Oracle's Fusion applications business can't compete in buzz or growth rates compared to Oracle Cloud Infrastructure (OCI), but you'd be wise to pay attention to the software plan. Yes Virginia, Oracle is still a software company.

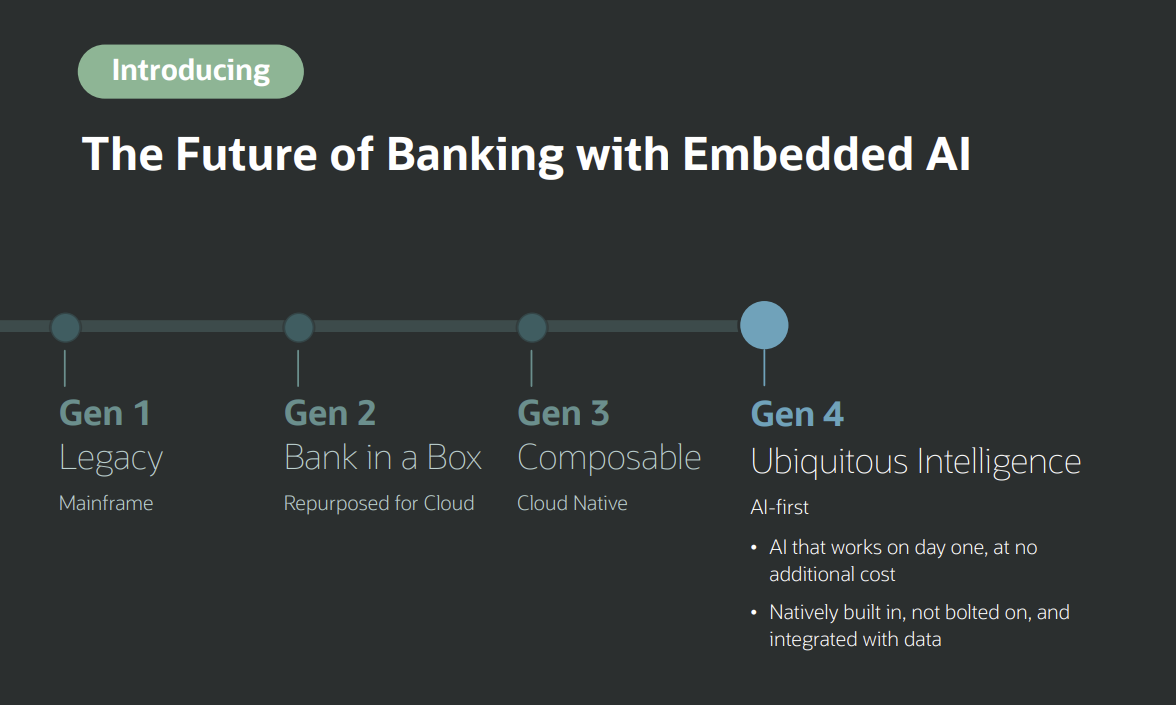

At the just concluded Oracle AI World, the buzz machine revolved around OCI as well as an AI platform and data lakehouse play. Fusion application news landed on Oracle AI World's last day. For what it's worth, Oracle is scaling up AI agents across its applications focused on various processes like accounts payable, payments, fulfillment, legal and financial planning and analysis.

In a week full of AI agent hubbub due to Salesforce's Agentforce barrage, you are forgiven for missing the Oracle AI agent news. But it's worth catching up.

- Mike Ni: Oracle AI World 2025: Shifting left AND right into Oracle’s suite spot

- Oracle CTO Larry Ellison on AI use cases for healthcare, agriculture, climate change

- Oracle AI World 2025: Autonomous AI Lakehouse, AI Data Platform launched

Steve Miranda, Executive Vice President of Oracle Applications Development, said at the company's investor day at Oracle AI World:

"What I talked about at this conference last year was that we would have 100 AI agents in Fusion. We actually have 600 AI agents, 400-plus in Fusion, 200-plus in the industry verticals. The 600 are agents that we've built and that does not count agents that our customers are building through the agent studio or what our partners have built."

