlying large language models, including OpenAIs as well as others, to explain those trustworthy facts in nuanced natural language. Tableau GPT will also enable users to ask questions in truly natural language, rather than unnatural “query speak†that’s only natural for SQL-savvy users.

Tableau offered three reassurances about how Tableau GPT will work. First, customer data will never be sent outside the “Salesforce trust boundary,†meaning LLMs won’t be able to train on customer data. Second, the language generated by Tableau GPT will always be grounded in facts and analyses done by the Tableau Analytics Engine – so the LLM can’t “hallucinate†and make up facts, Tableau insists. Third, humans will always remain in the loop, so “think Iron Man†(a human assisted by technology) “not terminator†(a robot with its own agenda).

Tableau GPT, which is also set to preview in Q3, will be a behind-the-scenes service that will be available for both exploratory self-service analysis, including natural language query that’s handled by Ask Data today, and by the coming Tableau Pulse service.

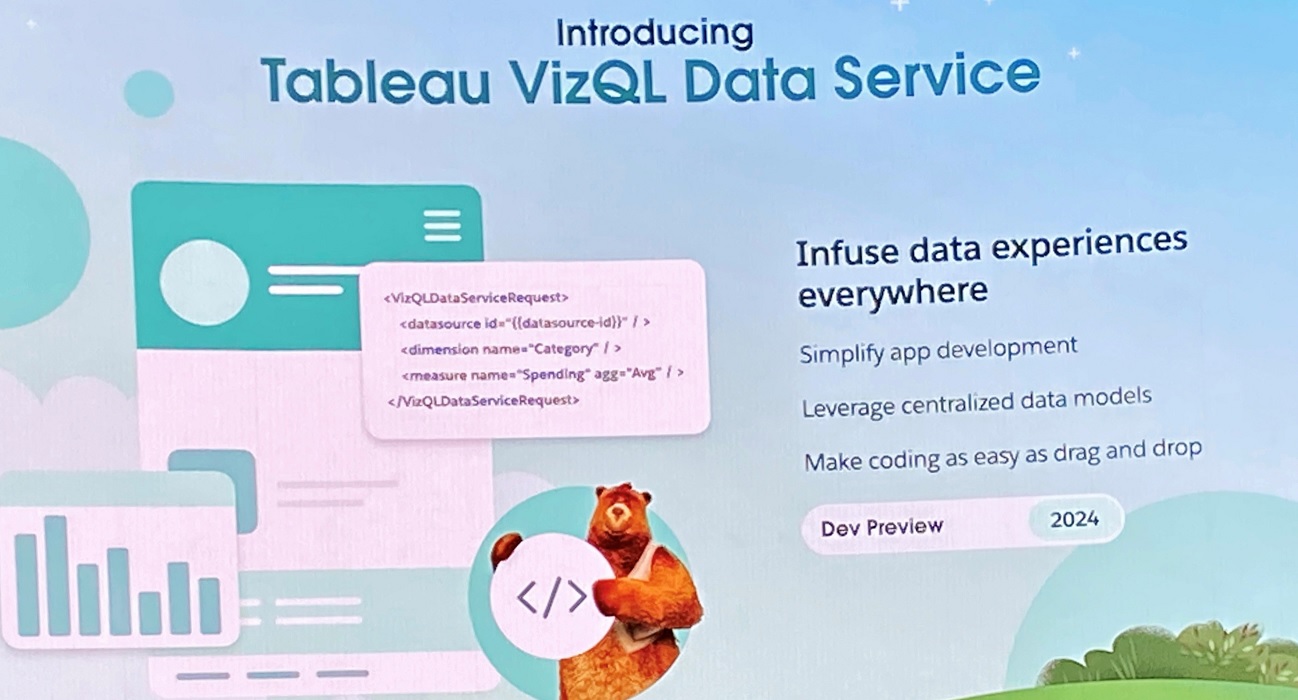

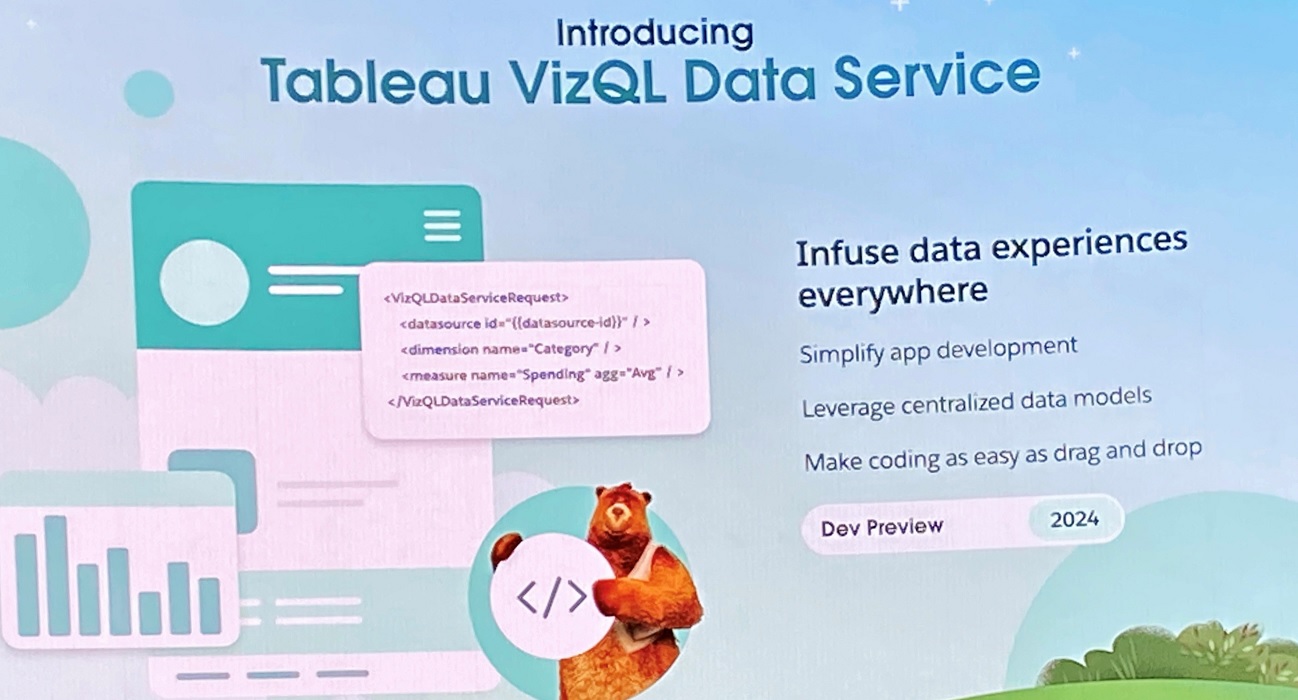

VizQL Data Service: Headless BI liberates insights from the Front End

The VizQL Data Service, expected in 2024, will advance Tableau's embedded analytics capabilities.

In another sign of an embrace of the embedded BI trend, Tableau is planning to support so-called “headless BI†with the VizQL Data Service, expected to preview in 2024. VizQL will decouple Tableau’ back-end analytics engine from the front-end visualization, dashboarding and authoring interfaces. Using APIs, developers will use VizQL to programmatically deliver Tableau insights within chatbots, workflows, and third-party apps to drive and automate data-driven action based on analytic triggers (human oversight and interaction with visualizations optional).

The VizQL Data Service is complemented by a new usage-based licensing model, which supports ephemeral user, and by an embedded playground with no-code, drag-and-drop development options.

