New Relic goes private in $6.5 billion deal, aims to accelerate observability platform ubiquity

New Relic is going private via a $6.5 billion acquisition by Francisco Partners and TPG in a move that aims to speed up a business model transformation and expansion plans.

The Francisco Partners and TPG deal wasn't unexpected and talks had been reported in various outlets for weeks. New Relic shareholders will get $87 per share in cash, good for a 26% premium to the company's 30-day volume weighted average. Like most mergers, customers will wait and see what the deal means for them.

For its part, New Relic CEO Bill Staples said the company has made "significant progress" toward moving to a business model based on consumption going private will give it "the resources and flexibility to complete the final chapter of this transition, but also accelerate our strategy."

Staples added that the buyout will also give customers innovation and avenue to standardize data practices to monitor, improve and debug. Francisco and TPG said New Relic can optimize observability and be well positioned to create a unified platform.

TPG's active portfolio investments include Boomi, Noodle.ai, Planview and Tanium to name a few. Francisco Partners is also a technology veteran with active investments in e2open, Payscale and a series of software providers focused on industries.

New Relic is on Constellation Research Shortlists for observability, DevOps and digital performance management. The company competes with Cisco's AppDynamics, Datadog, Splunk, Dynatrace and a bevy of others.

New Relic's transition

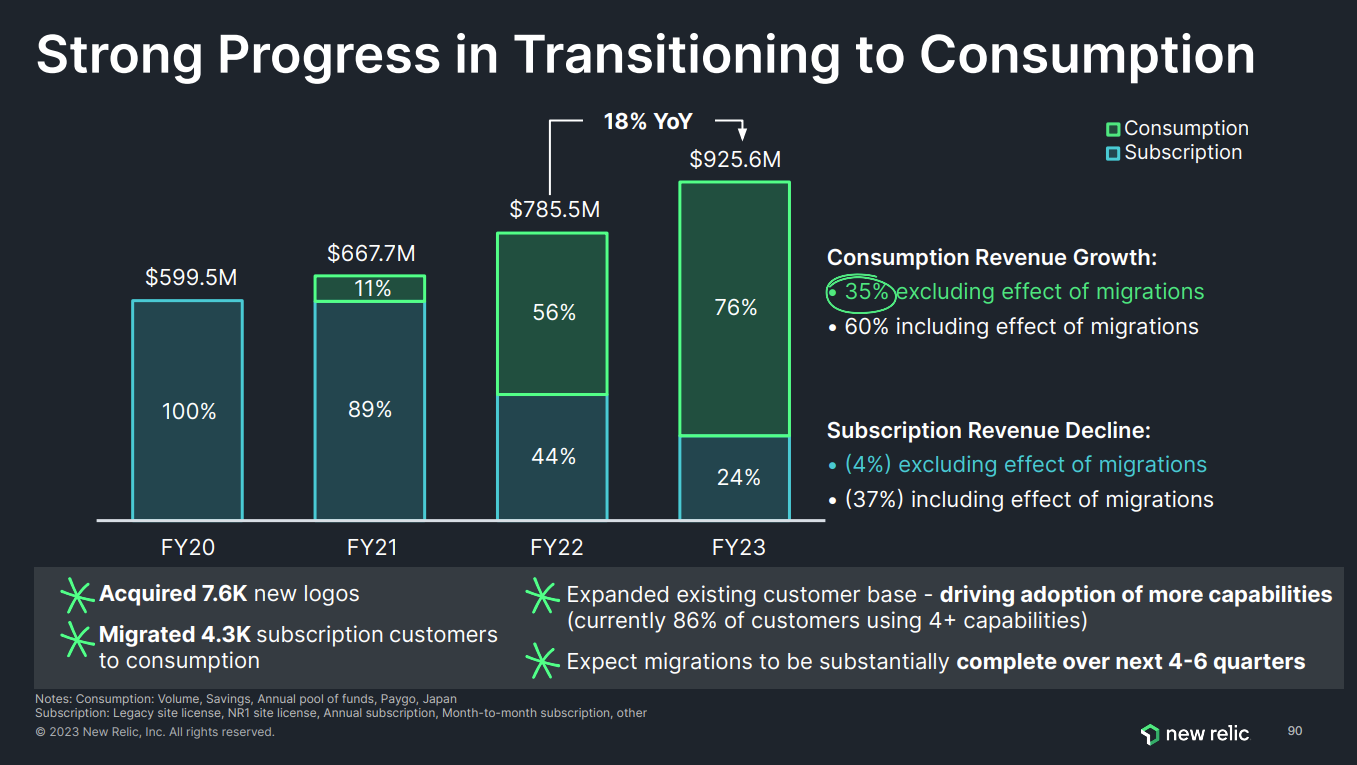

Before agreeing to the Francisco Partners and TPG deal, New Relic was approaching $1 billion in annual revenue and 80% of customers were under a consumption model.

Staples laid out the strategy at New Relic's May 25, analyst day. In a nutshell, New Relic wants to be the single source of truth so engineers can make data driven decisions during the software life cycle.

"We've been striving to turn observability from a collective set of reactionary monitoring-focused tools that have been built up over the past decade that really serve a limited set of production-focused engineers into a standardized data-driven practice for every engineer that every company can benefit from.

In a word, we are striving to make observability ubiquitous."

Staples added that New Relic's platform is critical to monitoring public cloud, applications, digital experiences and artificial intelligence tools.

"Increasingly, every piece of infrastructure, every application and service emits telemetry data through open standards, like open telemetry, in the form of events, traces, logs, metrics that must be captured and analyzed in real time and then stored for future query by millions of engineers who build these systems."