Oracle also launched an AI agent marketplace to expand the ecosystem. Mike Sicilia, co-CEO of Oracle and leader of the applications side of the company, said Fusion AI agents are native to the company's stack and available to customers at no additional costs.

"We have 2,400 customers already leveraging Oracle AI embedded inside our applications today," said Sicilia. "They are live across a large variety of industries. Fusion applications are quickly becoming a collection of AI agents."

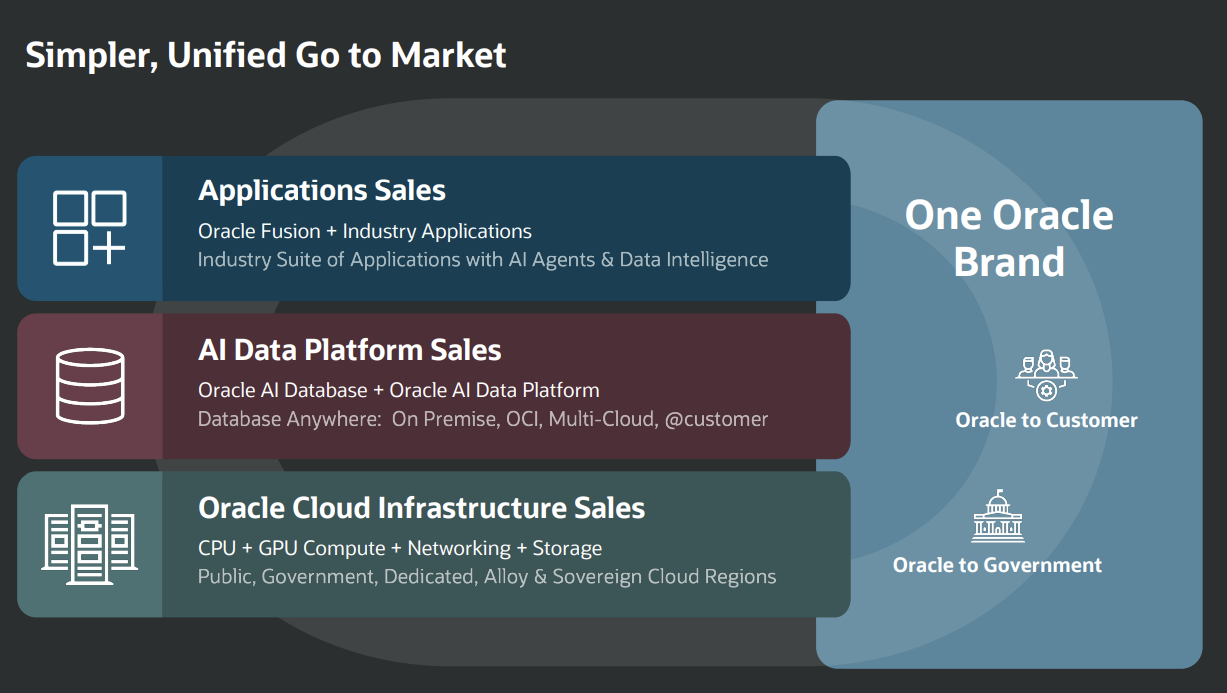

Today's reality: Oracle applications revenue tops infrastructure

Given the growth rates of Oracle's cloud infrastructure business, up 55% in the first quarter, it's easy to forget that the company even has an applications business. After all, Oracle has been all about Nvidia GPUs, now AMD too, and building capacity for customers like OpenAI.

