Snowflake's Slootman steps down as CEO, technologist Ramaswamy takes over

Snowflake has a new CEO. The company said Sridhar Ramaswamy will become CEO immediately as Frank Slootman stepped down but remains Chairman of the board.

Ramaswamy (right) had been SVP of AI at Snowflake. Slootman said "there is no better person than Sridhar to lead Snowflake into this next phase of growth and deliver on the opportunity ahead in AI and machine learning."

Ramaswamy (right) had been SVP of AI at Snowflake. Slootman said "there is no better person than Sridhar to lead Snowflake into this next phase of growth and deliver on the opportunity ahead in AI and machine learning."

Previously, Ramaswamy led all of Google's Advertising products, which included search, display and video advertising, analytics, shopping, payments, and travel.

Slootman explained the succession strategy on Snowflake's earnings conference call:

"The Board has run a succession process that wasn't based on arbitrary timeline, but instead, looked for an opportunity to advance the company's mission, well into the future. The arrival of Sridhar Ramaswamy through the acquisition of Neeva last year represented that opportunity.

With the onslaught of generative AI, Snowflake needs a hard-driving technologist to navigate the challenges the new world represents. Sridhar's vision for the future and his proven ability to execute at scale made it clear to us as a Board, he is the right executive at the right time to lead Snowflake."

Ramaswamy added:

"To deliver on the opportunity ahead, we must have clear focus and move even faster to bring innovation on the Snowflake platform to our customers and partners. This will be my focus."

