Vice President and Principal Analyst

Constellation Research

Title: About Dion Hinchcliffe

Dion Hinchcliffe is an internationally recognized business strategist, bestselling author, enterprise architect, industry analyst, and noted keynote speaker. He is widely regarded as one of the most influential figures in digital strategy, the future of work, and enterprise IT. He works with the leadership teams of large enterprises as well as software vendors to raise the bar for the art-of-the-possible in their digital capabilities.

He is currently Vice President and Principal Analyst at Constellation Research. Dion is also currently an executive fellow at the Tuck School of Business Center for Digital Strategies. He is a globally recognized industry expert on the topics of digital transformation, digital workplace, enterprise collaboration, API…...

Read more

In the context of the modern IT, technology has become the bedrock for most businesses worldwide, a fundamental enabler of growth and innovation. Despite being essential, it has driven IT infrastructures to an unparalleled level of sophistication, consuming a significant portion of budgets and resources just to keep it properly coordinated and well-managed. This constant balancing act between managing existing systems and embracing new advancements is now the new norm. I am finding that CIOs today are engaged in a steadily growing effort to manage this technology complexity, in concert with the ever-increasing numbers of vendors and service providers required to successfully deliver all these technological capabilities to the business. .

Thus, the technological landscape of organizations continues to be fraught with an broad swath of tech solutions, data silos, and the hefty operational overhead of ensuring security, integration, optimization, and evolution, and technical debt are all addressed. In my experience, a majority of Chief Information Officers (CIOs) now see this complexity as a leading challenge in the IT management sphere today. Consequently, almost half of organizations are seeking to outsource day-to-day support and maintenance services to focus on more strategic and innovation-centric projects.

Looking at Emerging Models to Manage Complexity in IT Services

Third-party IT services are rising in demand, growing by about 7% annually, according to our firm's most recent estimates. These vital outside services, encompassing a wide array of functions from cybersecurity to IT support and digital transformation, can help streamline and simplify IT infrastructures. As enterprises grow, the demand for more integrated systems, better access to data across silos, added functionality, and increased automation has led to the cultivation and consumption of an increasingly diverse enterprise services portfolio. This has driven growth of the IT services industry year-of-year for a decade, but it has also introduced a significant new layer of complexities.

That's because the introduction of each new service provider is accompanied by the need for onboarding, vendor management, and time investment to overee them and integrate them into the IT service fabric, which then becomes another bottleneck and source of inconsistency in service delivery. As IT becomes critical for rapidly changing requirements and operating conditions, the need for better-coordinated enterprise services is at an all-time high. This need is further fueled by a significant talent shortage in the IT sector, ranging from operations to cybersecurity, further driving organizations to either outsource, and further silo the work being done, or to find other solutions. There has to be a better way.

In 2023, CIOs have reported that they spend most of their time on activities like security management, improving IT operations, aligning IT with business goals, modernizing infrastructure, and leading change efforts. A significant portion of these activities can potentially be outsourced to third-party IT services, as costs and talent availability remain significant concerns. But only if this does not signifciantly exacerbate service delivery and IT management overhead.

