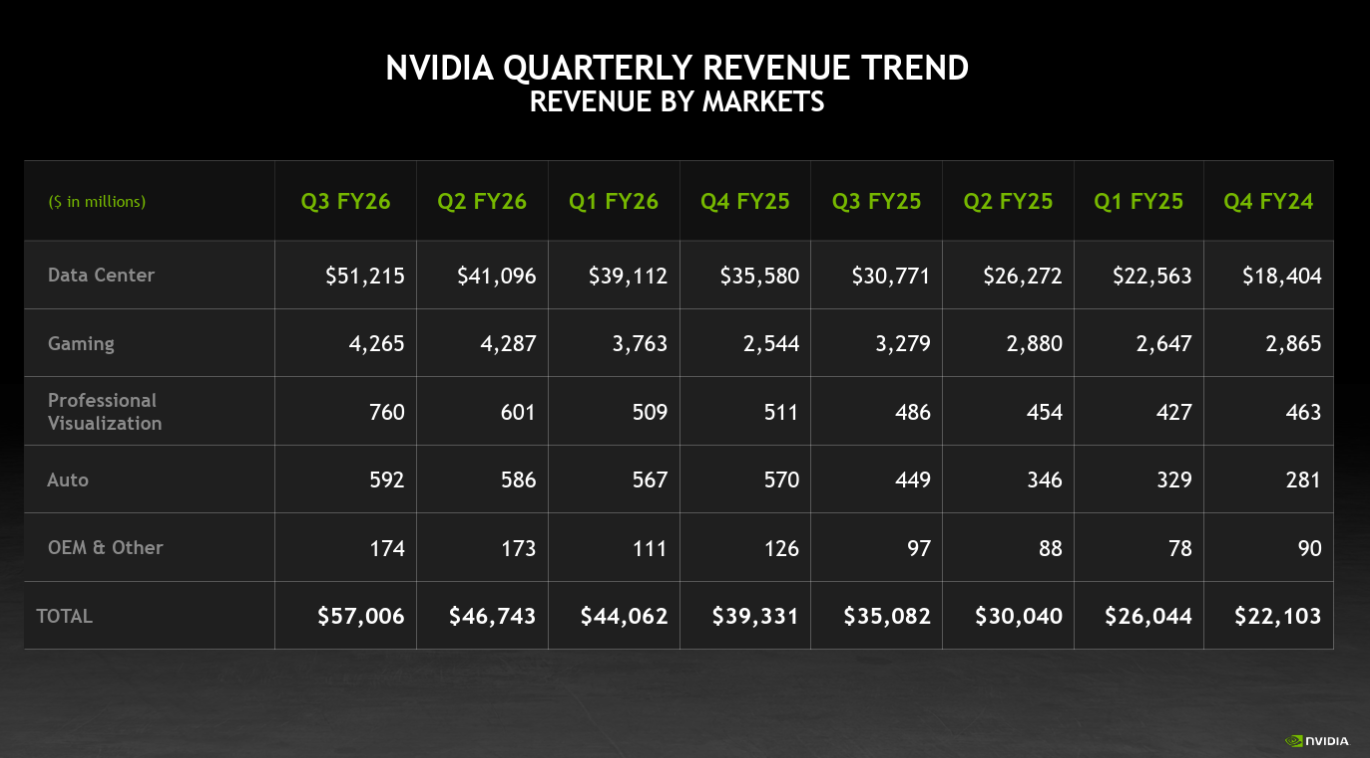

Demand for Nvidia's GPUs shows no sign of slowing down as the company's data center unit delivered fiscal third quarter growth of 66%.

The company reported third quarter net income of $31.91 billion, or $1.30 a share, on revenue of $57 billion, up 66% from a year ago. Non-GAP earnings were $1.30 a share.

Wall Street was expecting non-GAAP earnings of $1.26 a share on revenue of $55.09 billion.

Nvidia CEO Jensen Huang said, "Blackwell sales are off the charts, and cloud GPUs are sold out" and that the "AI ecosystem is scaling fast — with more new foundation model makers, more AI startups, across more industries, and in more countries."

- Anthropic, Microsoft Azure, Nvidia ink $30 billion compute pact

- Dell brings more automation to Nvidia AI factory deployments

- Nvidia's GTC Washington DC news barrage lands amid US vs China AI backdrop

- Nvidia DGX Spark now available for $3,999, but real impact will be AI at the edge

- Nvidia to invest $100 billion in OpenAI, which will deploy Nvidia next-gen AI infrastructure

- Nvidia invests $5 billion in Intel, aims to codevelop for data centers, PCs

The quarter was driven by the data center unit, which delivered third quarter revenue of $51.21 billion, up 66% from a year ago. Compute revenue was $43.03 billion, up 56% from a year ago, and networking, which had revenue growth of 162% to $8.19 billion.