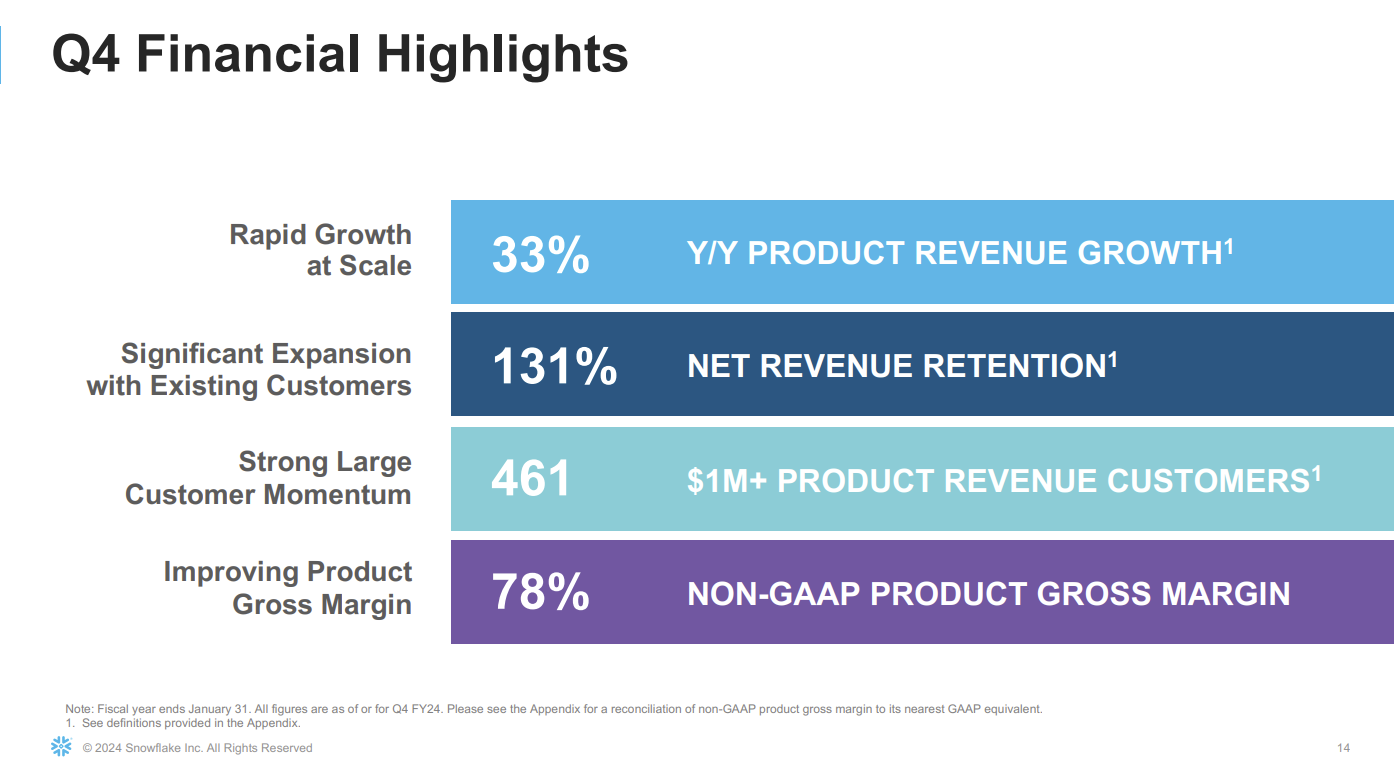

The news overshadowed a strong quarter from Snowflake. Snowflake reported fourth quarter revenue of $774.7 million, up 33% from a year ago, with a net loss of $169.35 million, or 51 cents a share. The non-GAAP fourth quarter earnings per share were 35 cents per share.

Wall Street was expecting Snowflake to report fourth quarter earnings of 18 cents per share on revenue of $760.22 million.

Constellation Research analyst Doug Henschen said Snowflake could be entering a newer slower growth phase.

For the first quarter, Snowflake said product revenue will be $745 million to $750 million, up 26% to 27% from a year ago. For fiscal 2025, Snowflake projected revenue $3.25 billion, up 22% from a year ago.

Henschen said:

"Frank Slootman joined Snowflake in May 2019 and quickly and spectacularly achieved what he was brought there to do: take the company public. Snowflake's September 2020 IPO raised an impressive $3.4 billion and still stands as the biggest software IPO in history. Now that market conditions have changed, there's a sense that Snowflake's fastest growth years may be behind it and it will require even harder work to maintain what's likely to be moderating growth. I wouldn't be surprised to see Slootman come out of retirement at some future date to take another company public."

CFO Mike Scarpelli said the fourth quarter was more normalized after a challenging year.

"Holidays make it difficult to discern meaningful consumption trends. In the quarter, younger customers led revenue growth. These accounts are adding new workloads in migrating from legacy vendors. Financial Services and retail were our largest revenue contributors, and we are seeing emerging momentum from the EMEA region and technology vertical.

Customer optimizations returned to a normal level, with eight of our top 10 accounts growing sequentially. We proactively engaged with customers to help them optimize their Snowflake usage and we'll continue to do so. History has shown that optimizations expand our long-term opportunity. We now have 83 customers with trailing 12-month product revenue greater than $5 million, up from 75 in Q3."

Scarpelli noted that Snowflake's outlook accounts for a few moving parts related to storage pricing and product efficiency.

"We are forecasting increased revenue headwinds associated with product efficiency gains, tiered storage pricing and the expectation that some of our customers will leverage Iceberg Tables for their storage. We are not including potential revenue benefits from these initiatives in our forecast. These changes in our assumption impact our long-term guidance. Internally, we continue to march towards $10 billion in product revenue. Externally, we will not manage expectations to our previous targets until we have more data. We are focused in executing in FY '24 to ensure long-term durable growth."

Scarpelli said that Snowflake is assuming an additional $50 million of GPU related costs in fiscal 2025 and $10 million should flow to product revenue. Snowflake's guidance isn't assuming that product revenue.

Constellation Research analyst Holger Mueller noted that Snowflake's expenses have been rising.

"Snowflake had a great year on the top line, but all costs went up – from cost of revenue all the way to operating expenses that topped $3 billion for the first time. The change in the CEO position – not telegraphed before – may or may not have to do with this, but certainly a slightly increased loss per share was not what investors wanted to see. Slootman is now out and with Ramaswamy a more technology focused executive is in charge. Like all data centric vendors, Snowfllake needs address the generative AI trend, and that is something Ramaswamy is probably in a better position to deliver on. Future will tell – starting with Q2."

Ramaswamy said he is focused on executing on Snowflake's current roadmap.

"I've had over 100 conversations with customers over the past year about generative AI in particular. And the product announcements that we've already made, things in private preview, including Snowflake Cortex, which is our managed AI and search layer combined with applications like Document AI for extracting structured data or our Copilot. These have been very well received. Document AI, for example, has hundreds of customers waiting for it to hit GA that are on our waitlist. So, I would say it is a matter of executing to the roadmap that we have already laid out. Cortex will hit public preview soon. Getting this in the hands of our customers, and having them realize value is the top priority. I don't think of this as needing a new strategy."