Unified Software Services as a Leading New Model

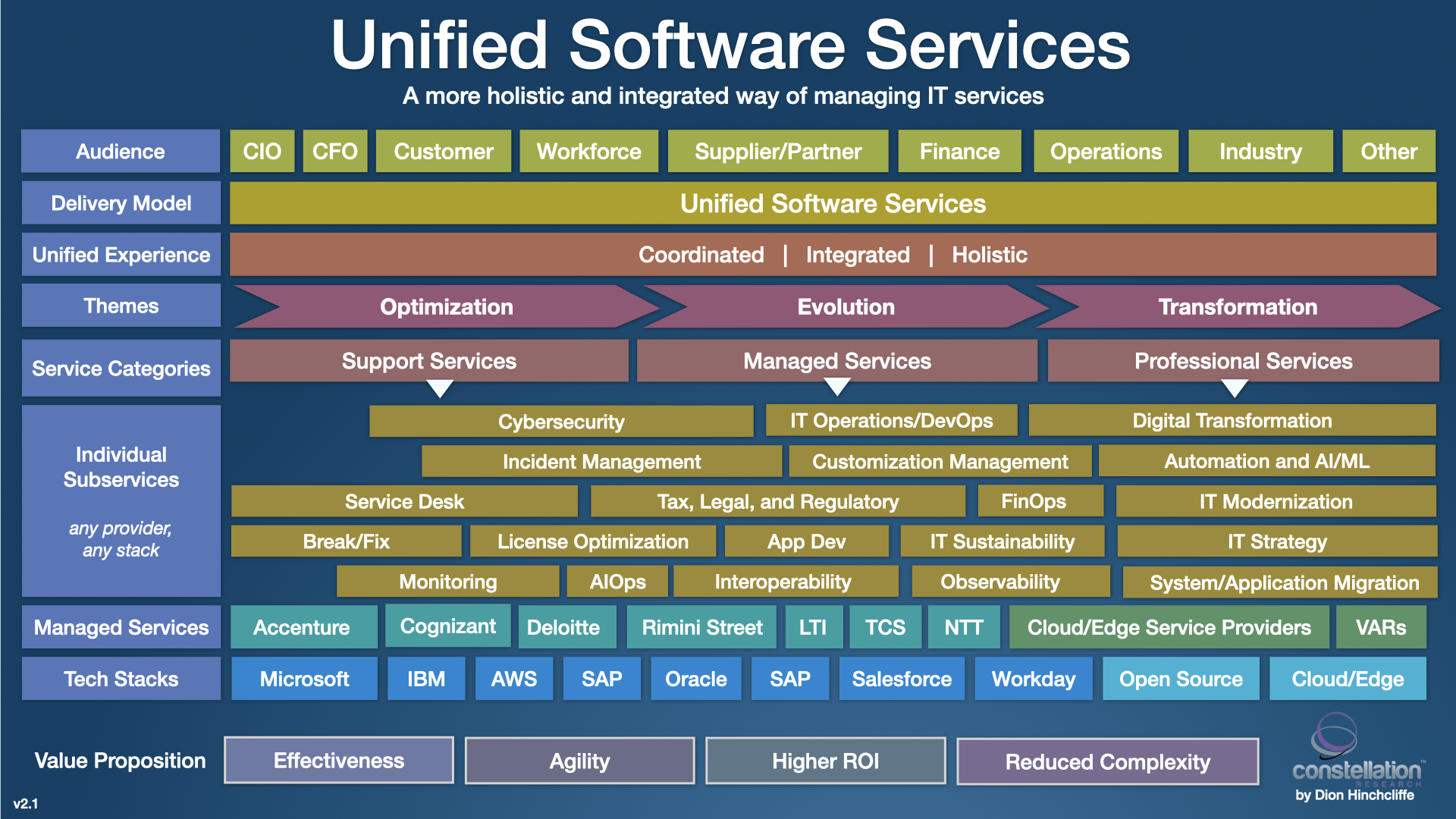

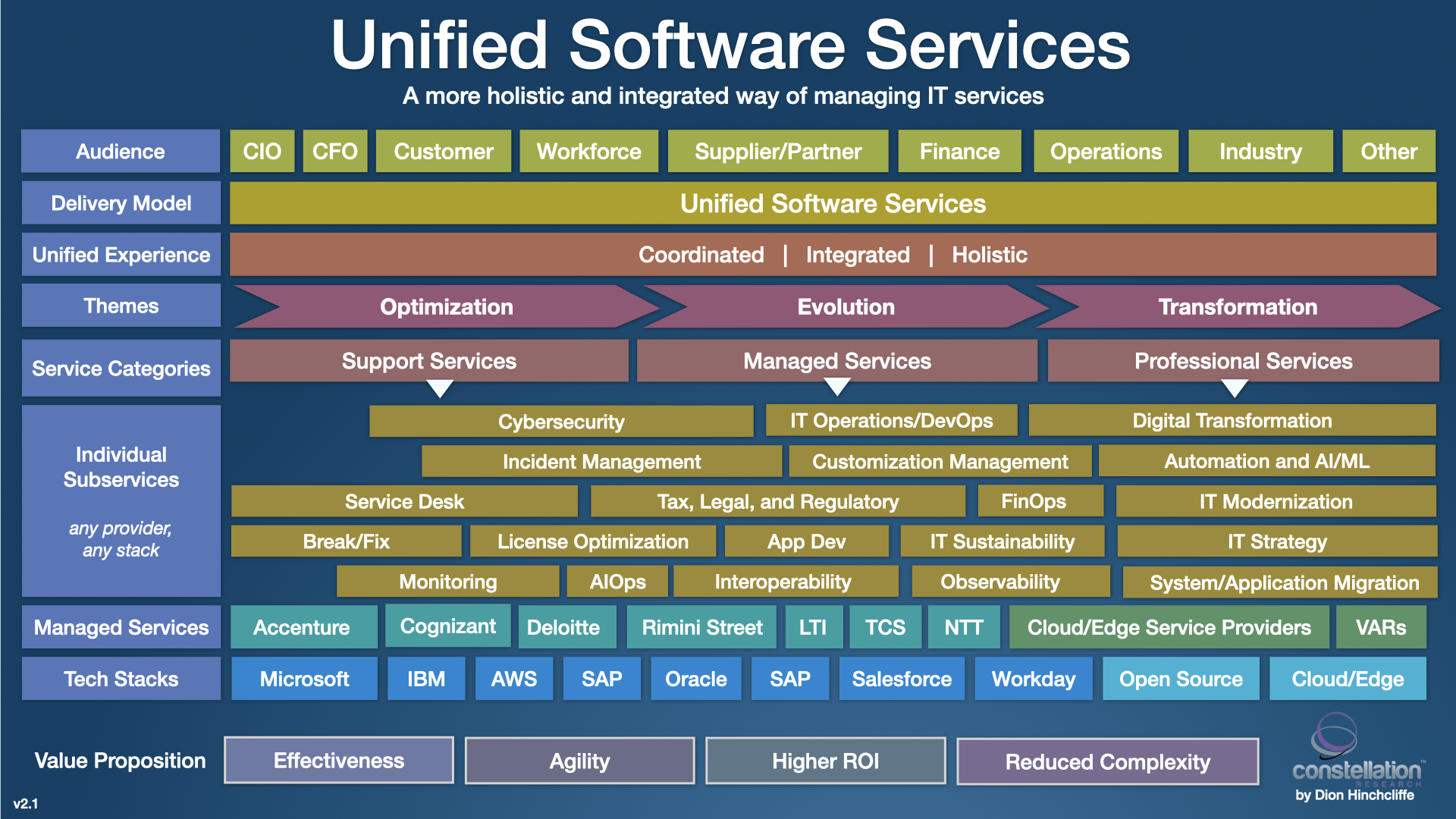

As I unveiled as a significant emerging IT trend in a major research report last year, The Rise of Unified Software Services, the IT services industry has responded with a new strategic approach: Unified Software Services (USS). This model enables enterprises to engage service providers in a more encompassing and holistic manner. A USS provider offers a long-term services strategy, catering to everything from basic security and IT modernization to digital transformation.

As I unveiled as a significant emerging IT trend in a major research report last year, The Rise of Unified Software Services, the IT services industry has responded with a new strategic approach: Unified Software Services (USS). This model enables enterprises to engage service providers in a more encompassing and holistic manner. A USS provider offers a long-term services strategy, catering to everything from basic security and IT modernization to digital transformation.

One of the key insights is that a USS offering can provide a better-integrated solution to meet an organization's needs. Adopting a USS approach can result in faster, smoother, and more efficient delivery of IT services, with benefits ranging from cost optimization to improved agility and governance.

While the USS model offers a multitude of benefits, the critical, breakthrough advantage is the reduction in overall complexity. When IT is simpler to manage, evolve, and govern, the path to future becomes significantly easier to travel. A shift to USS can provide organizations with numerous benefits, from cost savings to improved agility and shorter time to value.

Constellation Research recommends IT departments to consider the benefits of USS and start integrating it into their IT services mix. A shift of between 20% and 50% towards USS can provide significant benefits and reductions in complexity. In 2024 and beyond, organizations are encouraged to transition to and adopt USS to advance their existing portfolios and meet their emerging technology agendas, such as with AI and advanced cybersecurity.