Gaming revenue was up 30%, professional visualization revenue was up 56% and automotive revenue was up 32%.

CFO Collette Kress said the data center unit was powered by AI agent workloads. "Blackwell Ultra is now our leading architecture across all customer categories while our prior Blackwell architecture saw continued strong demand. H20 sales were insignificant in the third quarter," said Kress. "Networking revenue was a record $8.2 billion, up 162% from a year ago from the introduction and continued growth of NVLink compute fabric for GB200 and GB300 systems."

As for the outlook, Nvidia projected fourth quarter revenue of $65 billion, give or take 2%, and gross margins of about 75%.

Constellation Research CEO R “Ray” Wang said on Fox Business that Nvidia is the “poster child” for AI and there’s not a bubble. “There's a trillion dollars of cross sell, joint investments, balance of trade, if you want to call it that. But at the end of the day, these are real profits and quality revenue. And unlike the internet age, what's happening here is, these are real profits being spent on capex,” said Wang.

Speaking on a conference call, Kress said:

- "We currently have visibility to a half a trillion dollars in Blackwell and Rubin revenue from the start of this year through the end of calendar year 2026."

- "We see the transition to accelerated computing and generative AI across current hyper scale workloads contributing toward roughly half of our long term opportunity. Another growth pillar is the ongoing increase in compute driven by foundation model builders."

- "Enterprises broadly are leveraging AI to boost productivity, increase efficiency and reduce cost."

- "We announced AI factory and infrastructure projects amounting to an aggregate of 5 million GPUs. This demand spans every market, CSPs, sovereigns, modern builders, enterprises and supercomputing centers."

Kress also addressed concerns that have been circulating on Wall Street. Regarding GPU depreciation, Kress argued that Nvidia's software stack stretches out the lifespan of GPUs due to optimization. She said:

"The long useful life of Nvidia's CUDA GPUs is a significant TCO advantage over accelerators. CUDA's compatibility and our massive installed base extend the life in our systems well beyond their original estimated useful life. For more than two decades, we have optimized the CUDA ecosystem, improving existing workloads, accelerating new ones, and increasing throughput with every software release. Most accelerators without CUDA and Nvidia's time tested and versatile architecture became obsolete within a few years. The A100 GPUs we shipped six years ago, are still running at full utilization today, powered by vastly improved software stack."

She also defended Nvidia's investments in other AI companies that are also customers. "Our strategic investments represent partnerships that grow the Nvidia CUDA AI ecosystem and enable every model to run optimally on Nvidia everywhere. We will continue to invest strategically while preserving our disciplined approach to cash flow management," she said.

Huang took on the AI bubble concerns.

"There's been a lot of talk about an AI bubble. From our vantage point, we see something very different. As a reminder, Nvidia is unlike any other accelerator in that we excel at every phase of AI, from pre training and post training to inference. We are also exceptional at science and engineering simulations, computer graphics, structured data processing to classical machine learning.

The world is going is undergoing three massive platform shifts at once. The first transition is from CPU general purpose computing to GPU accelerated computing. Secondly, AI is also reached a tipping point and is transforming existing applications while enabling entirely new ones for existing applications. The transition to agentic and physical AI will be revolutionary."

Constellation Research analyst Holger Mueller said:

"Nvidia achieved something remarkable in the quarter. Its data center revenue growth matched the profitability growth of overall Nvidia, a rare feat. It shows that Jensen Huang and team - despite all the growth - are still managing cost. The other key takeaway is that networking is now Nvidia second largest business having solidly overtaken former #1 Gaming."

Huang said on the conference call:

- "Performance per watt, the efficiency of your architecture is incredibly important. And the efficiency of your architecture can't be brute force. There is no brute forcing about it. Your performance per watt translates directly absolutely directly to your revenues, which is the reason why choosing the right architecture matters so much now. The world doesn't have an excess of anything to squander. And so each generation, our economic contribution will be greater. Our value delivered will be greater but the most important thing is our energy efficiency per watt is going to be extraordinary, every single generation."

- "One of the areas that is really misunderstood about the hyperscalers is that the investment on Nvidia GPUs not only improves their scale, speed and cost for -- from general purpose computing."

- "Each country will fund their own infrastructure. And you have multiple countries, you have multiple industries. Most of the world's industries haven't really engaged agentic AI yet, and they're about to. All of those different industries are now getting engaged, and they're going to do their own fundraising. And so don't just look at the hyperscalers as a way to build out for the future. You got to look at the world, you got to look at all the different industries and enterprise computing is going to fund their own industry."