Snowflake expanded its partnership with Anthropic to cover joint sales efforts and model integration with Snowflake Intelligence, detailed AWS Marketplace growth and teamed up with Accenture on enterprise AI deployments. The company also reported strong third quarter results.

The news lands after Snowflake's acquisition of Select Star. The purchase expands Snowflake Horizon Catalog view into enterprise data. Select Star integrates with multiple database systems and business intelligence tools as well as data pipelines.

Here's a look at the partnerships, which was announced shortly after Snowflake earnings.

Anthropic and Snowflake expand partnership

The partnership expansion brings Anthropic models to Snowflake Cortex AI in a deal valued at $200 million.

Anthropic and Snowflake will collaborate on joint sales efforts and go-to-market motions.

Since the two companies announced their initial partnership, thousands of customers have signed up for Claude models on Snowflake.

Anthropic Claude will be a key model powering Snowflake Intelligence, the company's data intelligence agent.

Sridhar Ramaswamy, CEO of Snowflake, said the partnership with Anthropic was expanded because the two companies are seeing usage surge as a team.

Anthropic CEO Dario Amodei said "this partnership expansion is a direct result of the momentum and demand we’ve already seen from customers who are driving real business value with Anthropic and Snowflake."

Here's a look at Snowflake's deals with AWS and Accenture.

- Accenture and Snowflake launched the Accenture Snowflake Business Group to offer AI and data transformation services. The two companies cited Caterpillar as a customer. Accenture and Snowflake will meld Accenture's AI Refinery with Snowflake Intelligence and Snowflake Cortex AI.

- Snowflake said it has been leveraging AWS marketplace to drive sales and adoption. The company said AWS Marketplace sales have doubled to $2 billion. Snowflake said it has recognized by AWS across 14 Partner Award categories. The two companies are collaborating on multiple integrations.