I've updated my current research on USS as well as taken at look at how it can aid in delivering on some of the latest industry trends in a brand-new follow-up report, The Evolution of Unified Software Services. It explores how USS can be used to bettter deliver consistently across projects and prgrams. The report also examines how USS can specifically help new focus areas and practices such FinOps, sustainability and ESG, industry clouds, reallocation of tech talent/nearshoring, cloud adoption for cost reduction, and artificlal intelligence.

CIOs and IT executives are encouraged to evaluate the USS model as technology continues to grow in overall enterprise spend. Oganizations need to find more efficient ways to manage the services they consume, and I believe that Unified Software Services currently offers one of the most mature current path to optimize IT delivery, management, and support today, whilst also facilitating the transformation of IT and business for the future. For CIOs and IT executives, the USS model emerges as the most flexible, integrated, and efficient method to manage their IT services, shaping the future of their organizations.

My video exploration of the rise and evolution of Unified Software Services.

Update: Rimini Street has graciously made this report available to the general public for a limited time. You can download a copy here.

My Related Research

Private Cloud a Compelling Option for CIOs: Insights from New Research

An Update on IBM Cloud for the CIO

How CXOs Can Attain Minimum Viable Digital Experience for Customers, Employees, and Partners

Cloud Reaches an Inflection Point for the CIO in 2022

An Oracle NetSuite Roadmap for the CIO and CFO

Objectives and Key Results (OKRs) Turns COOs into Transformation Leaders

To Strategically Scale Digital, Enterprises Must Have a Multicloud Experience Integration Stack