CoreWeave said it will acquire Core Scientific in an all-stock deal valued at about $9 billion. Core Scientific, a crypto mining company, was a data center provider to CoreWeave.

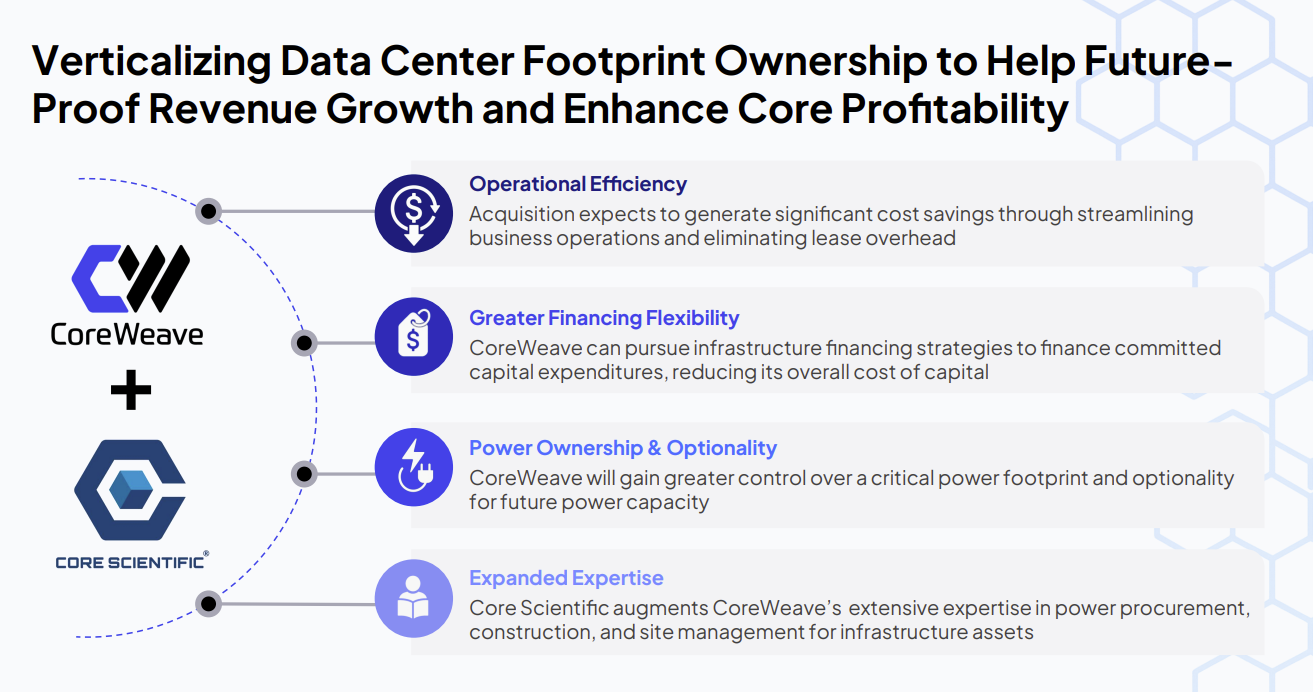

According to CoreWeave, the acquisition of Core Scientific will eliminate about $10 billion of future leases, create $500 million annual run rate cost savings by the end of 2027 and simplify operations.

CoreWeave said it may "repurpose or divest" Core Scientific's crypto mining business over time.

- AI's boom and the questions few ask

- CoreWeave raises $7.5 billion in debt financing for AI data center buildout

- CoreWeave's IPO: What you need to know

Under the terms of the deal, expected to close in the fourth quarter, CoreWeave sill issue 0.1235 shares of Class A share for each Core Scientific shares. When the deal closes, Core Scientific shareholders will own less than 10% of CoreWeave.

