Intel's Q2 better than expected, issues remain

Intel's second quarter results weren't as bad as feared as the company saw an uptick in its Intel Foundry Services business and declines elsewhere.

The company, which is lagging Nvidia in processors used for AI workloads, reported second quarter revenue of $12.9 billion, down 15% from a year ago. Intel delivered net income of $1.5 billion, or 35 cents a share, in the second quarter. The company reported second quarter non-GAAP earnings of 13 cents a share.

Wall Street was expecting Intel to report a loss of 3 cents a share on revenue of $12.13 billion, down 21% from a year ago. At the end of the first quarter, Intel forecasted second quarter revenue of $11.5 billion to $12.5 billion with a non-GAAP loss of 4 cents a share.

As for the outlook, Intel projected non-GAAP third quarter earnings of 20 cents a share on revenue of $12.9 billion to $13.9 billion.

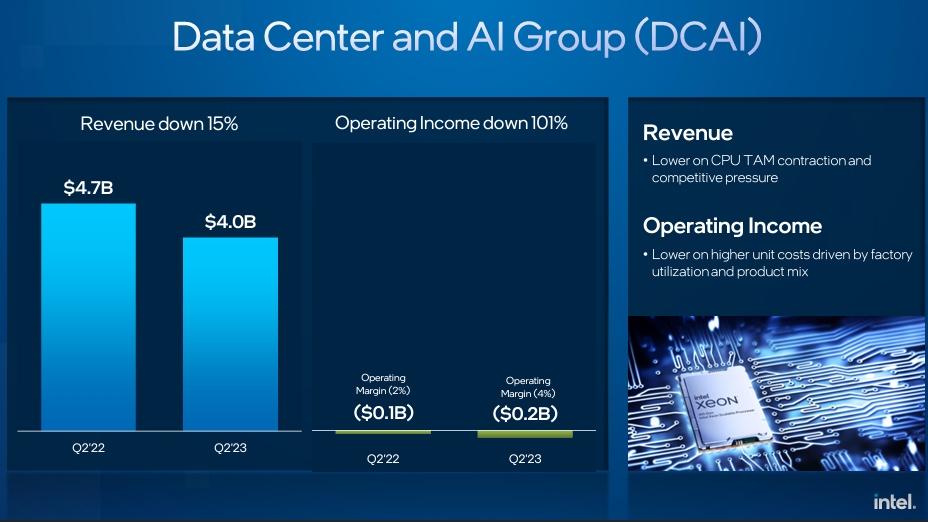

While the second quarter results were better than expected, Intel is still facing multiple issues. Its PC chip business was down 12% from a year ago to $6.8 billion and its data center and AI business had revenue of $4 billion, down 15% from a year ago. Network and edge saw revenue fall to $1.4 billion, down 38% from a year ago.

Intel noted the following:

- In the client computing unit, revenue fell as PC makers worked through excess inventory.

- For the data center and AI group, Intel said it saw lower revenue due to competitive pressure (AMD and Nvidia) as well as a shrinking total addressable market for CPUs.

- In network and edge, revenue ws lower on weak telecom demand.

On the bright side, Intel Foundry Services had second quarter revenue of $232 million, up 307% from a year ago.

Intel CEO Pat Gelsinger said the company was "well-positioned to capitalize on the significant growth across the AI continuum by championing an open ecosystem and silicon solutions that optimize performance, cost and security to democratize AI from cloud to enterprise, edge and client."

The company also said it's on track to deliver $3 billion in cost savings in 2023.

Speaking on a conference call with analysts, Gelsinger said the following:

- Intel said the company is regaining customer trust with expectations of a "modest second half 2023 recovery."

- The client business performed better than expected with share gains in consumer and education. Gelsinger added that the AI PC will drive demand as well now healthy inventory levels.

- The CPU server market remains soft in enterprise and internationally. Gelsinger said focus has been on AI accelerators. He expects the server market to recover in 2024.

- "Our strategy is to democratize AI across the continuum," said Gelsinger, adding that Intel will bring AI to cloud to edge to client.

- Foundry services is "a significant accelerant to our Intel 2.0 strategy" and diversifies the semiconductor supply chain outside of Asia. Gelsinger said it is investing in additional capacity.

- "I'm pleased to report all of our programs or on track or ahead of schedule," said Gelsinger, noting that Intel plans to close the power and performance gap by 2025.