Editor in Chief of Constellation Insights

Constellation Research

About Larry Dignan:

Dignan was most recently Celonis Media’s Editor-in-Chief, where he sat at the intersection of media and marketing. He is the former Editor-in-Chief of ZDNet and has covered the technology industry and transformation trends for more than two decades, publishing articles in CNET, Knowledge@Wharton, Wall Street Week, Interactive Week, The New York Times, and Financial Planning.

He is also an Adjunct Professor at Temple University and a member of the Advisory Board for The Fox Business School's Institute of Business and Information Technology.

Constellation Insights does the following:

Cover the buy side and sell side of enterprise tech with news, analysis, profiles, interviews, and event coverage of vendors, as well as Constellation Research's community and…...

Read more

The big three cloud providers--Amazon Web Services (AWS), Microsoft Azure and Google Cloud--all appear to be hitting similar themes as they continue to battle for workloads, artificial intelligence supremacy and enduring customer relationships.

With Amazon, Microsoft and Alphabet, parent of Google, all reporting earnings, enterprise tech buyers are able to gauge just how much their companies were contributing to margins. The talking points among the big three appear to be led by Microsoft CEO Satya Nadella, who has leveraged the company's investment in OpenAI and ChatGPT to turbo charge its Azure and SaaS roadmaps.

Here's a look at the common themes from AWS, Microsoft Azure and Google Cloud.

See: Constellation ShortList™ Global IaaS for Next-Gen Applications

Optimization

In cloud computing and SaaS models, customers rarely cut budgets, according to vendors. These cloud buyers simply "optimize." Cloud vendors say they are helping customers optimize their spending to play the long-game with customers.

Nadella said:

"Optimizations do continue. In fact, we are focused on it. We incent our people to help our customers with optimization because we believe in the long run that the best way to secure the loyalty and long-term contracts with customers when they know that they can count on a cloud provider like us to help them continuously optimize their workload. That's sort of the fundamental benefit of public cloud, and we are taking every opportunity to prove that out with customers in real time."

Nadella added the enterprise customers were all about adding new cloud workloads and scaling during the COVID-19 pandemic. Historically, enterprise customers were balancing optimization with new workloads. Today, customers are moving back to optimization, but will ultimately regain balance, said Nadella.

Amazon CFO Brian Olsavsky said on the company's first quarter conference call that customers are clearly in optimization mode.

"Given the ongoing economic uncertainty, customers of all sizes in all industries continue to look for cost savings across their businesses, similar to what you’ve seen us doing at Amazon. As expected, customers continue to evaluate ways to optimize their cloud spending in response to these tough economic conditions in the first quarter. And we are seeing these optimizations continue into the second quarter with April revenue growth rates about 500 basis points lower than what we saw in Q1. As a reminder, we’re not trying to optimize for any one quarter or year. We’re working to build customer relationships and a business that will outlast all of us."

Andy Jassy, CEO of Amazon, added that there is a difference between cost optimization and cutting. "Customers are looking for ways to save money however they can right now," said Jassy. "They tell us that most of it is cost optimizing versus cost cutting, which is an interesting distinction because they say they’re cost optimizing to reallocate those resources on new customer experiences."

Alphabet CEO Sundar Pichai said Google Cloud is "leaning into optimization." "It is an important moment to help our customers, and we take a long-term view," he added. "We are leaning in and trying to help customers make progress in their efficiencies when we can."

Ruth Porat, Alphabet's CFO, said customers are slowing cloud consumption as they optimize costs.

These cloud giants are optimizing today to set up growth in the future. Microsoft CFO Amy Hood noted that new workloads will play in the quarters ahead. "At some point, workloads just can't be optimized much further," said Hood. "And when you start to anniversary that, you do see that it gets a little bit easier in terms of the comps year-over-year."

Generative AI

Microsoft is rallying Azure and its entire cloud product line around OpenAI, ChatGPT and generative AI tools. Nadella is clearly pressing its advantage in generative AI mindshare.

Nadella said:

"We have the most powerful AI infrastructure and it’s being used by our partner, OpenAI, as well as NVIDIA and leading AI start-ups like Adept and Inflection to train large models.

Our Azure OpenAI Service brings together advanced models, including ChatGPT and GPT-4 with the enterprise capabilities of Azure. From Coursera and Grammarly to Mercedes-Benz and Shell, we now have more than 2,500 Azure OpenAI Service customers, up 10x quarter-over-quarter. Just last week, Epic Systems shared that it was using Azure OpenAI Service to integrate the next generation of AI with its industry-leading EHR software.