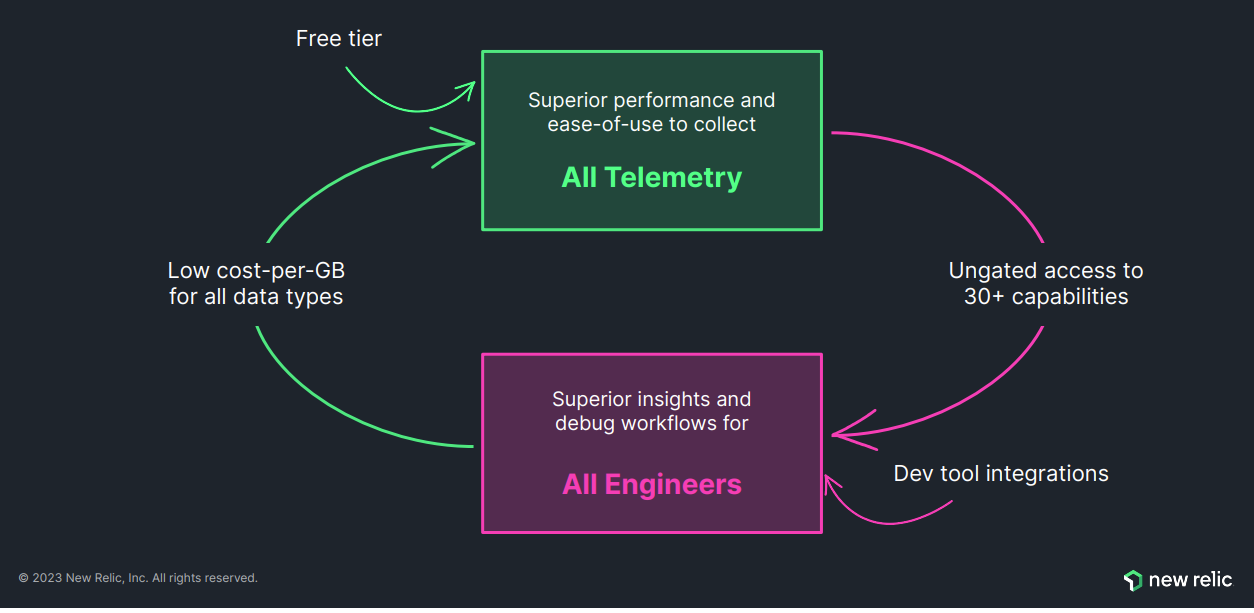

In other words, New Relic wants to be the standard engineering platform so enterprises can optimize, be more efficient and deliver customer experiences better. The ubiquity play is New Relic's consumption model, which is designed to add more customers and users.

In 2020, New Relic set out to unify its products into a platform with one data architecture. That and the move to a consumption model--and a free tier on-ramp, has given New Relic 60,000 active users on its platform.

Staples said the pivot to consumption is built around playing the long game with customers. New Relic moved from a licensing model to one based on pay for what's used and aligned sales compensation accordingly.

Gunning for ubiquity

At New Relic's analyst day, Manav Khurana, Chief Product Officer, explained how most customers start with the free tier and move up based on consumption.

The biggest reason for boosting consumption is that New Relic can surface dependencies beyond application performance monitoring. He said:

"Engineering teams need data-driven insights to make sure that the application and the services they provide are serving their business properly for the key transactions. They need to understand the end user experience. They need to understand the security posture. As they go from just the break/fix use case to serving full life cycle use cases, customers end up getting more value, and we see our data revenue and user revenue growth as a result of it."

Khurana added that AI use cases make observability even more critical.

New Relic also has more than 600 integrations with its platform and open standards. Khurana also said that New Relic is building out pipelines for large enterprises that have compliance requirements.

Is the New Relic platform ubiquitous today? No. The bet is that the company can accelerate its strategy by going private.

With the acquisition announcement, New Relic reported its fiscal first quarter results. The company reported a net loss of 54 cents a share, non-GAAP earnings of 43 cents a share and revenue of $242.6 million, up 12% from a year ago.

According to New Relic, 75% of its customers are using more than 5 monitoring tools. The plan is to get those customers to standardize. What remains to be seen if going private gets more New Relic customers on the standardization path.

Constellation Research's take

Constellation Research analyst Andy Thurai gave the following assessment of the New Relic deal:

"Despite the acquisition New Relic made in 2020, (Pixie Labs - a Kubernetes observability platform), the company struggled to make inroads with the cloud-native companies. The newer players like Chronosphere, Observe, Lightstep (ServiceNow), and Honeycomb have all established a lead over New Relic in cloud-native enterprises. Even the legacy players such as Splunk, Datadog, and Elastic via acquisition or organic growth have been aggressive in the cloud-native market and have a solid hybrid observability story. AppDynamics/Cisco fell behind after its acquisitions and allowed New Relic to gain some customers in the traditional APM as well as in the total observability space with the legacy clients.

The transition from a subscription-based ELA model to a consumption-based model is almost complete and NewRelic is surprisingly able to hold the pricing power. The company had 18% YoY growth with about 76% of the customers converted to the consumption-based pricing model. However, some of the customers have complained about the higher cost of observability for the New Relic solution in the consumption-based model and the sticker shock of prices at the end of the year.

One of New Relic's pitfalls is the shortness of storage duration. By default, the observability information (which can be very heavy and sizeable data if logs are turned on) is stored ONLY for 30 days. If the customers choose to increase to 90 days then the cost goes much higher. Some of New Relic's competitors offer cheaper solutions such as Amazon S3 and partner with log optimization solutions such as Cribl. For customers who are interested in doing longer-term analyses, New Relic could get very expensive. On the positive side, their customers always mention the real-time dashboards and reporting.

The purchase price of $6.5 billion (26% premium over the 30-day weighted average closing price) seems rather high for a company that is not growing as fast and facing stiff competition from a new breed of players."