Here's the comical part. In the first quarter where Wall Street went bonkers over remaining performance obligations, Oracle's cloud applications revenue was still larger than infrastructure. Oracle's applications business, primarily Fusion Cloud ERP and NetSuite, delivered first quarter revenue of $3.8 billion, up 11% from a year ago. Fusion Cloud ERP was up 17% and NetSuite up $1 billion. Oracle's SaaS revenue for the quarter was $3.8 billion. Cloud infrastructure revenue in the first quarter was $3.35 billion.

Going forward, Oracle's revenue mix will change toward infrastructure (at lower margins for a bit). But for now, don't discount applications. For fiscal 2025, Oracle cloud applications revenue was $14.3 billion compared to cloud infrastructure revenue of $10.23 billion.

Another point for your Oracle future file. Oracle's applications business will have to more than pull its weight to fund the OCI investment.

Industry and process focused

Sicilia spent a good bit of time talking about Oracle Fusion and its industry plays. Oracle has its core ERP and HCM systems, but company has a penchant for targeting industries and regulated processes.

Healthcare is the obvious play and one of CTO Larry Ellison's passions. Oracle is planning to automate entire healthcare ecosystems.

"We've got dozens of AI agents live across our health ecosystem today, many more planned. We're looking at chart review care navigation, clinical decision support, patient risk predictions, preventative care and many more. In fact, our next-generation AI EHR is now generally available," said Sicilia.

To Sicilia, the more regulated an industry is the more Oracle can play a role. He said in the next year, Oracle will have 125 AI agents live in banking and insurance.

