ODDITY Tech, a tech-meets-cosmetics company, generated a bevy of headlines due to a successful initial public offering, but the success of its AI models is what's really worth watching.

The company has leveraged its data platform and models to grow two brands, IL MAKIAGE and SpoiledChild, with more on deck via ODDITY Labs.

"We deploy algorithms and machine learning models leveraging user data seeking to deliver a precise product match and seamless shopping experience," explained the company in its prospectus. "We harness our user data to develop physical beauty and wellness products that deliver excellent performance and functionality. We never settle on quality. If our data doesn’t show it is the best we can deliver, we won’t launch it."

ODDITY is marrying two different worlds of tech and physical products via data and models. ODDITY has a platform of 40 million users, 1 billion unique data points on beauty preferences and 4 million active customers.

Here's why ODDITY could be more than just a hot stock: It may be an example of a company that's built on top of AI, data and machine learning where the technology enables a physical product. Today, ODDITY is aimed at the health, wellness and cosmetics category. But if data, technology and the ODDITY Platform are the real differentiators then ODDITY could go into any market.

Research: CX, Data to Decisions, Matrix Commerce

I'm thinking about ODDITY largely due to generative AI. Generative AI will be implemented by enterprises and the technology will create new types of companies just like cloud computing and mobile did. A company like Uber wouldn't exist without cloud and mobile. Technology has enabled new businesses throughout history.

Enter ODDITY, which lives up to its name from a business model perspective. The company is part technology, part e-commerce and part media and relies on AI models to drive its business.

A tour through ODDITY's regulatory filings reveals a company that's as much about data science, machine learning and AI as it is health and wellness products. In addition to ODDITY's datasets, the company has proprietary algorithms and models, computer vision tools and Kenzza, a collection of on-demand bespoke beauty media content.

This data flywheel is designed to improve model training, drive product sales and fuel returns.

ODDITY makes it clear that its data flywheel is critical to the business. One of ODDITY's biggest risk factors is AI model accuracy. ODDITY said in its filing that if it can't continue to improve it AI models its business will suffer. ODDITY said:

"AI presents risks and challenges that could affect our products’ further development, adoption, use, and therefore, our business. AI algorithms may be flawed, and data sets may be insufficient, of poor quality, or contain biased information. Inappropriate or controversial data practices by data scientists, engineers, and end-users of our systems could impair the acceptance of AI solutions."

ODDITY, based in Israel, also said that if its models can't accurately analyze facial or hair features or computer vision fails it will face higher returns and costs. The company added that errors, bias and restrictions on third-party data used to train and improve models can also hurt sales.