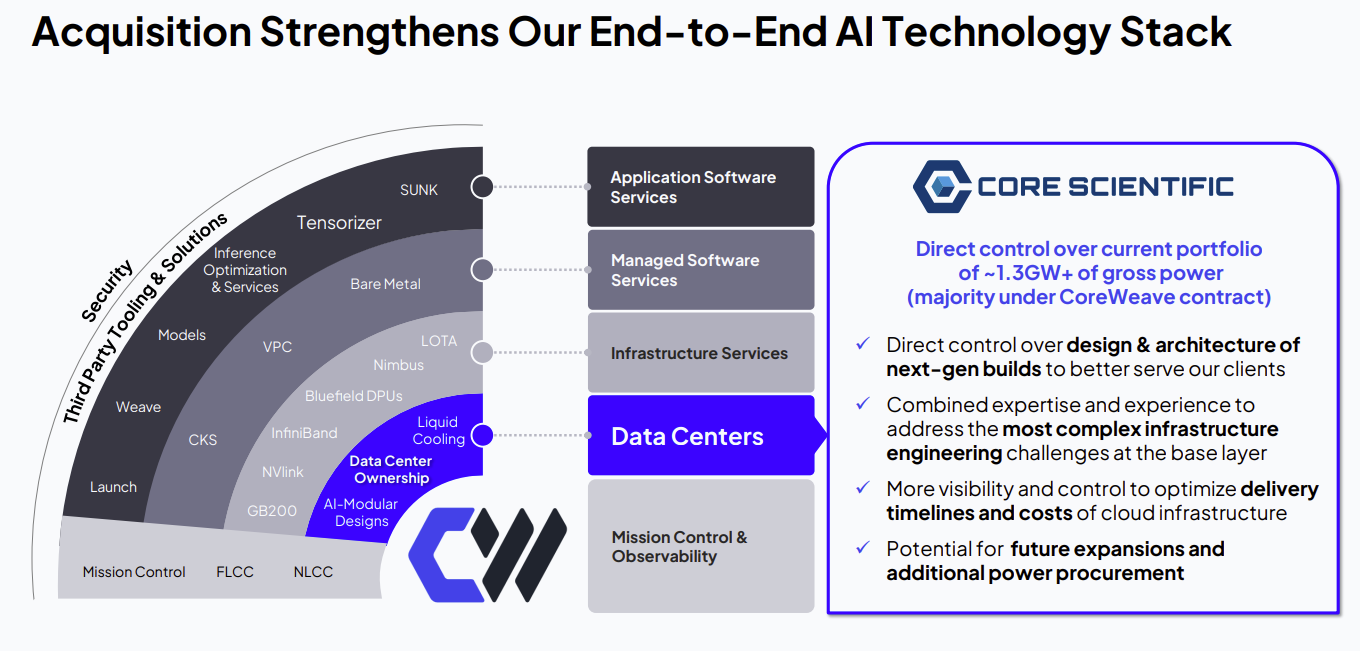

The purchase of Core Scientific will give CoreWeave 1.3 GW of gross power and an expanded data center footprint. CoreWeave also said the deal will give it 1 GW of power for expansion.

Michael Intrator, CEO of CoreWeave, said adding CoreScientific's data center network enables it to " significantly enhance operating efficiency and de-risk our future expansion, solidifying our growth trajectory."

CoreWeave said the purchase will give reduce its cost of capital, give it more control over its footprint and add expertise in construction, power and site management. CoreWeave derives 83% of its revenue from three customers led by Microsoft. The company also recently announced deals with OpenAI and IBM.

The AI-cloud provider has been expanding rapidly since its March 2025 IPO. CoreWeave has been standing up systems based on Nvidia's latest technology, acquiring firms like Weights & Balances and growing revenue at a rapid clip amid a boom in AI infrastructure.

For the first quarter, CoreWeave reported revenue of $981.63 million, up 420% from a year ago. The company's net loss was $314 million. Non-GAAP net loss for the first quarter was $149.55 million.