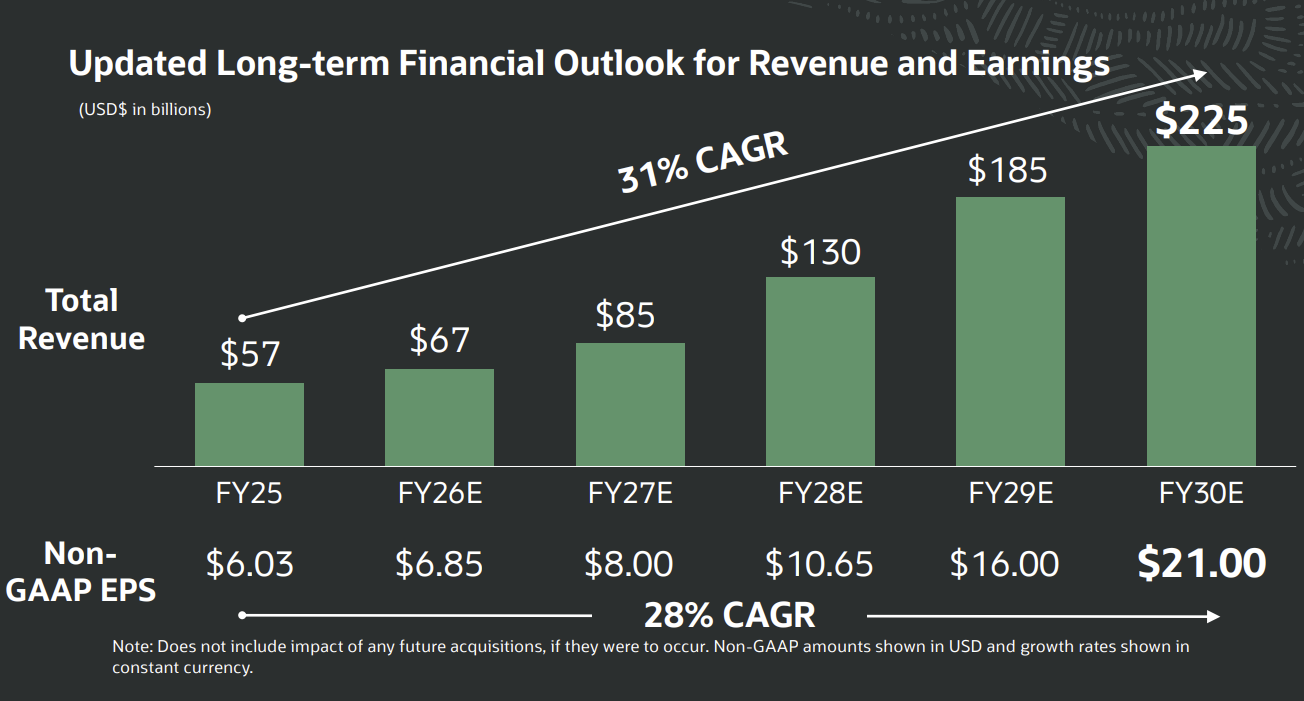

Oracle is aiming to automate multiple industry ecosystems. The company is projecting fiscal 2030 revenue of $225 billion with a compound annual growth rate of more than 31% over the next five years. For earnings, Oracle is targeting $21 cents a share in annual earnings by fiscal 2030.

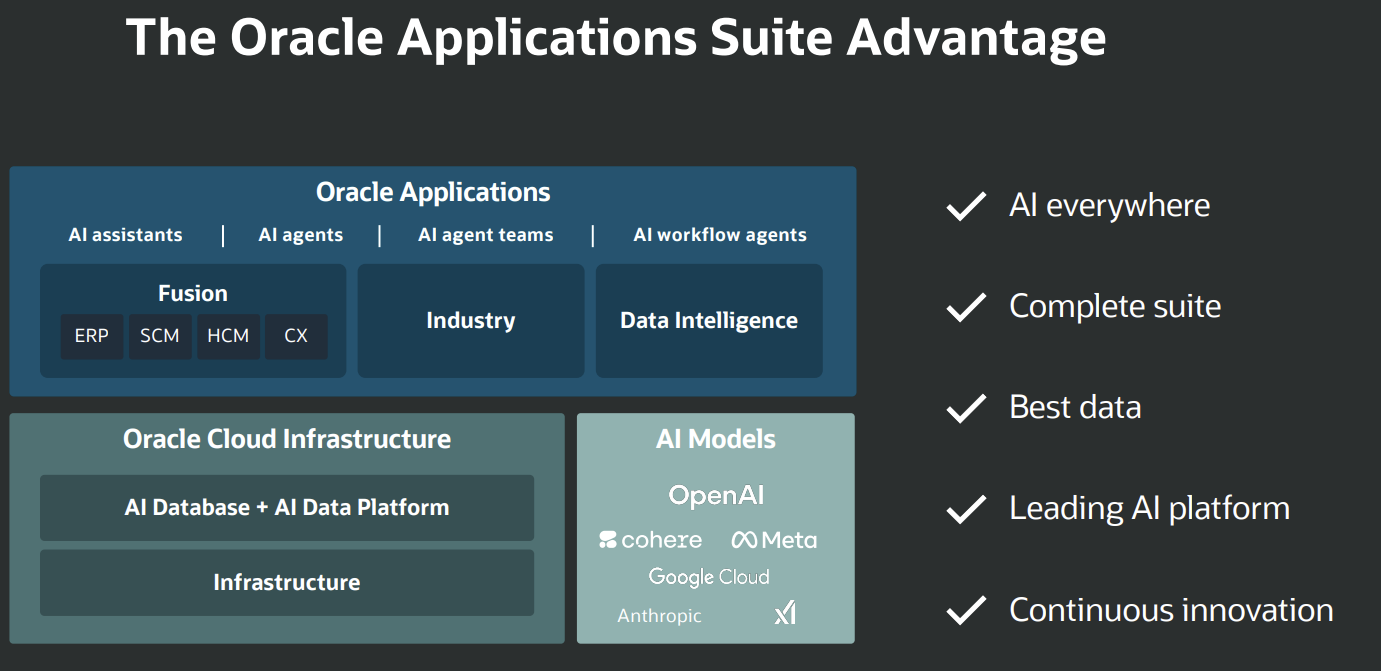

An Apple-ish approach to the stack

In many ways, Oracle has lifted the Apple approach with integrated hardware and software. With tight integration, Apple has argued it can provide a better experience.