Azure also powers OpenAI API and we are pleased to see brands like Shopify and Snap use the API to integrate OpenAI's models."

Generative AI guide: ChatGPT: Hype or the Future of Customer Experience?

According to Nadella, the Azure OpenAI Service is growing workloads for its CosmosDB, but also landing new customers. Microsoft is also making Copilot for Business broadly available. If you're keeping score at home, Microsoft executives mentioned OpenAI 14 times during its earnings conference call.

Pichai also talked up generative AI but focused on its own large language models (LLMs). Pichai noted Google launched its Bard conversational AI service and updated it to help with programming and software development.

"A number of organizations are using our generative AI large language models across Google Cloud platform, Google Workspace and our cybersecurity offerings," said Pichai.

Pichai's message is that Google has been using AI for years to improve search, ads, Maps, YouTube and other services. Meanwhile, Pichai said Google will make its infrastructure more efficient to optimize its own costs and bolster AI efforts. Google has a big optimization effort underway and is focusing on external procurement and its real estate portfolio.

Case Study: AWS Propels the Bundesliga Fan Experience to the Next Level

Amazon's Jassy said AWS is tackling LLMs and generative AI by focusing on enabling it with managed services. AWS recently announced Amazon Bedrock, new instances and Amazon CodeWhisperer to enable enterprise generative AI.

"Few folks appreciate how much new cloud business will happen over the next several years from the pending deluge of machine learning that’s coming," he said.

Amazon's plan is to use its savings from streamlining fulfillment and transportation operations and investing in AWS infrastructure for generative AI.

Jassy, like Pichai, said generative AI has hit an inflection point, but has been part of Amazon's DNA for years. "I think if you look at what’s happened over the last 9 months or so is that these Large Language Models and generative AI capabilities, they’ve been around for a while, but frankly, the models were not that compelling before about 6, 9 months ago," he said. "And they have gotten so much bigger and so much better, much more quickly that it really presents a remarkable opportunity to transform virtually every customer experience that exists."

Value

Cloud providers are also pivoting to ensure they provide value to customers. The big three all said they are playing the long game with customers.

"We’re going to do whatever it takes to help customers be successful over a long period of time because we’re trying to build relationships in a business that outlast all of us," said Jassy. "We’re spending a lot of time with customers trying to help them think of smart ways, not short-term ways, but smart ways to optimize their costs and to be able to scale up and down."

Nadella said:

"We are focused on continuing to raise the bar on our operational excellence and performance as we innovate to help our customers maximize the value of their existing technology investments and thrive in the new era of AI."

Hood said Microsoft said its Copilot effort should deliver some productivity improvement to customers.

On Alphabet's conference call, the word "value" was mentioned as much as it was on Microsoft's call. Executives, however, talked more about delivering value to industries, notably retail.

Pichai's talk about value revolved around customers, but also creating returns for shareholders. Google Cloud delivered profits in the first quarter.

Part of the value from cloud providers will be providing the scale needed for generative AI. Jassy said:

"All of the Large Language Models are going to run on compute. And the key to that compute is going to be the chip that’s in that compute. And to date, I think a lot of the chips there, particularly GPUs, which are optimized for this type of workload, they’re expensive and they’re scarce. It’s hard to find enough capacity."

AWS' bet is that its investment in chips such as Trainium will provide value as customers look for underlying compute.

The numbers

- AWS reported first quarter operating income of $5.12 billion on revenue of $21.35 billion, up 16% from a year ago. In the year ago quarter, AWS had operating income of $6.52 billion on revenue of $18.44 billion.

- Microsoft Cloud reported fiscal third quarter revenue of $28.5 billion, up 22% from a year ago. Microsoft doesn't break out its operating income for Microsoft Cloud, which includes Azure, Office 365 Commercial and the commercial portion of LinkedIn, Dynamics 365 and other cloud properties.

- Google Cloud reported first quarter operating income of $191 million on revenue of $7.45 billion, up 28% from a year ago. In the first quarter a year ago, Google Cloud had an operating loss of $706 million.