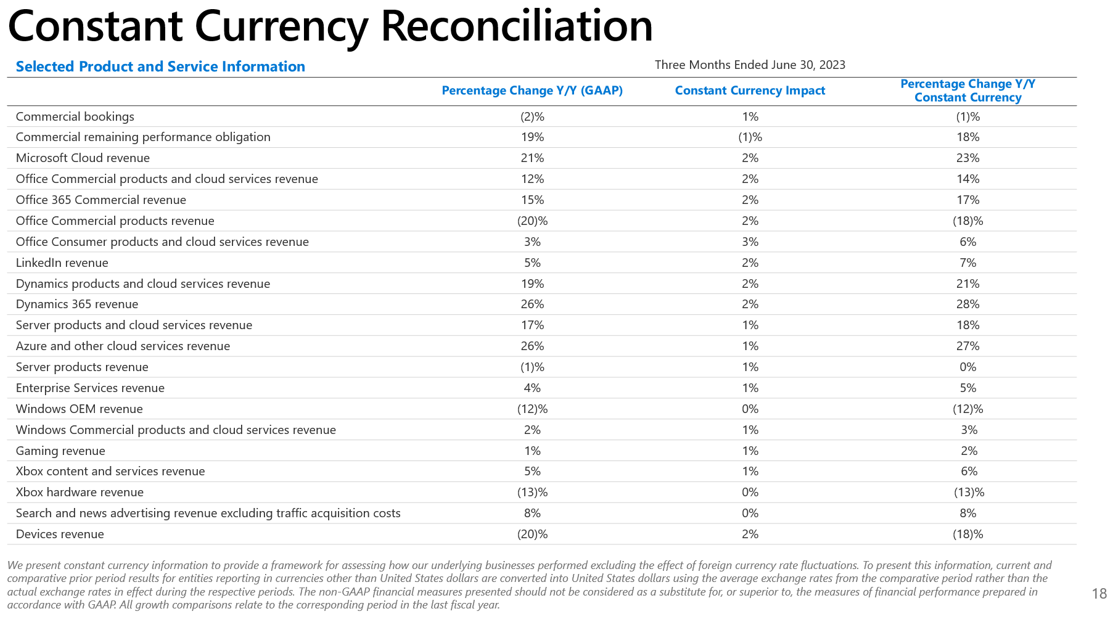

Luckily, 40% of ODDITY's workforce are technology employees. So far, ODDITY's data-driven business model is working well. For 2022, ODDITY delivered net revenue of $324.5 million. For the six months ended June 30, ODDITY is projecting revenue between $300 million and $310 million with net income between $40.5 million and $44.5 million.

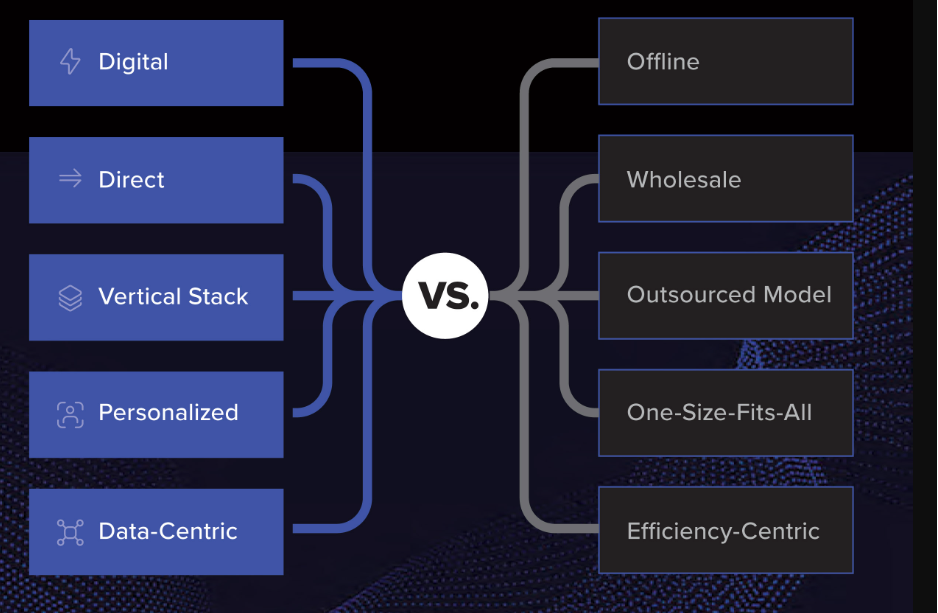

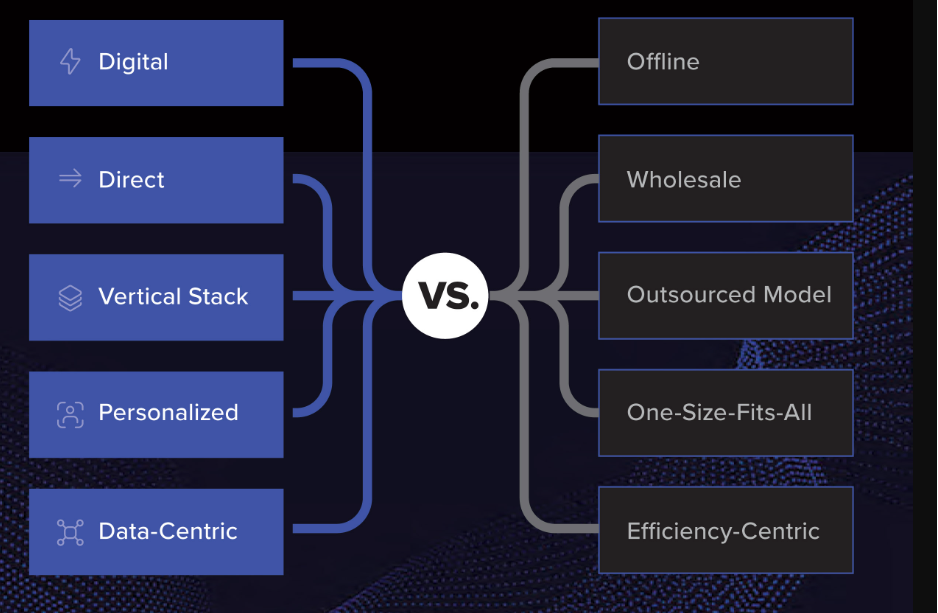

Here's ODDITY's approach relative to other direct-to-consumer companies.