Oracle's integrated stack between infrastructure, database and applications is a similar story. AI is juicing that integrated stack approach.

Clay Magouyrk, co-CEO of Oracle overseeing OCI, laid out the integrated stack strategy.

"We do applied technology. We do applications. We use our tech, and we also build the tech. We build data centers. We train models. We build databases. We build code generators. We do all this stuff to enable the creation of applications and then we actually create the applications. The database is now inextricably linked to our AI strategy and inextricably linked to our application strategy. So all the pieces at Oracle now are fitting together."

- Holger Mueller: Oracle Makes It 4 for 4: Oracle Database@AWS Is Generally Available | Oracle Solves Decades-Old DBMS Challenges and Future-Proofs Oracle Database

- Stargate ramps as OpenAI, Oracle, Softbank outline 5 new data centers

- Oracle names Magouyrk and Sicilia co-CEOs as Catz moves to Vice Chair

Magouyrk said it wasn't that long ago that the integrated approach looked like a disadvantage because the company was doing too much. The applications and infrastructure approach gives Oracle a built in feedback wheel to continuously improve.

Mark Hura, Oracle President of Field Operations, said the company is engaging companies with its entire portfolio. The argument is that Oracle can take away the enterprise integration pain.

"For our customers to be able to consume and bring outcomes that deliver real value, where they're not focused on integrating solutions, they're not focused on deploying differentiated capabilities, they're not worrying about where their data is moving and how is it secured or not," said Hura.

Miranda said Oracle is threading the needle where customers are able to spend less on IT, but spend more with Oracle. "The customers are actually spending less. They're spending more with Oracle because of the single stack advantage and all the engineering putting all the pieces together instead of customers having to stitch it together," said Miranda.

Sicilia added that the Oracle ambition is have the world run on its integrated stack. "What does it look like beyond 2030? I think we're rapidly heading towards self-implementing self-learning, self-healing systems," he said. "What does it mean in terms of Oracle? It's hard to say. I can't imagine that there's anything negative to say about it because I like our chances of being able to deliver that full system ecosystem."

Constellation Research's take

Constellation Research analyst Michael Ni made the following points about Oracle's strategy.

- Vertically AI integrated. "Oracle moved from 'catch-up' to a credible top-tier option for decision-centric, governed agents. Especially for enterprises already standardized on Oracle data and apps. AWS and Microsoft remain broader ecosystems, and Google is strong on tooling and AI platform and partners. Oracle’s differentiator is vertical integration from database to governance that expands to private data to apps with agent lifecycle controls promising to simplify management and decrease costs."

- The stack not the tools. "Oracle’s embedding move is classic Larry Ellison. Centralize complexity by delivering an “engineered stack” that brings tight integration, delivered semantics and data models, and governed context. This helps Oracle own the applications context and actions differentiates Oracle’s offering from other hyperscalers. While AWS and Google sell you the toolkit, Oracle ships the machinery already wired for output. That’s provides performance and extensibility, but at a tradeoff to portability."

- Differentiated. "Oracle’s strategy is differentiation through vertical integration, not head-to-head competition on horizontal cloud scale. While Oracle Cloud Infrastructure (OCI) is already positioned has highly competitive from a price-performance perspective, Oracle is doubling down on the enterprise data–to–decision stack by connecting applications, context and ability to act, where governance, trust, and application context matter more than raw hyperscale capacity."

- AI peanut butter and jelly. "Oracle's dual investment in AI and infrastructure are not two bets. Those investments are one play: control the cost curve and own the decision loop as a data and AI foundation for enterprise AI. Ellison eyes the large hyperscaler market and knows Oracle can differentiate if it can manage the margin hungry AI solutions that is increasingly creating cost as fast as it creates value for the application level. You can’t win the AI platform war without owning both the brains (agents) and the body (infrastructure)."