Data to Decisions

Tech Optimization

Digital Safety, Privacy & Cybersecurity

Innovation & Product-led Growth

Future of Work

Next-Generation Customer Experience

Google

Google Cloud

Microsoft

amazon

SaaS

PaaS

IaaS

Cloud

Digital Transformation

Disruptive Technology

Enterprise IT

Enterprise Acceleration

Enterprise Software

Next Gen Apps

IoT

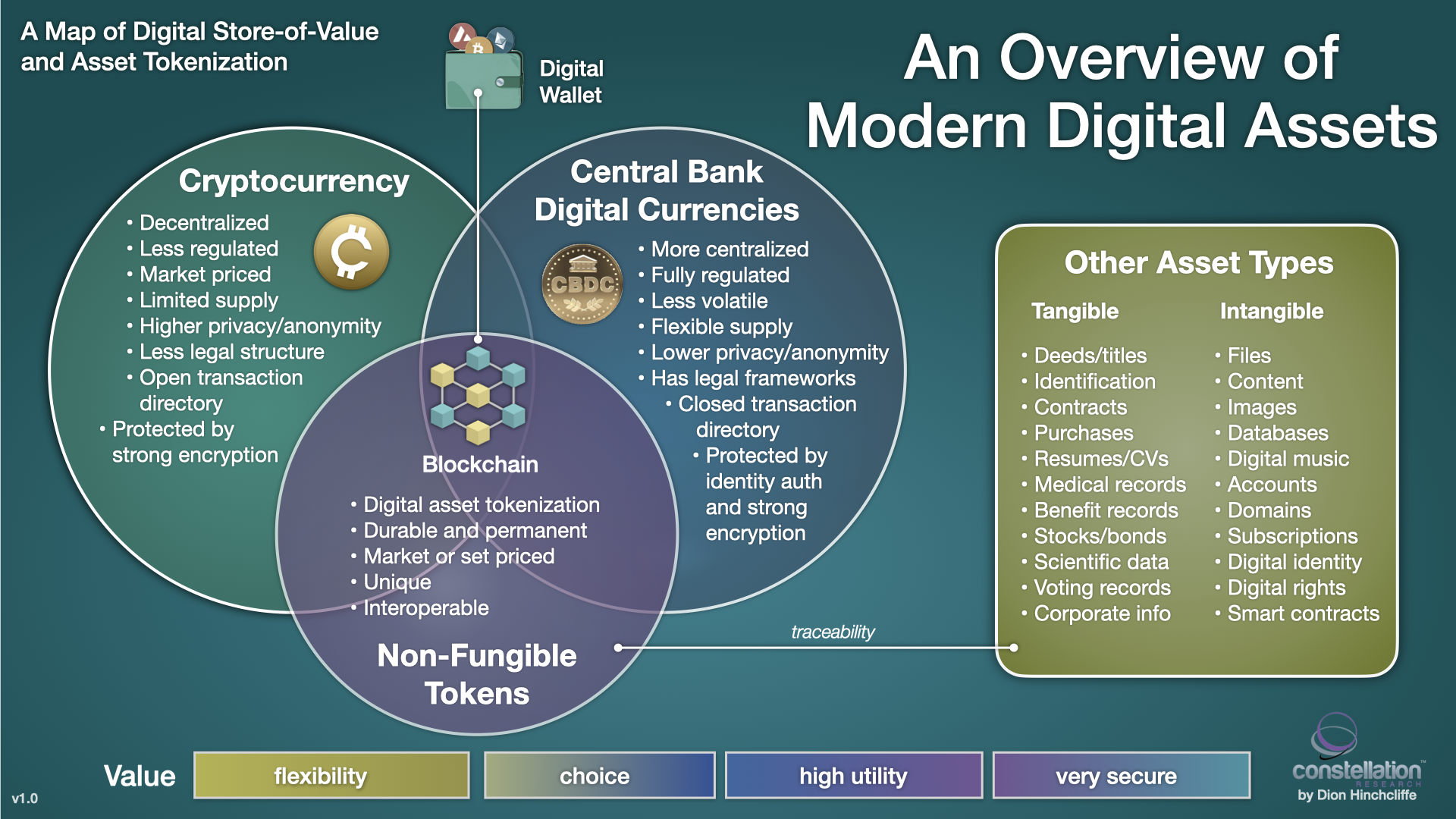

Blockchain

CRM

ERP

CCaaS

UCaaS

Collaboration

Enterprise Service

AI

GenerativeAI

ML

Machine Learning

LLMs

Agentic AI

Analytics

Automation

Chief Financial Officer

Chief Information Officer

Chief Analytics Officer

Chief Data Officer

Chief Technology Officer

Chief Information Security Officer

Chief Executive Officer

Chief AI Officer

Chief Product Officer