Constellation’s Analysis

Personalized insights and exception-based alerting are nothing new, but with its metrics layer, understanding of business context, and use of generative AI through Tableau GPT, Tableau Pulse has the potential to stand on the shoulders of prior efforts and bring business utility to the next level. In truth, Tableau first-generation augmented features including Ask Data, Explain Data, and Data Stories, had mixed success, so we’re eager to see how eagerly and widely customers will adopt these second-generation capabilities.

Also yet to be determined is how these new features will be packaged and priced. Tableau Pulse, for one, is a cloud-based service that will be coupled exclusively with Tableau Cloud (and not available with Tableau Server), though it’s not yet know whether it will be a standard or optional (extra cost) feature. Tableau GPT will likely be available both through Tableau Cloud and Tableau server, but feature vs. option decisions and pricing have yet to be determined. VizQL pricing and packaging decisions also are yet to be made, but I’d expect this to be exposed through Tableau Embedded.

For now what we do know is that Tableau, and analytics and BI deployments in general, are breaking out of the self-service reporting and dashboarding mold in a big way.

Data to Decisions

Tech Optimization

Innovation & Product-led Growth

Future of Work

Next-Generation Customer Experience

Digital Safety, Privacy & Cybersecurity

tableau

salesforce

ML

Machine Learning

LLMs

Agentic AI

Generative AI

AI

Analytics

Automation

business

Marketing

SaaS

PaaS

IaaS

Digital Transformation

Disruptive Technology

Enterprise IT

Enterprise Acceleration

Enterprise Software

Next Gen Apps

IoT

Blockchain

CRM

ERP

finance

Healthcare

Customer Service

Content Management

Collaboration

GenerativeAI

Chief Information Officer

Chief Digital Officer

Chief Analytics Officer

Chief Data Officer

Chief Technology Officer

Chief Information Security Officer

Chief Executive Officer

Chief AI Officer

Chief Product Officer