Better-than-expected third quarter results

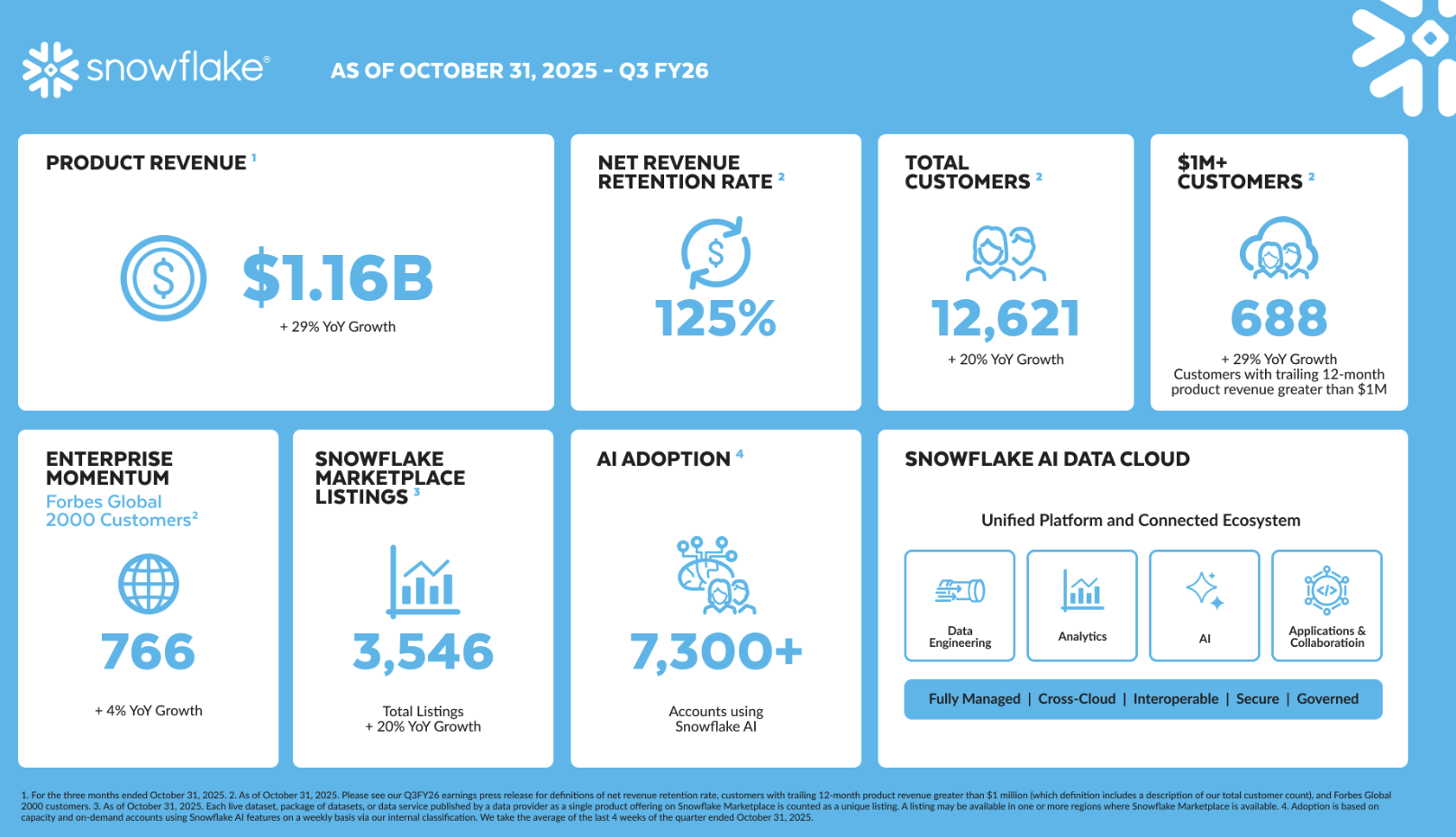

Snowflake reported a third quarter net loss of $291.6 million, or 87 cents a share. Non-GAAP earnings were 35 cents a share on revenue of $1.21 billion, up 29% from a year ago.

Wall Street was looking for non-GAAP earnings of 31 cents a share on revenue of $1.18 billion.

Snowflake said it had 688 customers with trailing 12-month product revenue greater than $1 million. Remaining performance obligations were $7.88 billion, up 37% from a year ago.

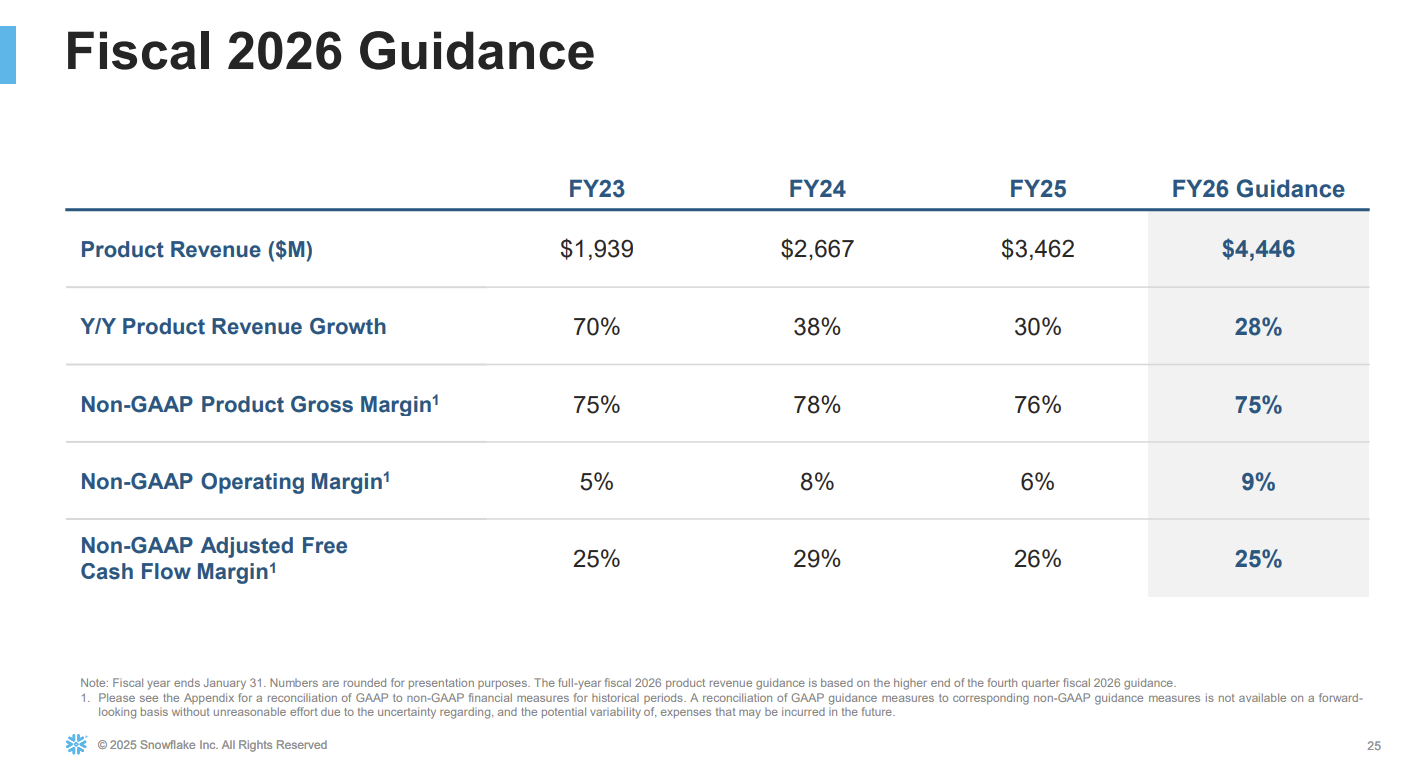

As for the outlook, Snowflake projected product revenue of $1.195 billion to $1.2 billion, up 27% from a year ago. Ramaswamy said Snowflake Intelligence, the company's enterprise AI agent, saw "the fastest adoption ramp in Snowflake history."

Also: